Tax Schedule Templates

Documents:

174

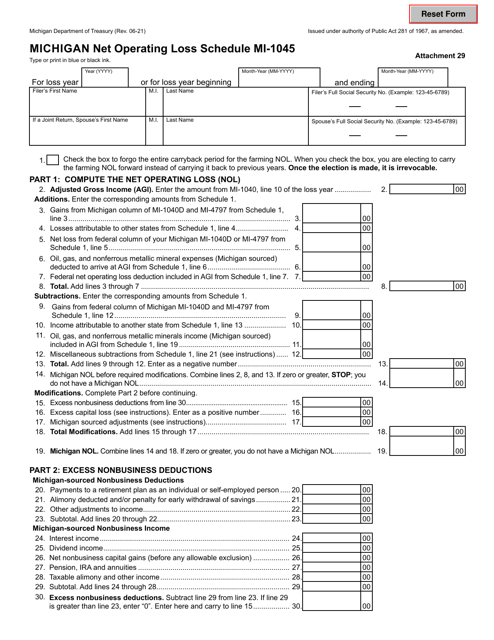

This document is used for reporting net operating losses in the state of Michigan. It is a schedule that taxpayers must complete and submit along with their Michigan income tax return.

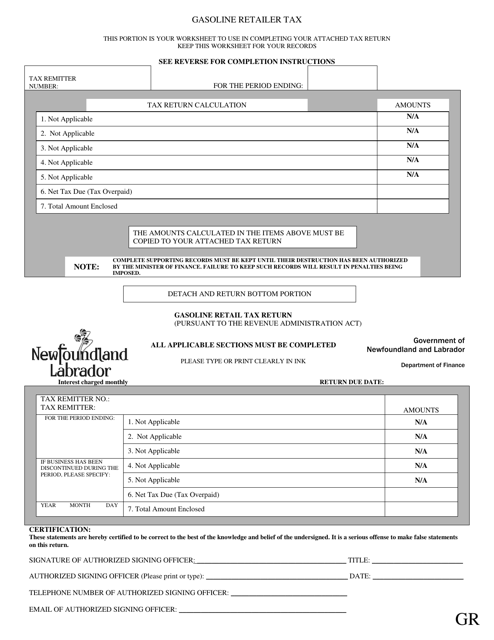

This document is used to schedule and pay the gasoline retailer tax in Newfoundland and Labrador, Canada.

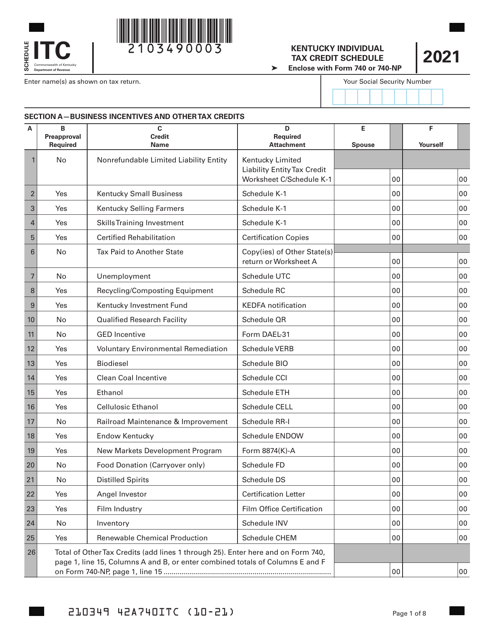

This document is the Schedule ITC Kentucky Individual Tax Credit Schedule for residents of Kentucky. It is used to report any tax credits that individuals may be eligible for in the state of Kentucky.

