Loan Servicer Templates

Are you a borrower looking for reliable loan servicing? Look no further! Our loan servicer offers a comprehensive range of loan services to meet your needs. Whether you are in need of a loan consolidation, repayment assistance, or information on income-driven repayment plans, our loan servicers have got you covered.

At our loan servicing company, we understand that managing your loans can be overwhelming. That's why we are here to assist you every step of the way. Our team of experienced professionals is dedicated to ensuring that your loans are serviced efficiently and effectively.

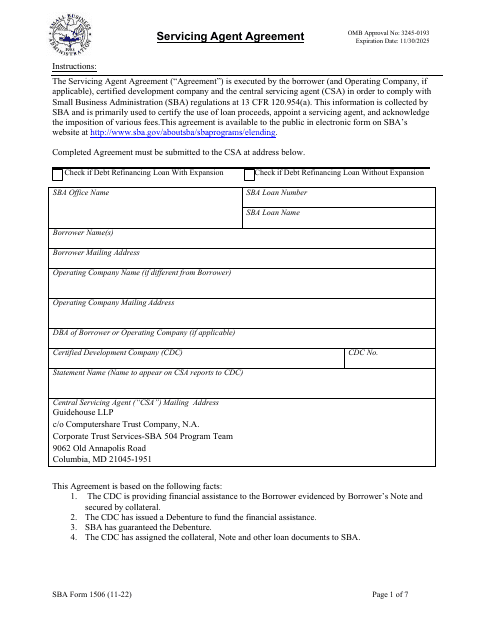

With our loan servicers, you can expect personalized assistance tailored to your specific circumstances. We offer various services such as reimbursement requests, annual reports, and servicing agent agreements. Our versatile loan servicers are proficient in handling different types of loans, including residential mortgage loans.

When it comes to loan servicing, trust is vital. Our loan servicers are licensed and regulated to provide you with the peace of mind you deserve. We work closely with federal and state agencies to ensure compliance and transparency in all our operations.

Don't let loan servicing become a burden. Let our loan servicers take care of all your loan management needs. Contact us today to learn how we can assist you and ease the complexity of loan servicing.

Documents:

21

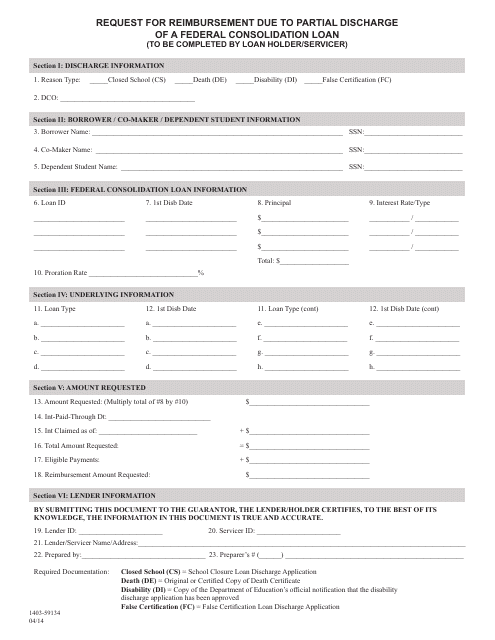

This Form is used for requesting reimbursement due to a partial discharge of a Federal Consolidation Loan.

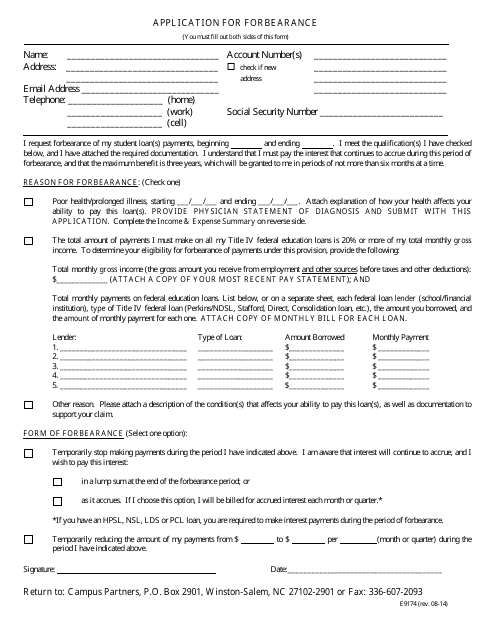

This Form is used for requesting forbearance on student loans with Campus Partners.

