Child and Dependent Care Expenses Templates

When it comes to balancing work and family life, child and dependent care expenses can play a significant role. This collection of documents provides valuable information and guidance to help individuals navigate the complexities of claiming these expenses. Whether you are a working parent or caregiver, understanding the various rules and regulations can save you time, money, and stress.

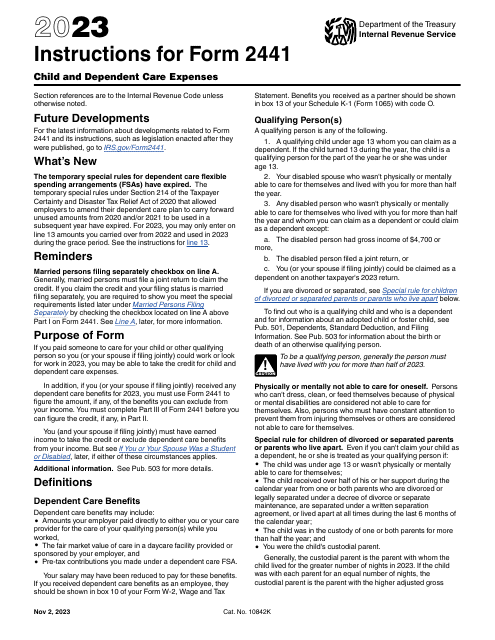

The Instructions for IRS Form 2441 and the IRS Form 2441 Child and Dependent Care Expenses are important resources for individuals in the United States who are looking to file their taxes and claim eligible expenses. By following the step-by-step instructions outlined in these documents, taxpayers can ensure they accurately claim the credits and deductions they are entitled to.

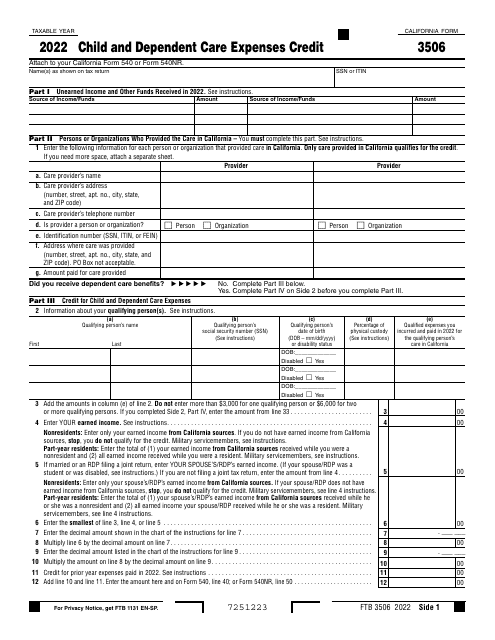

For residents of California, the Form FTB3506 Child and Dependent Care Expenses Credit is a vital document. This form is specific to California taxpayers and allows them to claim state-level credits for qualifying child and dependent care expenses. By carefully reviewing the instructions provided, individuals can maximize their potential tax savings.

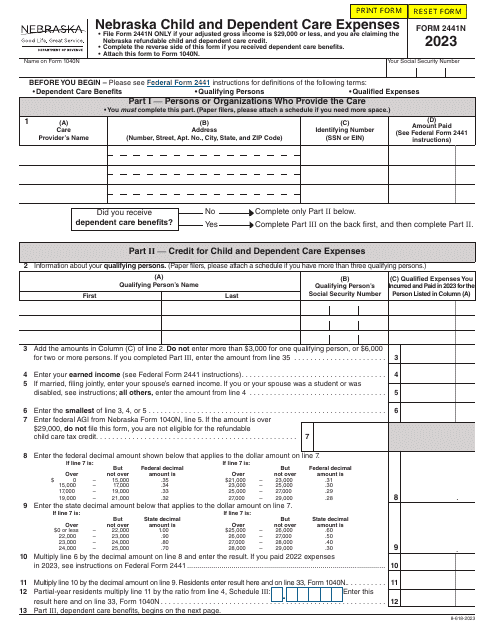

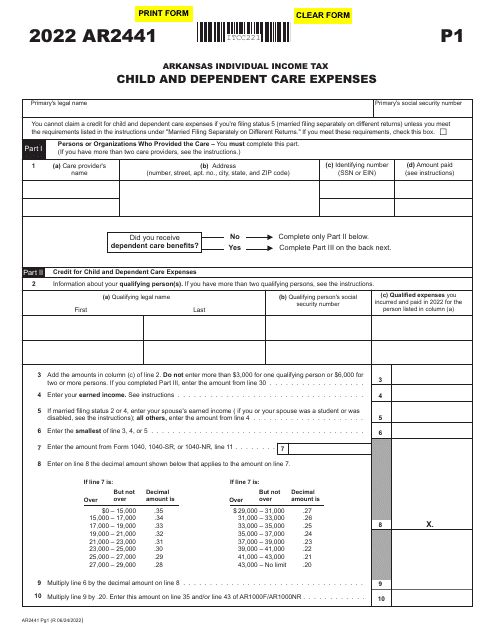

These documents also serve as a valuable reference for understanding the various requirements surrounding child and dependent care expenses. From determining eligible expenses to knowing the limitations and income thresholds, the information provided in these documents can help individuals make informed decisions regarding their finances.

Whether you are seeking information on tax credits, deductions, or state-specific programs, this collection of child and dependent care expense documents is here to assist you. Understanding and properly claiming these expenses can provide much-needed financial relief and ensure that your loved ones receive the care they need. By utilizing the resources provided in this collection, you can navigate the complexities of child and dependent care expenses with confidence.

Documents:

12

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.