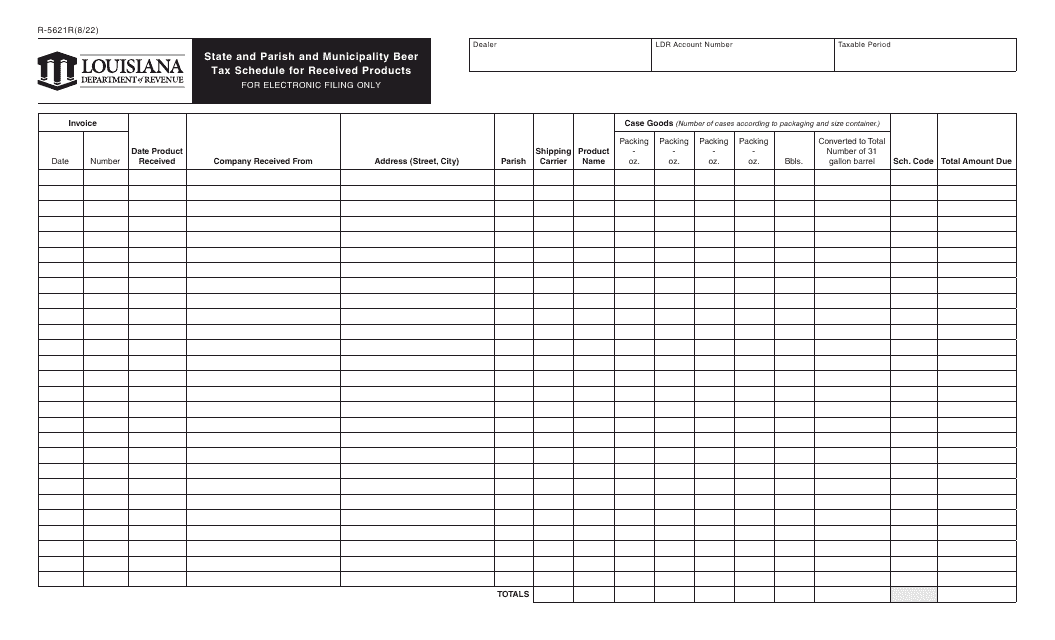

This Form is used for reporting and paying beer tax for received products in the state of Louisiana, broken down by state, parish, and municipality.

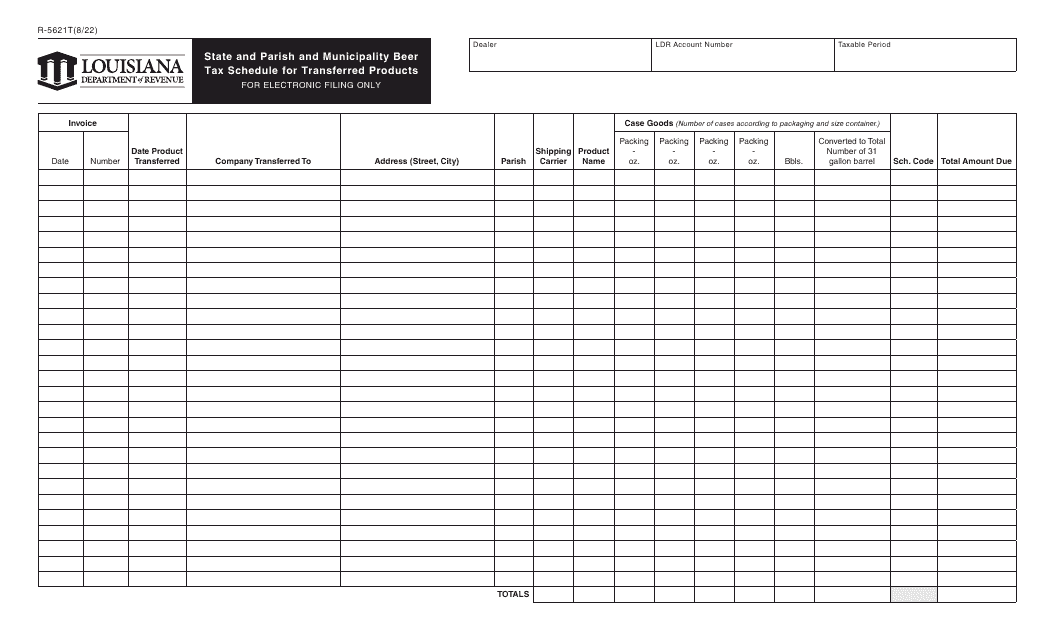

This type of document provides instructions for completing Form R-5621T, which is used for reporting beer tax schedule for transferred products in the state of Louisiana, including state, parish, and municipality taxes.

This form is used for reporting and calculating beer taxes for received products in the state of Louisiana, including state, parish, and municipality taxes.

This Form is used for reporting beer taxes for transferred products in Louisiana.

