Income Distribution Templates

Income Distribution

Looking for information about the distribution of income? Our webpage provides in-depth knowledge and analysis on income distribution, also known as distributive income or distribution income. Explore a wide range of topics related to income distribution, including its impact on poverty rates, economic inequality, and social mobility.

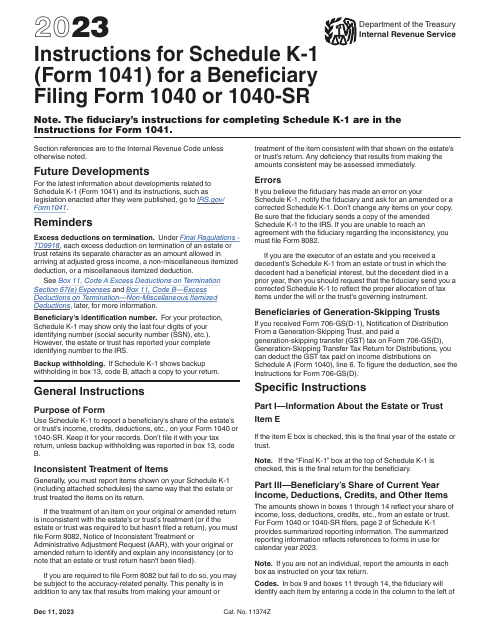

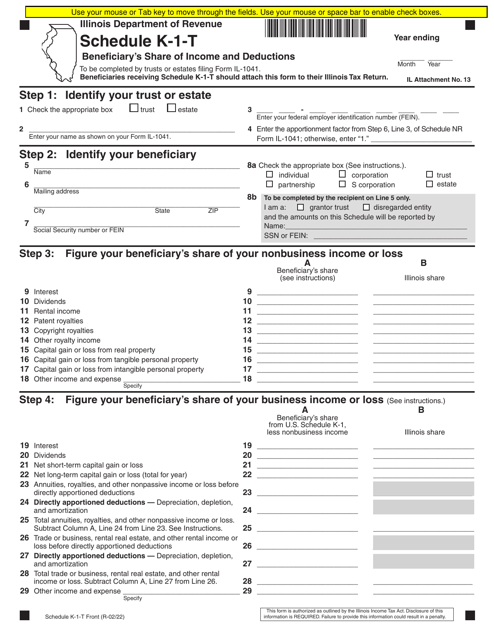

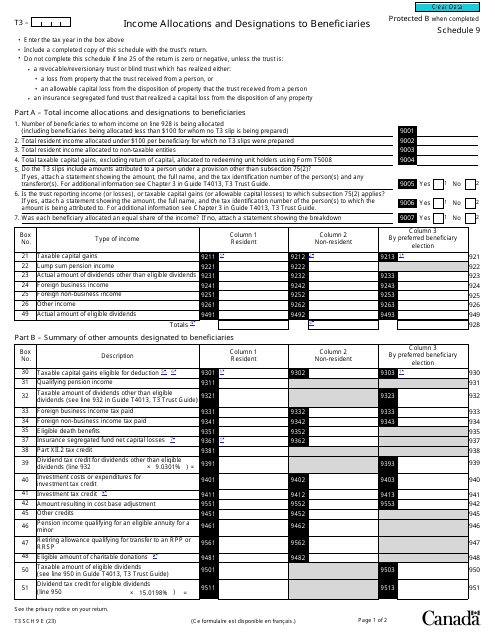

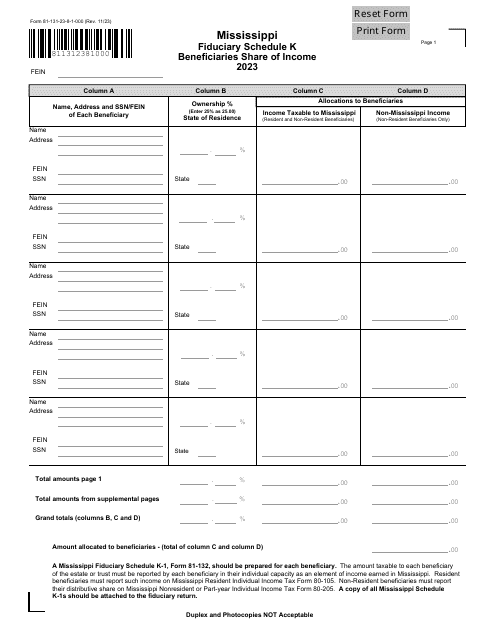

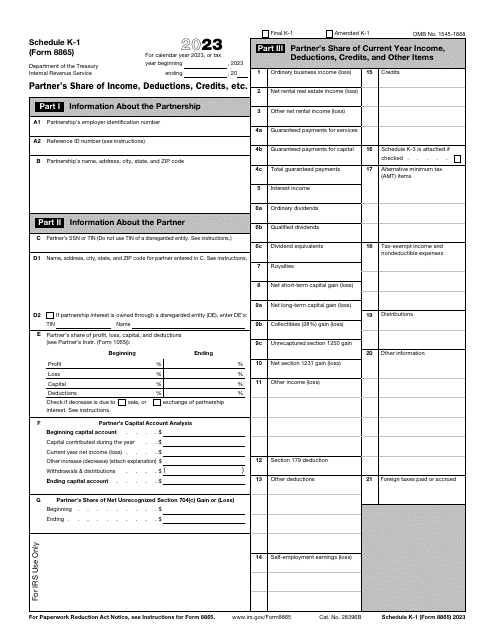

Our collection includes various documents that shed light on income distribution in different contexts. For instance, "Income and Poverty in the United States" provides an overview of national income distribution trends, highlighting the disparities and challenges faced by different population groups. Meanwhile, "IRS Form 1041 Schedule K-1 Beneficiary's Share of Income, Deductions, Credits, Etc." delves into the distribution of income among beneficiaries of certain types of trusts.