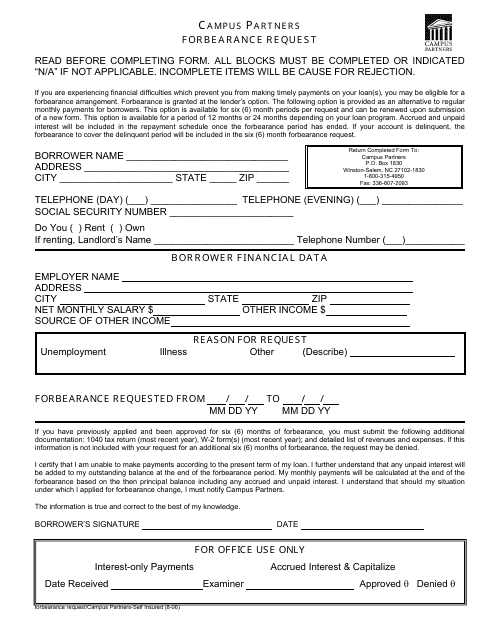

This Form is used for requesting a forbearance from Campus Partners.

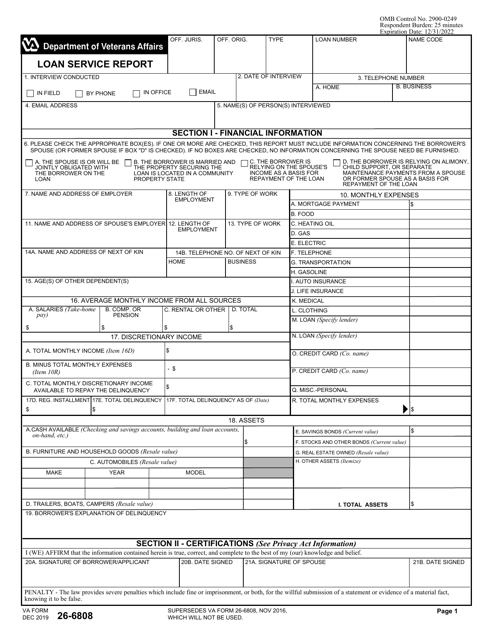

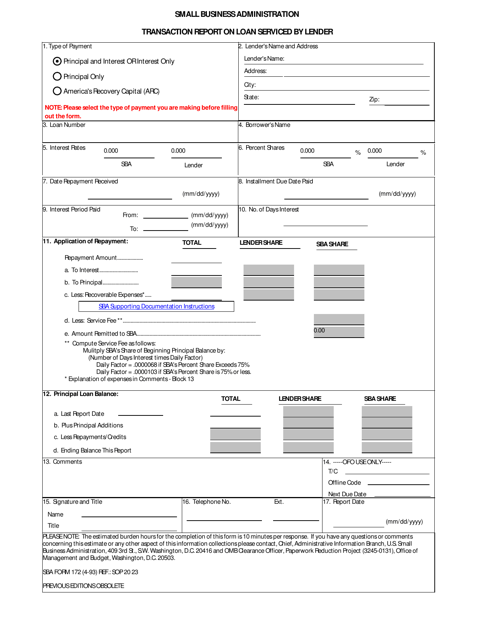

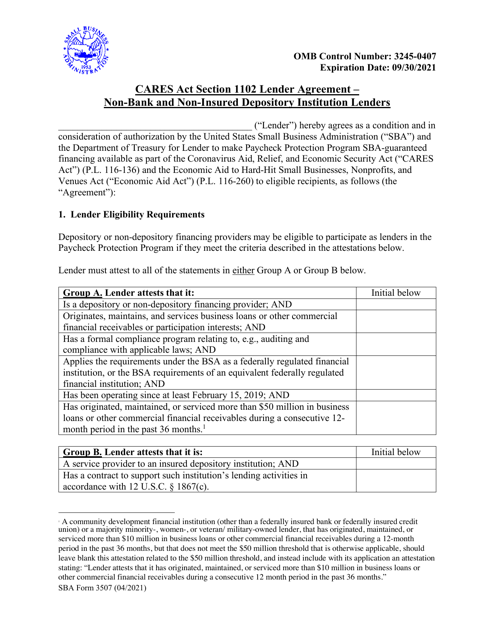

This form is used for reporting transactions related to a loan that is being serviced by a lender.

