Excess Property Templates

Excess Property Management and Inventory Documentation

Welcome to our comprehensive resource for managing and documenting excess property. We understand that tracking and valuing excess property can be a complex and time-consuming task. That's why we have created this collection of resources to help streamline the process and ensure compliance with state regulations.

Our collection of documents includes forms, receipts, and schedules tailored to different states and jurisdictions. Whether you are in Nevada, California, West Virginia, or any other state, you'll find the necessary paperwork to accurately record and evaluate your excess property inventory.

Some may refer to this collection as the Excess Property Inventory Valuation Documentation or the Excess Property Tax Credit Forms. These alternate names reflect the various aspects covered by our resources. From valuing your excess inventory to claiming tax credits related to excess property, our documents cover it all.

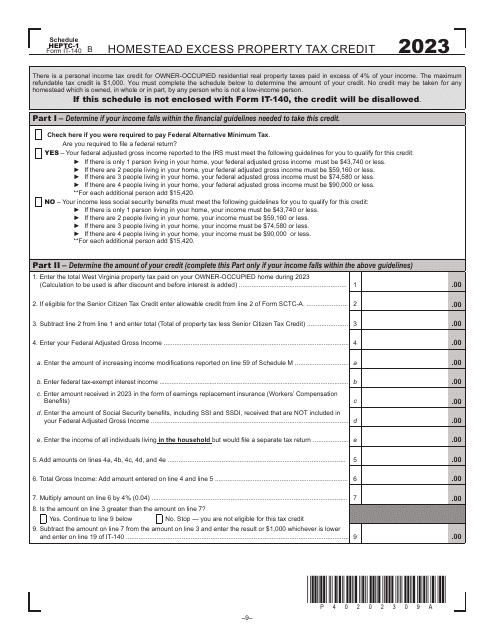

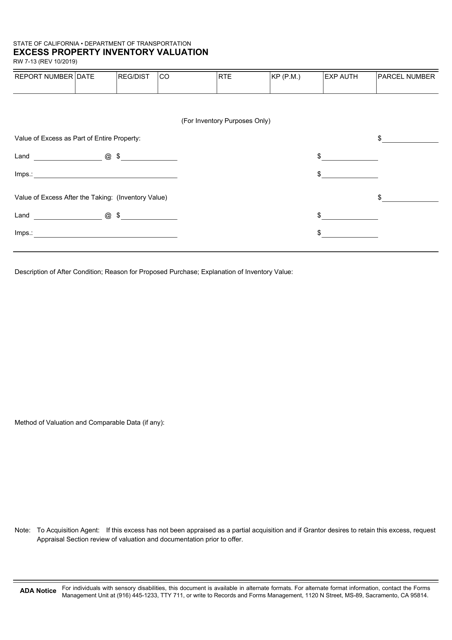

Our Receipt of Excess Property forms enable you to record the transfer of excess property, while the Excess Property Inventory Valuation forms facilitate the valuation process, ensuring accurate asset evaluation. For homeowners, the Homestead Excess Property Tax Credit forms assist in claiming tax credits associated with excess property.

We know that navigating the world of excess property management can be overwhelming, especially with differing regulations across states. That's why our collection is designed to provide a centralized and easily accessible resource for all your documentation needs.

Whether you are a business owner, a government agency, or an individual managing excess property, our collection of documents will simplify the process and ensure compliance with the relevant regulations. Choose the appropriate document from our Excess Property Management and Inventory Documentation

collection, and stay organized and compliant.Documents:

