Amount Owed Templates

Are you having trouble keeping track of the amounts you owe? Don't worry, we've got you covered. Our comprehensive collection of documents on amounts owed, also known as amount owing or amounts owing, will provide the guidance and information you need.

Whether you're in California or British Columbia, Canada, we have the tools to help you manage your outstanding balances. From notice of action forms for overpayment amounts owed to certificates of amounts owing, we've compiled a range of resources to make the process easier for you.

Our documents cover various timeframes, ensuring that we are up to date with the latest regulations and guidelines. From forms applicable to overpayments occurring after specific dates to remittance vouchers for amounts owing, we've got you covered.

Don't let the stress of managing amounts owed weigh you down. Take advantage of our extensive collection of documents and gain peace of mind knowing that you have access to the necessary resources to navigate your financial obligations.

Note: The titles listed above are example documents and are not to be used in the text.

Documents:

6

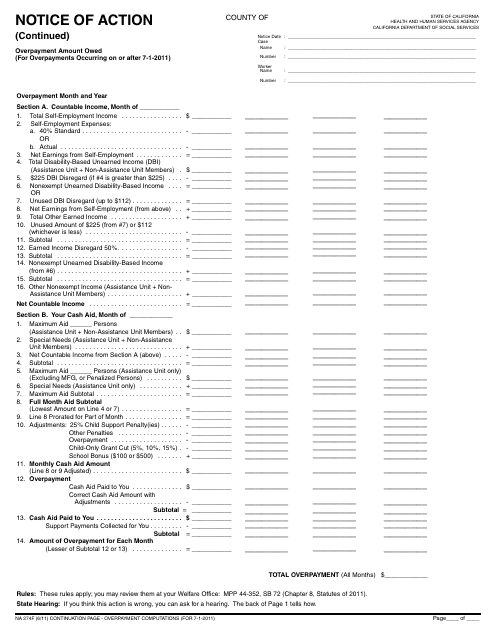

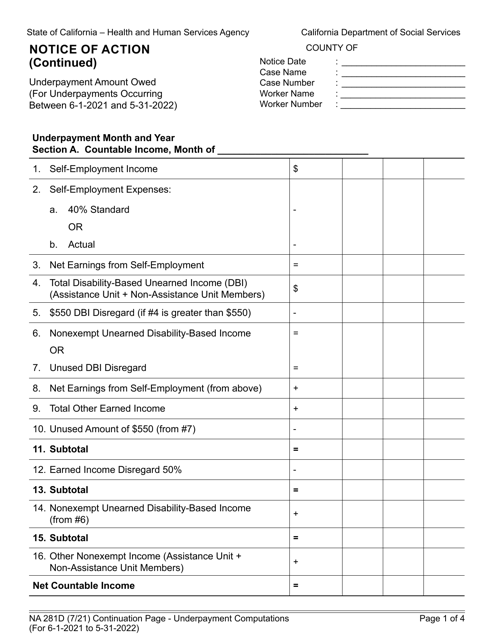

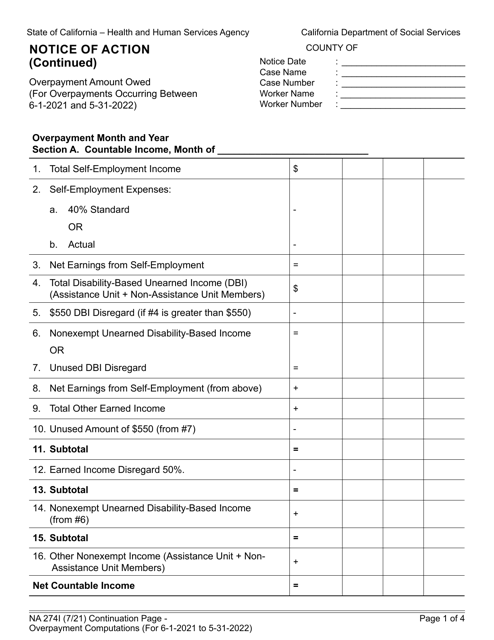

This form is used for reporting and calculating overpayment amounts owed to the state of California. It is specifically for overpayments that occurred on or after July 1, 2011.

