Tax Bill Templates

Are you looking for information on tax bills? Look no further! Our website provides a comprehensive guide to understanding tax bills and navigating the tax system. Whether you are an individual taxpayer or a business owner, understanding your tax obligations is crucial.

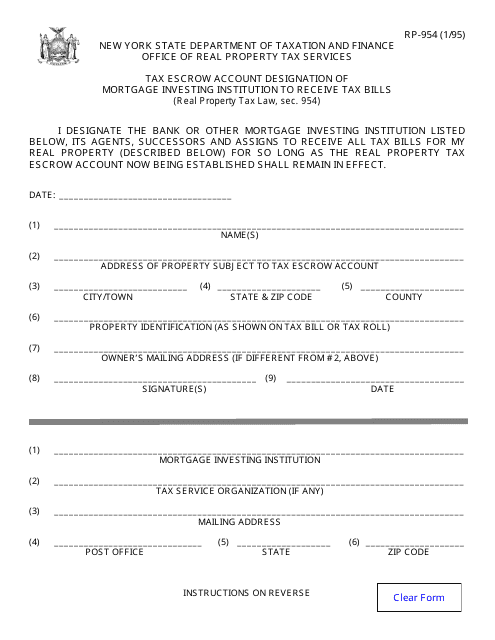

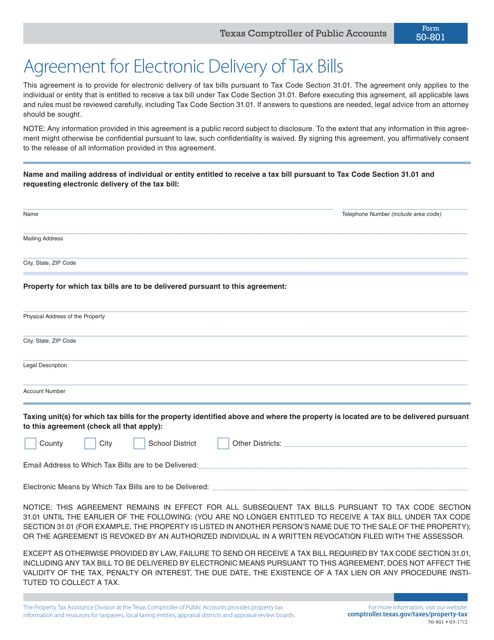

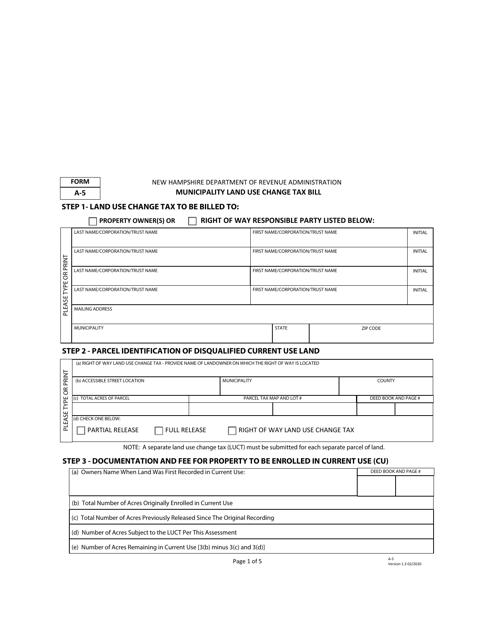

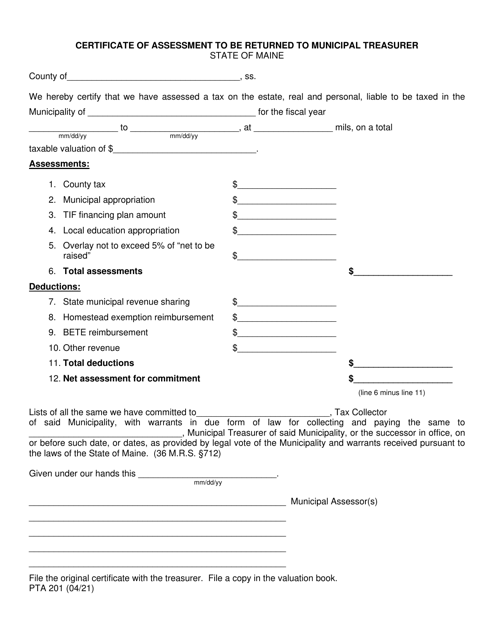

Tax bills, also known as tax bill forms or tax bill templates, are official documents that outline the amount of tax owed by an individual or business entity. These bills are issued by the tax authorities in different states across the United States, such as the New York Form RP-954 Tax Escrow Account Designation of Mortgage Investing Institution to Receive Tax Bills and the Texas Form 50-801 Agreement for Electronic Delivery of Tax Bills. Additionally, tax bills can also be specific to certain transactions or changes, like the New Hampshire Form A-5 Municipality Land Use Change Tax Bill.

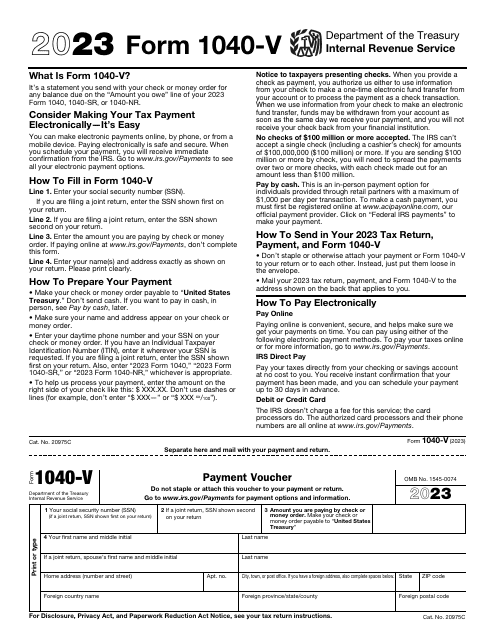

In order to ensure compliance with the tax laws, it is important to understand the information presented on your tax bill. This includes understanding the different components that make up the total amount owed, such as income tax, property tax, sales tax, and more. Additionally, knowing the deadline for payment and available payment options, like the IRS Form 1040-V Payment Voucher, can help you avoid penalties and interest charges.

