Tax Schedule Templates

Taxes can be complicated, and keeping track of all the necessary forms and schedules can be overwhelming. That's why we've created a comprehensive tax schedule collection to help you navigate through the process smoothly. Our tax schedule collection includes various forms and schedules designed to meet the specific requirements of different states and provinces.

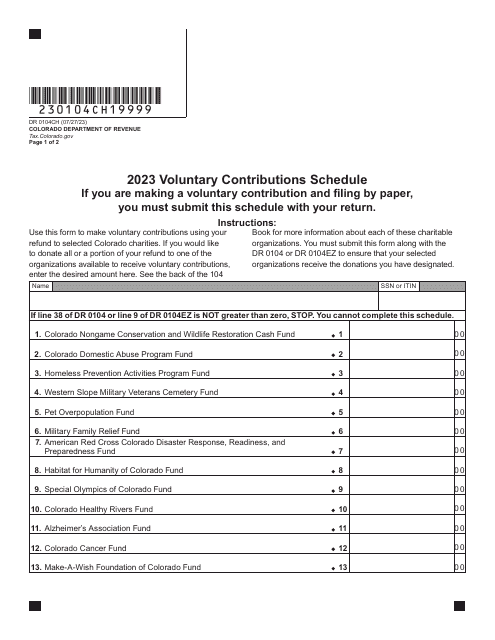

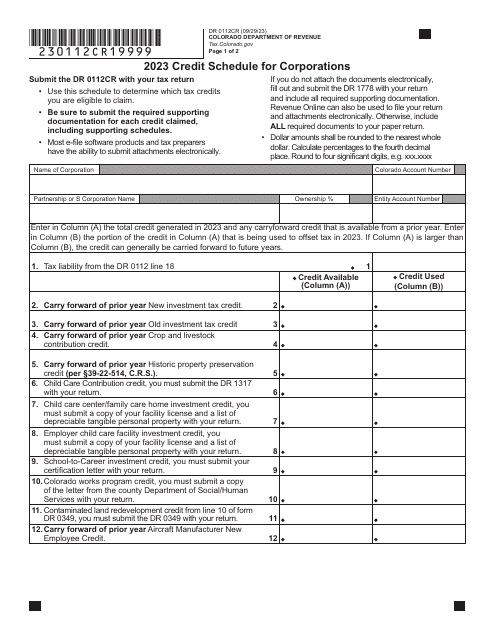

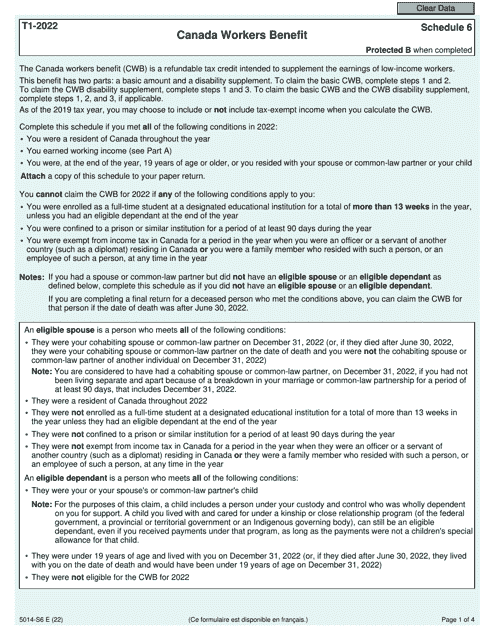

Whether you need to report Indiana Farm Winery Excise Tax, Canada Workers Benefit, Other Deductions Authorized by Law in Oregon, a Written Narrative Schedule in Kentucky, or Consumer Use Tax Reporting in Colorado, our tax schedule collection has got you covered. We understand that each jurisdiction has its own unique tax laws and regulations, and our extensive collection ensures that you have access to the appropriate forms and schedules for your specific needs.

Our tax schedule collection, also known as tax form schedules or tax schedules, provides a convenient and organized way for individuals and businesses to report their taxes accurately. With our comprehensive selection of tax schedules, you can ensure that you are meeting all your tax obligations and maximizing your deductions.

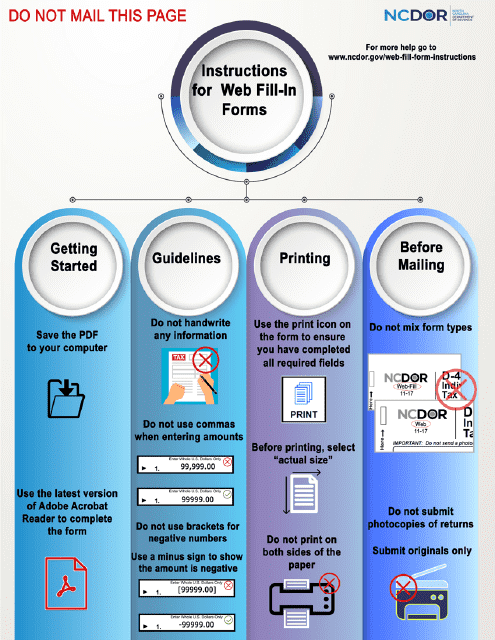

Navigating the tax landscape can be challenging, but with our tax schedule collection, you can simplify the process. We provide easy-to-understand instructions and support to help you complete your tax forms accurately and efficiently. Whether you are an individual taxpayer or a business owner, our tax schedule collection is an essential resource to ensure compliance with tax laws and regulations.

So, why stress over tax schedules? Discover the convenience and peace of mind that our tax schedule collection offers. With our comprehensive selection of tax forms and schedules, you can tackle your taxes with confidence. Say goodbye to tax season headaches - let our tax schedule collection simplify your life. Trust us to provide you with the resources you need to navigate the complex world of taxes and ensure that you are fulfilling your tax obligations with ease.

