Net Investment Income Tax Templates

The net investment income tax, also known as the Medicare surtax, is a tax that applies to certain investment income. This tax is designed to fund Medicare and is imposed on individuals, estates, and trusts.

Our website provides comprehensive information and resources on the net investment income tax. Whether you are an individual taxpayer, an estate executor, or a trustee, we have the instructions and forms you need to accurately report and calculate your net investment income tax liability.

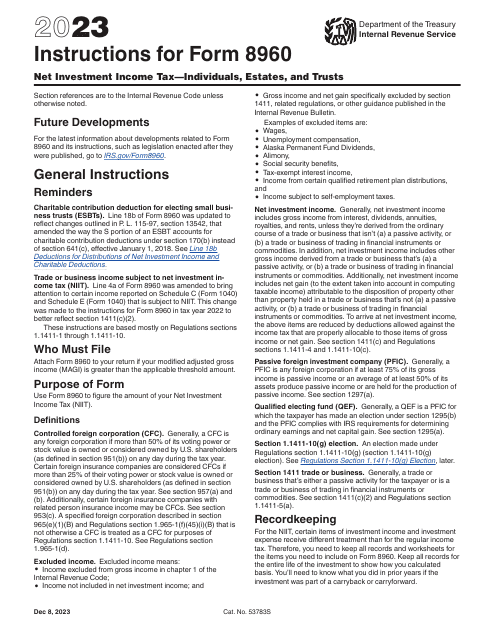

On our website, you will find detailed instructions for IRS Form 8960, which is the form used to report the net investment income tax. We provide step-by-step guidance to help you complete the form correctly and minimize the risk of errors or audits.

In addition to the instructions, we also offer downloadable copies of IRS Form 8960 for your convenience. These forms can be filled out electronically or printed and completed by hand. We understand that everyone has different preferences when it comes to preparing their taxes, so we provide options that cater to your needs.

Our goal is to make the process of understanding and complying with the net investment income tax as simple and straightforward as possible. We break down complex tax concepts into easy-to-understand language and provide examples to illustrate how the tax is calculated.

Whether you are looking for answers to specific questions about the net investment income tax or need general information about how it applies to your situation, our website is your go-to resource. Trust us to provide accurate and up-to-date information to help you navigate the net investment income tax with confidence.

Documents:

11

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.