Qualified Sales Templates

Welcome to our webpage on qualified sales!

Also known as sales qualifying, this document group is designed to help businesses accurately determine and certify their qualified sales transactions. These documents play a crucial role in ensuring that companies can take advantage of various exemptions and partial exemptions offered by state or local governments.

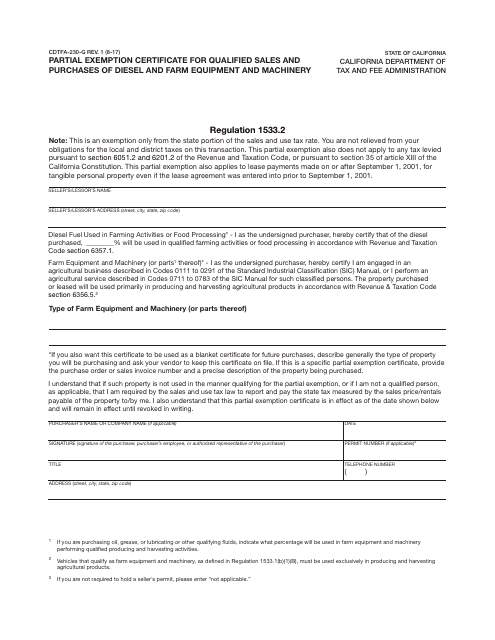

One important form in this collection is the Form CDTFA-230-G Partial Exemption Certificate for Qualified Sales and Purchases of Diesel and Farm Equipment and Machinery in California. This form allows businesses involved in the agricultural industry to claim exemptions on their sales and purchases of diesel and farm equipment, helping them reduce their tax liabilities.

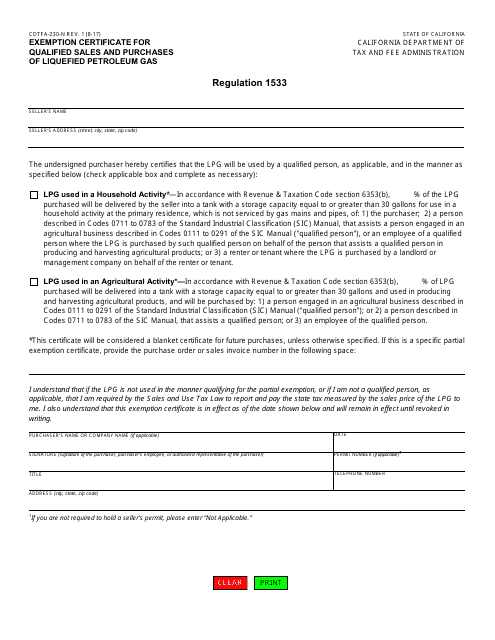

Another useful document is the Form CDTFA-230-N Exemption Certificate for Qualified Sales and Purchases of Liquefied Petroleum Gas in California. With this form, businesses operating in industries that rely on liquefied petroleum gas can certify their eligible sales and purchases, ensuring they qualify for exemptions and minimize their tax burden.

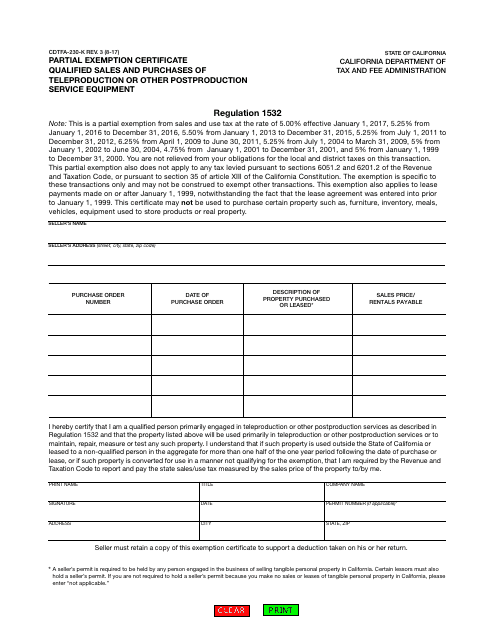

If you operate in the entertainment industry, the Form CDTFA-230-K Partial Exemption Certificate Qualified Sales and Purchases of Teleproduction or Other Postproduction Service Equipment in California may be relevant to you. This form enables businesses in this sector to claim exemptions on their qualified sales and purchases of teleproduction or postproduction service equipment.