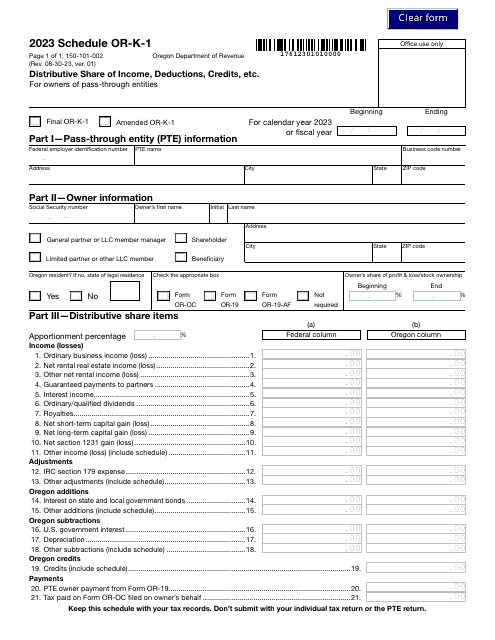

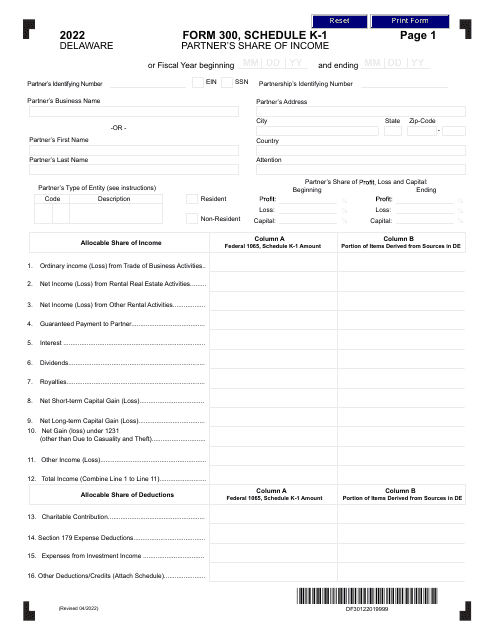

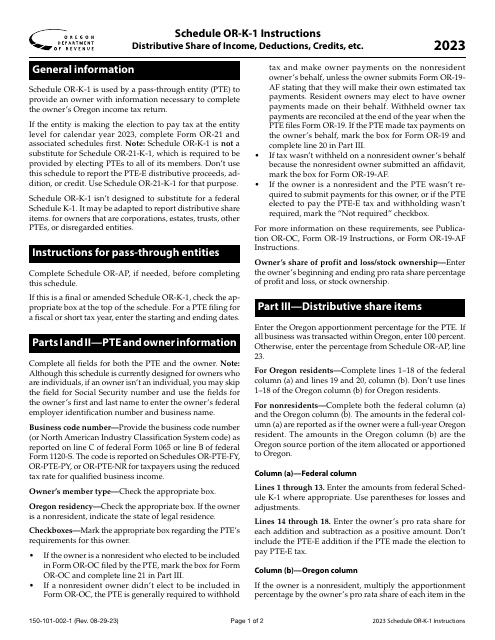

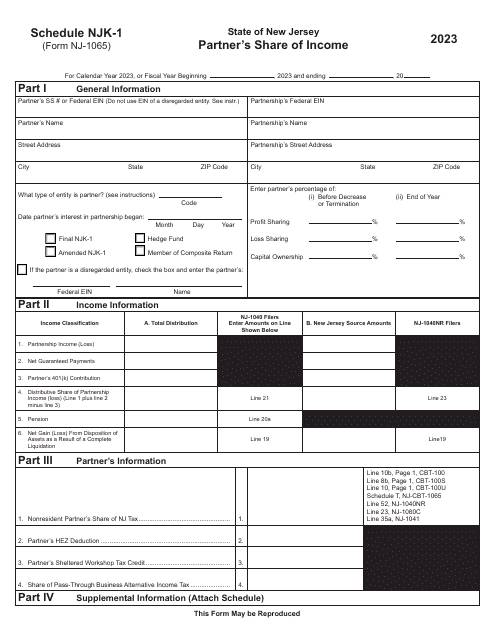

To further understand income distribution at a regional level, explore documents such as "Instructions for Form 150-101-002 Schedule OR-K-1 Distributive Share of Income, Deductions, Credits, Etc. - Oregon" and "Form NJ-1065 Schedule NJK-1 Partner's Share of Income - New Jersey." These documents provide insights into how income is distributed among individuals and businesses within specific states.

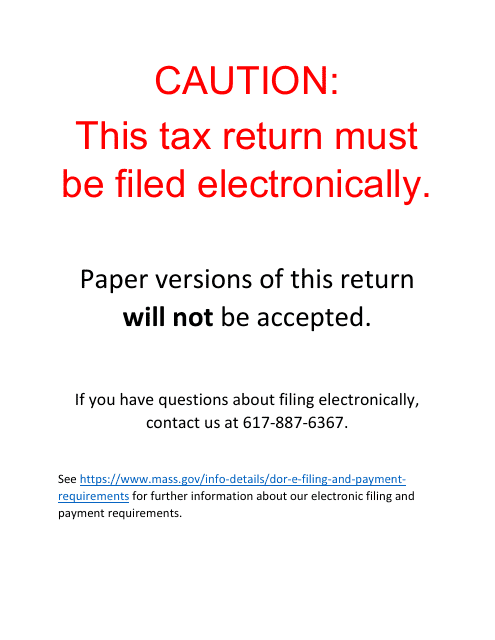

Whether you're interested in income distribution in the United States or looking for international perspectives, our webpage offers comprehensive resources. Dive into topics like the distributive income of S Corporations with "Schedule S S Corporation Distributive Income - Draft - Massachusetts" or explore income distribution patterns in different countries.

Stay informed about income distribution trends, understand the factors influencing these patterns, and discover potential policy implications. Our webpage on income distribution, also known as income distributions, is your go-to resource for understanding this important aspect of economic and social dynamics.

