Tax Transaction Templates

Tax Transaction: Welcome to our comprehensive collection of documents related to tax transactions. Whether you are in the United States, Canada, or any other country, this resource will provide you with all the information you need for tax-related transactions. From tax-free transactions to exemptions and amended returns, we have the documents you need to navigate the complex world of taxes.

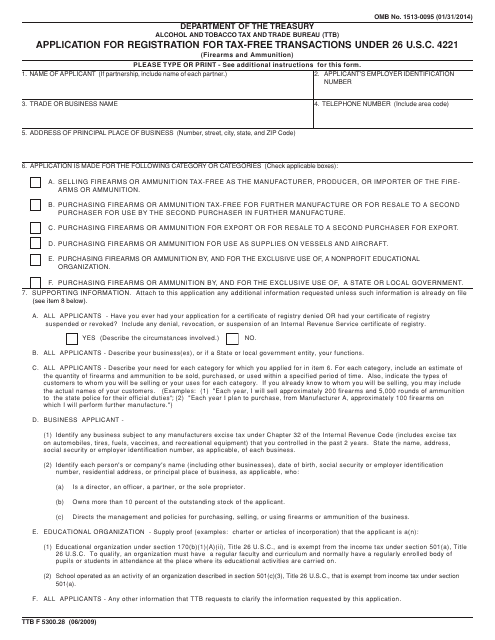

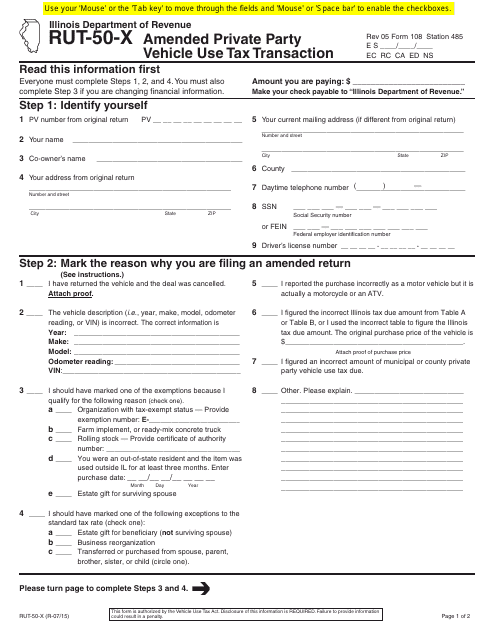

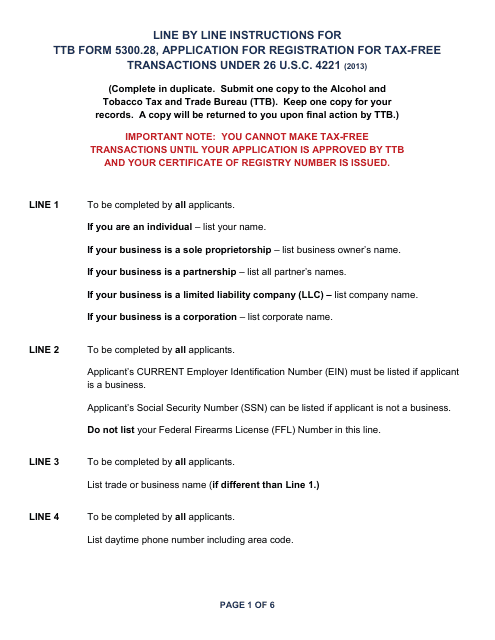

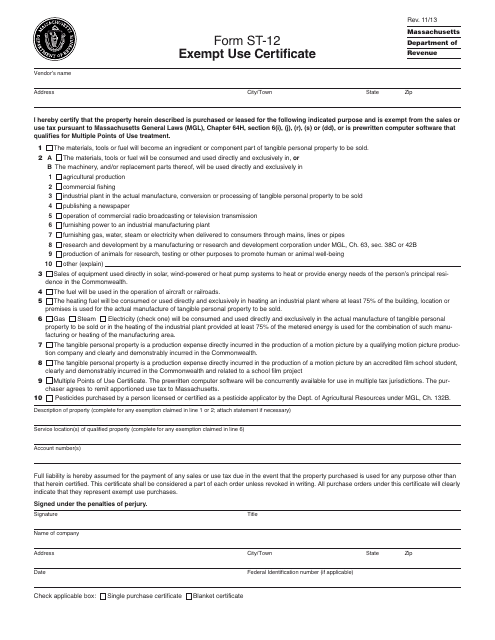

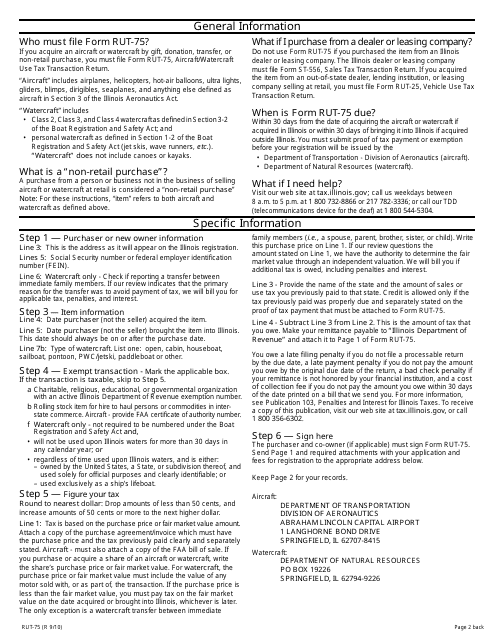

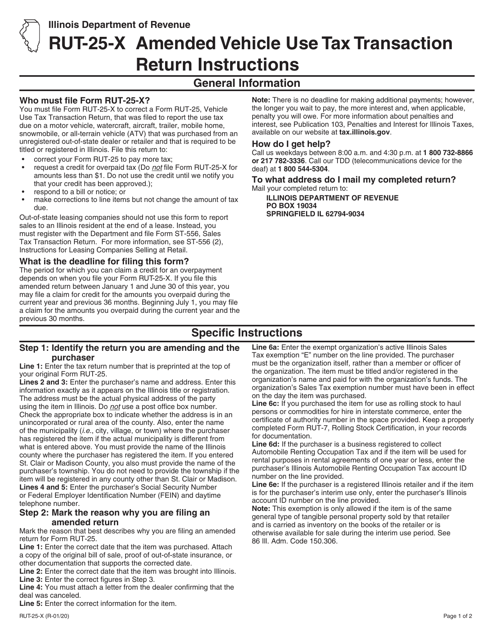

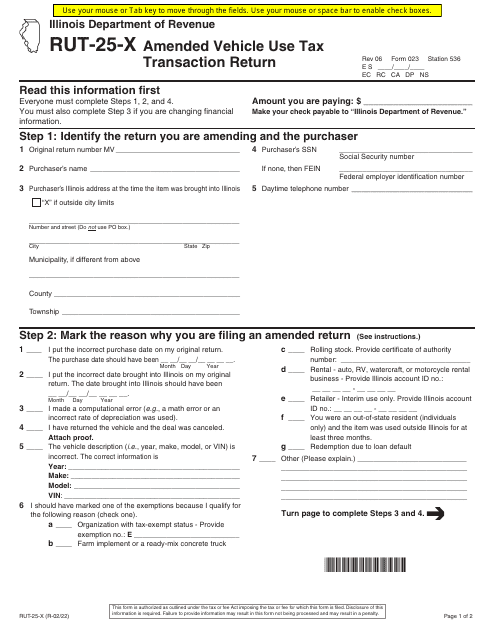

Our collection includes a variety of forms, such as the TTB Form 5300.28 for tax-free transactions under 26 U.S.C. 4221 (Firearms and Ammunition). We also have resources like the Form RUT-50-X for amended private partyvehicle use tax transactions in Illinois, and the Form ST-12 Exempt Use Certificate in Massachusetts. Additionally, you can find instructions for the Form RUT-75 for aircraft/watercraft use tax transactions in Illinois, and the Form RUT-25-X for amended vehicle use tax transactions.

With our comprehensive collection, you can easily access the forms you need and ensure compliance with tax regulations. Whether you are a business owner, an individual taxpayer, or a tax professional, our documents will provide you with the necessary guidance to navigate tax transactions effectively.

Alternate Names: Tax-Free Transactions, Tax-Exempt Transactions, Tax Transaction Forms

Documents:

7

This form is used for registering tax-free transactions for firearms and ammunition under 26 U.S.C. 4221. It is necessary for businesses involved in the sale or manufacturing of firearms and ammunition to apply for this registration.

This form is used for reporting an amended private party vehicle use tax transaction in Illinois.

This document is an application form used to register for tax-free transactions under a specific section of the U.S. tax code (26 U.S.C. 4221). It provides instructions on how to fill out the form and apply for this special tax status.

This document is a form used in Massachusetts for claiming exemption from certain taxes. It is known as the ST-12 Exempt Use Certificate.

This Form is used for reporting and paying use tax on aircraft and watercraft purchases in the state of Illinois. It provides instructions on how to complete the RUT-75 transaction return form.

This form is used for reporting and amending vehicle use tax transactions in Illinois. It is specifically meant for taxpayers to correct any errors or changes in their previous vehicle use tax returns.