Loan Eligibility Templates

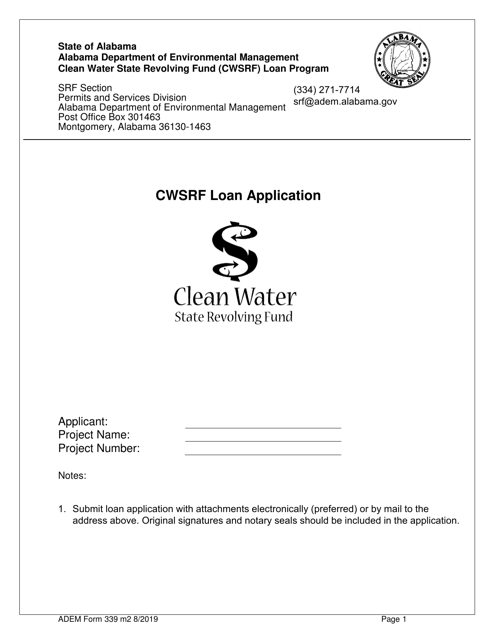

Are you looking to get a loan and wondering if you are eligible? Our loan eligibility documents collection provides you with all the information you need to determine if you qualify for a loan. Whether you are a student in Prince Edward Island, Canada looking for a student loan appeal form, or a resident in the United Kingdom in need of an integration loan application form, we have you covered. Our documents include SBA Form 444C Debenture Certification Form, Initial Maximum Rate Schedule for Consumer Credit Sales in South Carolina, and Revolving Loan Funds Application Forms for the City of Warren, Ohio. Don't waste your time searching for loan eligibility requirements elsewhere. Explore our comprehensive loan eligibility documents collection today.

Documents:

58

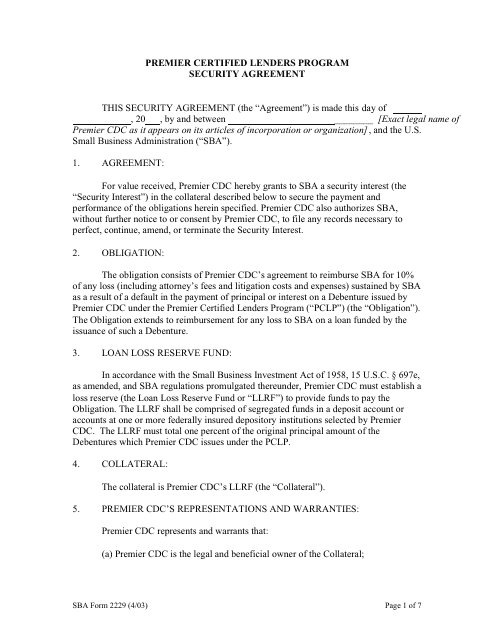

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

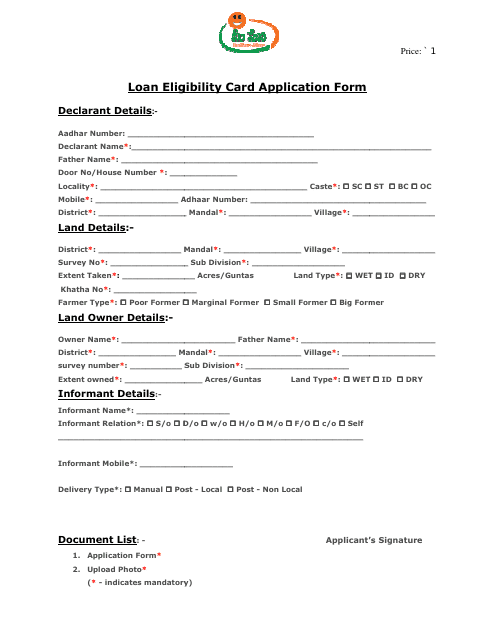

This form is used for applying for a loan eligibility card in India.

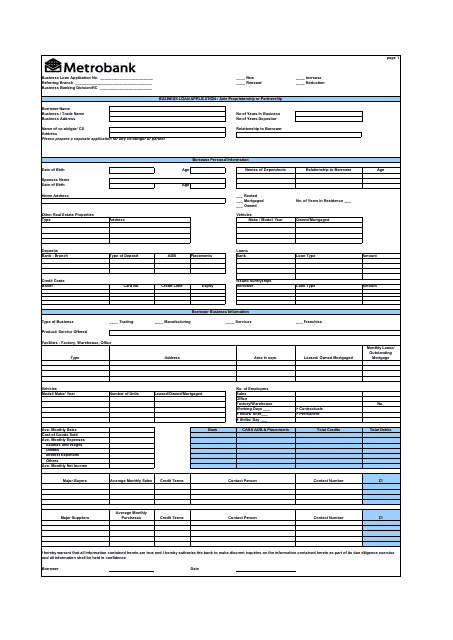

This document is used for applying for a business loan with Metrobank.

