Incur Cost Templates

Are you looking to incur costs for a specific project or activity? Our document group on incurring costs provides a comprehensive collection of resources to help you navigate the process and understand the necessary steps involved.

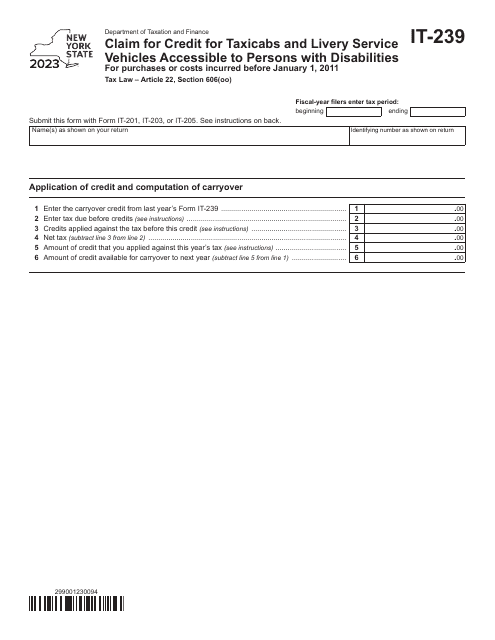

Whether you're a business seeking to request a grant to incur costs prior to contract execution or an individual looking to claim tax credits for costs incurred on accessible vehicles, our documents cover a wide range of scenarios and jurisdictions.