Documents:

174

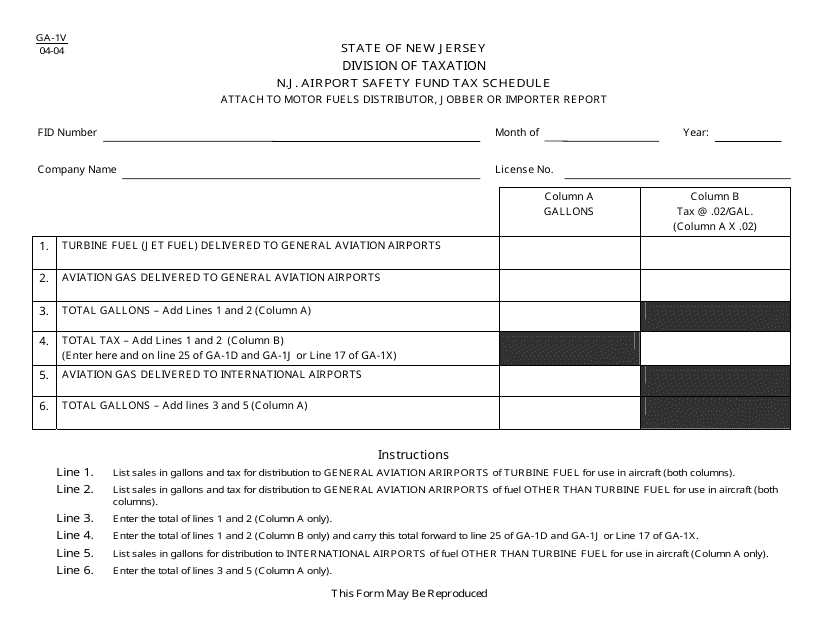

This form is used for reporting the N.J. Airport Safety Fund Tax Schedule in New Jersey.

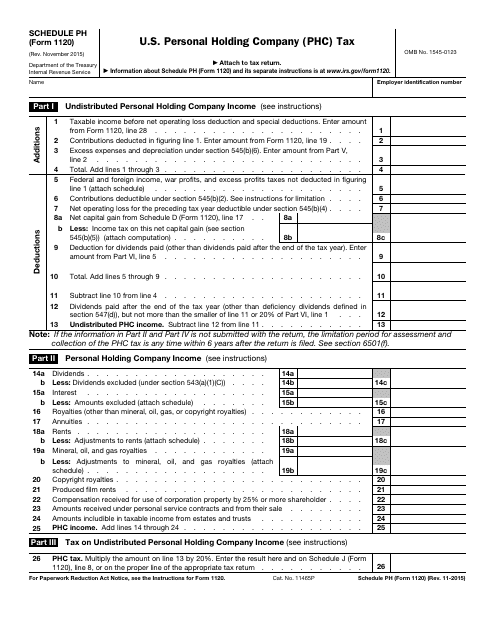

This form is used for reporting and paying U.S. Personal Holding Company (PHC) Tax for companies classified as personal holding companies.

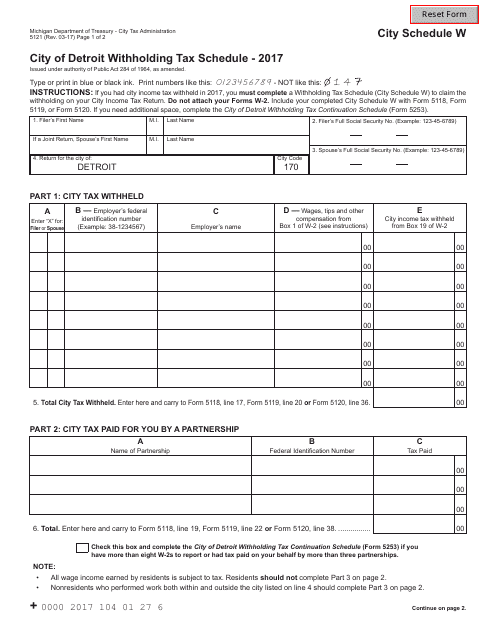

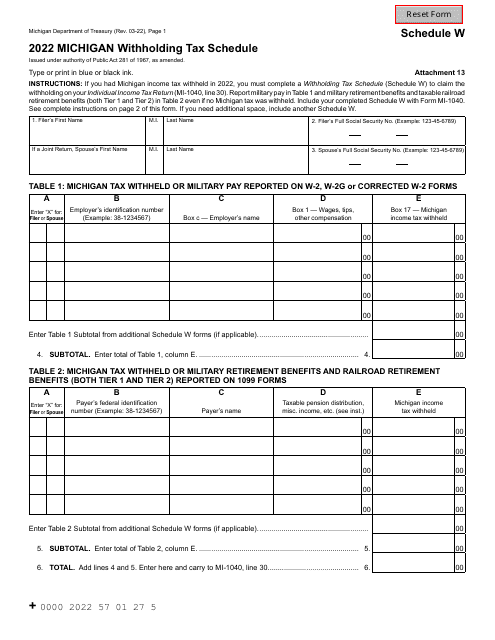

This form is used for reporting and calculating the withholding tax for City of Detroit residents in Michigan.