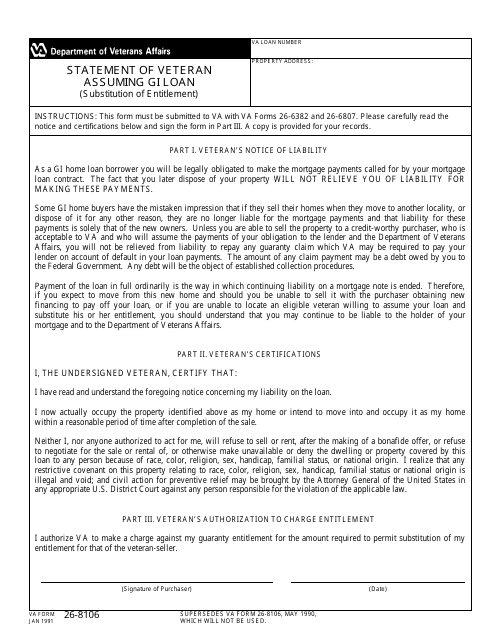

This Form is used for veterans assuming GI loans to provide a statement confirming their intention to assume the loan.

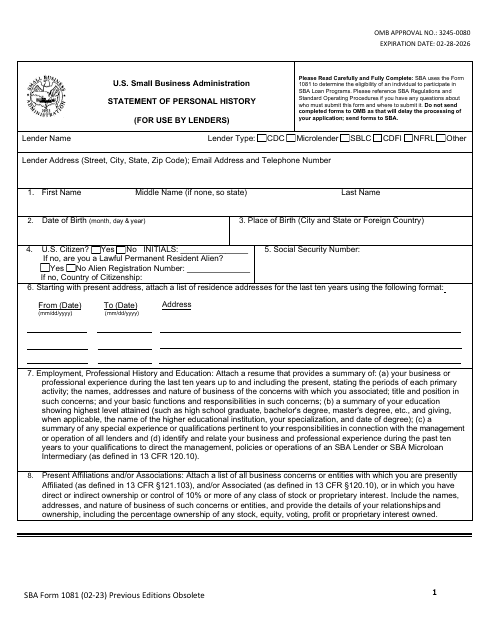

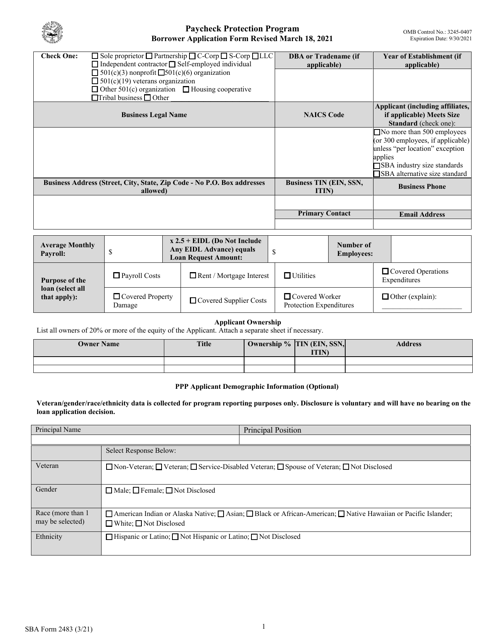

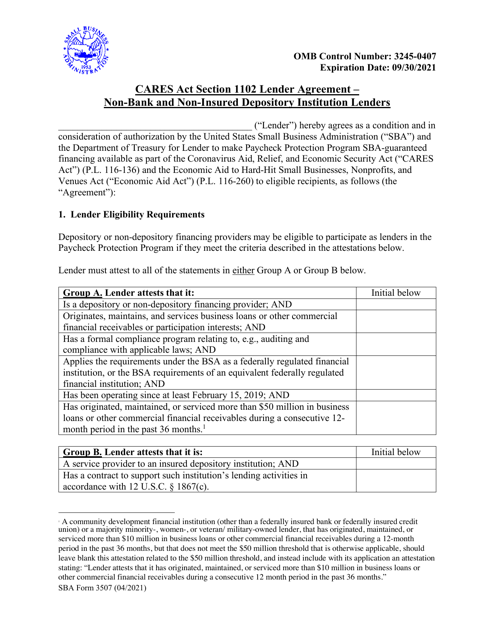

This form is used and sent to the Small Business Administration (SBA). It verifies your eligibility for participation in the Agency's loan programs.

