Filing State Taxes Templates

Filing State Taxes - Simplify Your State Tax Filing Process

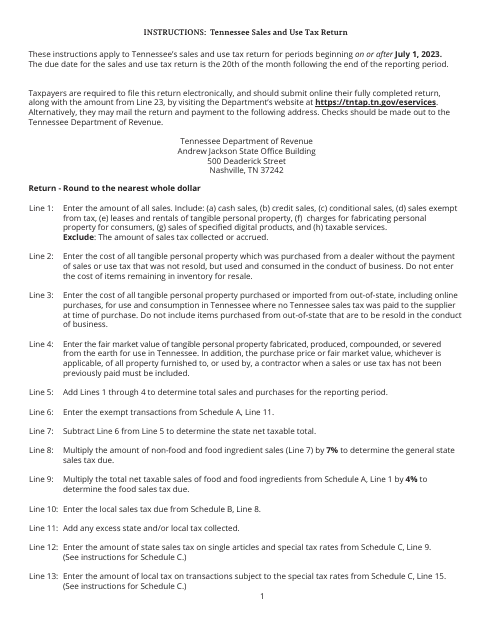

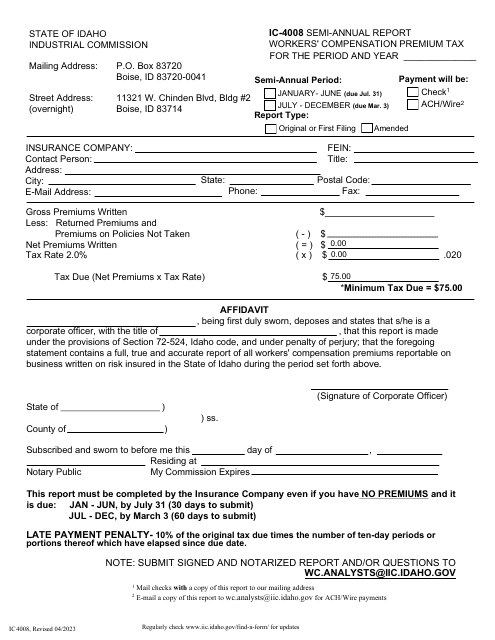

Are you feeling overwhelmed with filing your state taxes? Look no further! Our comprehensive collection of state tax documents is here to make your life easier. Whether you're filing in California, Indiana, Missouri, Mississippi, or any other state, we've got you covered.

Our user-friendly platform enables you to access and complete all the necessary state tax forms seamlessly. Say goodbye to tedious paperwork and confusing instructions. With our streamlined system, you'll breeze through your state tax filing in no time.

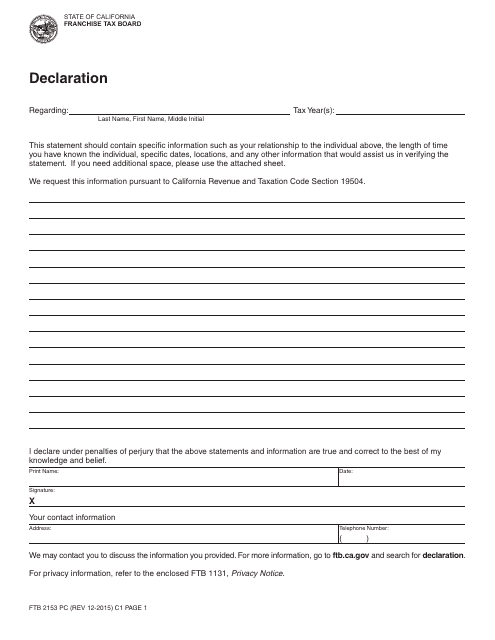

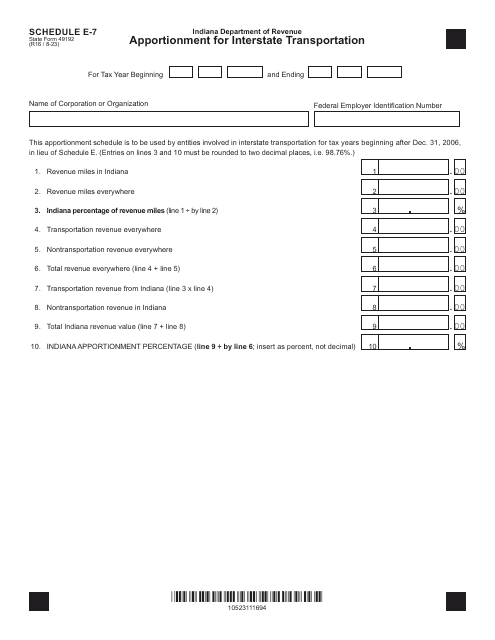

Also known as state tax filing or state tax form collection, our extensive database includes a wide range of documents specifically designed for each state. From the Form FTB2153 PC Declaration in California to the State Form 49192 Schedule E-7 Apportionment for Interstate Transportation in Indiana, we have it all.