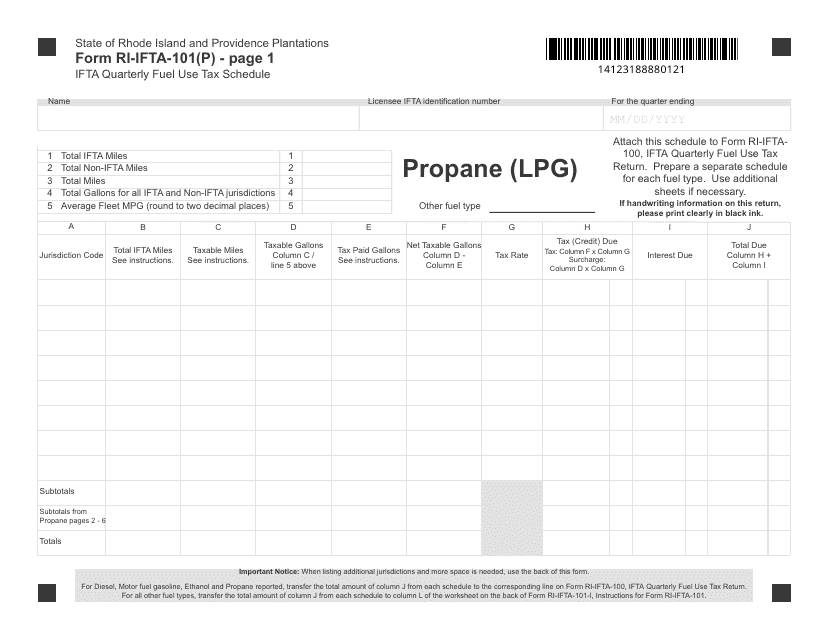

This form is used for reporting the quarterly fuel use tax for propane (LPG) in Rhode Island.

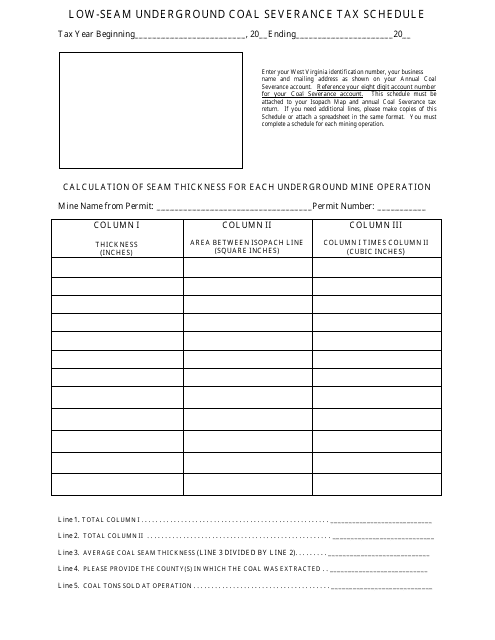

This document outlines the tax schedule for extracting coal from low-seam underground mines in West Virginia.

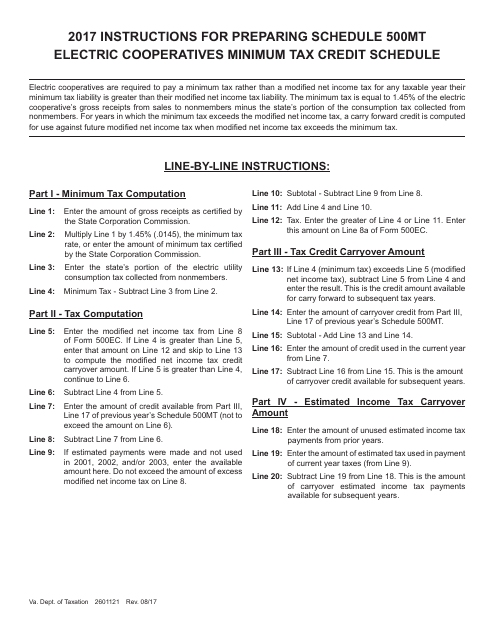

This Form is used for reporting the Minimum Tax Credit Schedule for Electric Cooperatives in Virginia.

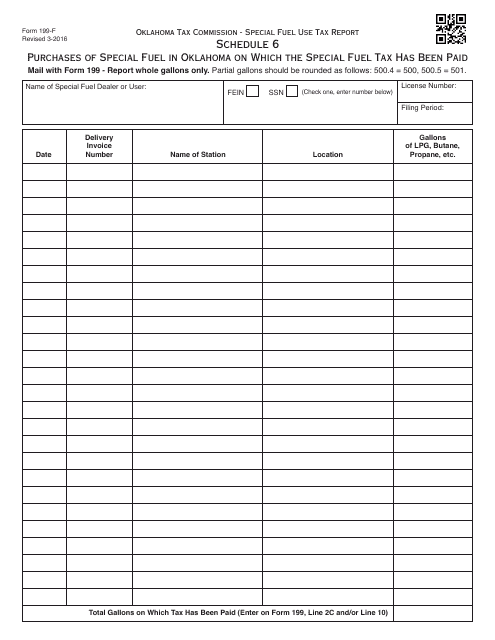

This form is used for reporting purchases of special fuel in Oklahoma on which the special fuel tax has already been paid.

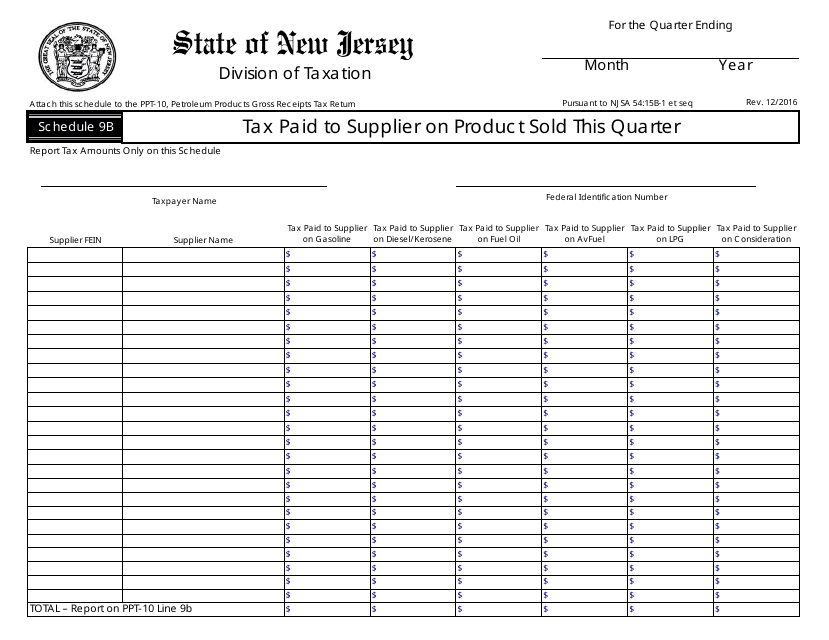

This Form is used for reporting tax paid to suppliers on products sold in the current quarter in the state of New Jersey.