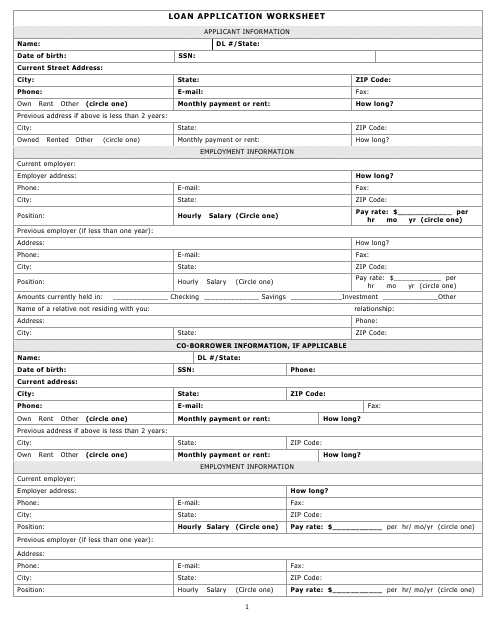

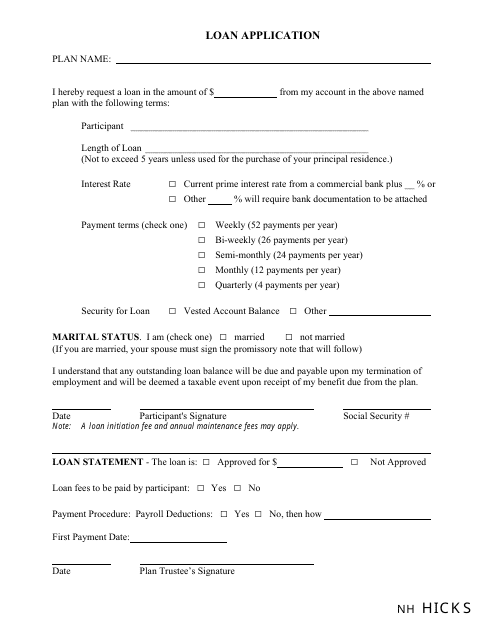

This Form is used for applying for a loan from Nh Hicks. It is a document that collects the necessary information and details for the loan application process.

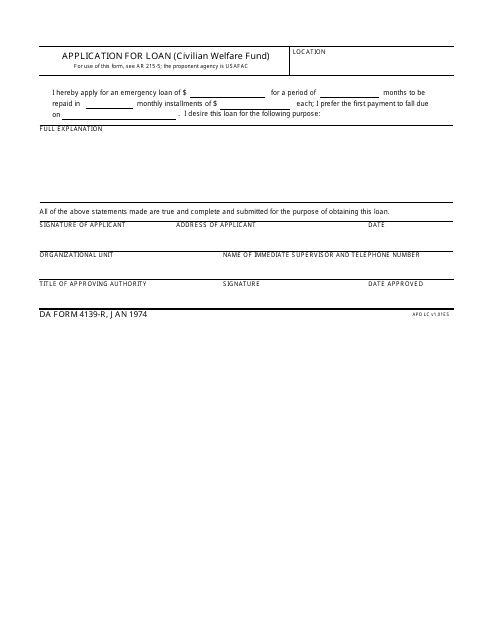

This form is used for applying for a loan from the Civilian Welfare Fund.

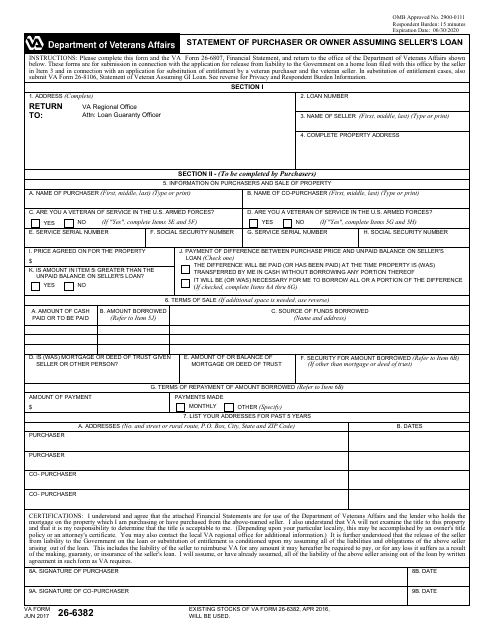

This Form is used for buyers or owners who are assuming the seller's loan.