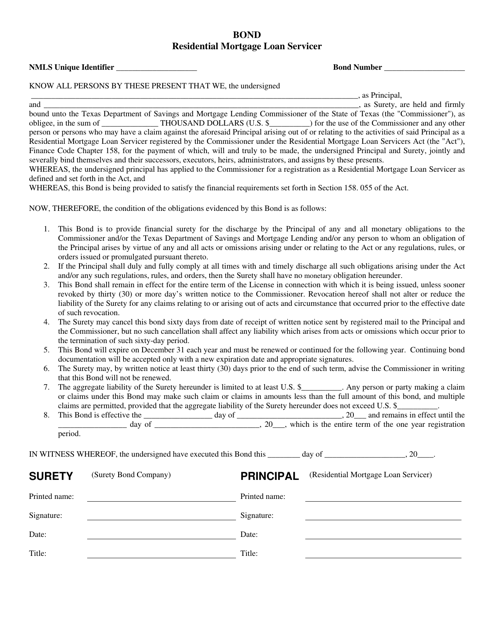

This document is for the Bond Residential Mortgage Loan Servicer in the state of Texas. It pertains to the responsibilities and regulations of mortgage loan servicing in Texas.

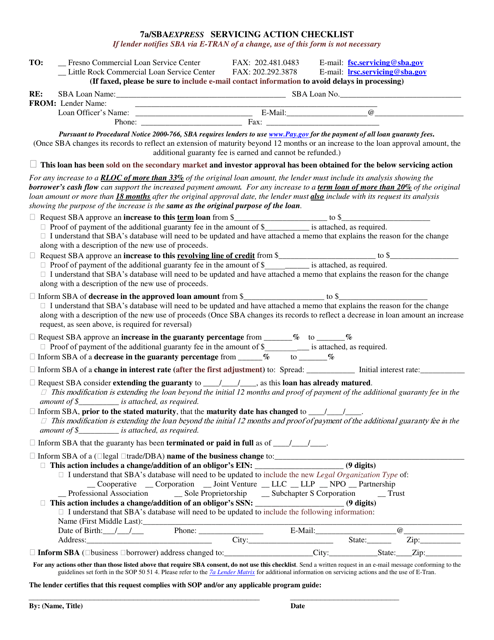

This document is a checklist for the Small Business Administration (SBA) Express Servicing Action. It provides a step-by-step guide for completing various tasks related to SBA Express loans. Use this checklist to ensure all necessary actions are taken to service SBA Express loans effectively.

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

This document is used to request forbearance for national service obligations.

This document is used for requesting a forbearance, which allows the borrower to temporarily suspend or reduce their loan payments.

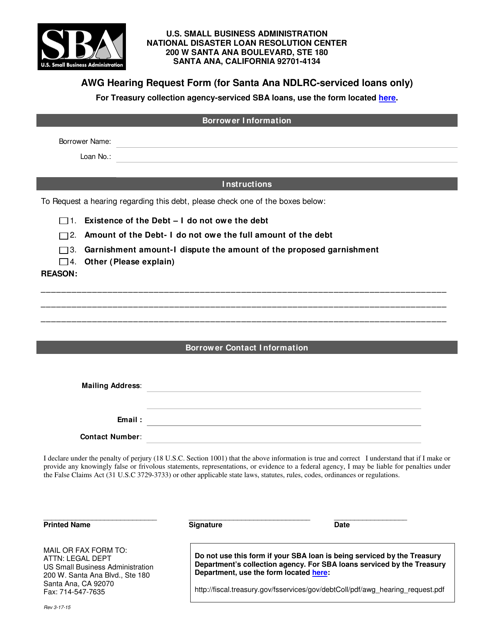

This Form is used for submitting a hearing request for Santa Ana NDLRC-serviced loans only.

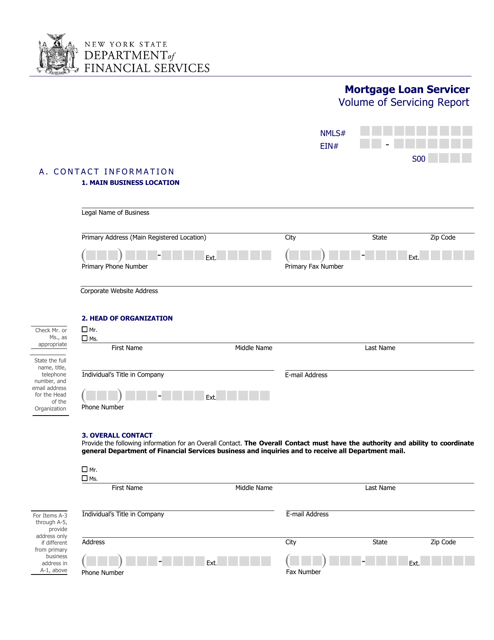

This document provides a report on the volume of mortgage loans serviced by a loan servicer in New York.