14

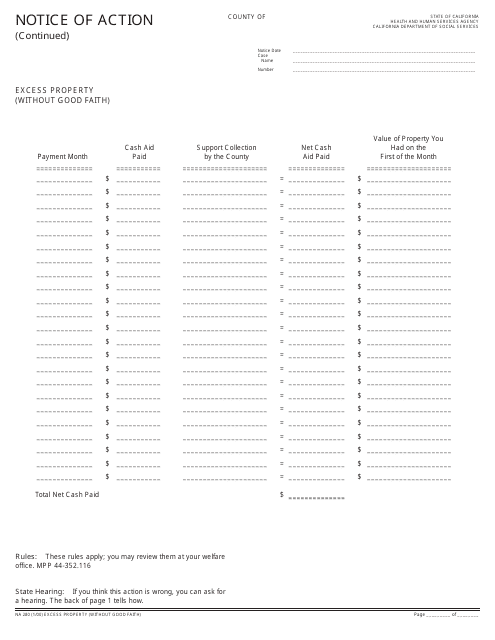

This Form is used for providing additional information regarding the Notice of Action for Excess Property (without Good Faith) in California.

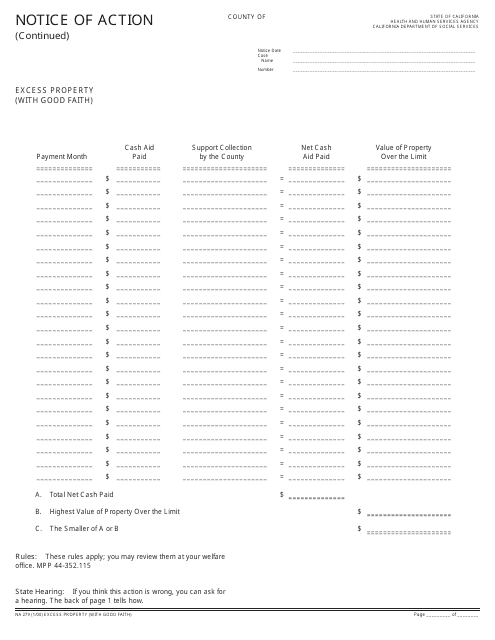

This form is used for notifying individuals in California about the continuation of previous actions taken regarding excess property with good faith.

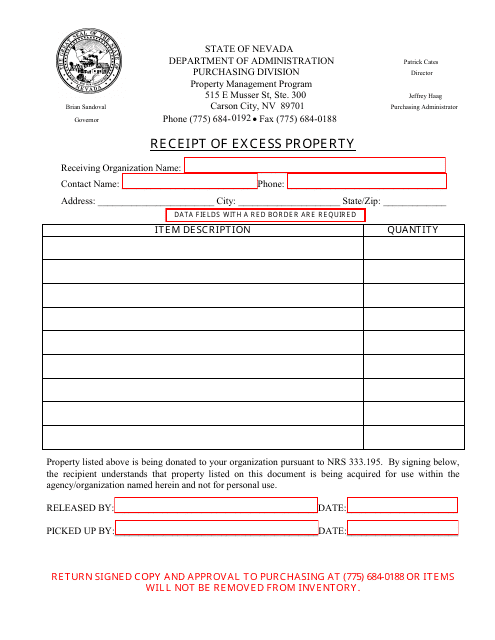

This document is used to acknowledge the receipt of excess property in the state of Nevada.

