Foreign Income Reporting Templates

Foreign Income Reporting

If you are a U.S. person residing outside of the United States or have income from foreign sources, it is important to understand the requirements for foreign income reporting. The Internal Revenue Service (IRS) has specific forms and schedules that need to be filled out to ensure accurate reporting and compliance with tax regulations.

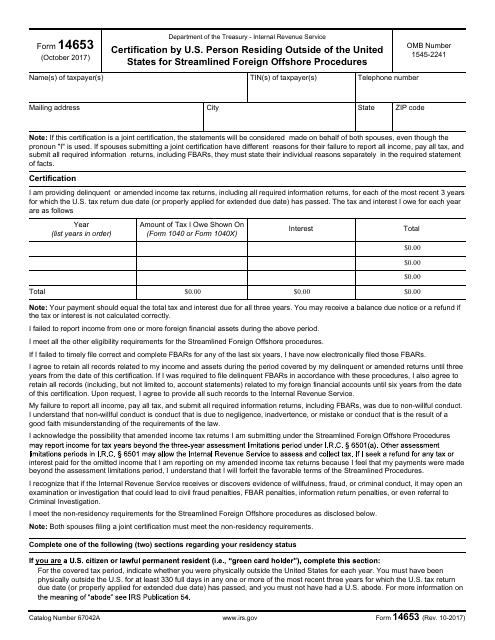

One of the key documents in this category is the IRS Form 14653, which is the Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures. This form is used to certify that eligible taxpayers meet the requirements for the streamlined filing compliance procedures for reporting their foreign income.

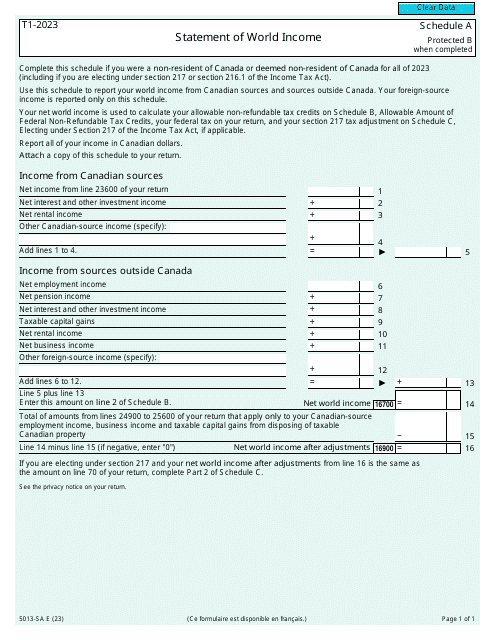

For Canadian residents, there is the Form 5013-SA Schedule A, also known as the Statement of World Income - Canada. This form is used to report income earned in Canada, ensuring that all foreign income is properly disclosed.

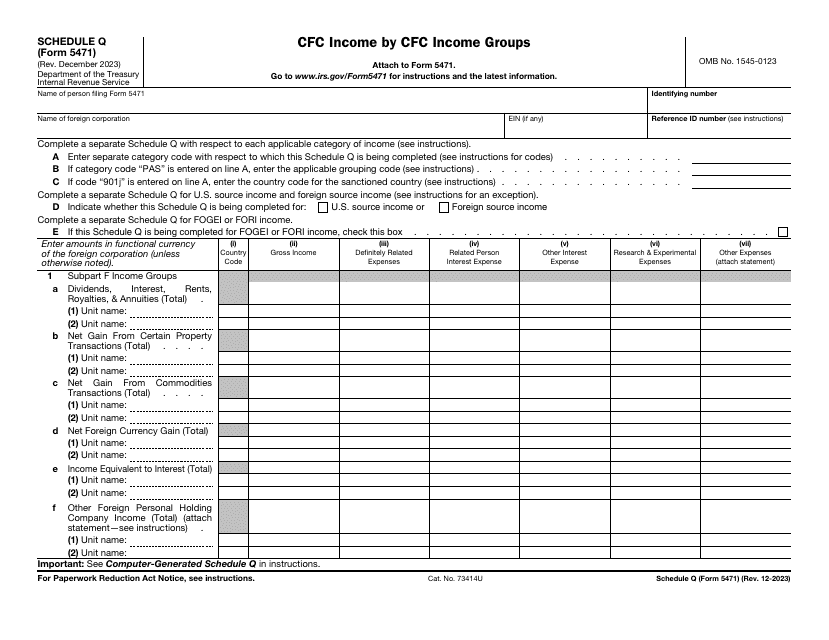

If you have investments in Controlled Foreign Corporations (CFCs), the IRS Form 5471 Schedule Q is essential. This form helps you report income from CFCs according to different income groups, ensuring accurate reporting of your foreign income.

Partnerships with foreign partners also have specific reporting requirements. The IRS Form 1065 Schedule K-3 is used to disclose a partner's share of income, deductions, credits, etc., specifically for international partnerships.

Similarly, if you are engaged in a partnership with foreign partners and have investments in a foreign partnership, the IRS Form 8865 Schedule K-2 and K-3 provide instructions for reporting the partner's share of income, deductions, and credits.

Accurate and timely reporting of foreign income is crucial to stay compliant with tax laws and avoid unnecessary penalties. Understanding the forms and schedules required for foreign income reporting is essential for U.S. persons residing outside of the United States or taxpayers with income from foreign sources.

Ensure your foreign income is properly reported by consulting with tax professionals who can provide guidance on the specific requirements and help you complete the necessary documentation. Stay compliant and avoid unnecessary headaches with thorough foreign income reporting.

Documents:

6

This form is used for certifying that a U.S. person residing outside of the United States is eligible for the Streamlined Foreign Offshore Procedures offered by the IRS.

This document provides instructions for completing Schedule K-3 of IRS Form 1065, which calculates a partner's share of income, deductions, credits, etc. for international partnerships.