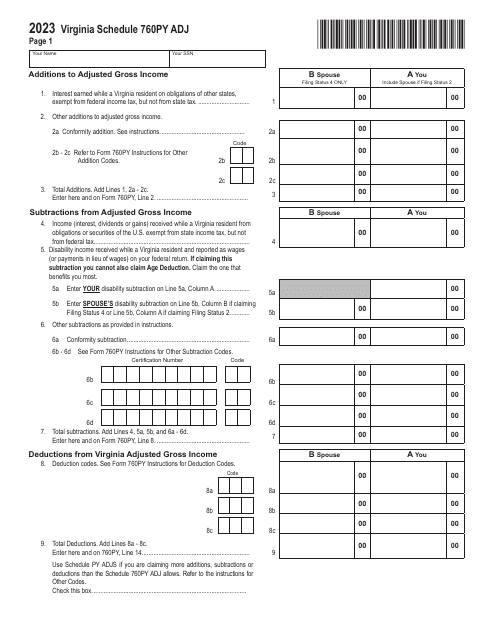

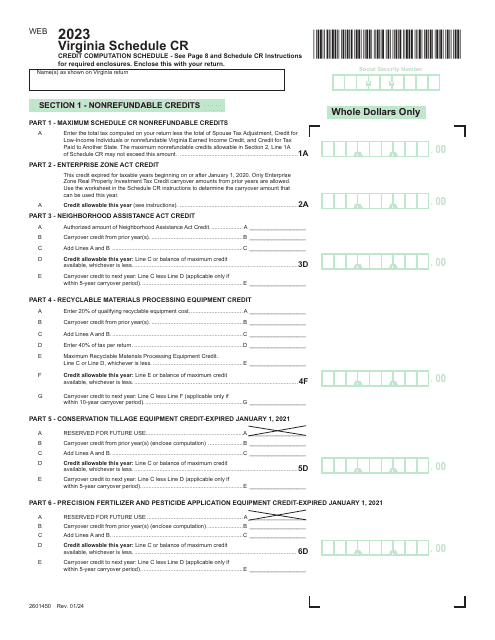

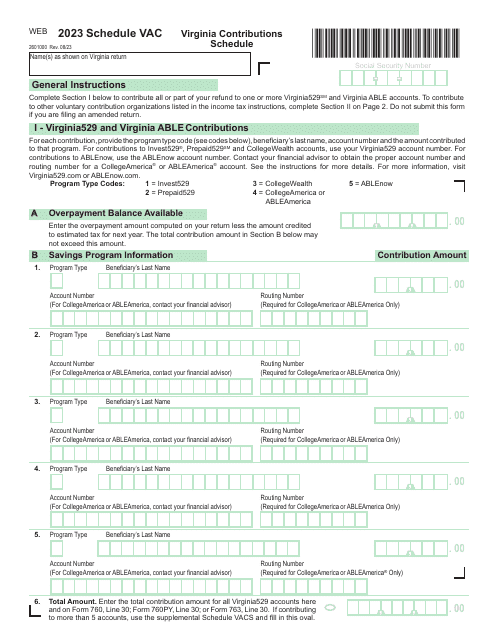

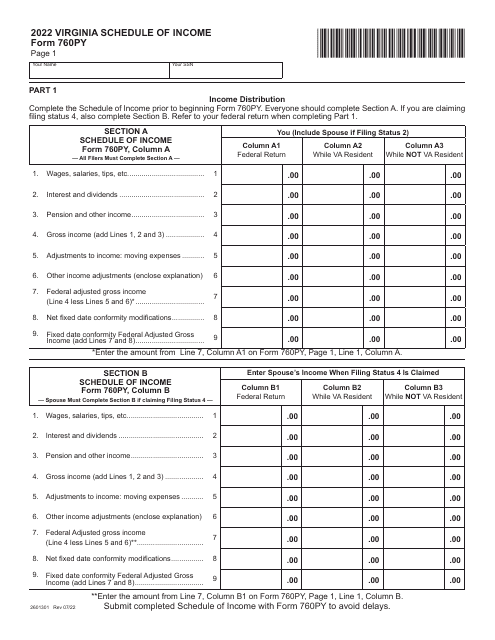

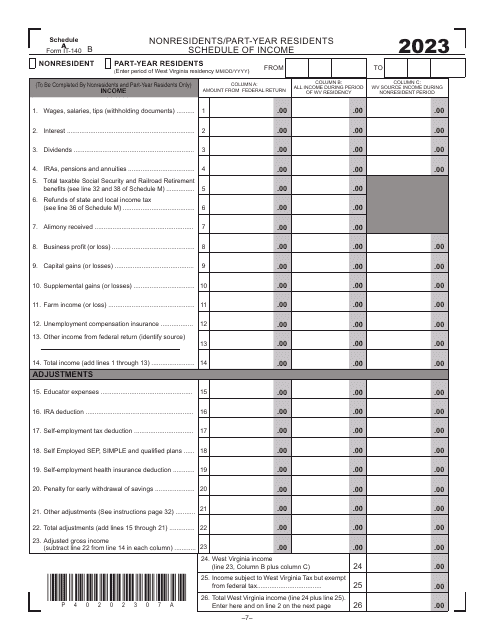

This form is used for reporting income in the state of Virginia. It is specifically for individuals who are nonresidents of Virginia, but have income from Virginia sources.