Tax Deductions Templates

Documents:

1801

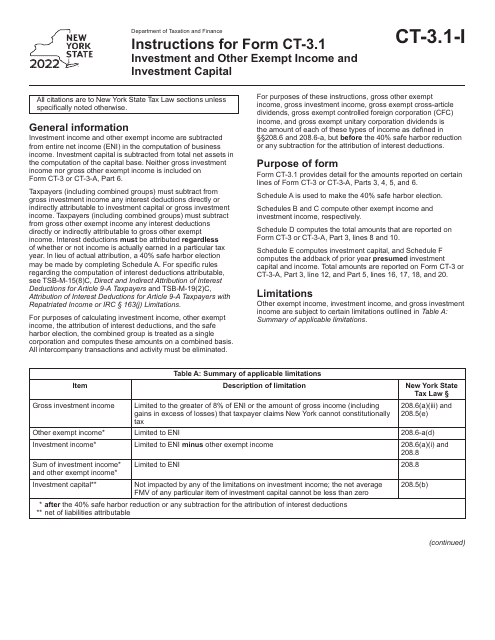

This form is used for reporting investment income and investment capital that are exempt from tax in the state of New York.

This document is used for reporting additions and deductions for pass-through entities, estates, and trusts in North Carolina. It is a form that taxpayers can use to accurately report their income, expenses, and deductions related to these entities.

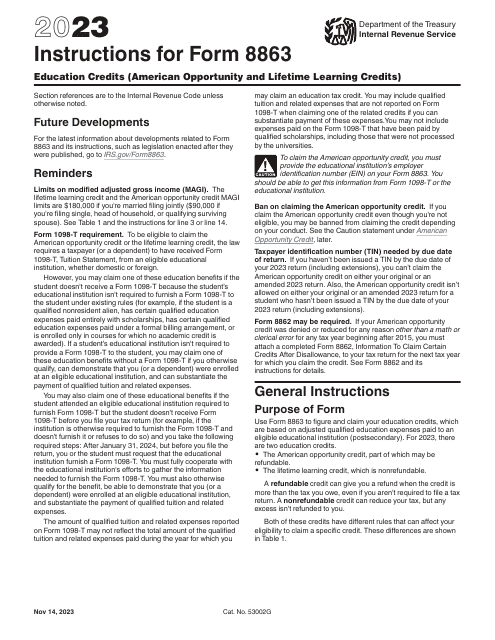

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.