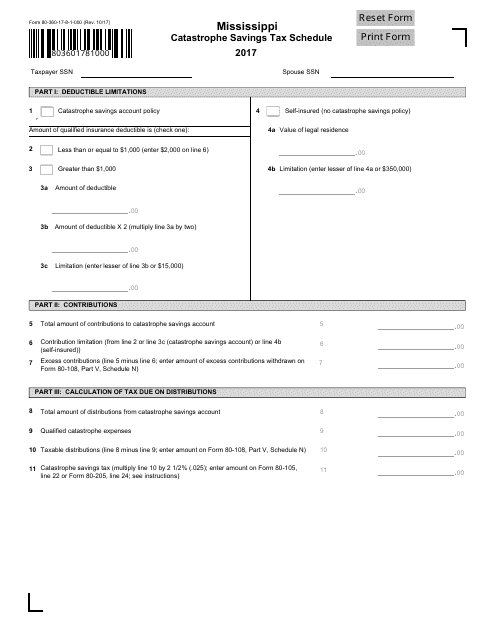

This form is used for reporting and filing taxes related to catastrophe savings in the state of Mississippi.

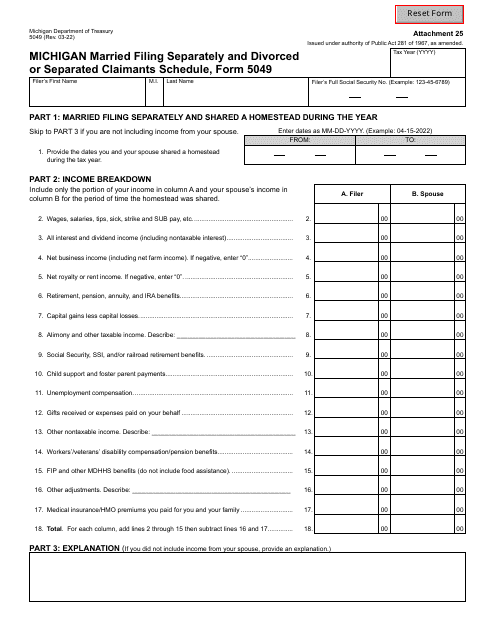

Form 5049 Michigan Married Filing Separately and Divorced or Separated Claimants Schedule - Michigan

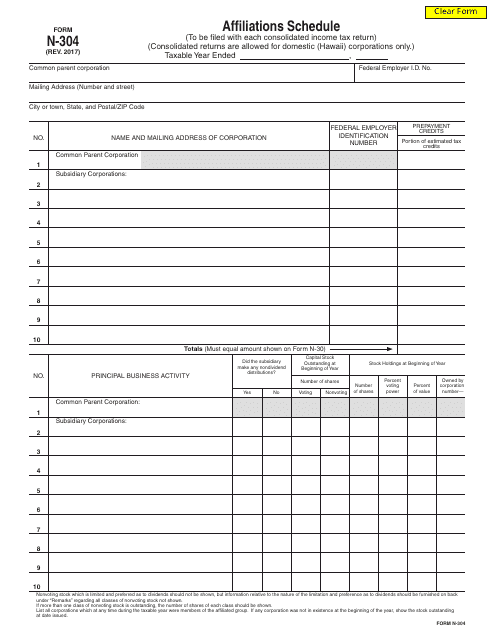

This Form is used for reporting any affiliations or connections that a taxpayer has with entities in Hawaii. It is used as part of the Hawaii state income tax return.

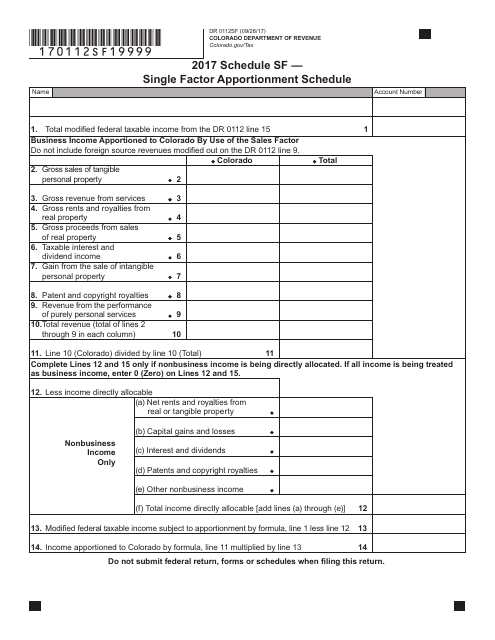

This form is used by taxpayers in Colorado to calculate their single factor apportionment schedule for tax purposes.

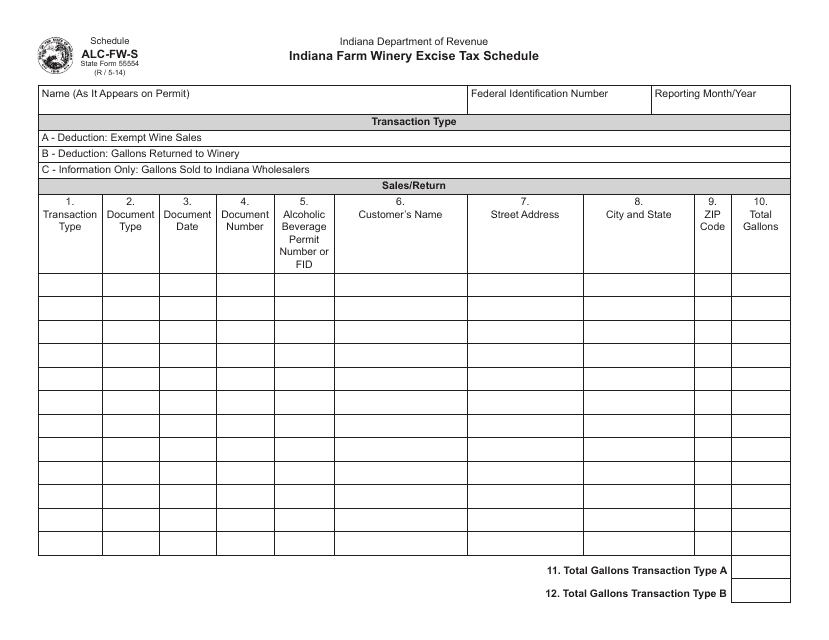

This document is used for reporting and paying excise taxes for farm wineries in Indiana.