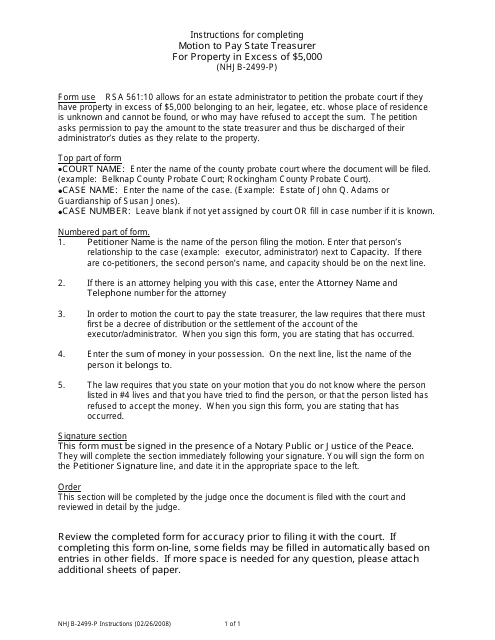

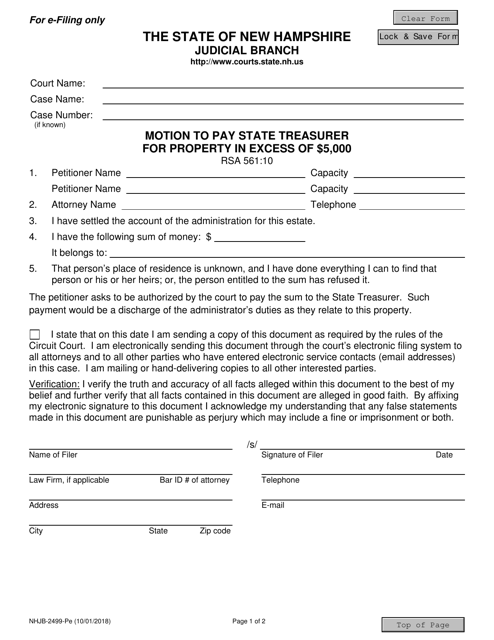

This Form is used to request payment to the State Treasurer for property in New Hampshire that exceeds $5,000. It provides instructions on how to fill out and submit the motion.

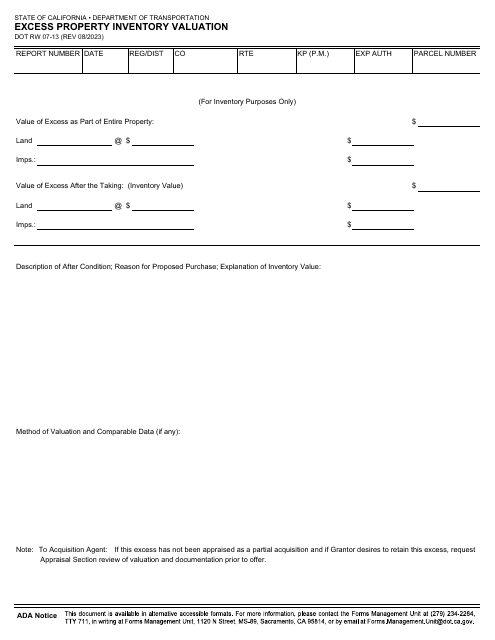

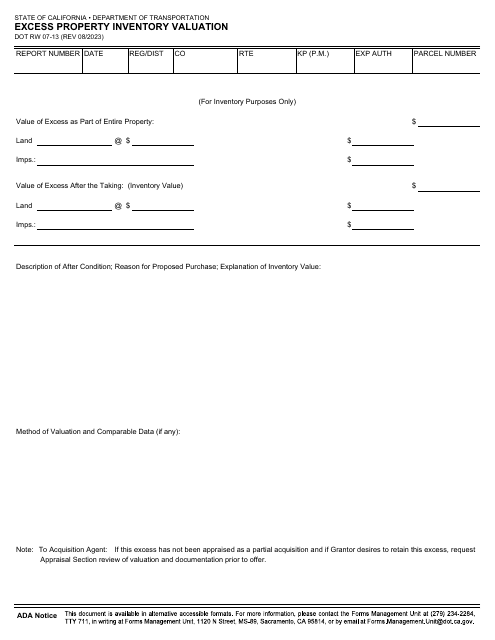

This Form is used for valuating excess property inventory in California.

