Refined Coal Templates

Refined Coal: Maximizing Renewable Energy Credits

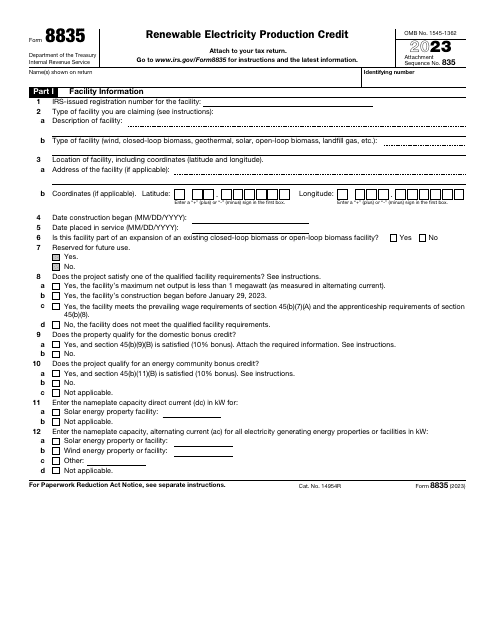

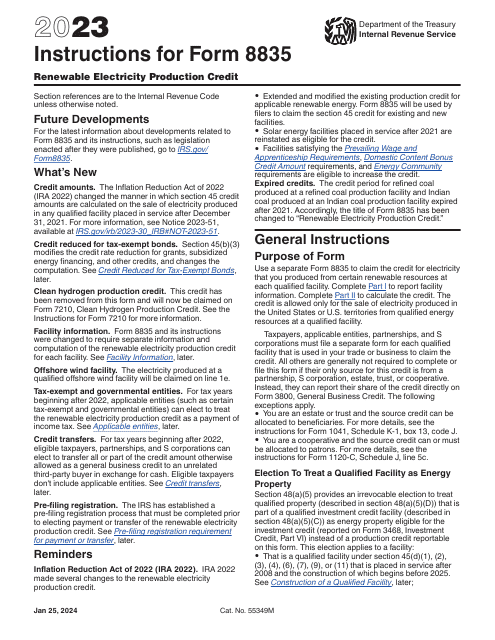

Welcome to our comprehensive guide on refined coal. Refined coal, also known as renewable electricity, is a unique source of energy that contributes to a greener and more sustainable future. Our platform provides thorough information, forms, and instructions for utilizing the IRS Form 8835 Renewable Electricity, Refined Coal, and Indian Coal Production Credit.

Investing in refined coal offers numerous financial and environmental benefits. By taking advantage of the IRS tax credits, individuals and businesses can substantially reduce their tax liabilities while promoting renewable energy production. Our platform offers detailed instructions on completing IRS Form 8835, ensuring that you optimize the benefits available to you.

Learn about the complex process of producing refined coal, how it helps reduce pollution, and how it contributes to the overall reduction of greenhouse gas emissions. Refined coal is an alternate name for renewable electricity, offering an alternative to conventional energy sources that is more sustainable and environmentally friendly.

Our platform provides a streamlined and user-friendly experience, guiding you through the intricacies of the IRS Form 8835 Renewable Electricity, Refined Coal, and Indian Coal Production Credit. Whether you are a taxpayer, a tax professional, or a business owner, our comprehensive resources will help you understand the benefits and requirements associated with refined coal.

Join the growing movement towards renewable energy and explore the world of refined coal today. Maximize your tax credits while contributing to a cleaner and healthier planet. Harness the power of renewable electricity, and let us be your trusted resource for all things related to refined coal.