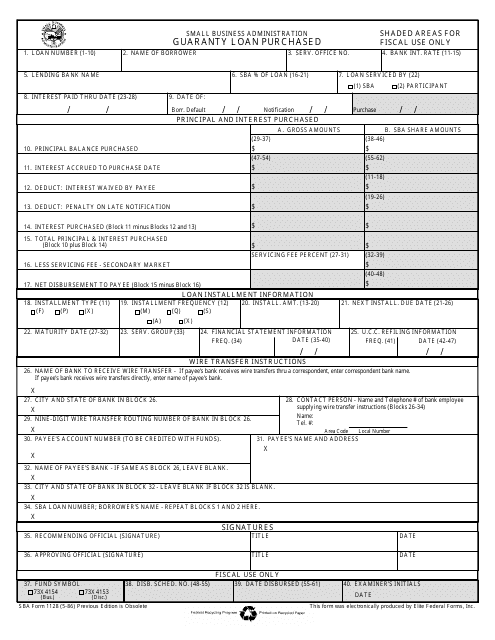

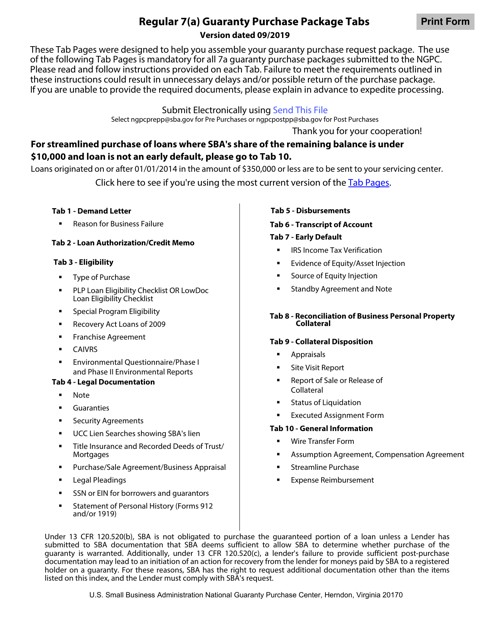

This Form is used for purchasing a guaranteed loan through the Small Business Administration (SBA).

This form is required to be filled out by the Certified Development Company (CDC) to report the debenture payment schedule of development companies.

This document is used for the Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans under the Small Business Administration (SBA) program.