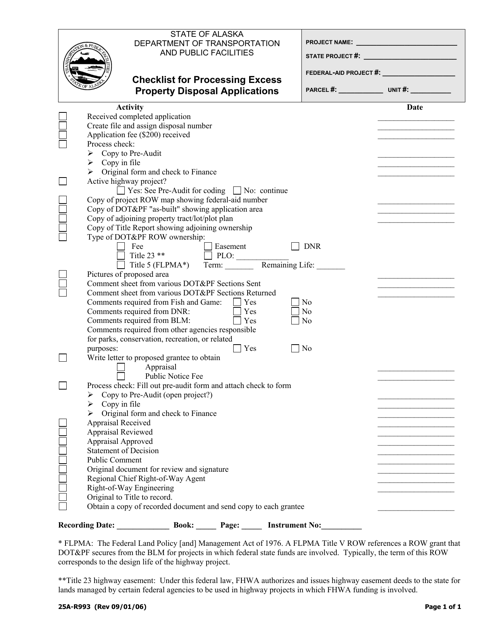

This document is a checklist for processing excess property disposal applications in Alaska. It ensures that all necessary steps are taken when disposing of excess property.

This form is used for requesting permission to pay the State Treasurer for any property that exceeds the value of $5,000 in the state of New Hampshire.

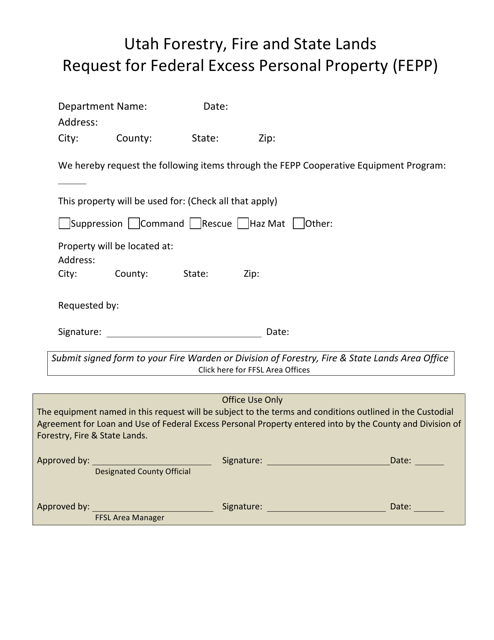

This document is used to request Federal Excess Personal Property (FEPP) in the state of Utah. FEPP refers to surplus federal property that is no longer needed and can be transferred to eligible organizations or individuals.

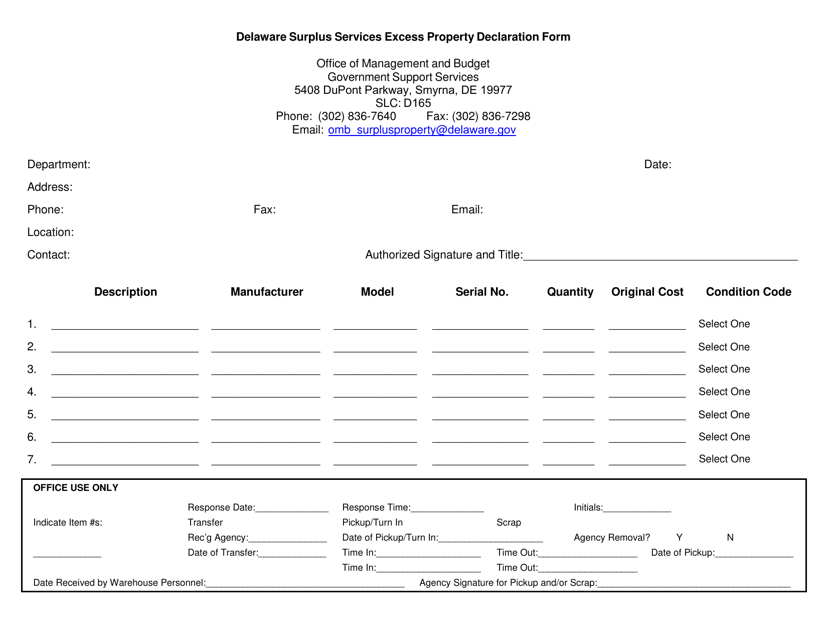

This document is used for reporting excess property and declaring it to Delaware Surplus Services.