Revocable Trust Templates

A revocable trust, also known as a living trust or an inter-vivos trust, is a legal document that allows you to dictate how your assets will be managed during your lifetime and distributed after your death. This flexible estate planning tool provides a means to transfer your property and wealth while avoiding the probate process.

By creating a revocable trust, you can maintain control over your assets, designate beneficiaries, and minimize estate taxes. This alternative to a traditional will allows for privacy and ensures a smooth transition of your assets to your loved ones.

Some common documents associated with a revocable trust include:

-

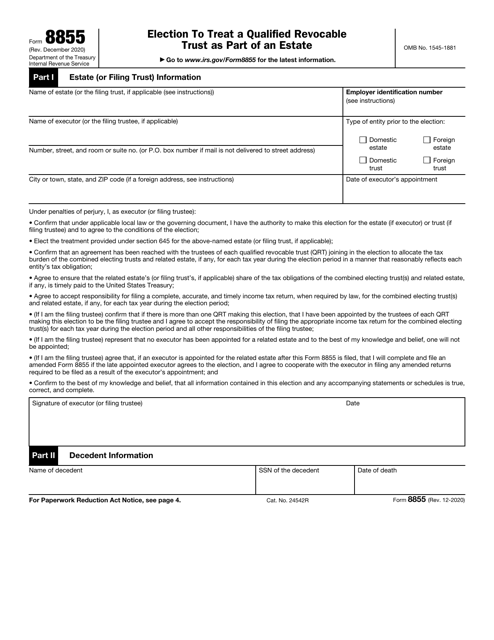

IRS Form 8855 Election to Treat a Qualified Revocable Trust as Part of an Estate: This form allows you to elect to include your qualified revocable trust as part of your estate, providing certain tax benefits.

-

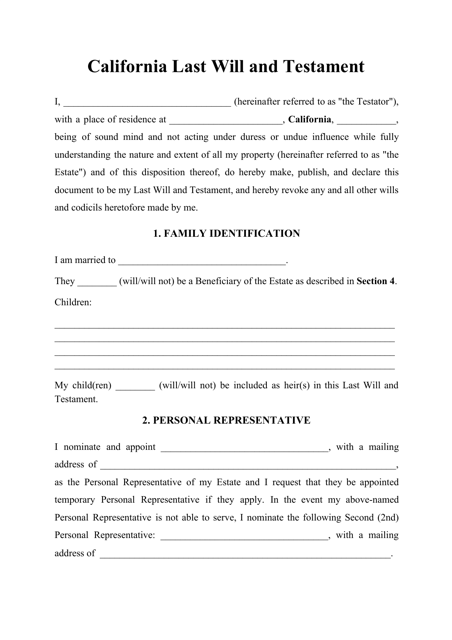

Last Will and Testament Template - California: A will is often used in conjunction with a revocable trust to cover assets that were not transferred into the trust during your lifetime.

-

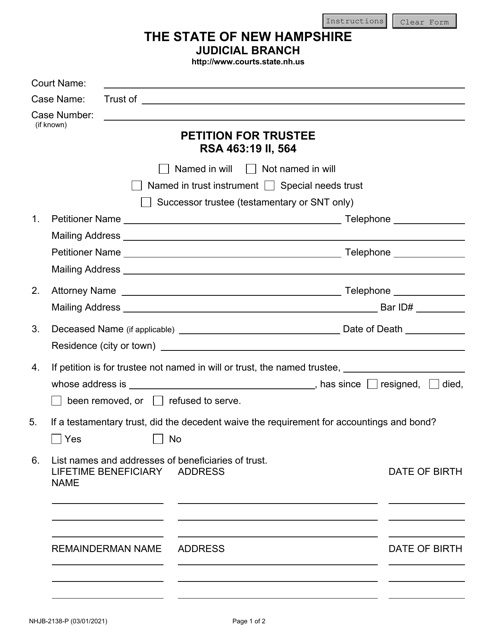

Form NHJB-2138-P Petition for Trustee - New Hampshire: This form is used to petition for the appointment of a trustee to oversee the administration of the trust in New Hampshire.