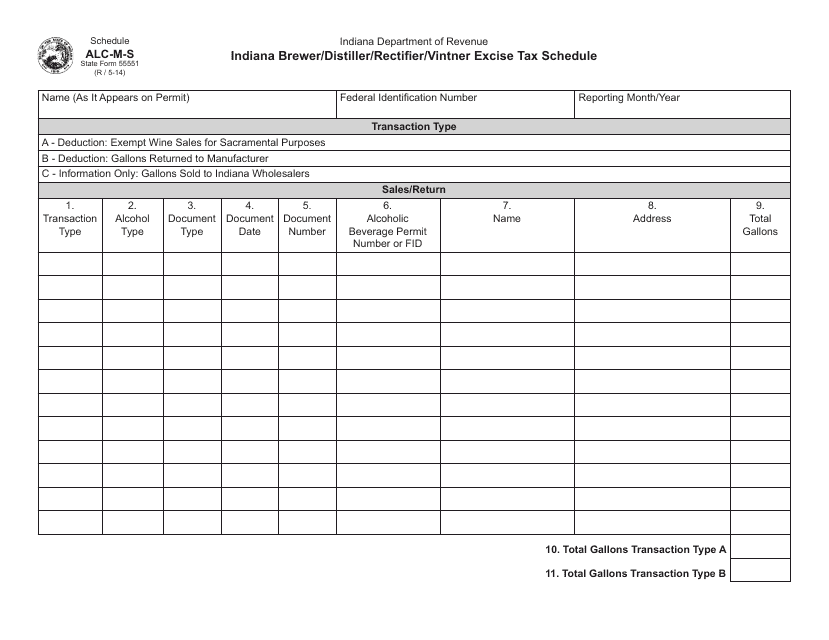

This document is a tax form used by brewers, distillers, rectifiers, and vintners in Indiana to report and pay excise taxes.

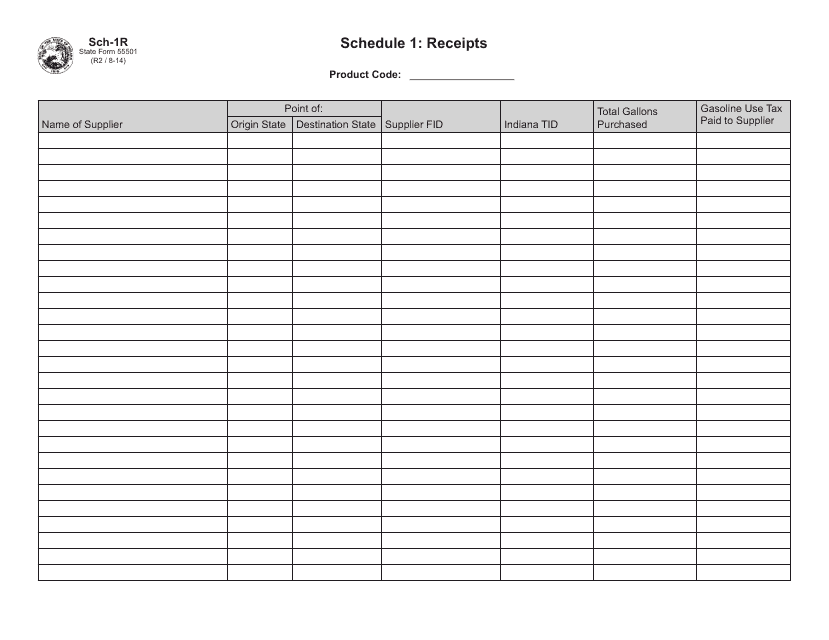

This document is used for reporting and tracking the receipts in the state of Indiana.

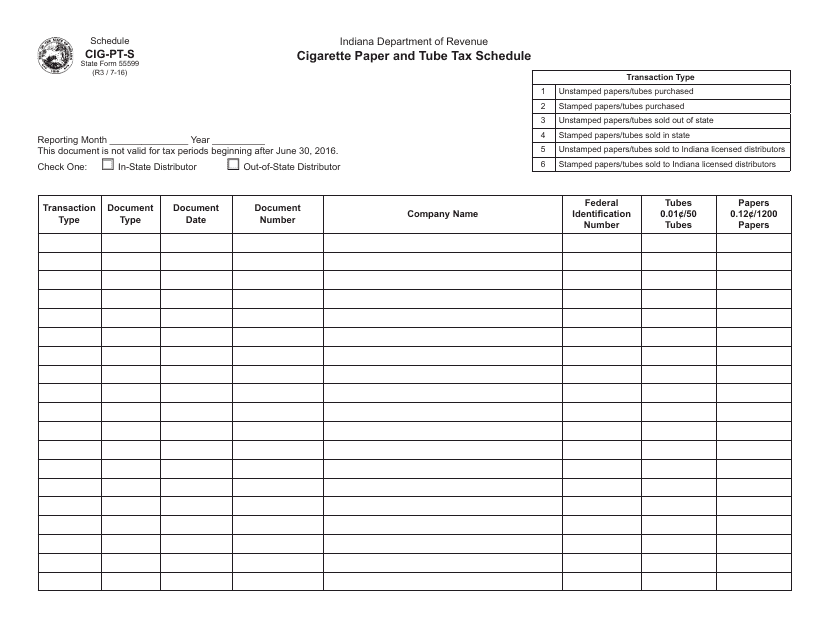

This form is used for reporting and paying the cigarette paper and tube tax in Indiana.

