Tax Deductions Templates

Documents:

1801

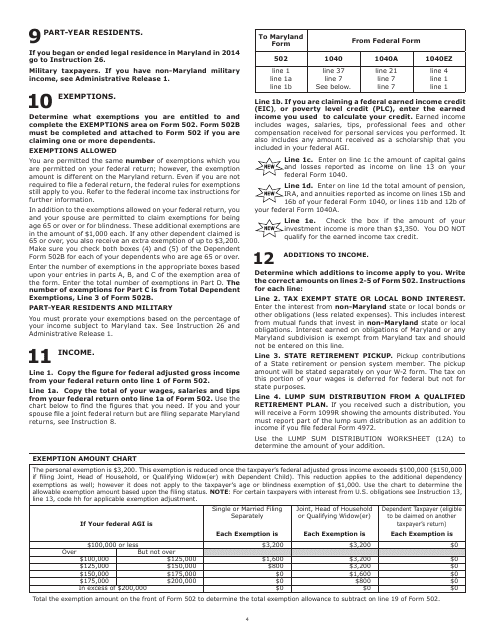

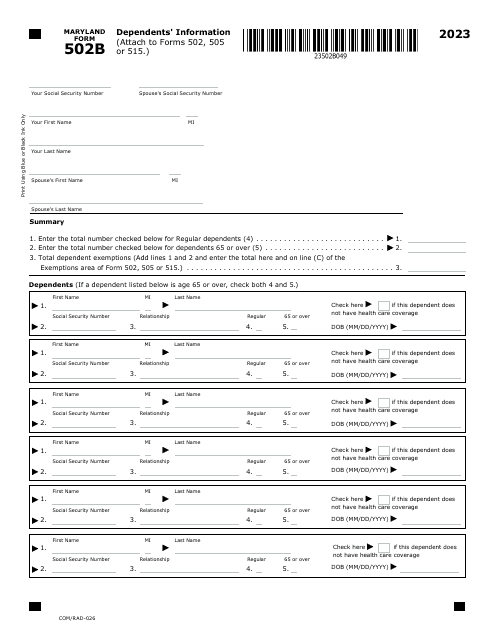

This document provides an exemption amount chart specifically for the state of Maryland. It details the specific amounts that individuals or businesses may be exempt from certain taxes or fees in Maryland.

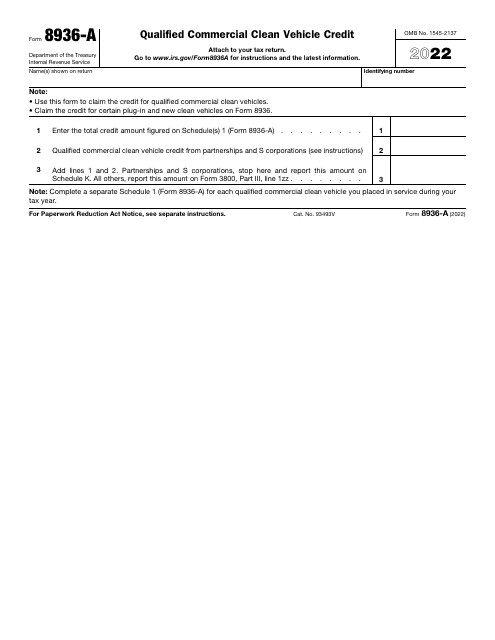

This form is used for claiming a tax credit for the purchase of a qualified commercial clean vehicle.