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

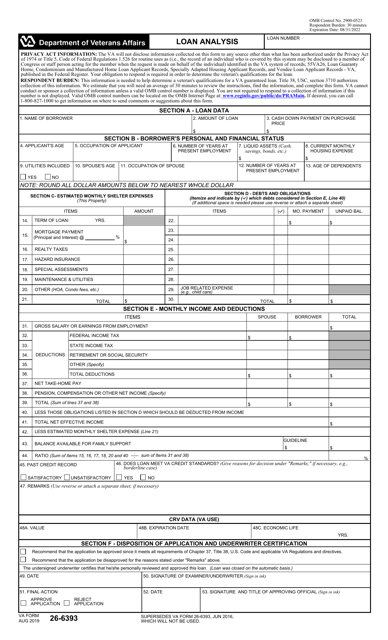

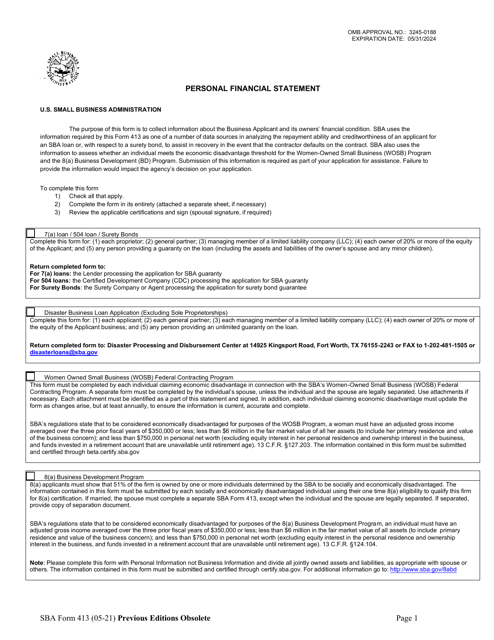

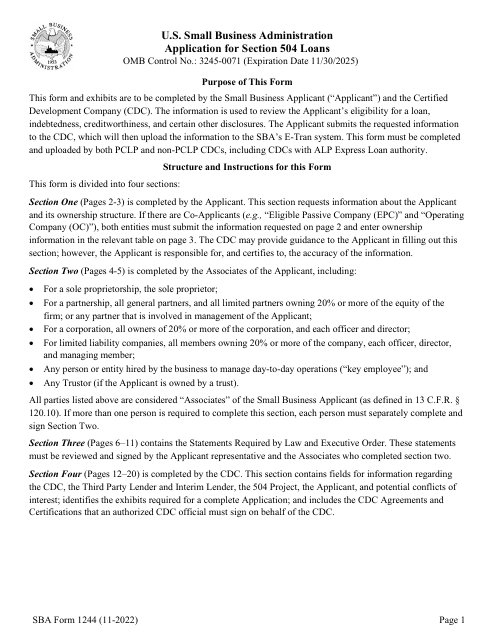

This form is used by the Small Business Administration (SBA) to determine a loan applicant's creditworthiness, indebtedness, and overall eligibility for the SBA Section 504 loan.

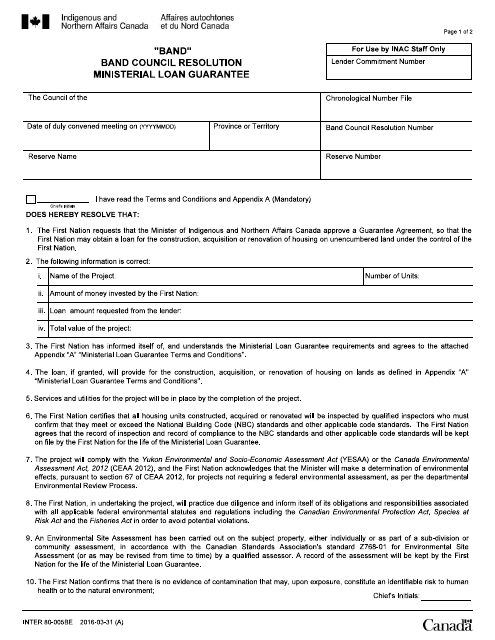

This Form is used for a Band Council Resolution in Canada to obtain a Ministerial Loan Guarantee.

