Unpaid Taxes Templates

Get help with your unpaid taxes and avoid penalties with our expert assistance. We understand that dealing with unpaid taxes can be overwhelming and stressful, which is why we are here to provide you with the guidance you need to navigate through this process.

At Templateroller.com, we specialize in helping individuals and businesses resolve their unpaid tax issues. Whether you are facing difficulties in submitting the correct forms or negotiating a settlement with the tax authorities, our team of experienced professionals is ready to assist you.

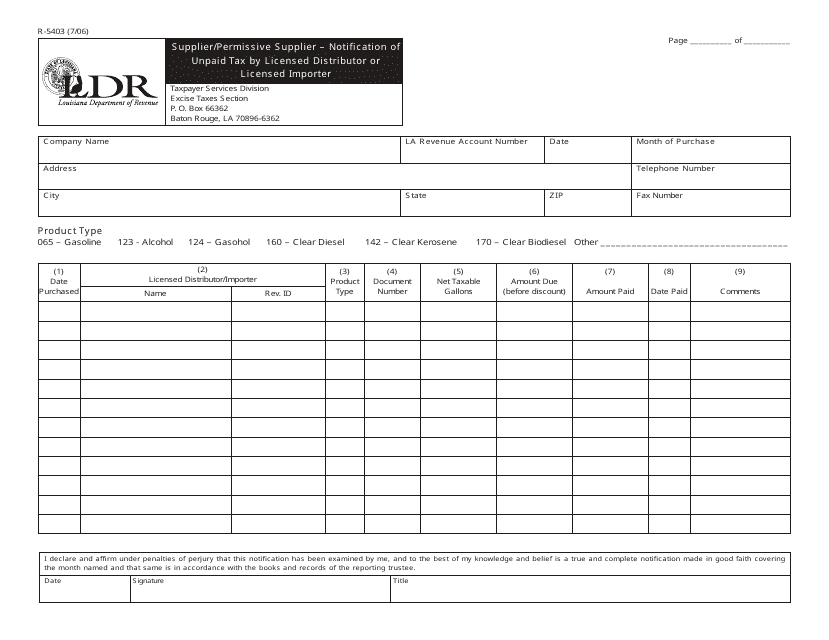

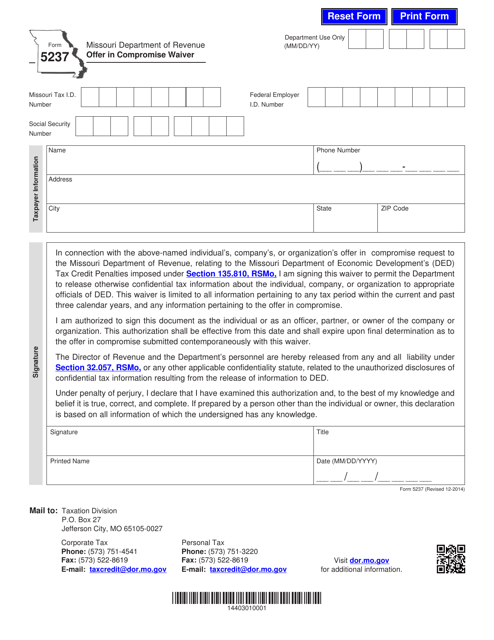

We offer a wide range of services to address your specific needs when it comes to unpaid taxes. Our experts can help you fill out forms and paperwork such as the Form R-5403 Supplier/Permissive Supplier - Notification of Unpaid Tax by Licensed Distributor or Licensed Importer in Louisiana, or the Form 5237 Offer in Compromise Waiver in Missouri.

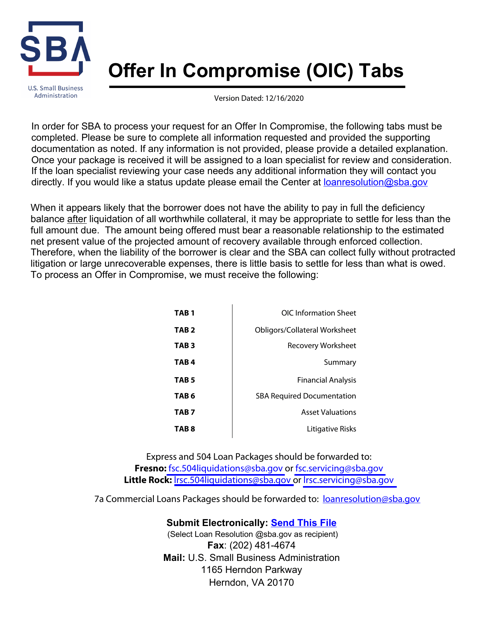

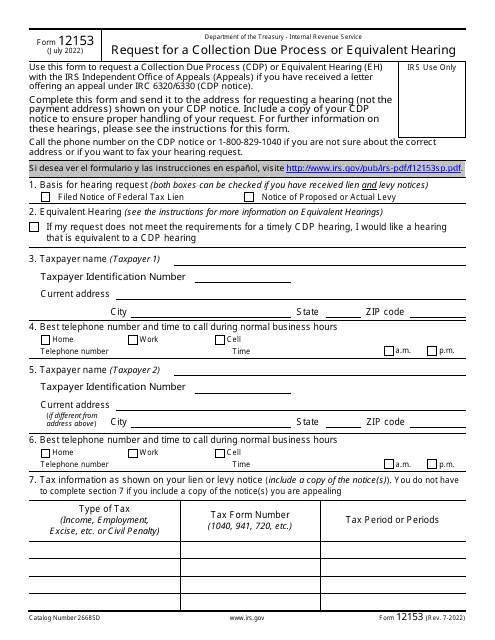

If you are looking for options to settle your unpaid taxes, we can guide you through the process of applying for an Offer in Compromise (OIC). This can potentially reduce the total amount you owe to the tax authorities. We can also assist you in completing the necessary paperwork, including the IRS Form 12153 Request for a Collection Due Process or Equivalent Hearing and the IRS Form 656 Offer in Compromise.