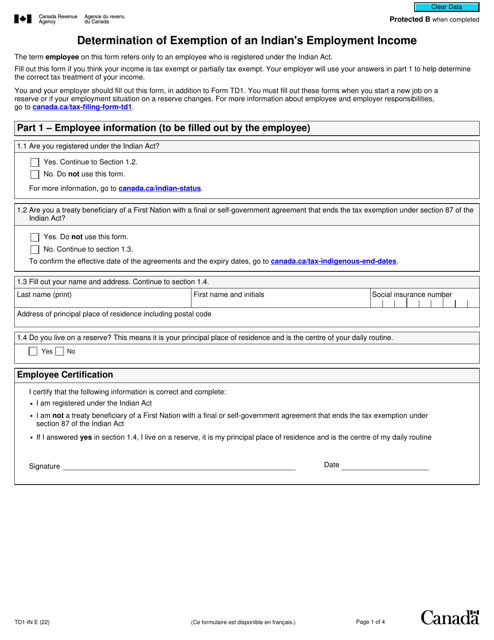

Employees who are defined as Indians under the Canadian Indian Act are supposed to use this form when they want to figure out whether their income from employment is exempt from income tax.

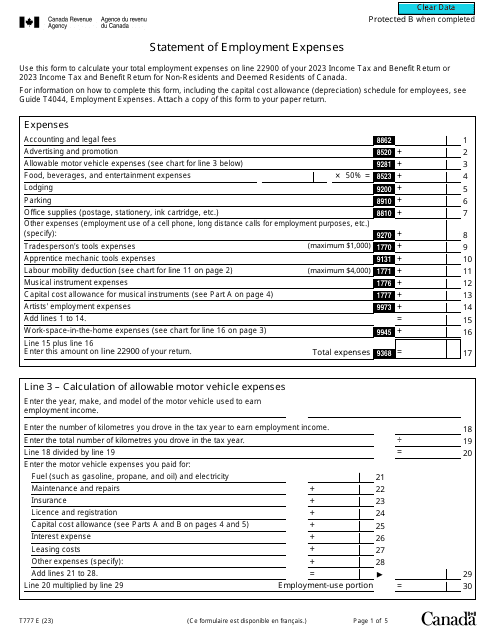

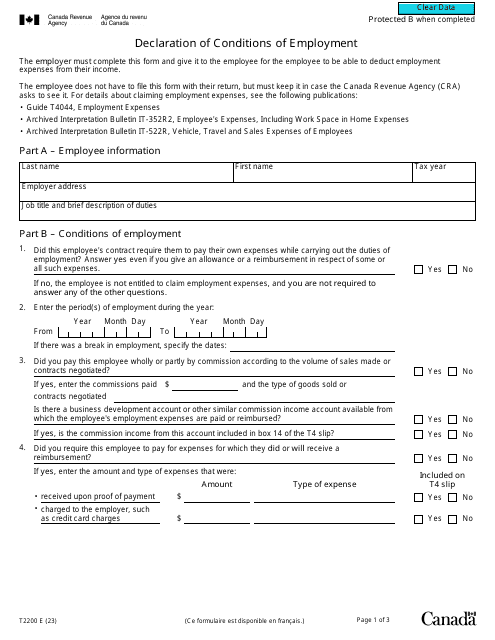

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

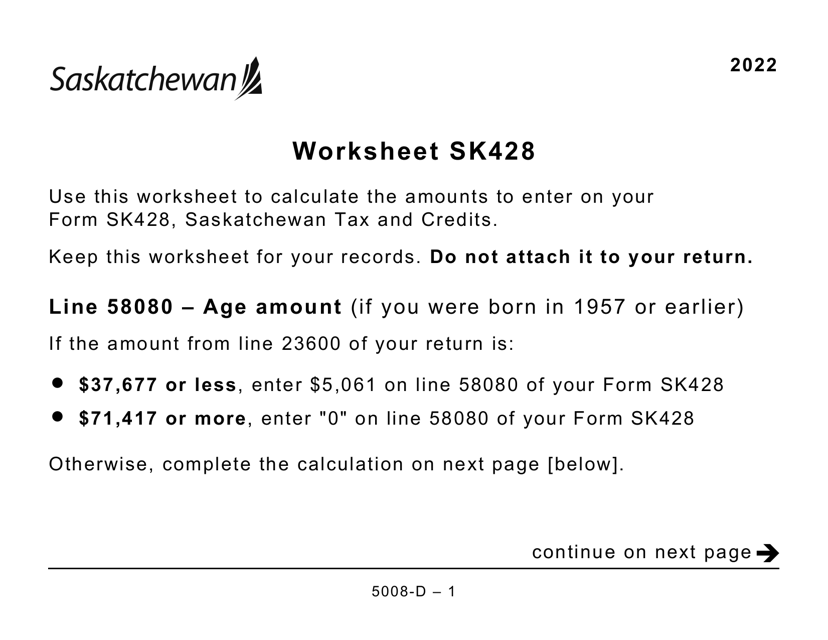

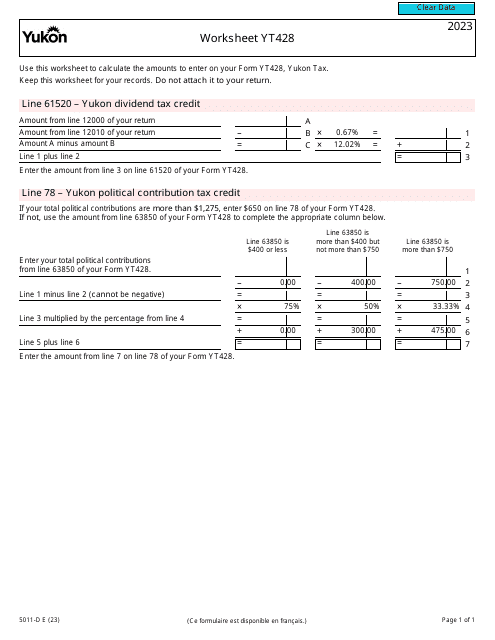