Our website provides helpful resources and guides to assist you in understanding tax bills and navigating the tax system. We aim to simplify the process and ensure that you have all the information you need to fulfill your tax obligations. Whether you are a first-time taxpayer or a seasoned professional, our website has valuable information that can help you make sense of tax bills and stay in compliance with the tax authorities.

So, if you're looking for guidance on tax bills or need information on specific tax bill forms or templates, browse through our website and take advantage of the valuable resources we have to offer. Understanding your tax obligations is essential, and we're here to help make the process a little easier for you.

Documents:

15

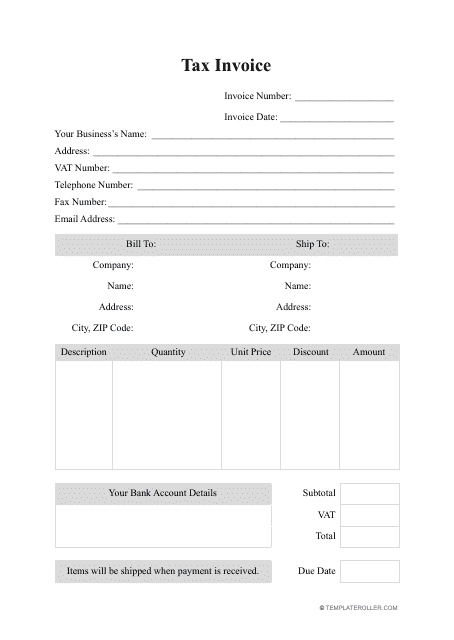

This document is a template for creating tax invoices. It provides a standardized format that businesses can use to invoice their customers for goods or services, including the necessary information for tax purposes.

This document is used for designating a specific mortgage institution to receive tax bills for a tax escrow account in New York.

