Debt Dispute Templates

Are you struggling with a debt dispute and looking for guidance on how to assert your rights? Our debt dispute resources are here to help you navigate through this challenging situation. We understand that dealing with debt collection agencies or creditors can be overwhelming, but you don't have to face it alone.

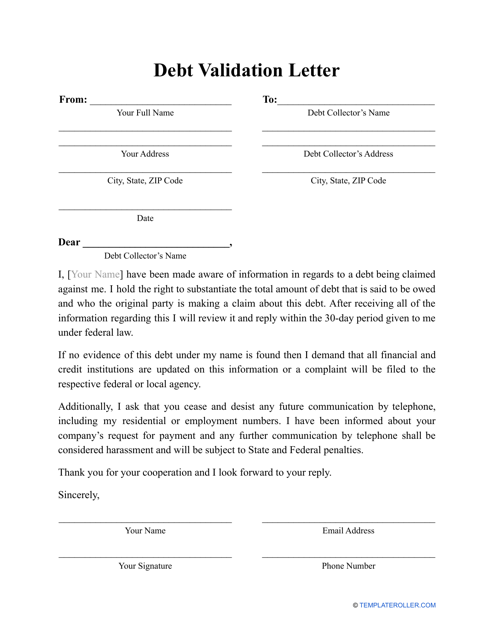

Our website provides a collection of valuable documents that can assist you in your debt dispute journey. These documents include a Debt Validation Letter Template, which outlines the necessary information to request validation of a debt. Additionally, we offer a Sample Debt Dispute Letter that you can use to formally dispute a debt's validity and seek clarification on its details.

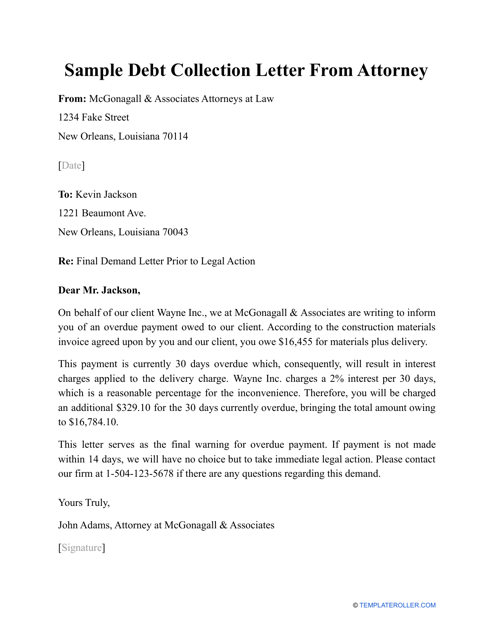

If you're facing legal action from a creditor or debt collector, we have a Sample Debt Collection Letter From Attorney that can help you respond appropriately. This document is specifically tailored for those who require legal representation in their debt dispute process.

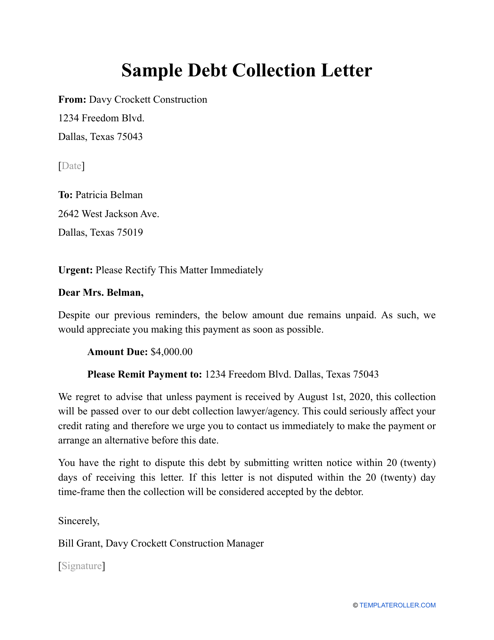

Furthermore, our Sample Debt Collection Letter serves as a practical resource for individuals seeking guidance on how to communicate with creditors or collection agencies effectively. It outlines the key elements to include in a debt dispute letter and provides tips on how to assert your rights while maintaining a professional tone.

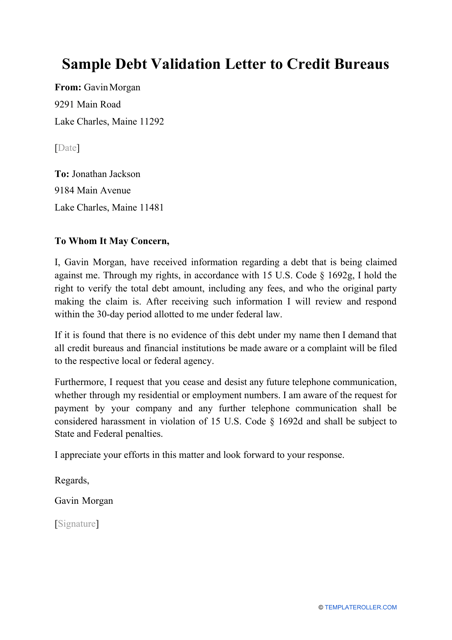

For those looking to dispute inaccurate or misleading information on their credit reports, we also offer a Sample Debt Validation Letter to Credit Bureaus. This letter outlines the steps you need to take to request that credit bureaus validate the debt information they are reporting.

Our debt dispute resources are designed to empower individuals like you to navigate the complex world of debt collection and protect your rights. Whether you need guidance on drafting letters, understanding your rights, or seeking legal representation, our documents can be a valuable tool. Explore our collection today and take the first step towards resolving your debt dispute.

Documents:

5

Use this letter to request information about your credit history and any particular debts you may have.

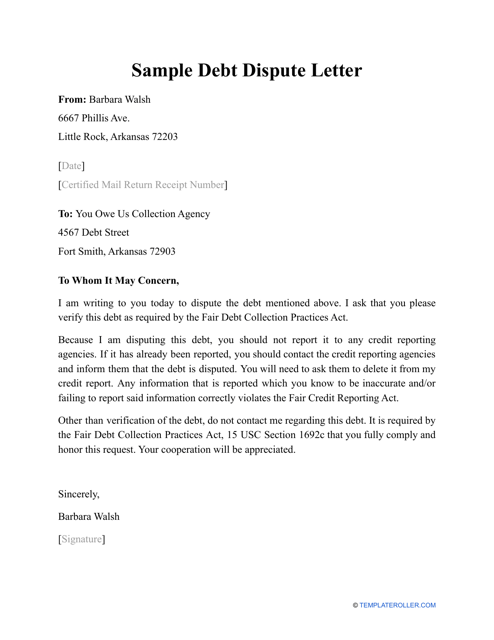

This is a written or typed letter that any individual can prepare when they have received a letter from a creditor or debt collector if they do not believe they owe any money or the amount of the debt indicated in the notice is not accurate.

This letter is prepared by the attorney that represents the lender and has a purpose to convince the debtor to pay the money back or face a lawsuit.

A lender can preparer this financial statement and send it to a borrower with the request for them to handle an unpaid debt.

A debtor or their representative may prepare this letter with the intention of finding out whether their debt is real, to request information about an existing debt, and to warn the credit bureau that handles the debt to cease their harassing behavior if necessary.