-

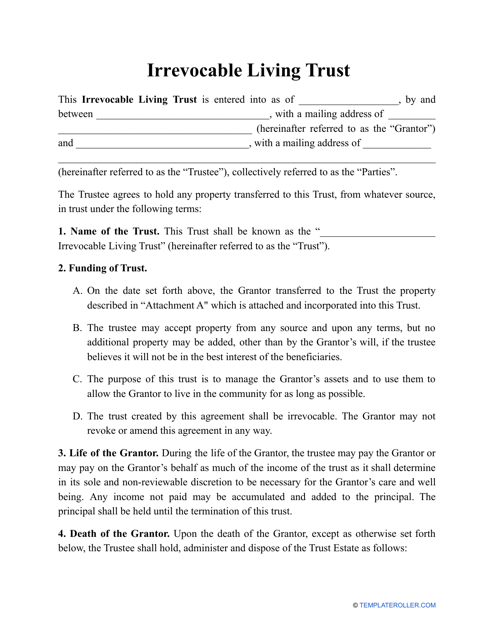

Irrevocable Living Trust Template: An irrevocable living trust is another type of trust that cannot be modified or revoked after creation. This template may be used for those who prefer a more permanent arrangement.

-

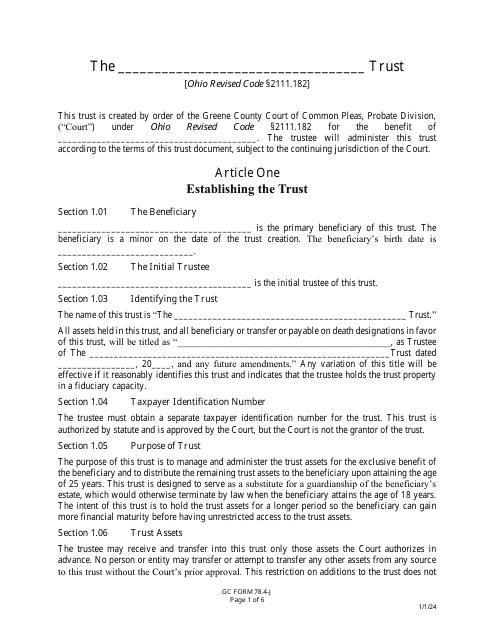

GC Form 78.4-J Trust Agreement - Greene County, Ohio: This trust agreement is specific to Greene County, Ohio, and outlines the terms and conditions of the trust, including the duties and responsibilities of the trustee.

Whether you're looking to protect your assets, preserve your privacy, or ensure a seamless transfer of your wealth, a revocable trust can be a valuable estate planning tool. Take control of your financial future and ensure your loved ones are taken care of by establishing a comprehensive revocable trust tailored to your individual needs.

Documents:

10

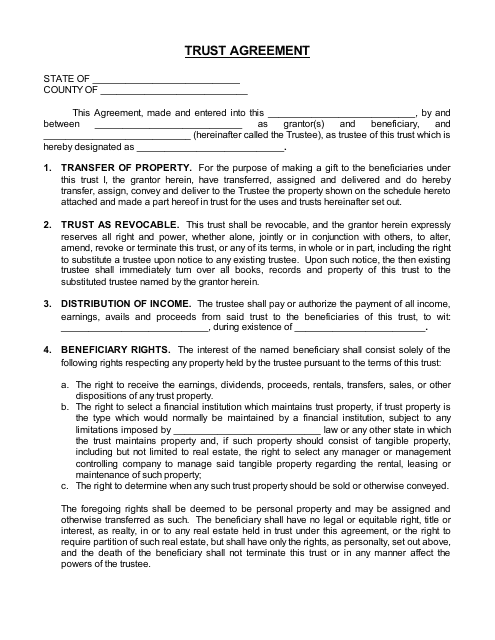

This document is a template for creating a trust agreement. A trust agreement is a legal document that specifies how assets should be managed and distributed to beneficiaries. Use this template as a starting point to create your own trust agreement.

This is a document that is used in California to describe the distribution of the personal and residential property of the deceased.