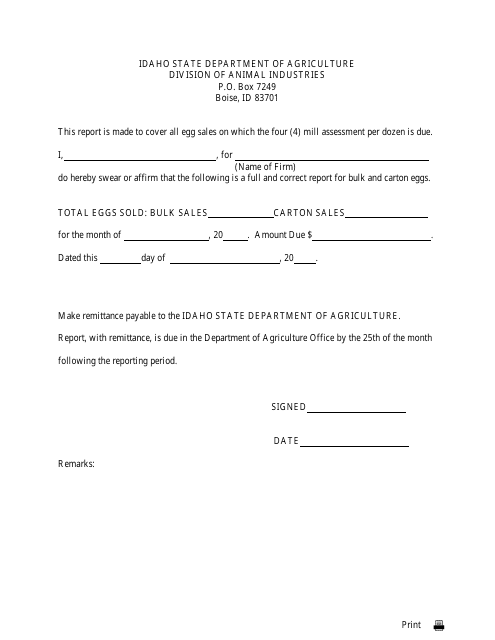

This document is used for calculating and assessing monthly mill levy in the state of Idaho. It determines the amount of property taxes owed by residents and businesses based on the assessed value of their properties.

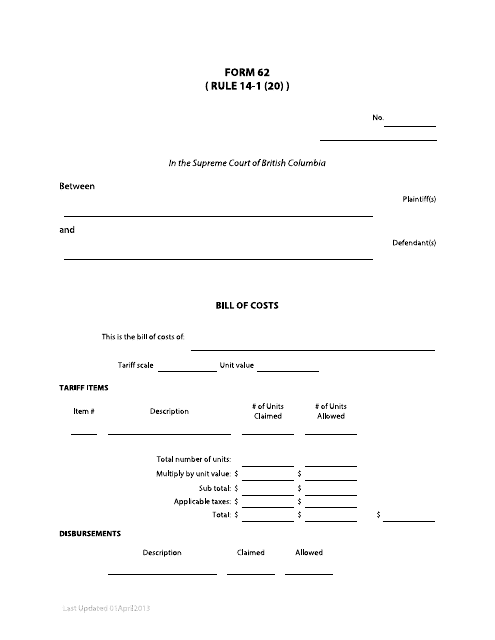

This form is used for submitting a bill of costs in the province of British Columbia, Canada.

This form is used for agreeing to receive tax bills electronically in Texas.

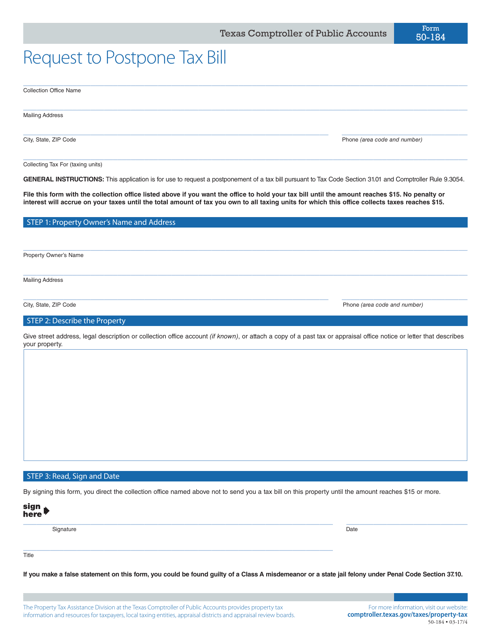

This form is used for requesting a postponement of a tax bill in the state of Texas.