Documents:

27

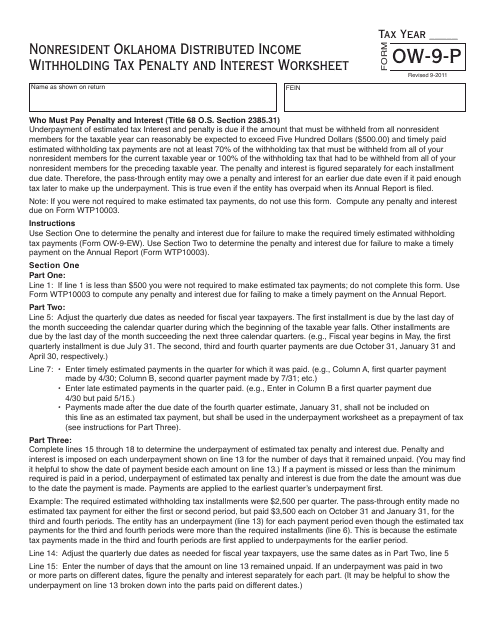

This form is used for calculating the penalty and interest on distributed income for nonresidents in Oklahoma.

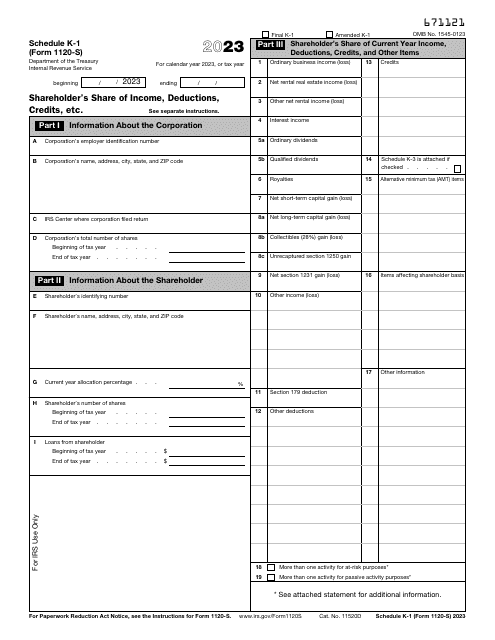

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This document provides information on the income levels and poverty rates in the United States. It offers insights into the financial well-being of individuals and families in the country.

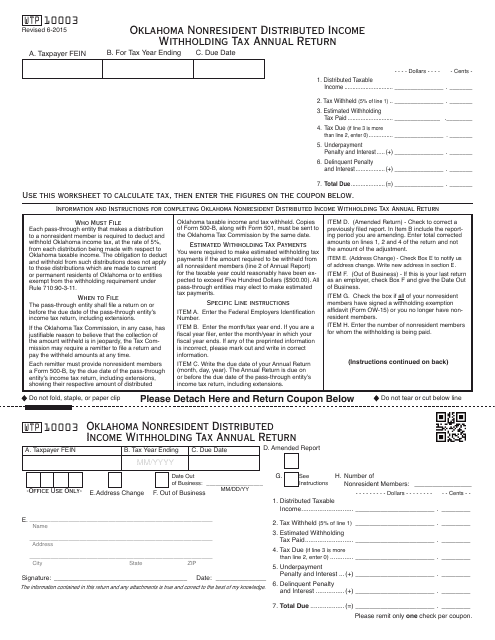

This Form is used for reporting and paying nonresident distributed income withholding tax in Oklahoma for the tax year.