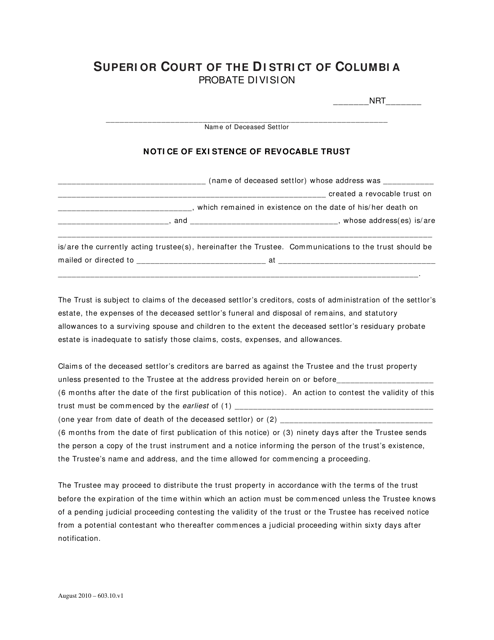

This document notifies individuals of the existence of a revocable trust in Washington, D.C. It provides information about the trust and its purpose.

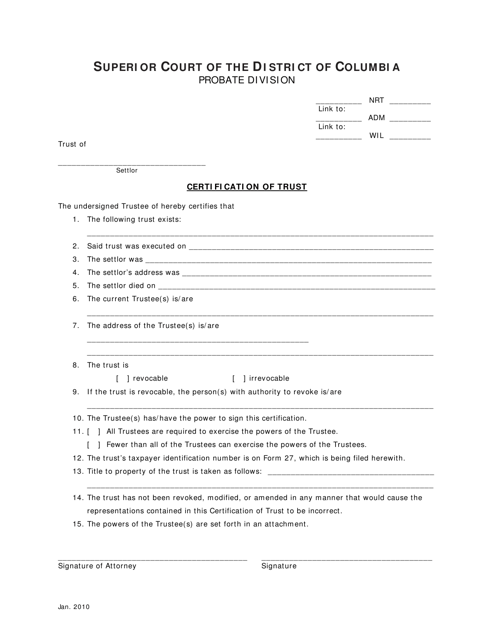

This document is used in Washington, D.C. to certify the authenticity of a trust. It ensures that the trust has been properly created and that the trustee has the authority to act on behalf of the trust. It is often required when dealing with financial institutions or transferring property.

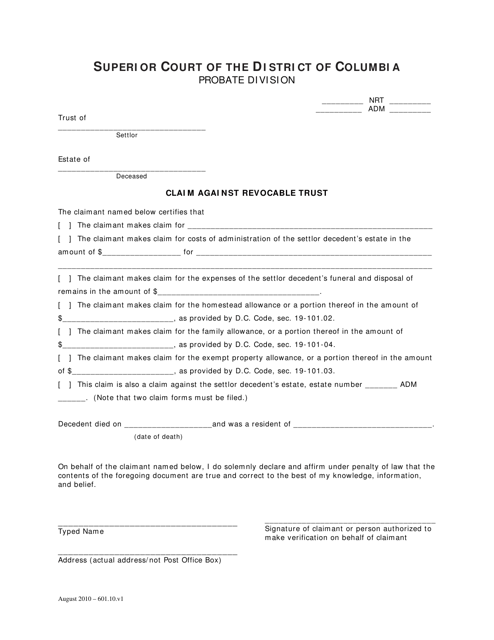

This document is used to file a claim against a revocable trust in Washington, D.C. It is a legal form that allows individuals to seek compensation or resolution for issues related to a revocable trust.

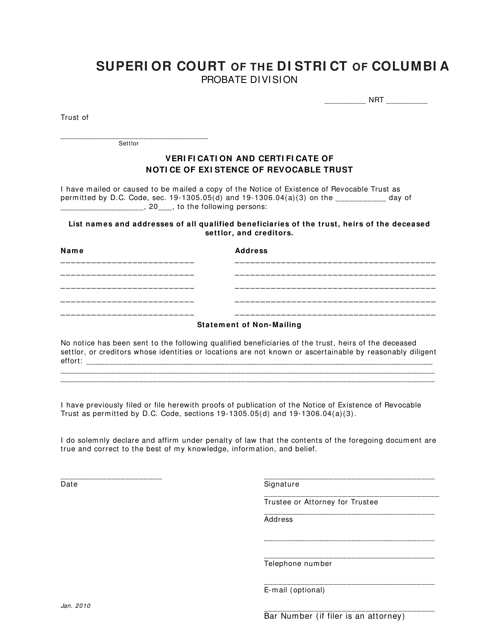

This document verifies the existence of a revocable trust and provides a certificate of notice. It is specific to Washington, D.C.

This is a formal instrument used to place money, real estate, and valuable items into a trust which allows the beneficiaries named in writing to receive their inheritance upon the passing of the trustor.