Forest Land Templates

Forest land, also referred to as forested lands, is a valuable and diverse resource that plays a critical role in our environment and economy. It encompasses vast areas of land filled with lush greenery, trees, and wildlife. As stewards of this land, it is important to understand the various procedures and benefits associated with forest land management.

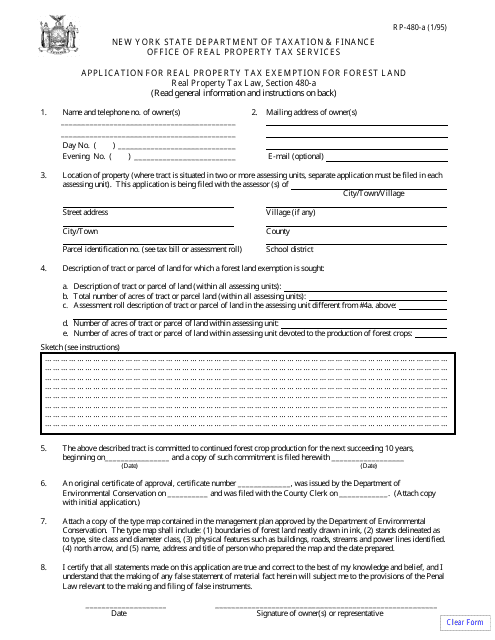

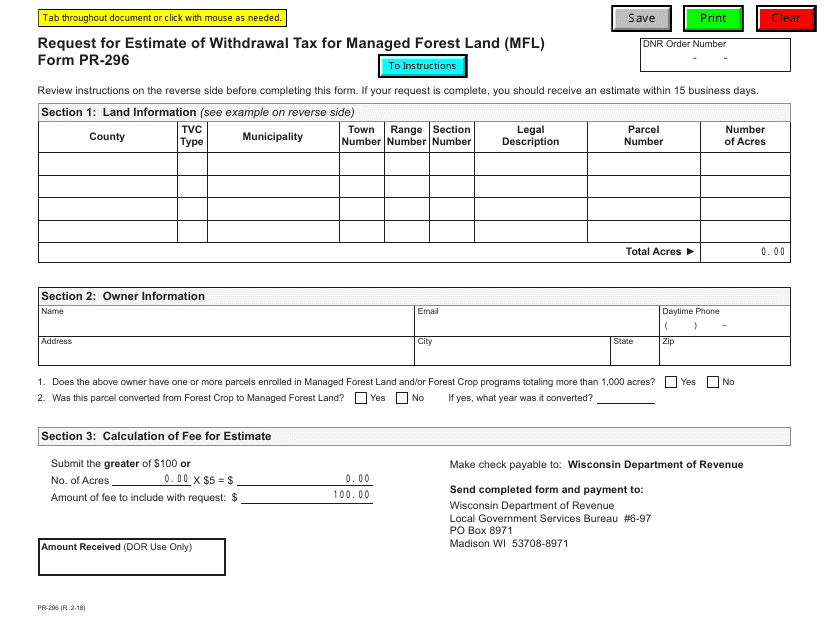

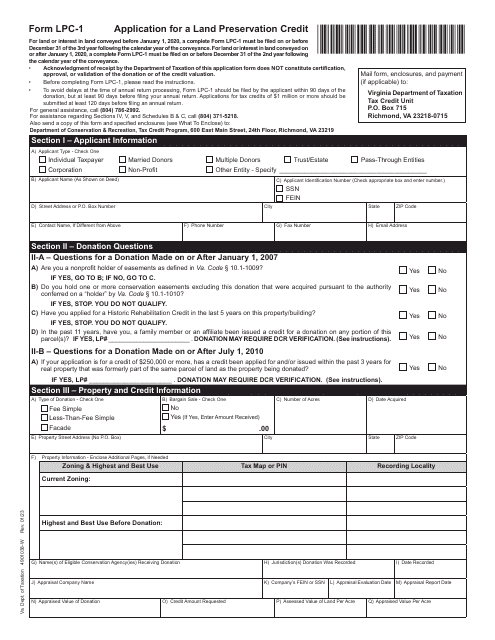

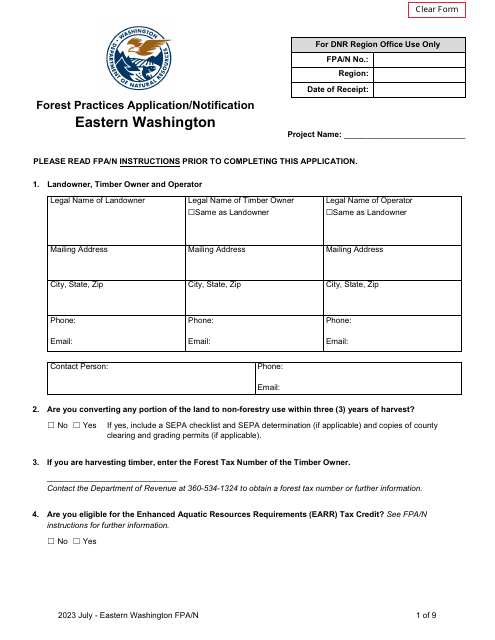

Whether you own forest land or are considering investing in this resource, it is crucial to be aware of the documentation and regulations specific to forest land. These documents, such as the Form PR-296 Request for Estimate of Withdrawal Tax for Managed Forest Land (Mfl) in Wisconsin or the Form LPC-1 Application for a Land Preservation Credit in Virginia, provide guidelines and instructions for landowners to navigate the complexities of managing forest land.