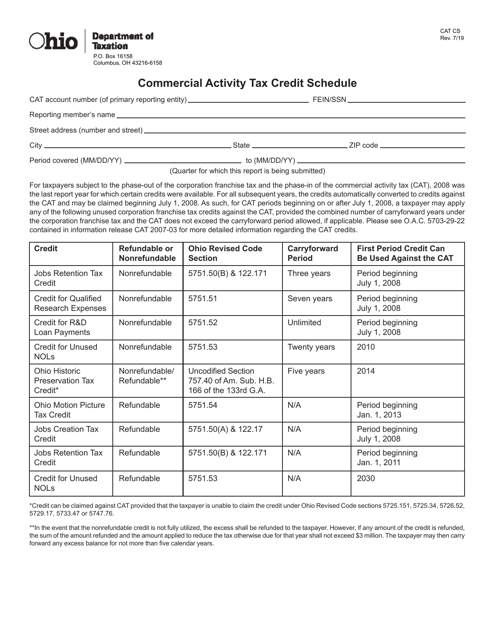

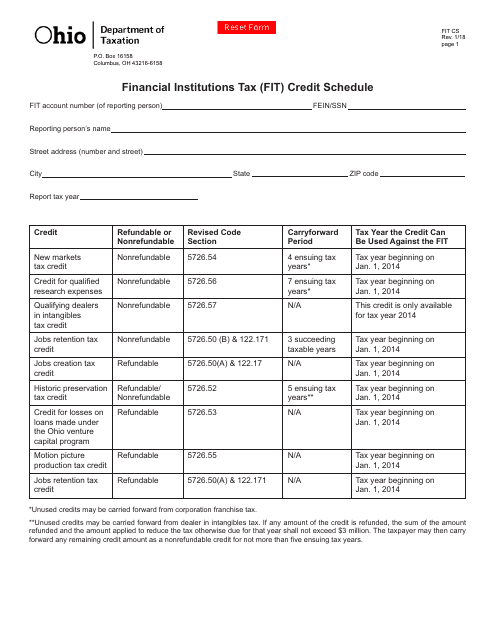

This Form is used for reporting and claiming the Financial Institutions Tax (FIT) Credit in Ohio.

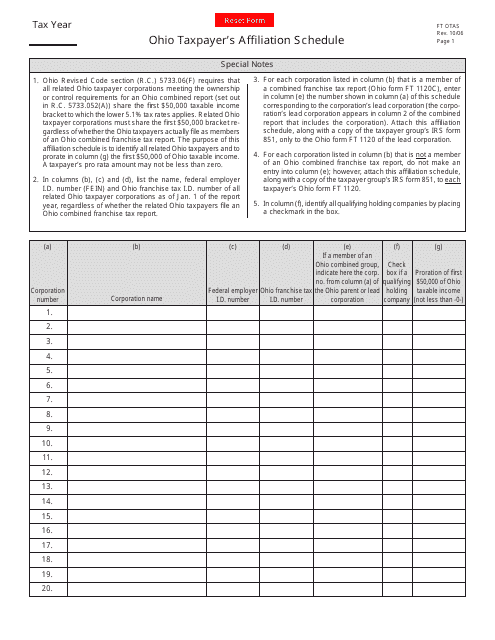

This Form is used for reporting the taxpayer's affiliation in Ohio for tax purposes. It is required by the Ohio Department of Taxation.

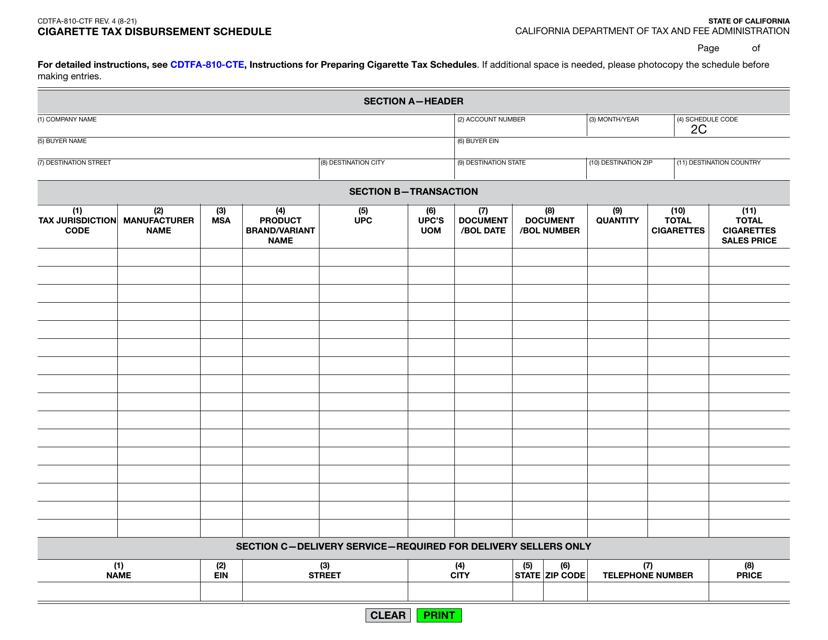

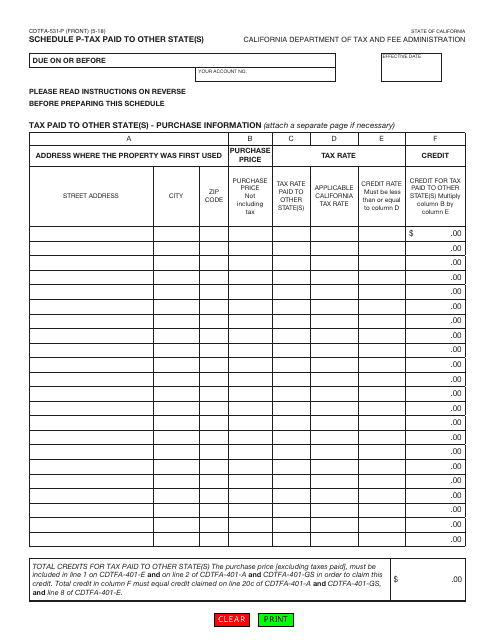

This form is used for reporting tax paid to other state(s) for California residents.