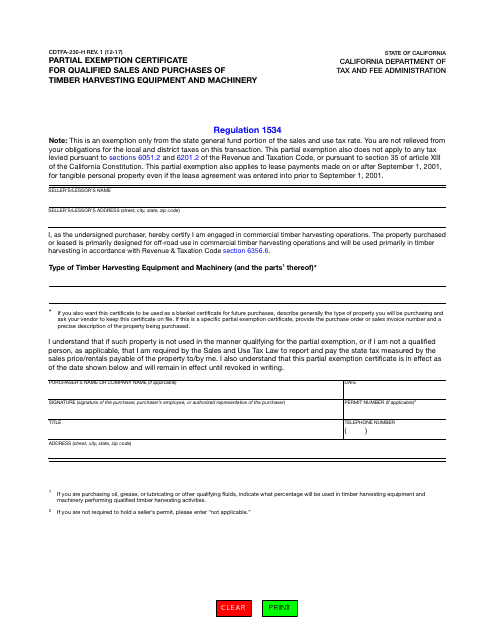

For companies engaged in timber harvesting, the Form CDTFA-230-H Partial Exemption Certificate for Qualified Sales and Purchases of Timber Harvesting Equipment and Machinery in California is essential. By properly certifying their sales of qualified equipment and machinery, these businesses can benefit from partial exemptions and reduce their tax expenses.

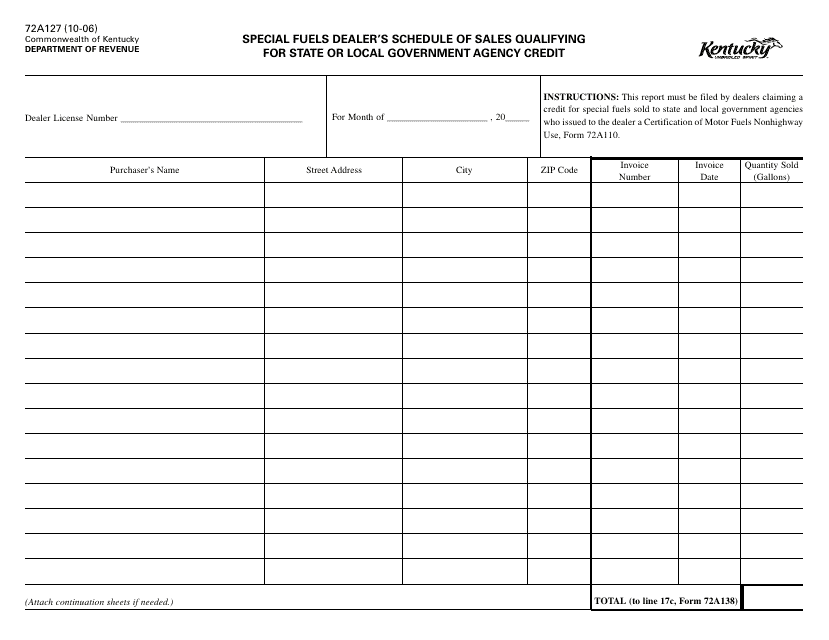

Lastly, in Kentucky, businesses involved in the sale of special fuels to state or local government agencies can utilize Form 72A127 Special Fuels Dealer's Schedule of Sales Qualifying for State or Local Government Agency Credit. This document allows them to report their qualified sales that qualify for credits, helping them maximize their benefits.

Our webpage provides detailed information on how to use and complete these various forms, ensuring that your business correctly certifies its qualified sales. By understanding the intricacies of these documents, you can confidently navigate the complex world of sales qualifying, saving on taxes, and maximizing your bottom line.

Unfortunately, I am unable to provide a text response for this document group.

Documents:

8

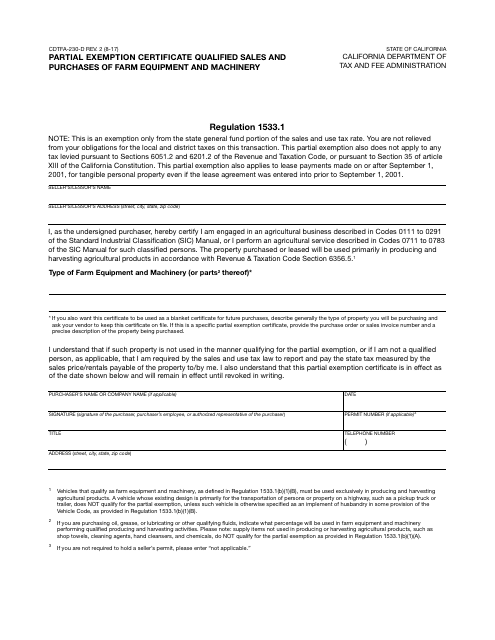

This form is used for claiming partial exemption on sales and purchases of farm equipment and machinery in California.