Whether you're an individual taxpayer or a business owner, our platform caters to your unique needs. We understand that each state has its own tax rules and regulations, which is why we've compiled a comprehensive collection of state-specific tax forms. No more searching for the correct form or wasting time on outdated resources.

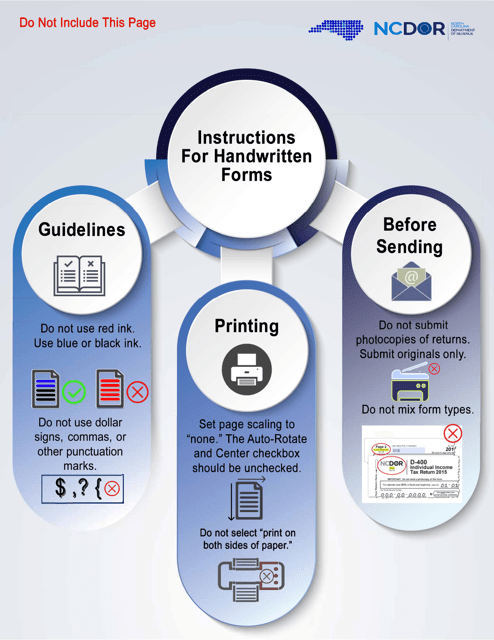

Our platform also offers additional resources and guidelines to help you navigate the complexities of state tax filing. We provide step-by-step instructions, FAQs, and expert advice to ensure that you have all the information you need to complete your state tax filing accurately.

Don't let the stress of state tax filing weigh you down. With our easy-to-use platform and extensive collection of state tax documents, you can confidently tackle your state tax filing obligations. Let us simplify your state tax filing process, so you can focus on what really matters – your financial well-being.

Start your state tax filing process today and experience the convenience of our comprehensive state tax document collection. Say goodbye to the headaches of state tax filing and hello to a hassle-free, streamlined process.

Documents:

10

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

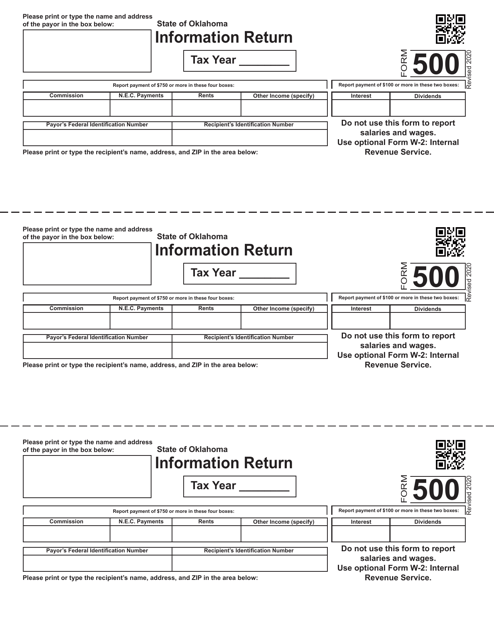

This document is used for filing an information return in the state of Oklahoma. It includes detailed information about various income sources and expenses.

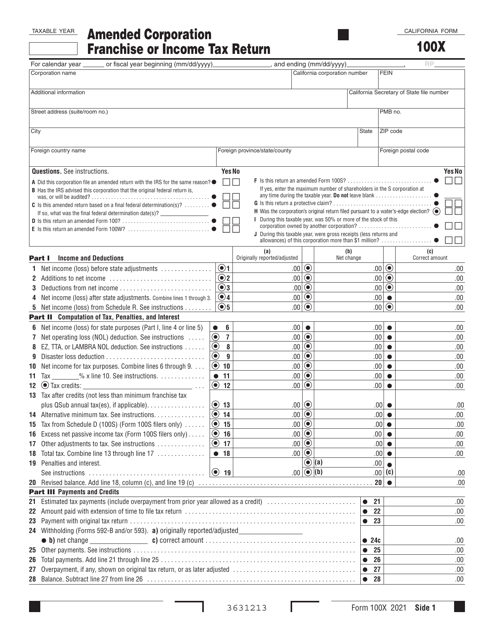

This Form is used for filing an amended corporation franchise or income tax return in California. It allows corporations to correct errors or make changes to their original tax return.