Suspicious Activity Templates

Are you concerned about suspicious activity in financial transactions? Stay informed and protected with our comprehensive collection of documents related to suspicious activity. Discover key resources, reporting forms, and guidelines on identifying and reporting suspicious behavior in various sectors.

Our documents cover a wide range of industries and jurisdictions, providing you with valuable information to prevent fraud and maintain the integrity of financial systems. Whether you are a money services business, retailer, or individual, our resources are tailored to your needs.

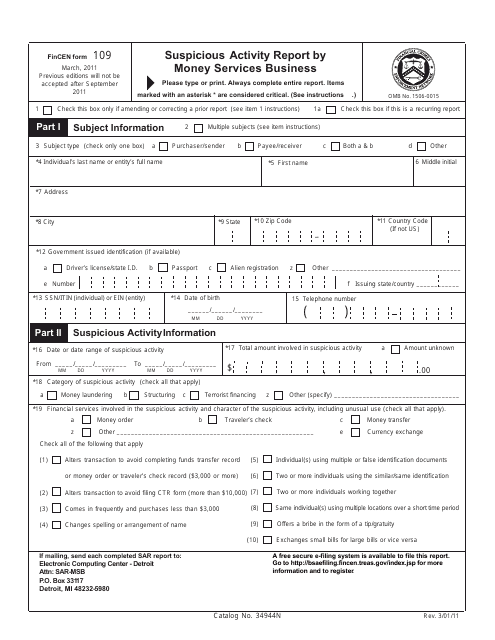

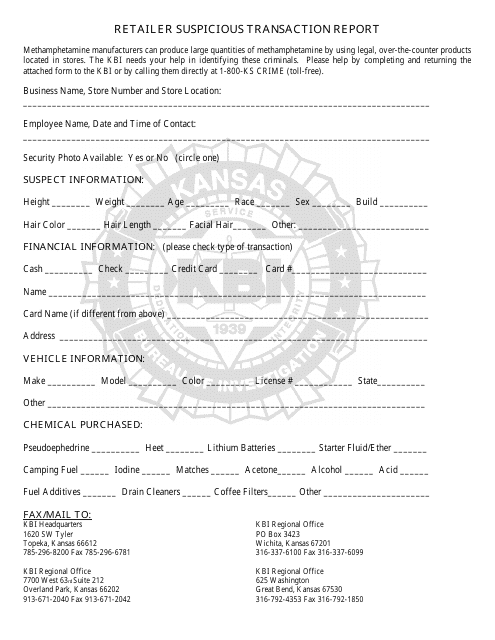

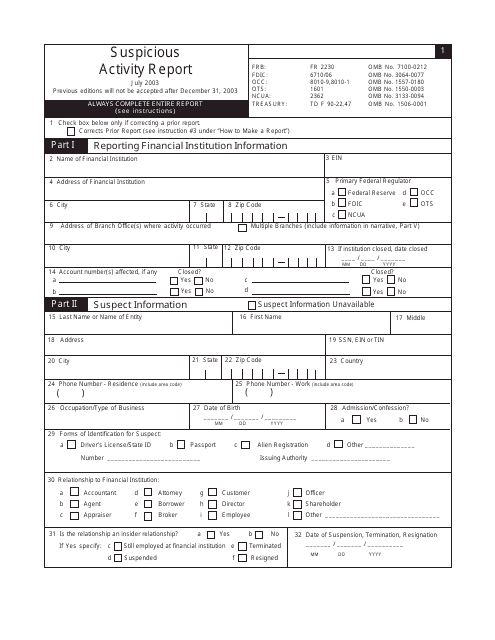

Learn about the FinCEN Form 109, a Suspicious Activity Report required by money services businesses, or explore the Retailer Suspicious Transaction Report Form specific to Kansas. Gain insights into the FDIC Form 6710/06, an essential tool for reporting suspicious activities in the banking sector.