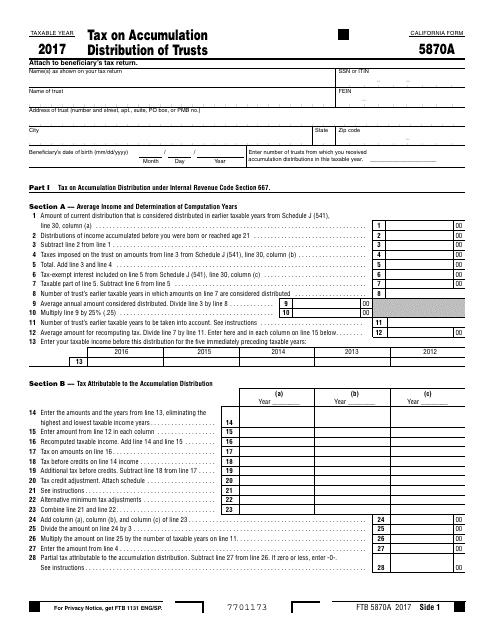

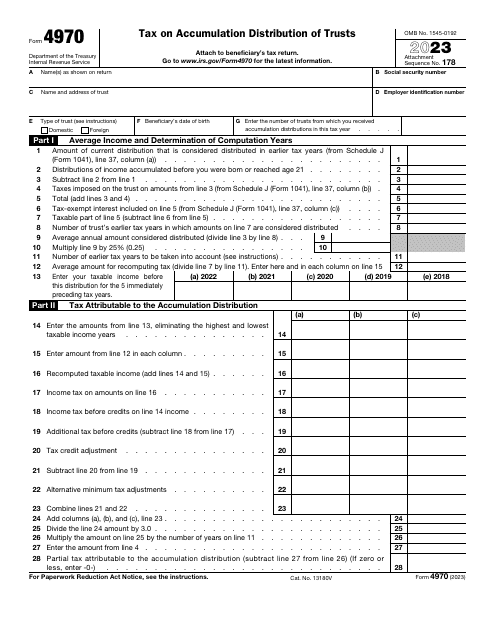

This form is used for reporting and calculating the tax on accumulation distribution of trusts in the state of California.

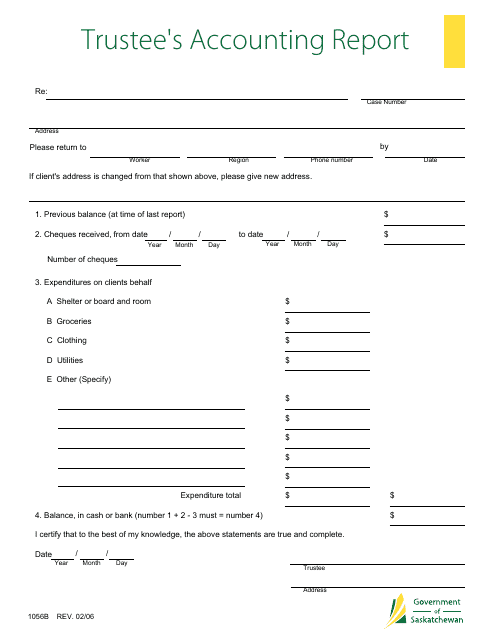

This form is used for reporting the financial activities of a trust as per the regulations in Saskatchewan, Canada. It helps trustees to provide an accounting report for the trust.

This document provides information about the income levels and poverty rates in the United States. It includes data on the distribution of income and the prevalence of poverty across different demographic groups.

This document discusses the topic of income inequality in America, separating fact from fiction. It is an issue brief published by E21.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

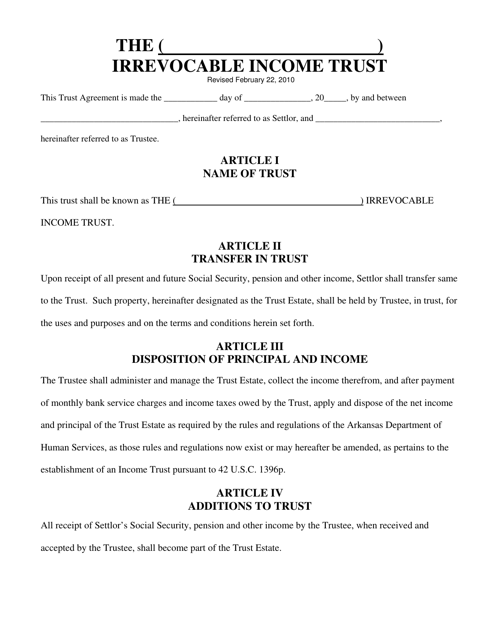

This Form is used to create an irrevocable income trust in the state of Arkansas. It is a legal document that allows a person to transfer assets into a trust for the benefit of beneficiaries, while also maintaining control over the income generated by those assets.

This document explores the rise of the middle class in developing countries and its impact on the global economy.