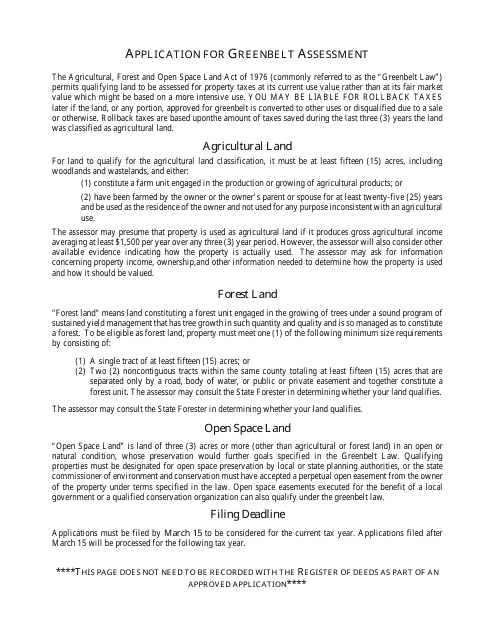

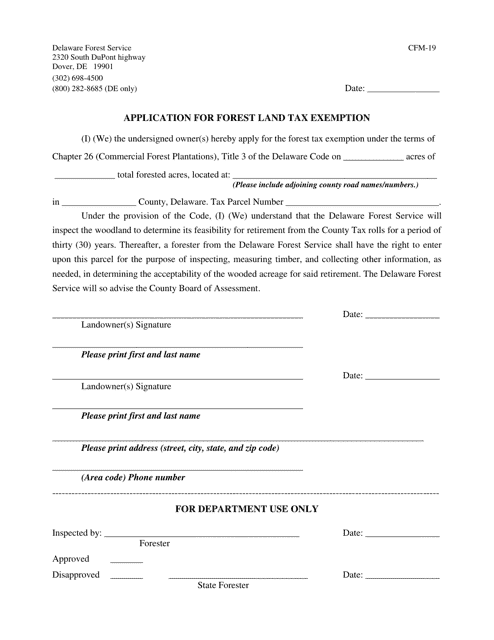

In some states, forest land owners may be eligible for tax exemptions or credits. For example, the Application for Greenbelt Assessment - Forest Land in Tennessee or the Application for Forest Land Tax Exemption in Delaware give forest landowners the opportunity to apply for tax benefits based on the size and condition of their forested acres.

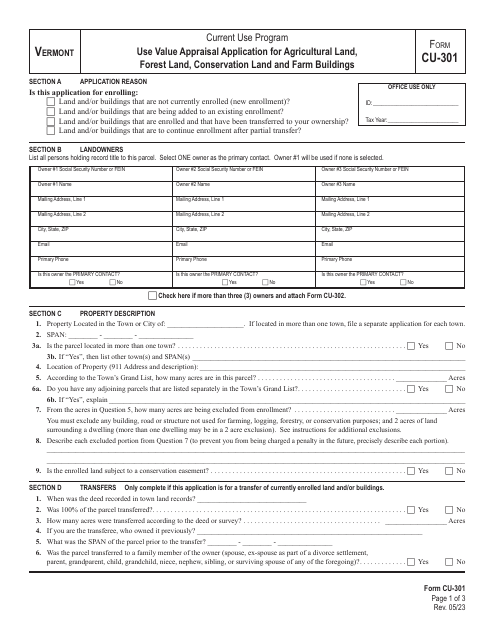

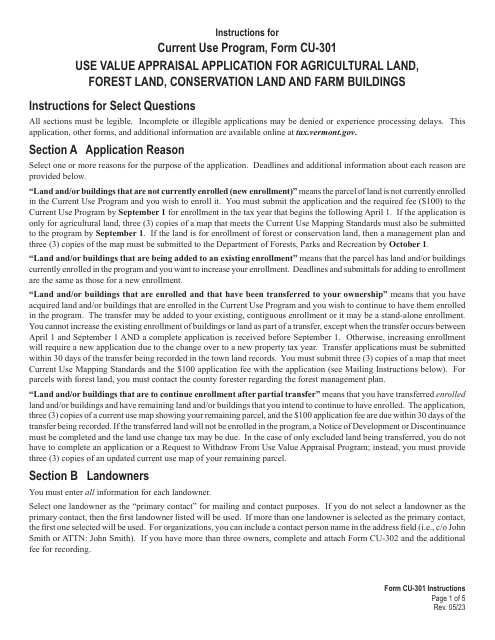

Additionally, understanding the regulations and requirements for land appraisal and the conservation of forest land is vital. Documents like the Instructions for Form CU-301 Use Value Appraisal Application for Agricultural Land, Forest Land, Conservation Land, and Farm Buildings in Vermont provide landowners with the necessary information to determine the value and potential use of their forest land while preserving its ecological integrity.

Whether you are a forest landowner looking to optimize land management or an individual interested in the ecological and economic significance of forested lands, these documents and resources are crucial for making informed decisions. By staying informed and following the appropriate procedures, forest landowners can ensure the sustainable management and preservation of this invaluable resource for generations to come.

Documents:

14

This Form is used for applying for a real property tax exemption for forest land in New York. It allows landowners to request a reduction in property taxes for qualifying forested areas.

This form is used for requesting an estimate of the withdrawal tax for Managed Forest Land (MFL) in Wisconsin. It helps landowners determine the potential tax liability when withdrawing land from the managed forest program.

This form is used for applying for use value appraisal for agricultural land, forest land, conservation land, and farm buildings in Vermont.

This Form is used for applying for a tax exemption on forest land in Delaware.