This form is used for claiming a partial exemption on sales and purchases of diesel and farm equipment and machinery in California. It allows businesses to reduce the amount of sales and use tax they owe on these eligible items.

This form is used for claiming exemption from sales and purchases of Liquefied Petroleum Gas in California. By submitting this form, qualified individuals and businesses can avoid paying sales tax on such transactions.

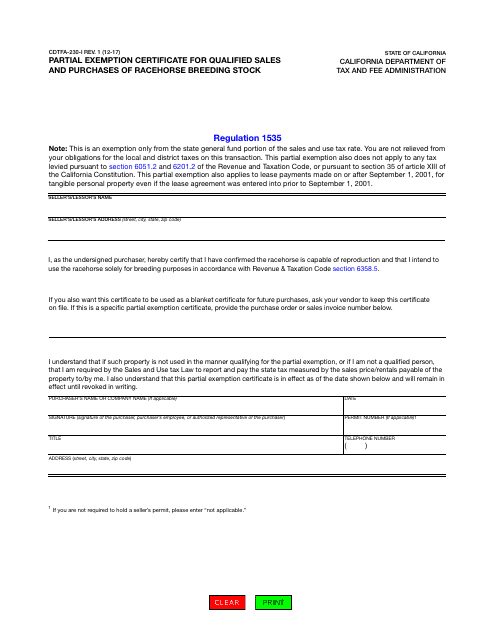

This form is used for claiming a partial exemption from sales and use tax for qualified sales and purchases of racehorse breeding stock in California.

This form is used for claiming a partial exemption on sales and purchases of teleproduction or other postproduction service equipment in California.

This form is used for applying for a partial exemption certificate in California for qualified sales and purchases of timber harvesting equipment and machinery.

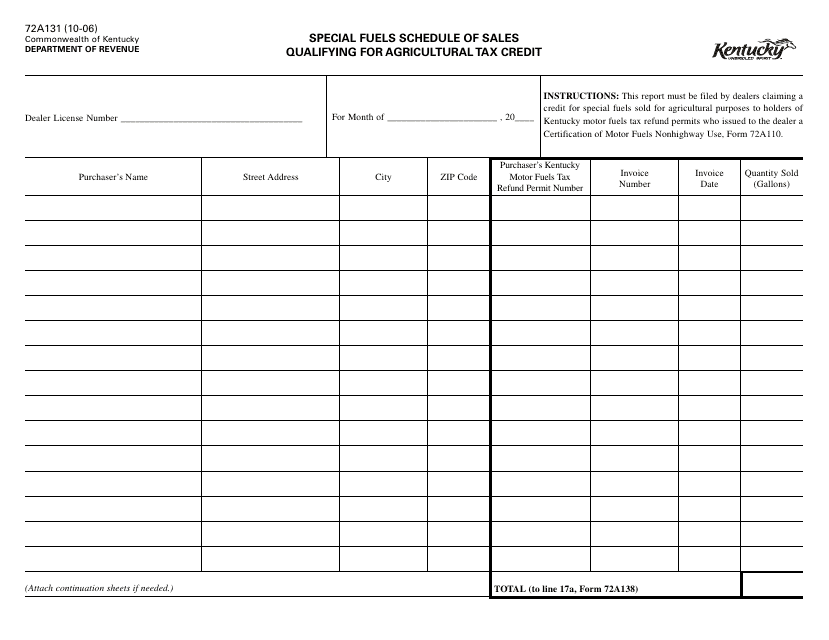

This form is used for reporting sales of special fuels that qualify for the agricultural tax credit in Kentucky. It is specifically for agricultural businesses to claim tax credits on fuel purchased for qualifying agricultural activities.

This form is used for reporting sales of special fuels eligible for state or local government agency credits in Kentucky.