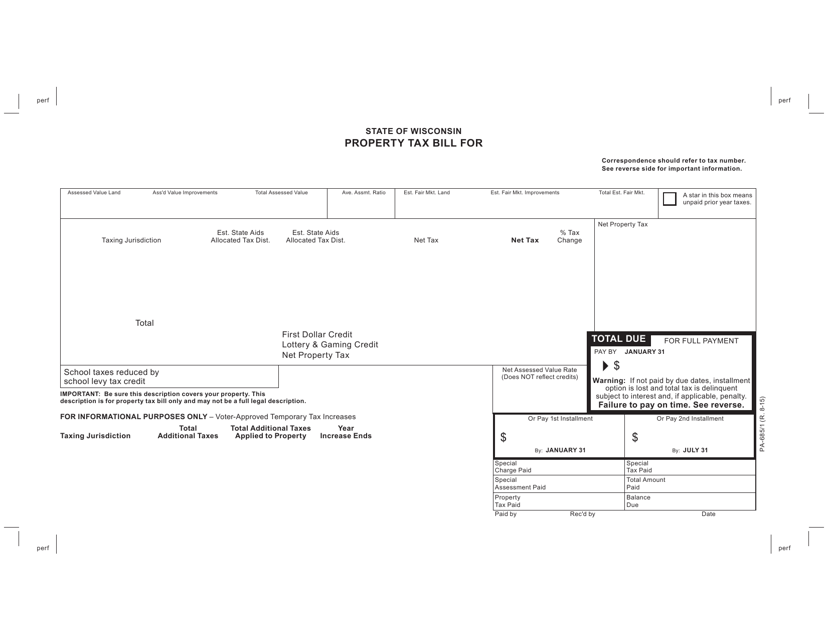

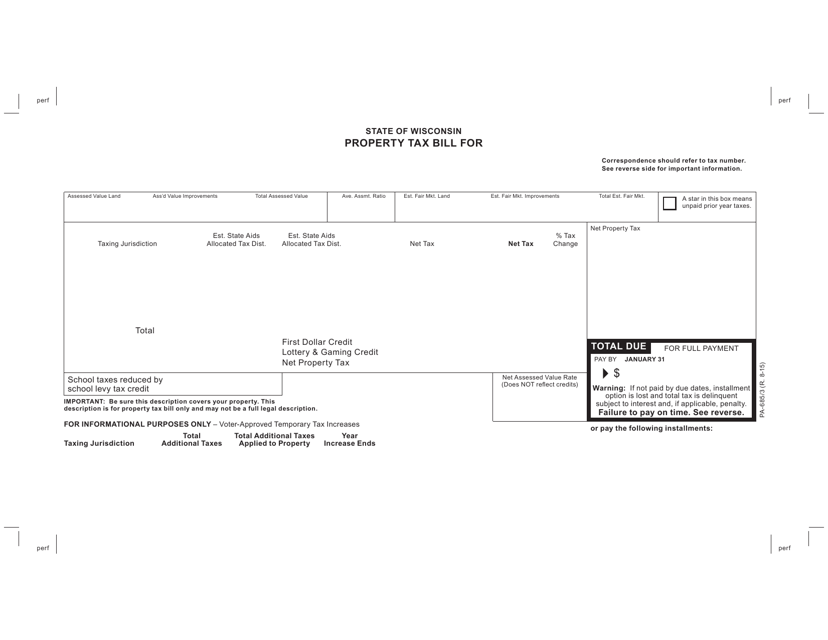

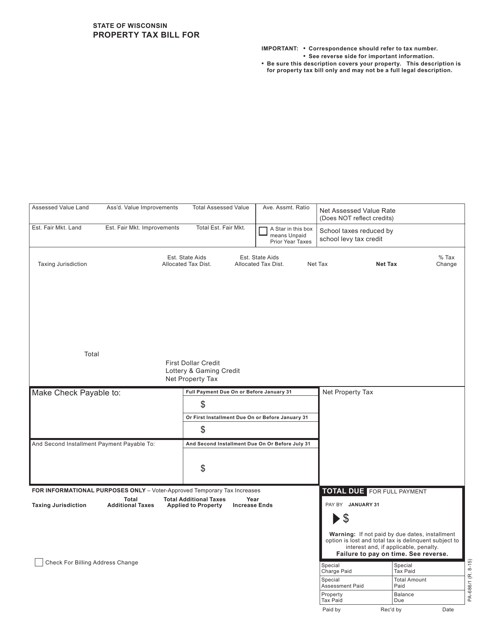

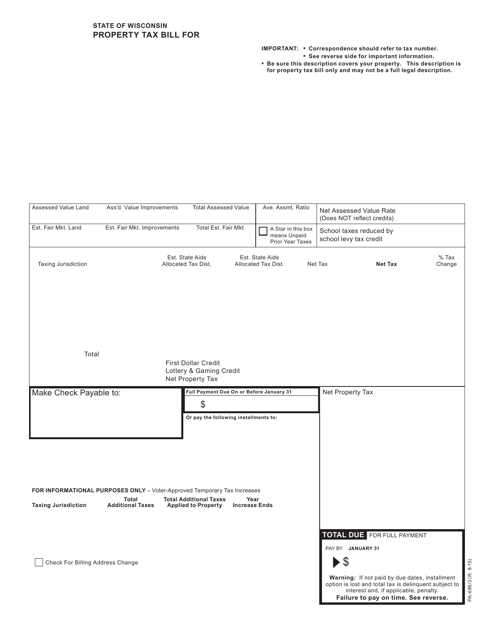

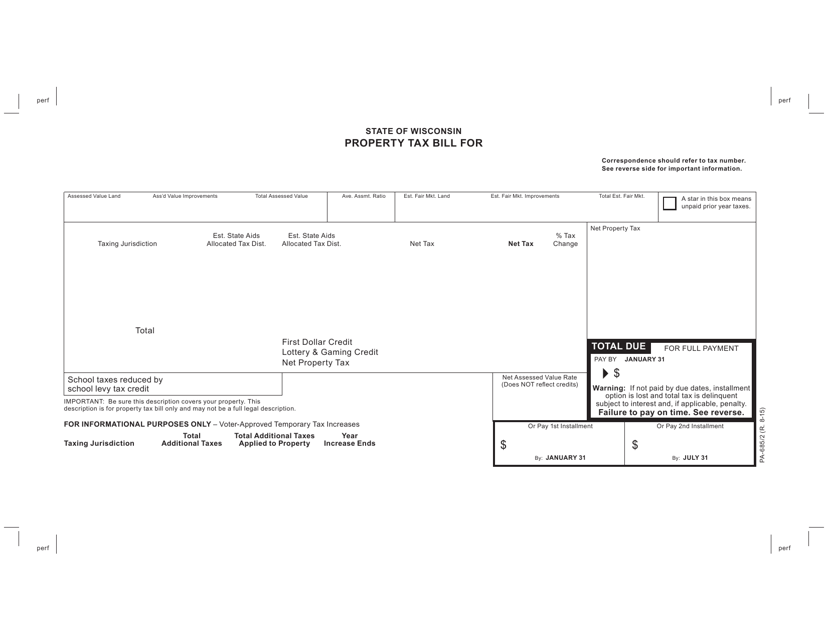

This Form is used for receiving and paying property tax bills in Wisconsin.

This form is used for paying property taxes in Wisconsin. It is the bill that homeowners receive to calculate and submit their property tax payments.

This form is used to send property tax bills to residents in Wisconsin.