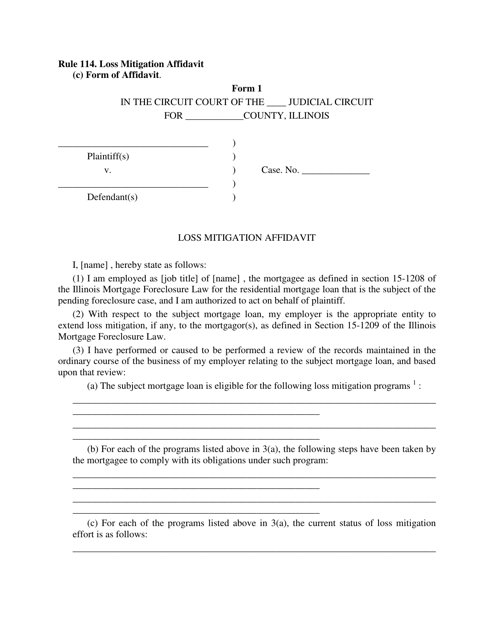

This document is used for submitting a Loss Mitigation Affidavit in the state of Illinois. It is a legal form that helps homeowners in financial distress provide information about their situation to their mortgage lender in order to potentially receive assistance in avoiding foreclosure.

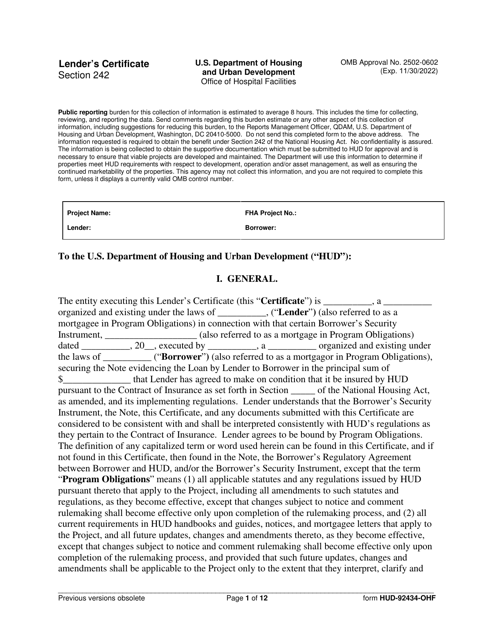

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

This document provides questions and answers about income-driven repayment plans. These plans help borrowers manage their federal student loan payments based on their income. It covers the basics of the plans and provides answers to commonly asked questions.

This document provides guidance and important information for borrowers of federal student loans who are preparing to exit or finish their loan repayment. It helps borrowers understand their rights and responsibilities and provides tips for managing their student loan debt after graduation.

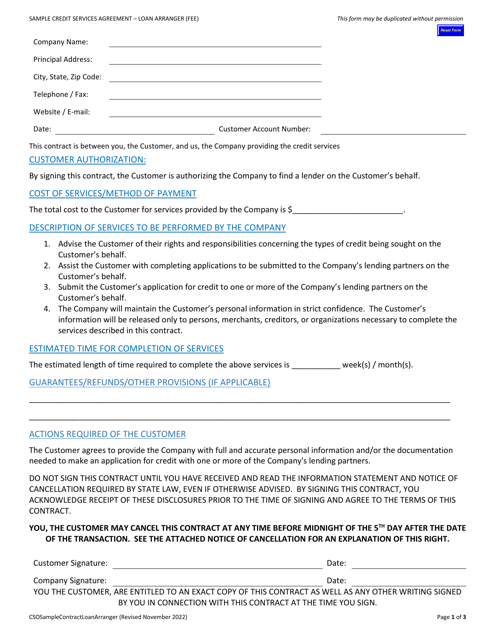

This agreement is used when loan arrangers in Wisconsin provide credit services for borrowers. It outlines the terms and conditions of the credit arrangement.