Ma Nrcr Templates

Looking to file your taxes as a nonresident in Massachusetts? Look no further than our comprehensive collection of documents, known as MA NRCR or Form MA NRCR. Whether you're a Canadian resident working in Massachusetts or a U.S. citizen earning income in the state, these forms will help you accurately report your earnings and comply with tax regulations.

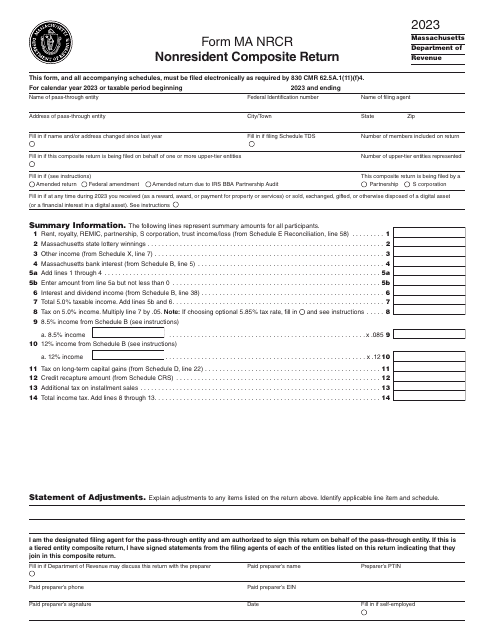

Our collection includes the Form MA NRCR Nonresident Composite Return for Massachusetts, which enables eligible taxpayers to file a single return on behalf of their nonresident partners. This convenient option simplifies the tax filing process for multiple entities with nonresident owners, saving you time and effort.

If you're unsure how to complete your tax return or need guidance on filing as a nonresident in Massachusetts, our documents provide detailed instructions and explanations. We understand that navigating tax regulations can be overwhelming, especially when dealing with complex forms. That's why our collection of MA NRCR resources is designed to make the process as seamless as possible.

As an alternate name for this documents collection, some refer to it as "Form MA NRCR". This name highlights the significance of this form in accurately reporting nonresident earnings in Massachusetts and helps distinguish it from other tax forms.

So, whether you're a nonresident individual or a business owner with nonresident partners, make sure you have the right forms at hand. Trust our collection of MA NRCR documents to ensure you comply with tax regulations and efficiently file your taxes in Massachusetts.