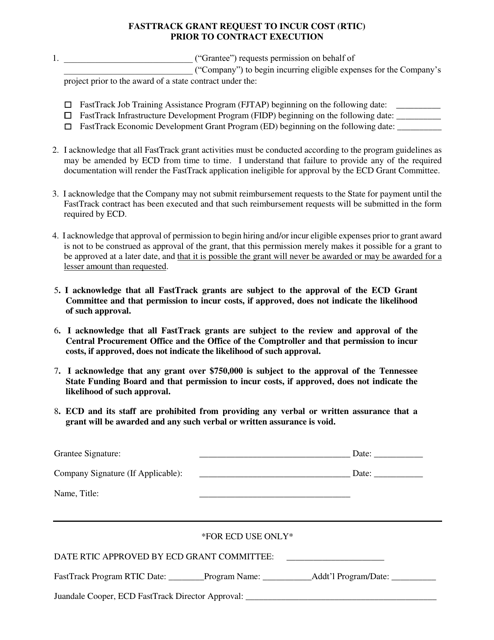

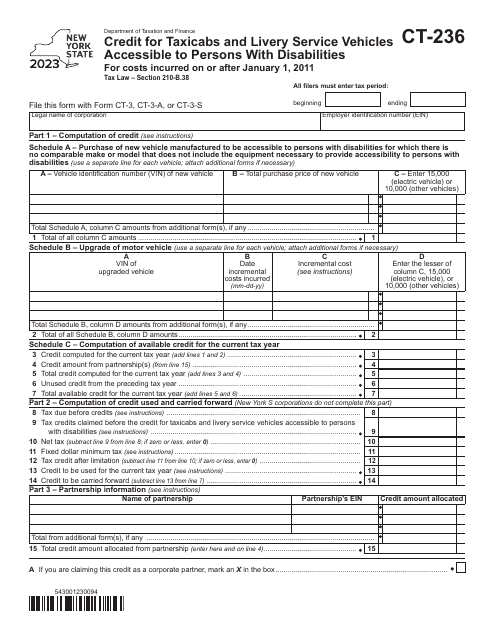

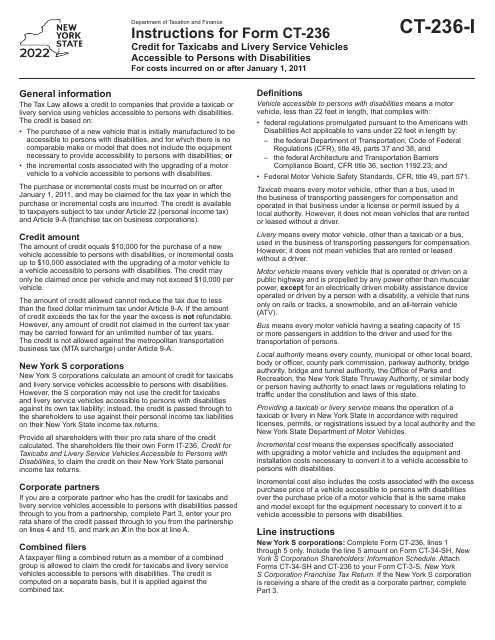

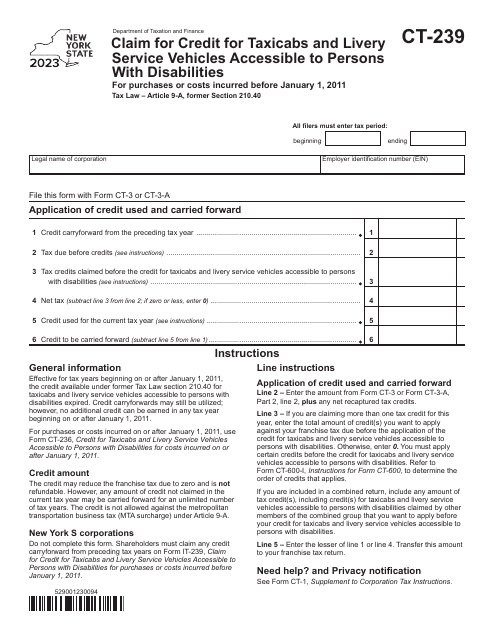

For example, you'll find forms and instructions such as the Fasttrack Grant Request to Incur Cost (Rtic) Prior to Contract Execution in Tennessee and the Form CT-236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities for Costs Incurred on or After January 1, 2011 in New York.

We understand that navigating these documents can be complex, which is why we've curated resources to make the process easier for you. Whether you're a business owner, taxpayer, or individual seeking reimbursement for incurred costs, our documents provide the necessary information and guidance.

So, if you're ready to take the next steps in incurring costs for your project or activity, explore our collection of documents and find the resources you need. We're here to support you every step of the way!

Documents:

14

This form is used for requesting fast-track grant funding in Tennessee to incur costs before a contract is executed.

