Wage Subsidy Templates

Are you a business owner looking for financial assistance during these challenging times? Look no further than our comprehensive wage subsidy program. Also known as a wage subsidy form, this program is designed to help businesses maintain their workforce while reducing the financial burden on employers.

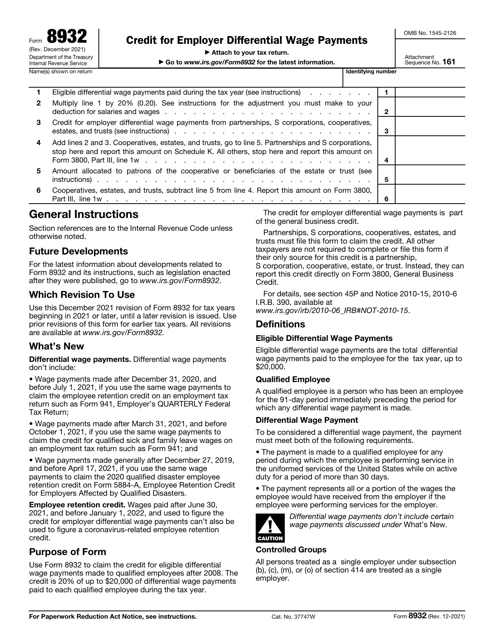

At the heart of our wage subsidy program is the IRS Form 8932 Credit for Employer Differential Wage Payments. This form allows eligible employers to claim a credit for a portion of the wages paid to employees during periods of inactivity or reduced hours. This not only helps businesses retain their valuable employees but also provides some relief from the economic impact of the current situation.

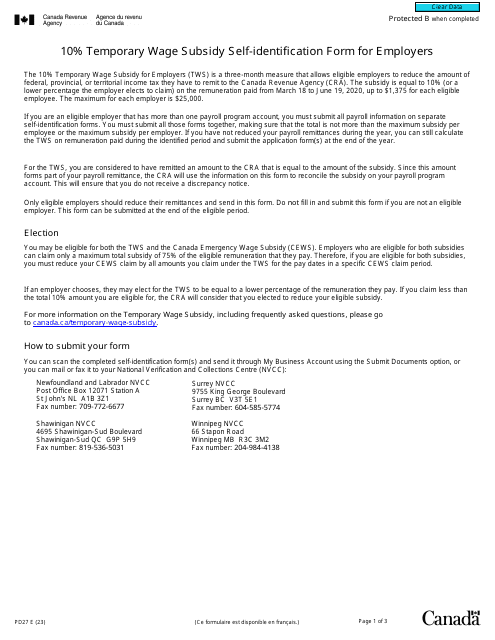

If you are a business located in Canada, you can take advantage of the Form PD27 10% Temporary Wage Subsidy Self-identification Form for Employers. This form allows eligible employers to identify themselves and apply for the temporary wage subsidy program, which provides financial support to businesses adversely affected by the pandemic.

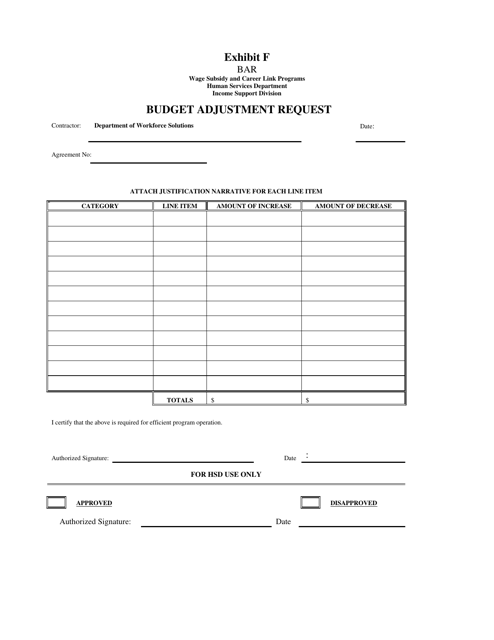

For businesses in New Mexico, there is the Exhibit F Budget Adjustment Request - Wage Subsidy and Career Link Programs. This document enables businesses to request a budget adjustment to access the wage subsidy and career link programs, offering crucial financial assistance to help retain employees and promote job stability.

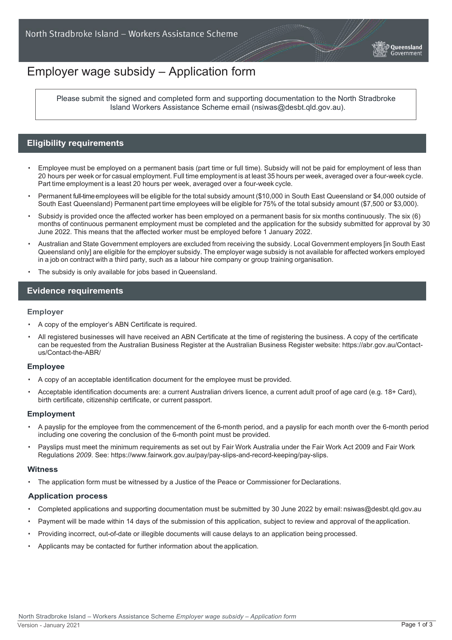

Businesses in Queensland, Australia, can benefit from the Employer Wage Subsidy Application Form. This form allows employers to apply for the wage subsidy program, helping to offset the costs of wages and maintain a skilled workforce in these challenging times.

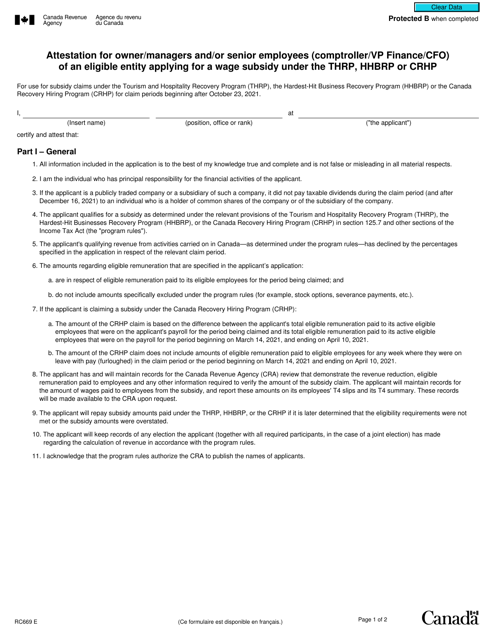

Lastly, the Form RC669 Attestation for Owner/Managers and/or Senior Employees provides eligible entities in Canada applying for a wage subsidy under the Thrp, Hhbrp, or Crhp with an opportunity to attest their eligibility and receive the necessary financial support.

Don't let the financial strain of the pandemic weigh you down. Explore our comprehensive wage subsidy program and access the necessary funds to support your business and employees. Apply today and secure the financial assistance you need to navigate these uncertain times.

Documents:

5

This document is a budget adjustment request form for the Wage Subsidy and Career Link programs in New Mexico. It is used to request changes in the allocated budget for these programs.

This document is used for applying for an employer wage subsidy in Queensland, Australia. The subsidy is provided to employers to assist them in hiring and retaining staff.

This document provides an attestation form for owner/managers and senior employees of eligible entities in Canada who are applying for a wage subsidy under the Thrp, Hhbrp, or Crhp programs.