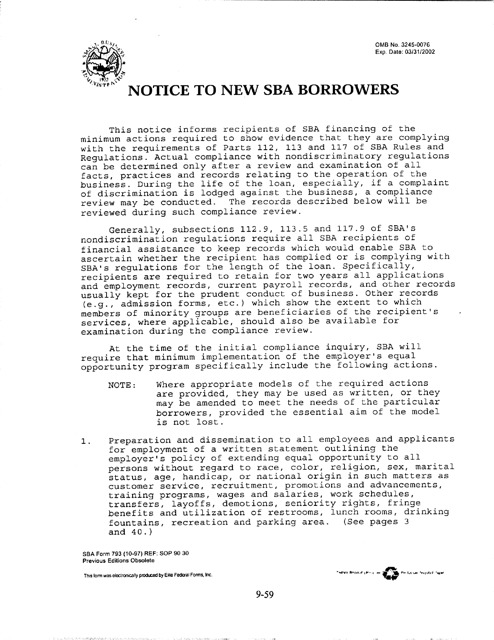

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

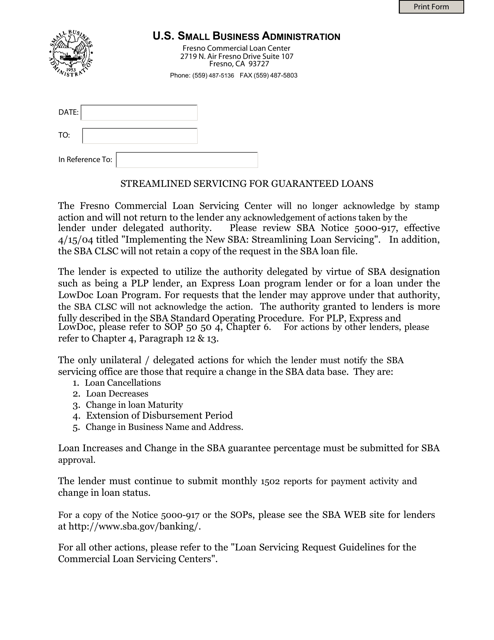

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

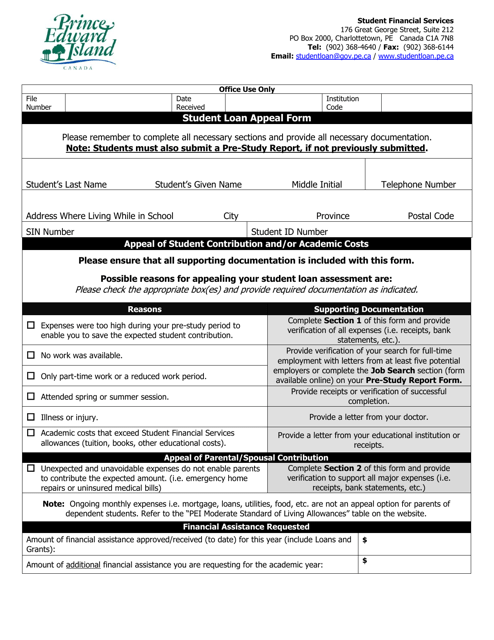

This document is used for appealing a student loan decision in Prince Edward Island, Canada.

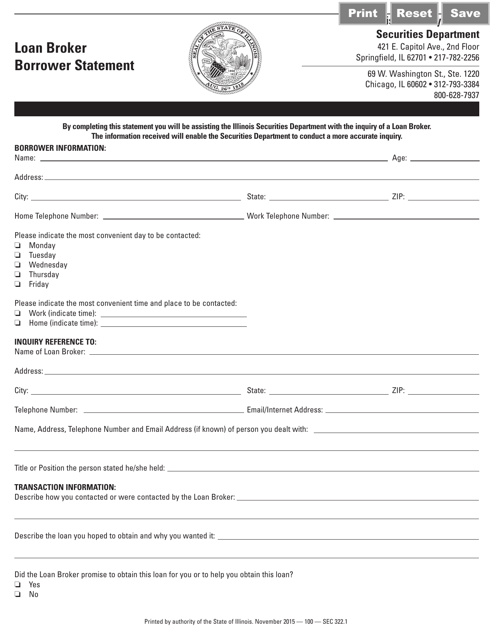

This form is used for borrowers in Illinois who are working with a loan broker. It is a statement that includes important information about the borrower's financial situation and their agreement with the loan broker.

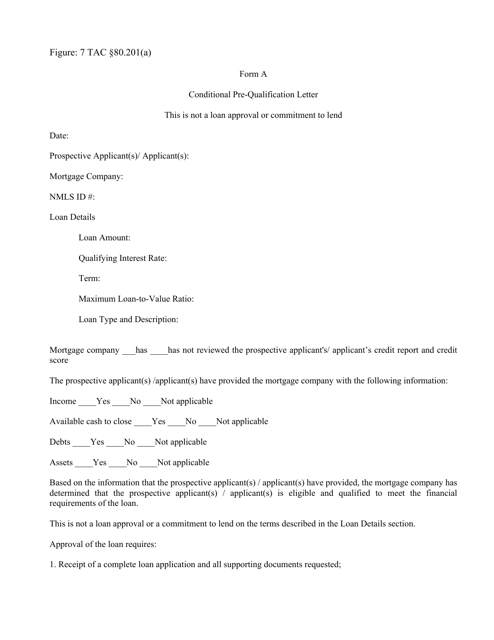

This form is used for obtaining a conditional pre-qualification letter in the state of Texas. It helps individuals determine their eligibility for a loan or mortgage.

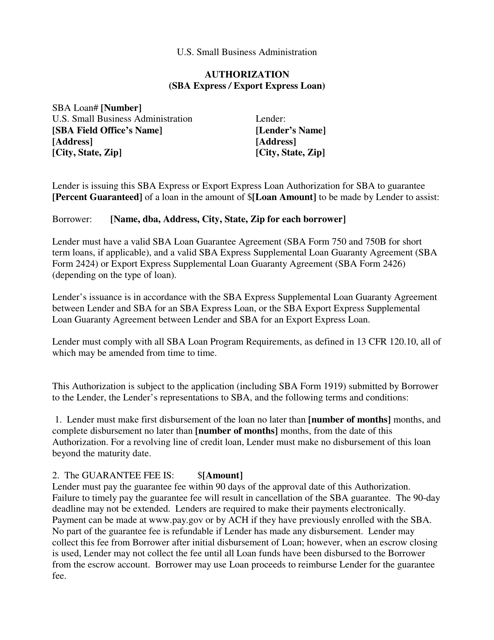

This document is for authorizing an SBA Express or Export Express Loan.