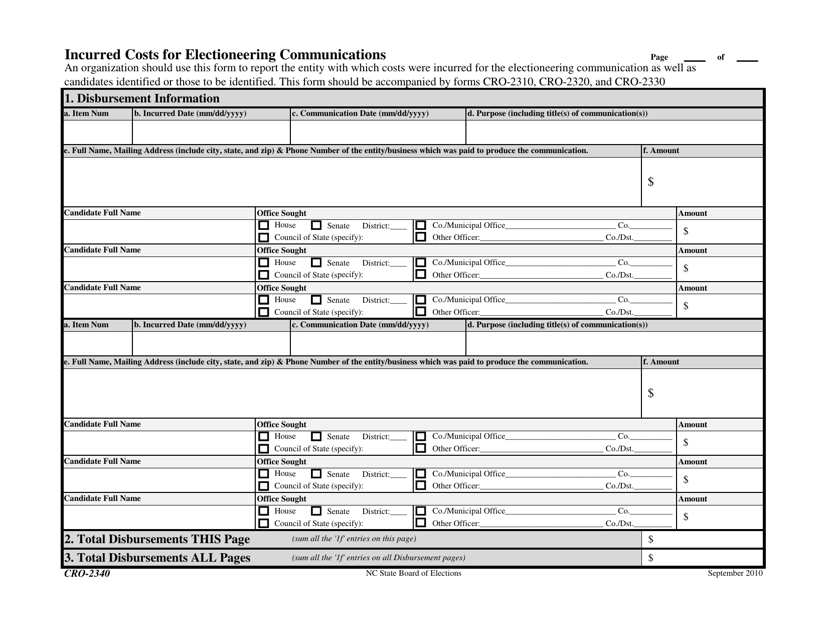

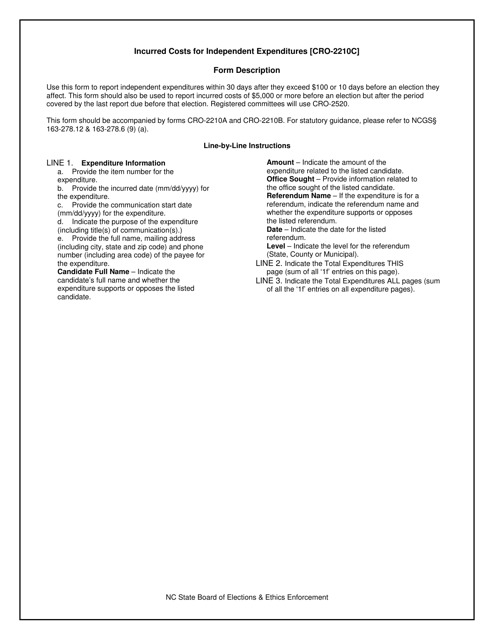

This Form is used for reporting the incurred costs of electioneering communications in the state of North Carolina.

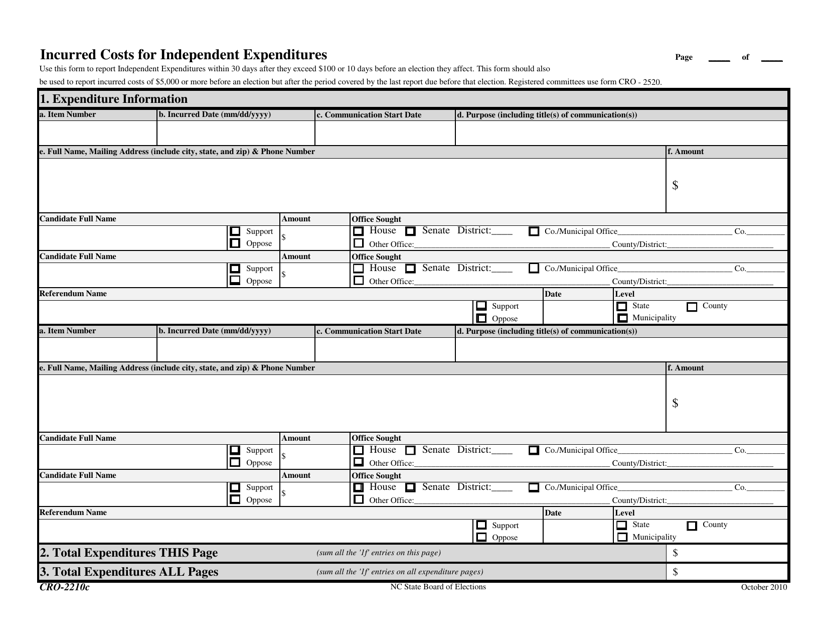

This Form is used for reporting the incurred costs of independent expenditures in North Carolina. It provides instructions on how to accurately fill out the form and submit the required information.

This form is used for reporting incurred costs for independent expenditures in the state of North Carolina.

This Form is used for reporting incurred costs for electioneering communications in North Carolina.

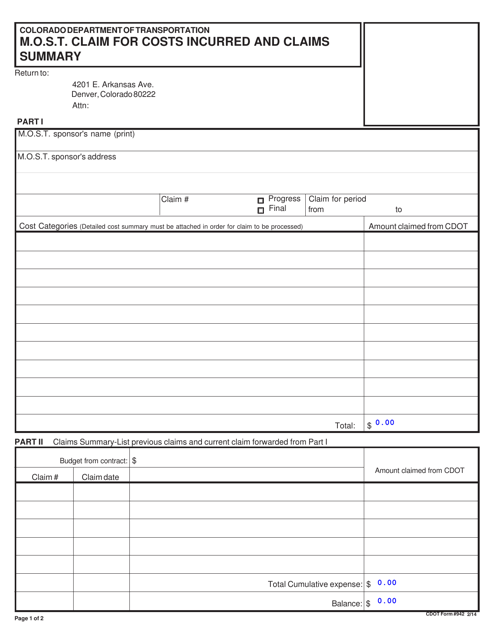

This form is used for filing a claim for costs incurred and providing a summary of claims in the state of Colorado.