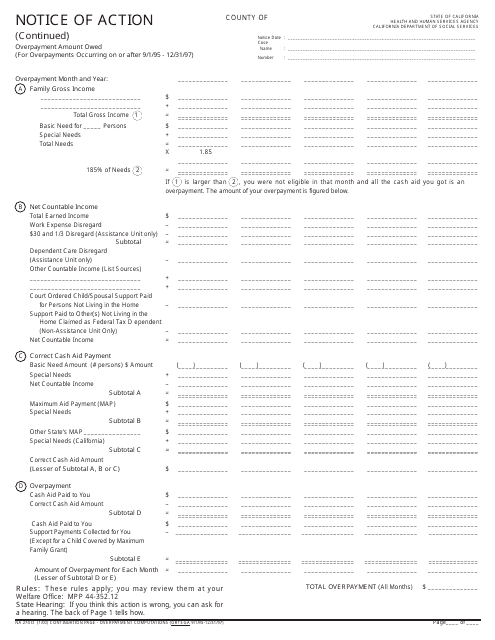

This form is used for notifying individuals in California of an overpayment amount owed from September 1, 1995, to December 31, 1997.

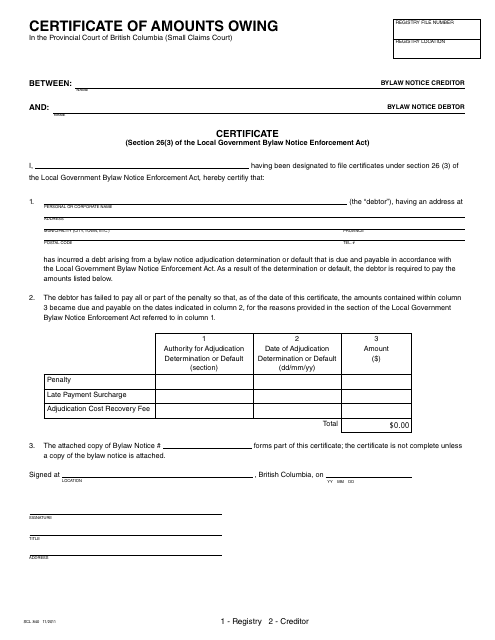

This form is used to certify the amounts owed in British Columbia, Canada.

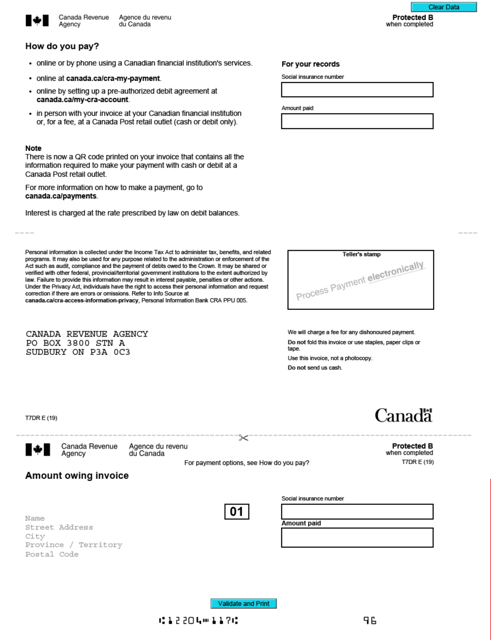

This form is used for making a payment to the Canada Revenue Agency when there is an amount owing on a tax return. It serves as a remittance voucher for submitting the payment.

This Form is used for notifying individuals in California about the amount of overpayment owed for overpayments that occurred between June 1, 2021, and May 31, 2022.