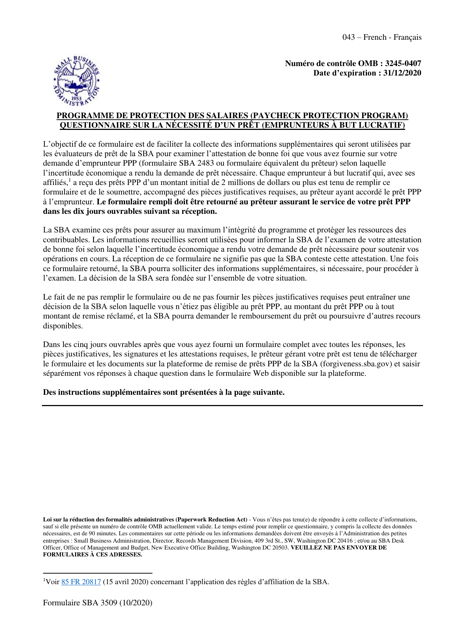

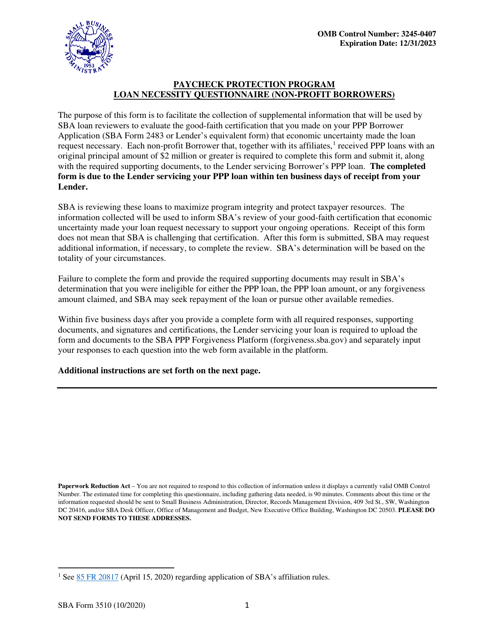

This document is used for non-profit borrowers who have received a Paycheck Protection Program loan and need to fill out a questionnaire regarding the necessity of the loan.

This form is used for non-profit organizations applying for the Paycheck Protection Program loan. It includes a questionnaire to assess the necessity of the loan.

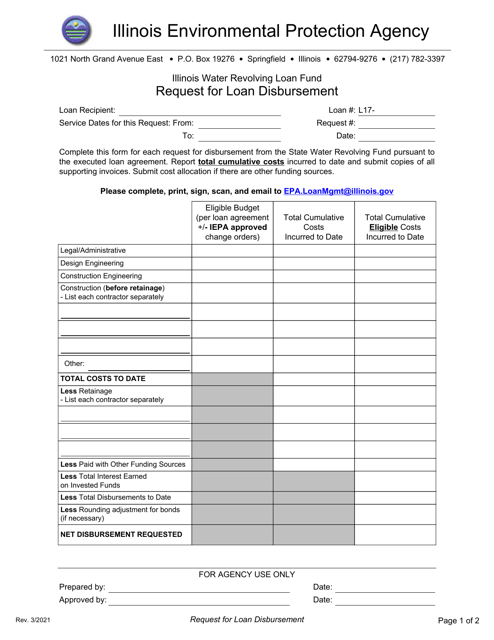

This document is used for requesting the disbursement of a loan in the state of Illinois.

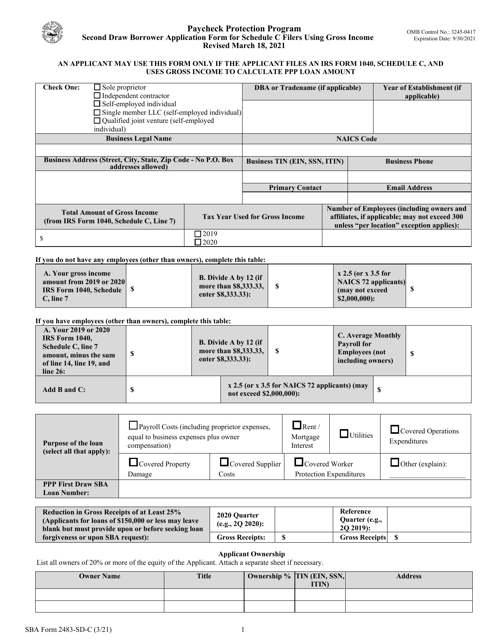

This form is used for small business owners who file their taxes with a Schedule C form and are applying for a second draw loan through the Small Business Administration. The form specifically caters to those who calculate eligibility based on gross income.