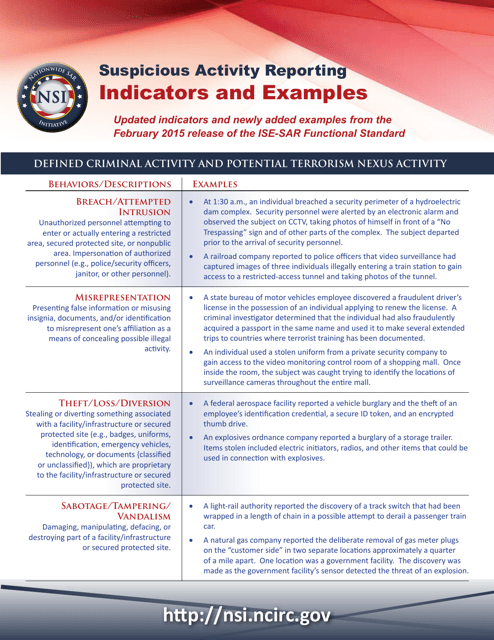

We also provide valuable guidance on identifying suspicious behavior and recognizing common indicators. Our document collection includes examples of suspicious activity and the corresponding reporting procedures. Stay ahead of potential threats and safeguard your business or personal finances.

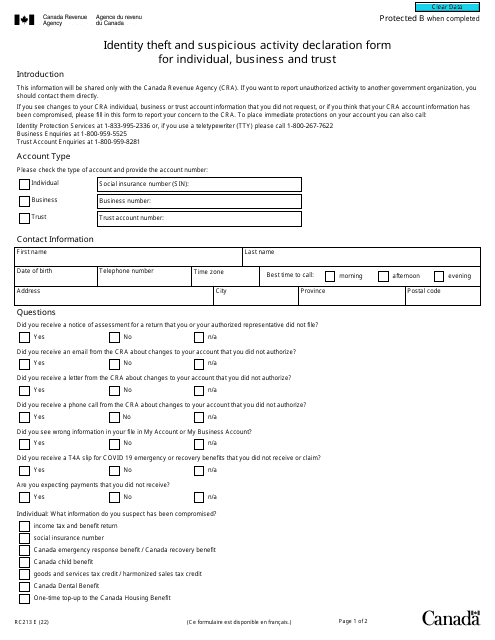

In addition to serving individuals and businesses in the United States, our resources extend beyond borders. For our Canadian audience, we offer the Form RC213 Identity Theft and Suspicious Activity Declaration Form, which ensures the reporting and prevention of fraudulent activities.

Don't leave your financial well-being to chance. Leverage our comprehensive collection of documents on suspicious activity to enhance your knowledge and protect yourself from potential harm. Stay vigilant and report any suspicious behavior promptly.

Documents:

7

This Form is used for reporting suspicious activity by a Money Services Business to the Financial Crimes Enforcement Network (FinCEN).

This form is used for reporting suspicious transactions by retailers in the state of Kansas. It helps to identify and prevent potential criminal activity in the retail industry.

This document is used for reporting suspicious activities to the Federal Deposit Insurance Corporation (FDIC) in order to prevent fraud and money laundering in the banking system.

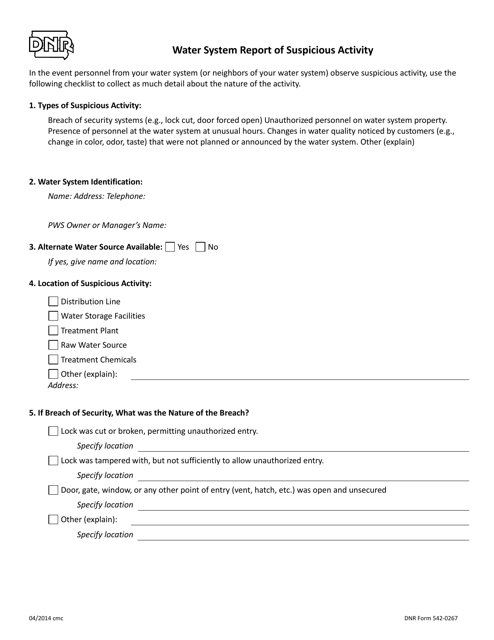

This form is used for reporting suspicious activity related to water systems in Iowa.

This document provides indicators and examples of suspicious activity that should be reported. It helps individuals identify signs of potential wrongdoing and take appropriate action.