This form is used for paying property tax bills in the state of Wisconsin.

This document is used for paying property taxes in the state of Wisconsin. It provides a detailed bill of the amount owed for the property tax and instructions for payment.

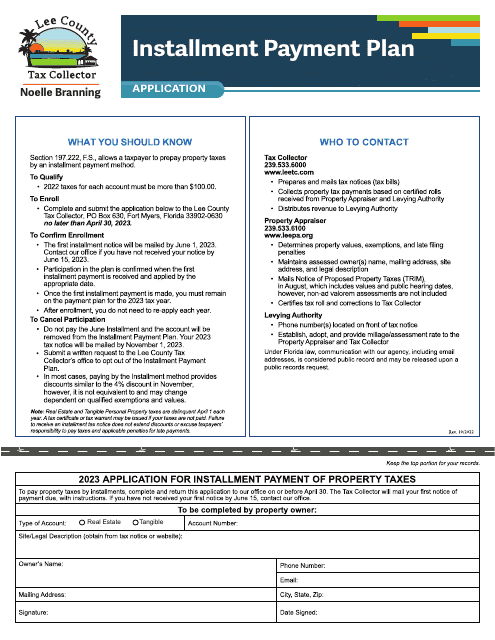

This document is for residents of Lee County, Florida who want to apply for an installment payment plan for their property taxes.

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.