Unit Investment Trust Templates

A unit investment trust, also known as a unit investment trust or unit investment trusts, is a type of investment vehicle that offers investors a unique way to diversify their portfolio. These trusts are organized as separate accounts and are registered with the Securities and Exchange Commission (SEC).

Unit investment trusts provide investors with the opportunity to invest in a variety of securities, such as stocks, bonds, or a combination of both. These trusts are designed to have a fixed portfolio that is held for a predetermined period of time, typically ranging from one to ten years.

Investors in unit investment trusts can benefit from the diversification provided by the trust's portfolio, as well as the potential for capital appreciation and income. These trusts are managed by professional investment managers who carefully select and monitor the securities held in the trust.

When considering investing in a unit investment trust, it is important to review the registration statements filed with the SEC. These statements, such as the SEC Form 2125 (N-4) Registration Statement of Separate Accounts Organized as Unit Investment Trusts and SEC Form 0977 (N-8B-2) Registration Statement of Unit Investment Trusts Which Are Currently Issuing Securities, provide valuable information about the trust's objectives, risks, and expenses.

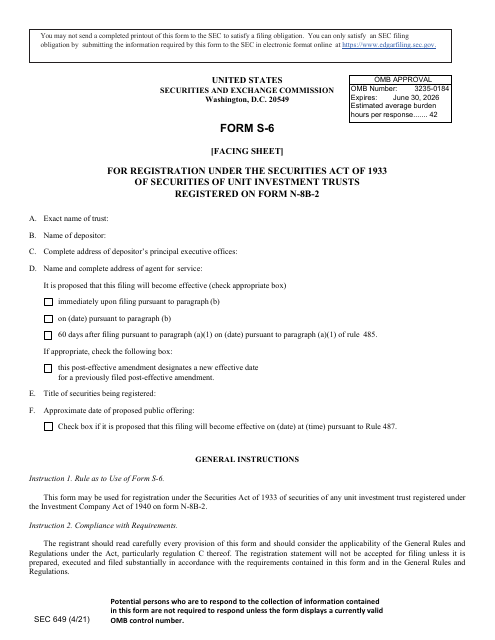

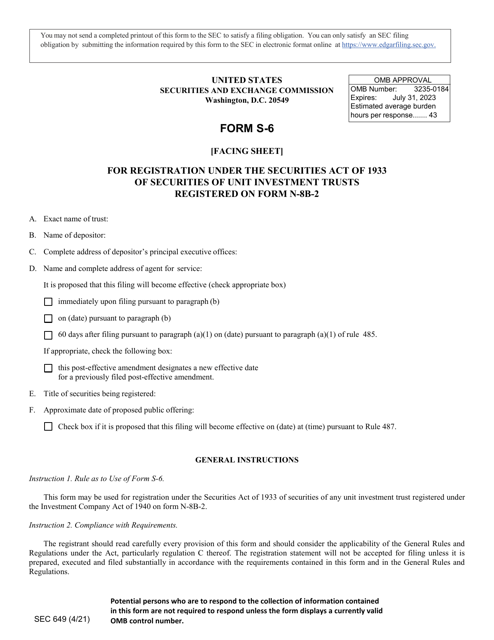

Whether you are a seasoned investor or just starting out, unit investment trusts offer a unique investment opportunity to consider. With their fixed portfolio structure and potential for diversification, these trusts can be a valuable addition to any investor's portfolio. Take the time to explore the various unit investment trust options available, including those registered on SEC Form 649 (S-6) Registration Under 1933 Act of Securities of Unit Investment Trusts Registered on Form N-8b-2 and SEC Form 2567 (N-6) Registration Statement for Separate Accounts Organized as Unit Investment Trusts That Offer Variable Life Insurance Policies, and find the one that best aligns with your investment goals and risk tolerance.

Documents:

11

This form is used for the registration of unit investment trusts that are currently issuing securities.

This document is used for the registration of separate accounts organized as unit investment trusts.

This form is used for registering separate accounts organized as unit investment trusts that offer variable life insurance policies.

This form is used for the registration of separate accounts organized as unit investment trusts.

This document is used for registering unit investment trusts that are currently issuing securities with the Securities and Exchange Commission (SEC).

This Form is used for registering securities of unit investment trusts under the 1933 Act, specifically for trusts registered on Form N-8b-2.

This form is used for registering separate accounts organized as unit investment trusts that offer variable life insurance policies.