Lump Sum Distribution Tax Templates

Are you facing questions regarding the lump sum distribution tax? Look no further! Our comprehensive collection of documents related to lump sum distribution tax is your ultimate guide to understanding and navigating through this tax law.

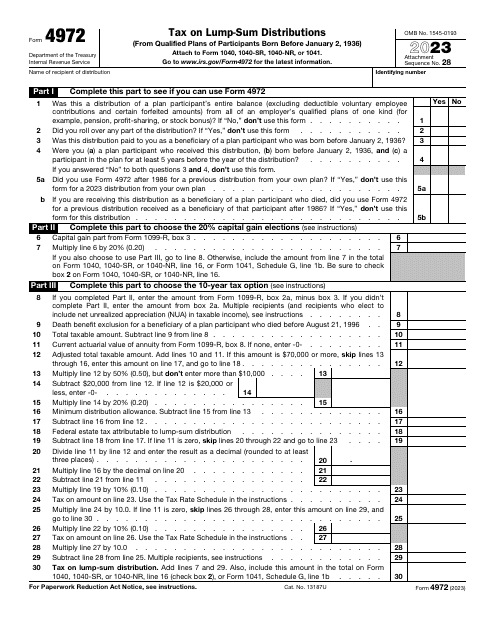

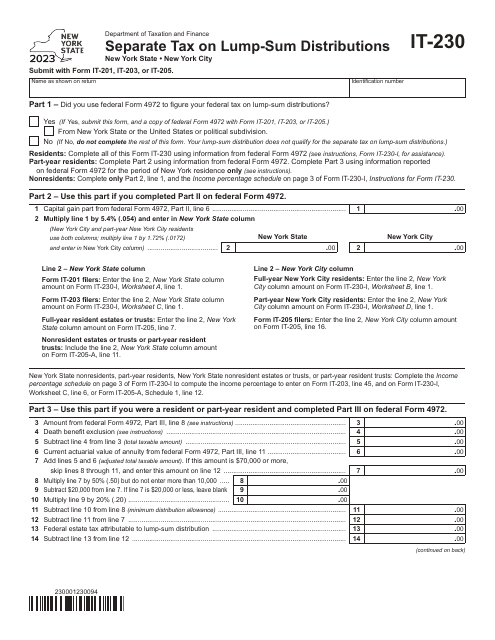

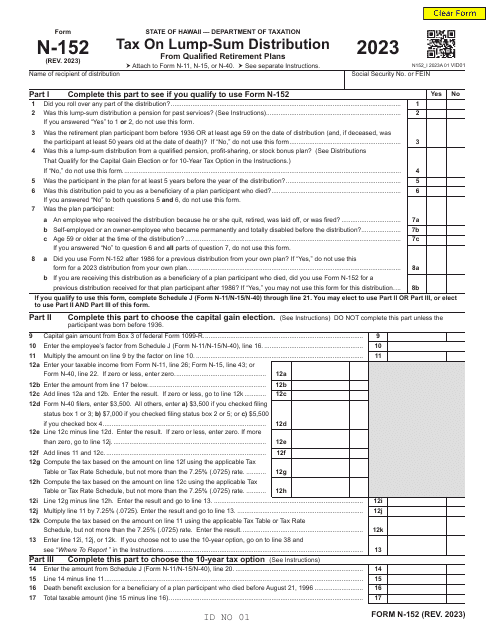

From the IRS Form 4972 Tax on Lump-Sum Distributions to state-specific forms like Form IT-230 Separate Tax on Lump-Sum Distributions in New York and Form N-152 Tax on Lump-Sum Distribution in Hawaii, we have it all covered. Our vast repertoire of resources provides you with the necessary knowledge to fulfill your tax obligations and make informed decisions.

Navigate through our collection to find the information you need, whether you are an individual taxpayer or a tax professional. We provide clarity on the tax implications, eligibility criteria, and any exemptions or deductions associated with lump sum distributions. Our user-friendly interface makes it easy to access and download the required forms, ensuring a seamless tax filing experience.

Stay up-to-date with the latest changes in tax laws and regulations. Our regularly updated document collection eliminates any confusion and keeps you well-informed. We understand the complexities surrounding the lump sum distribution tax, and our goal is to make the process as straightforward as possible for you.

For all your lump sum distribution tax needs, trust our comprehensive collection of documents. Save time, reduce stress, and ensure compliance with the help of our valuable resources. Explore our documents today and make informed decisions regarding your lump sum distribution tax requirements.