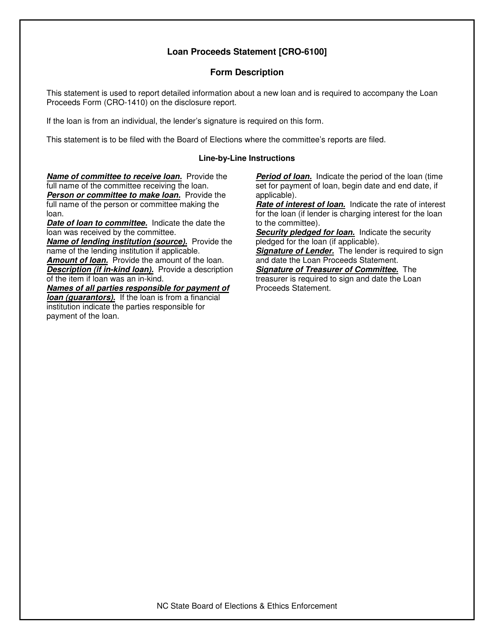

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

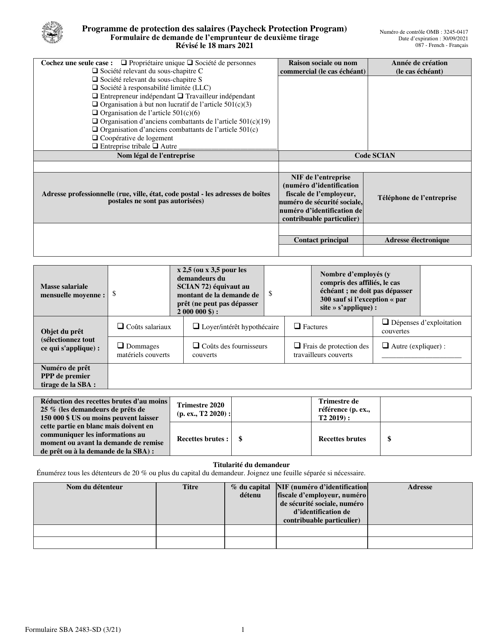

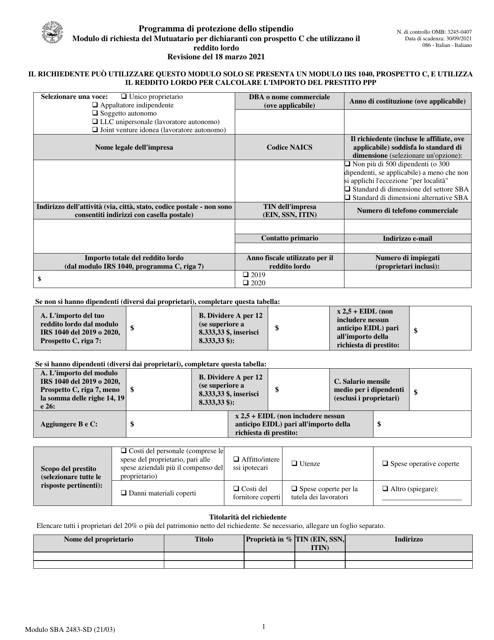

This Form is used for Italian Schedule C filers applying for the First Draw Borrower Application under the SBA program.

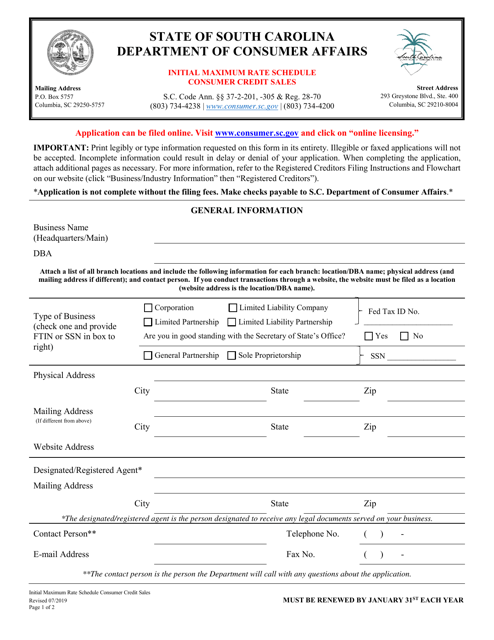

This document provides the maximum interest rates for consumer credit sales in South Carolina.