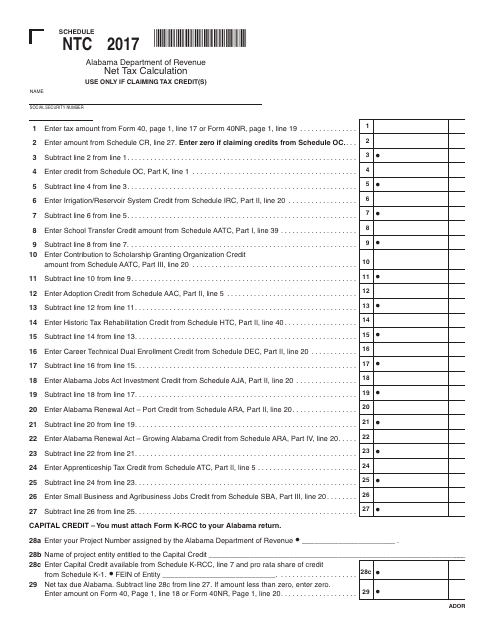

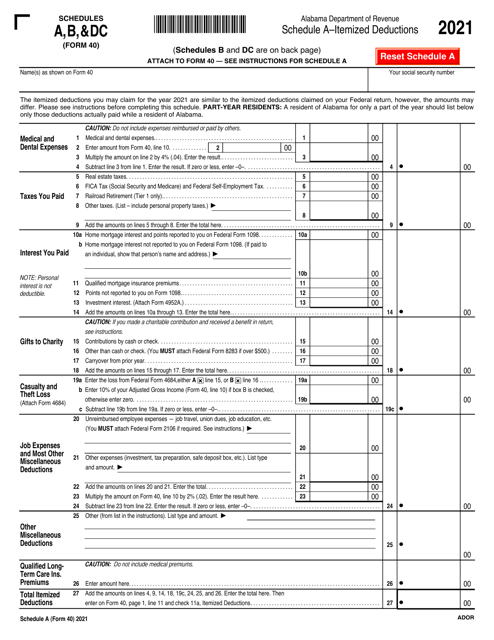

This document is used for calculating the net tax in Alabama using Schedule NTC.

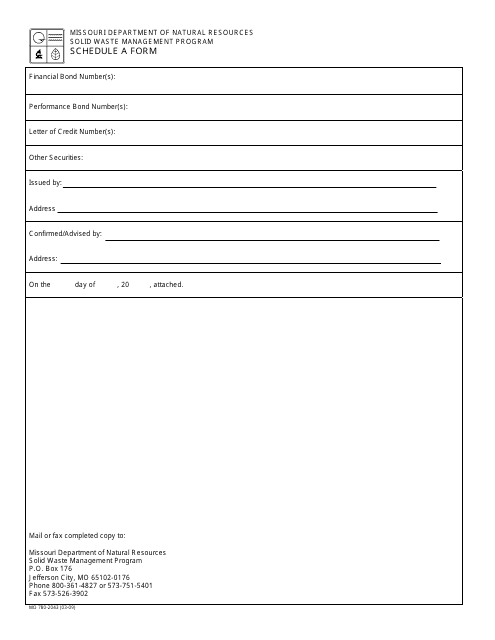

This Form is used for Schedule A Form in the state of Missouri.

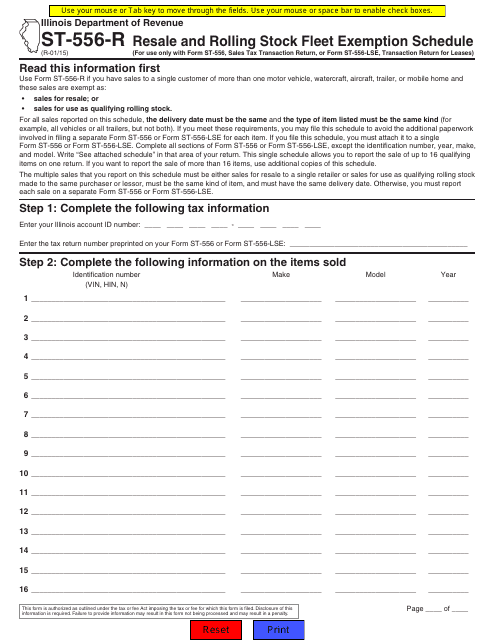

This form is used for reporting the resale and exemption schedule for rolling stock fleets in the state of Illinois.

This form is used for reporting supplemental prime contractor tax in Mississippi.

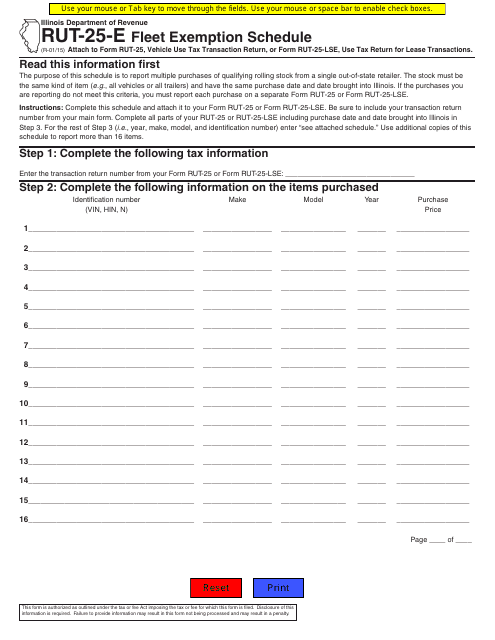

This form is used for fleet exemption schedule in Illinois. It is specifically for Form RUT-25-E.