This form is used for completing a worksheet for individuals filing taxes in Saskatchewan, Canada. It is specifically designed for individuals who require a larger print format.

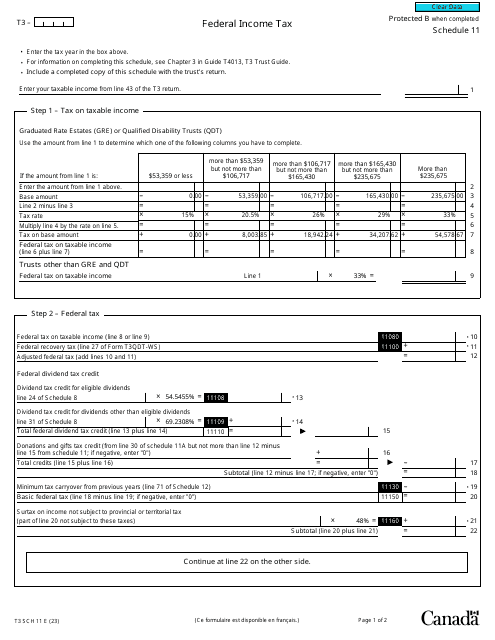

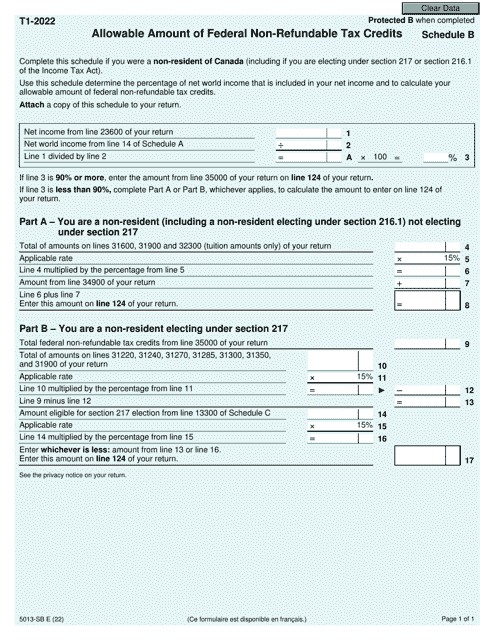

This form is used for calculating the allowable amount of federal non-refundable tax credits in Canada.

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.