Pension Payments Templates

Are you receiving pension payments or annuity payments? If so, there are several important documents that you may need to familiarize yourself with. These documents are essential for ensuring that you comply with tax regulations and provide accurate information to the relevant authorities.

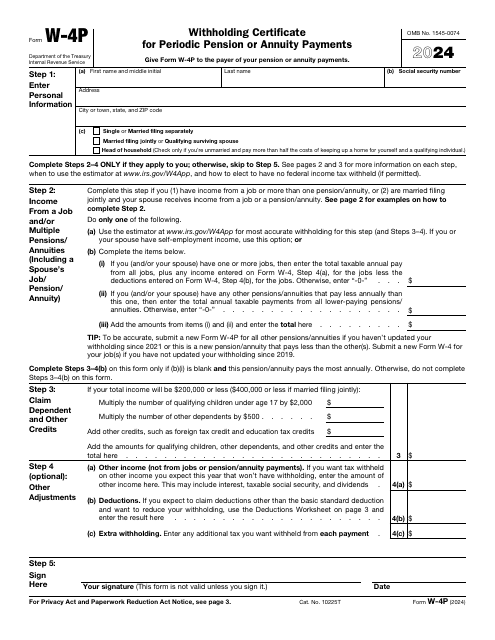

One such document is the IRS Form W-4P Withholding Certificate for Pension or Annuity Payments. This form allows you to specify the amount of federal income tax to be withheld from your pension or annuity payments. By filling out this form correctly, you can ensure that you meet your tax obligations without any surprises.

Another important document is the IRS Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc. This form provides information about the distributions you receive from your pension, annuity, or retirement plans, as well as other sources such as IRAs and insurance contracts. It is important to review this form carefully and report the information accurately on your tax return.

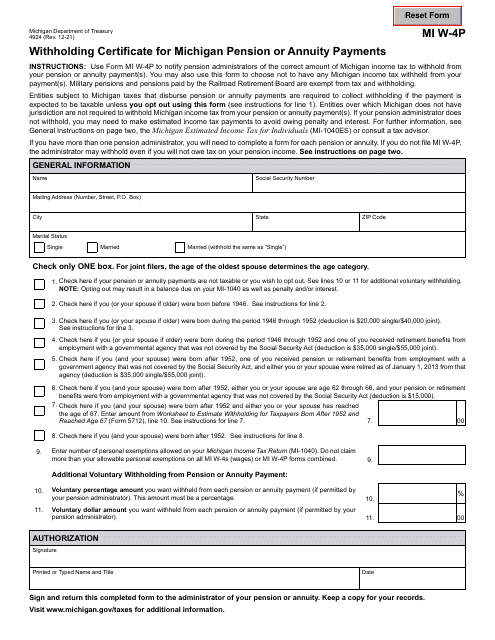

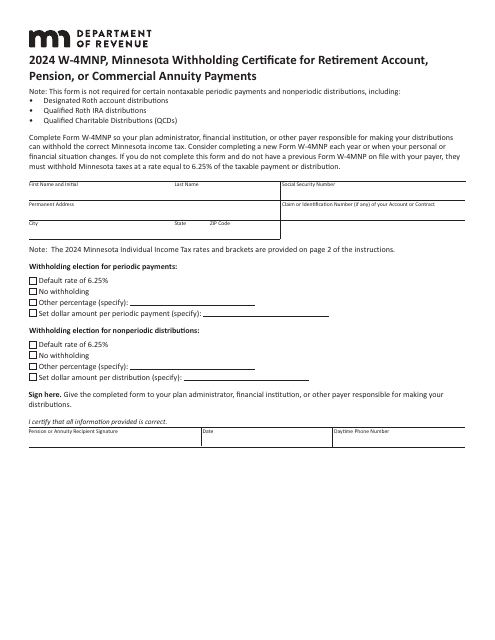

If you are a resident of Michigan or Minnesota, there are specific state withholding forms that you may need to file. For example, Michigan residents may need to fill out Form MI W-4P (4924) Withholding Certificate for Michigan Pension or Annuity Payments. Similarly, Minnesota residents may need to complete Form W-4MNP Minnesota Withholding Certificate for Pension or Annuity Payments. These forms ensure that the correct amount of state income tax is withheld from your pension or annuity payments.

Understanding and properly completing these documents is crucial for ensuring that you meet your tax obligations and avoid any penalties or issues with the authorities. It's a good idea to consult with a tax professional or refer to the relevant tax authority's guidelines to ensure that you fill out these forms accurately and in a timely manner.

And remember, staying informed about pension payments and related documentation is essential for staying in compliance and managing your finances effectively.

Documents:

5

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.