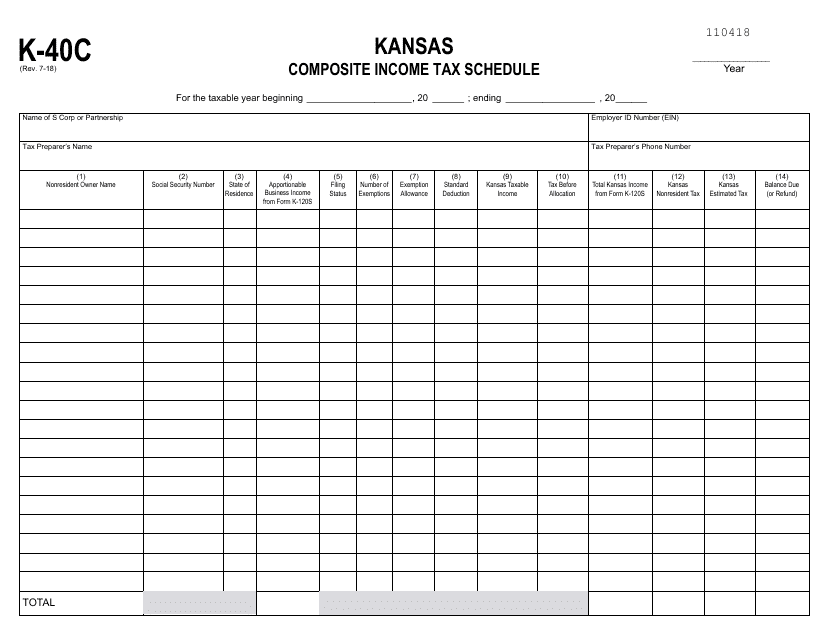

This form is used for reporting composite income tax for individuals in the state of Kansas.

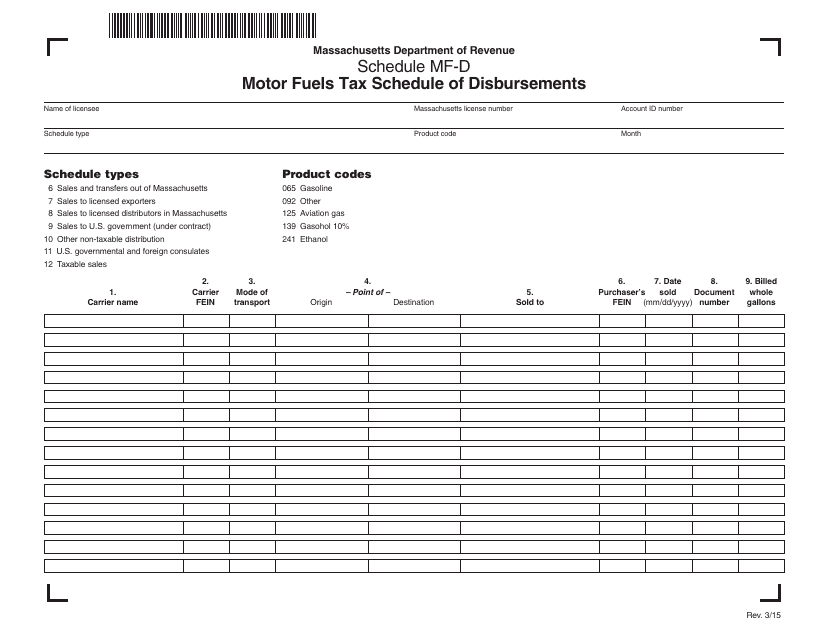

This type of document is used to report the disbursements of motor fuels tax in Massachusetts.

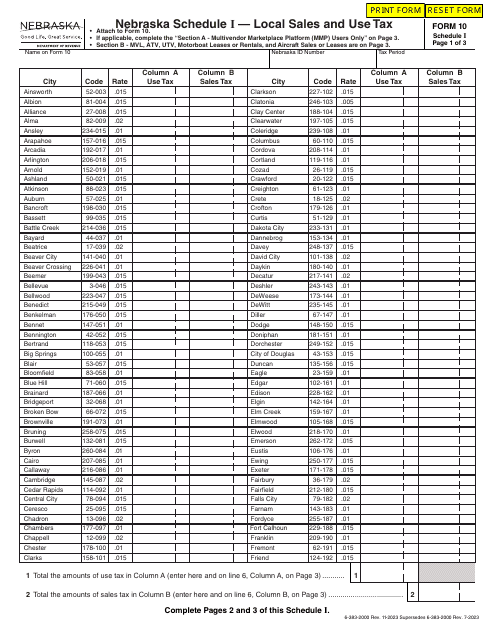

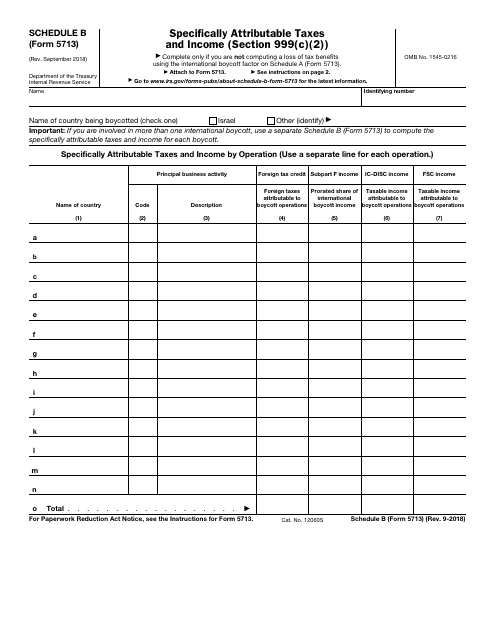

This document is used for reporting specifically attributable taxes and income under Section 999(C)(2) on Schedule B of IRS Form 5713.