Interest Deduction Templates

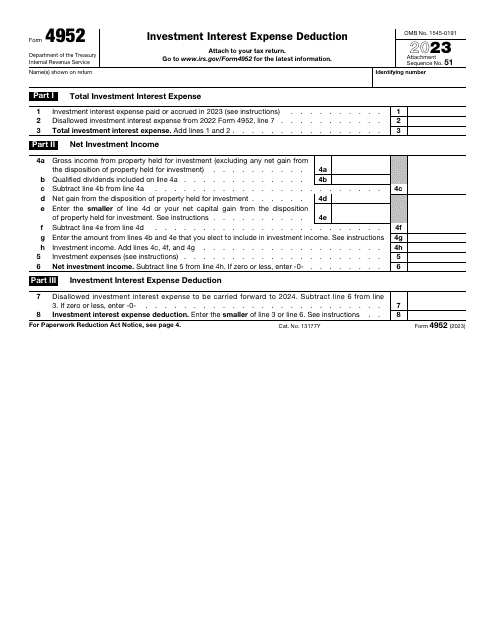

Interest Deduction (also known as the interest deduction) is a valuable tax benefit that allows individuals and businesses to deduct the interest paid on certain loans or accounts from their taxable income. This deduction applies to various types of loans, such as student loans, mortgages, and business loans, and can result in significant tax savings.

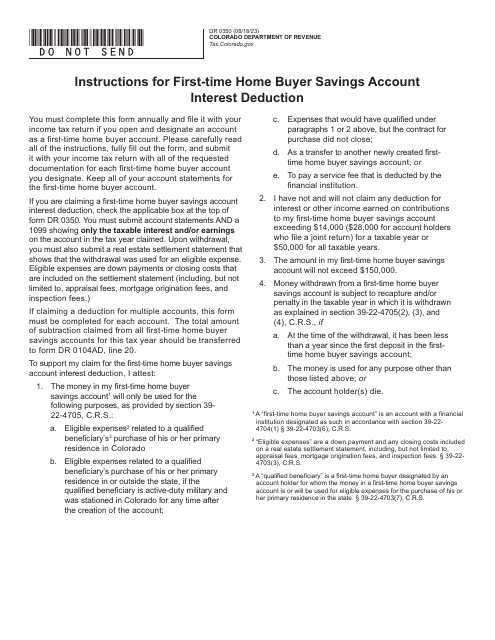

For first-time homebuyers in Colorado, the Form DR0350 First-Time Home Buyer Savings Account Interest Deduction allows individuals to deduct the interest earned on savings accounts specifically designed for purchasing a home. This deduction can help reduce the financial burden of buying a first home and make homeownership more affordable.

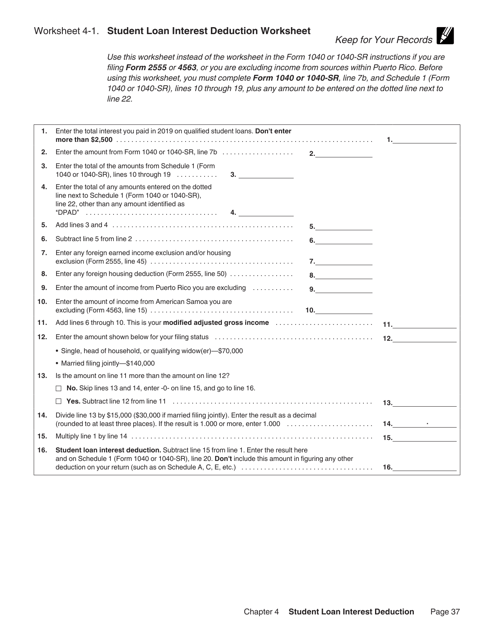

Educational expenses can also benefit from the interest deduction. The Student Loan Interest Deduction Worksheet (Publication 970) provides individuals with the necessary guidance to calculate and claim deductions for the interest paid on qualified student loans. This deduction can help alleviate the financial strain of student loan debt and make higher education more accessible.

In addition to these specific documents, various other forms and worksheets are available to assist taxpayers in claiming the interest deduction. Whether you're a homeowner, student, or small business owner, understanding and utilizing the interest deduction can result in significant tax savings.

Note: The alternate names provided for this document group are not sufficient to generate a comprehensive SEO text. However, based on the given information, the importance and benefits of the interest deduction have been highlighted.

Documents:

6

This document is a worksheet that helps you calculate the amount of student loan interest you can deduct from your taxes. It is explained in Publication 970, which provides information on tax benefits for education expenses.