Don't let unpaid taxes weigh you down. Contact Templateroller.com today to get the help you need to resolve your tax issues and find peace of mind.

Documents:

10

This form is used for licensed distributors or importers in Louisiana to notify the state of any unpaid taxes by suppliers or permissive suppliers.

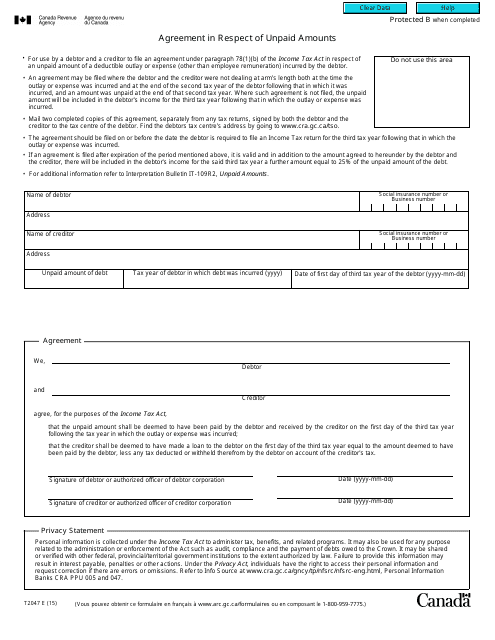

This form is used for an agreement in Canada regarding unpaid amounts.

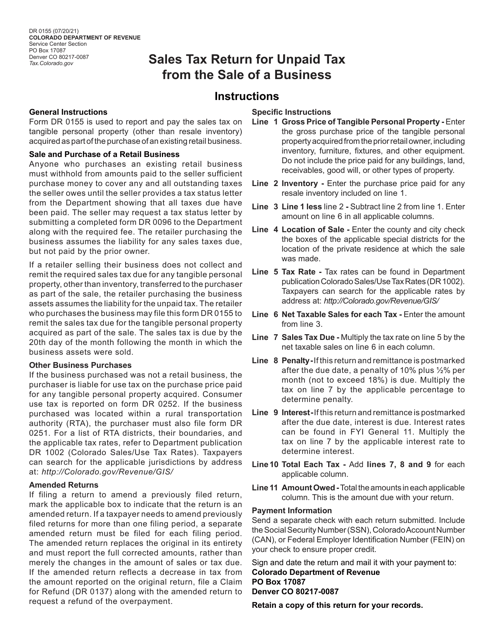

This form is used for reporting and paying any unpaid sales tax from the sale of a business in Colorado. It is necessary to fulfill tax obligations associated with the sale.

This form is used for applying for an offer in compromise waiver in the state of Missouri.

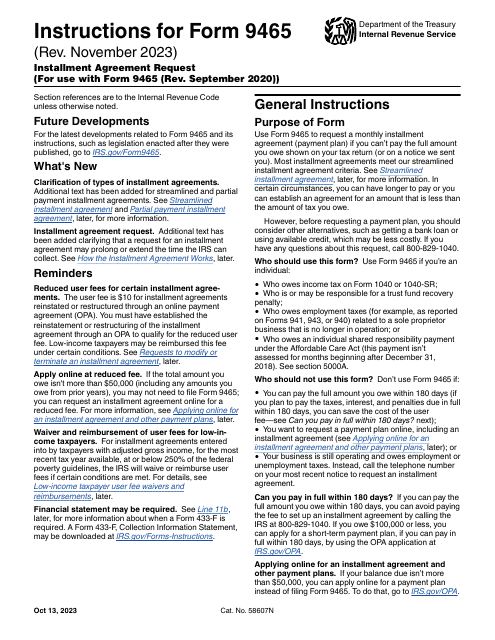

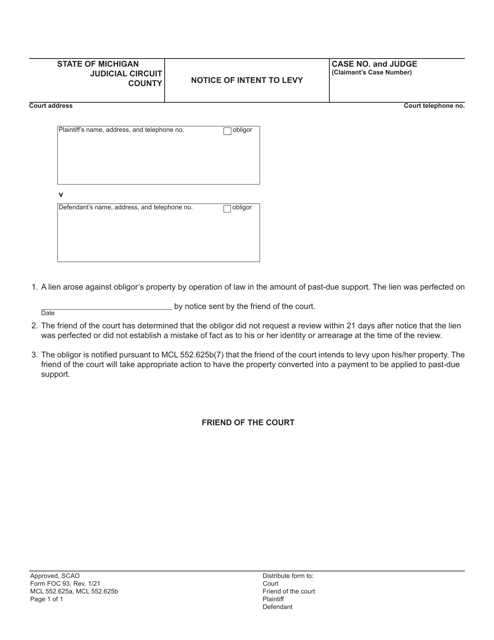

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.