Cost Allocation Templates

When it comes to managing finances and resources within an organization, cost allocation is a crucial aspect that cannot be overlooked. Cost allocation involves the process of distributing and assigning expenses to various departments, projects, or activities within a company.

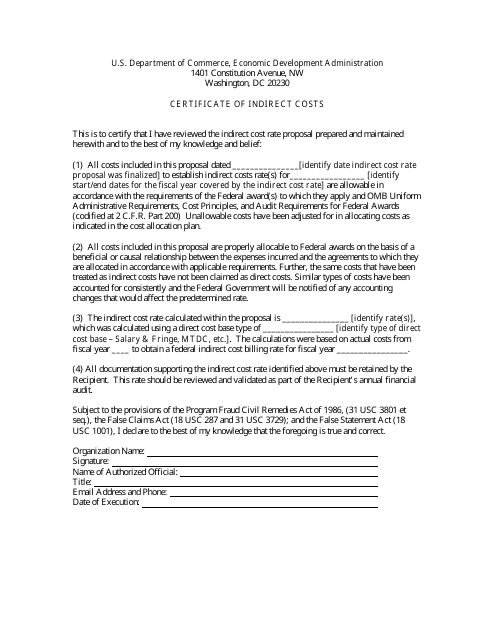

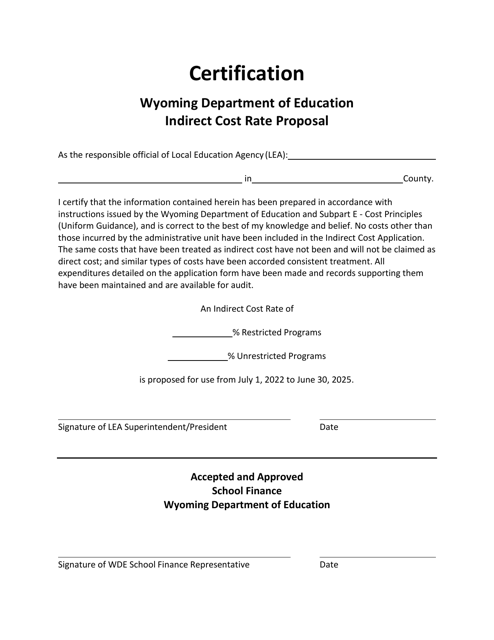

The Certificate of Indirect Costs serves as a formal document that outlines the calculations and methodology used to distribute indirect costs across different cost centers. This document ensures transparency and fairness in allocating costs, as well as establishing a clear understanding of the financial implications for each department.

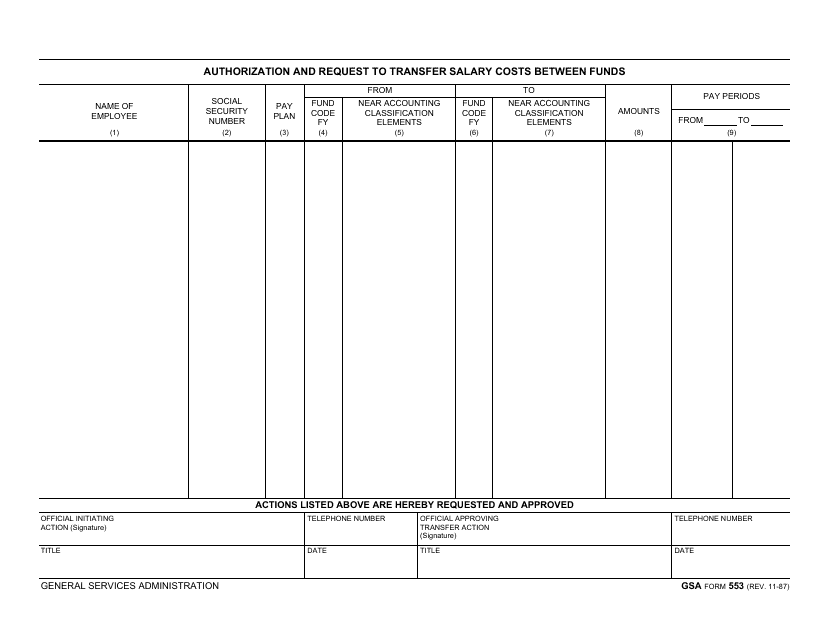

Another important document is the GSA Form 553 Authorization and Request to Transfer Salary Costs Between Funds. This form allows for the reallocation of salary costs between different accounts, enabling organizations to optimize their financial resources and budget effectively.

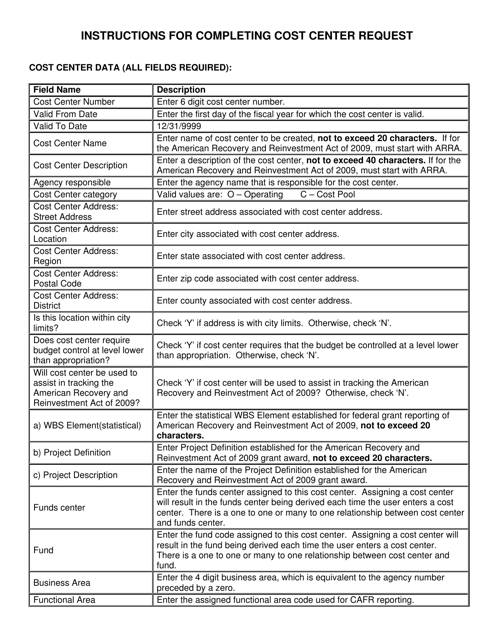

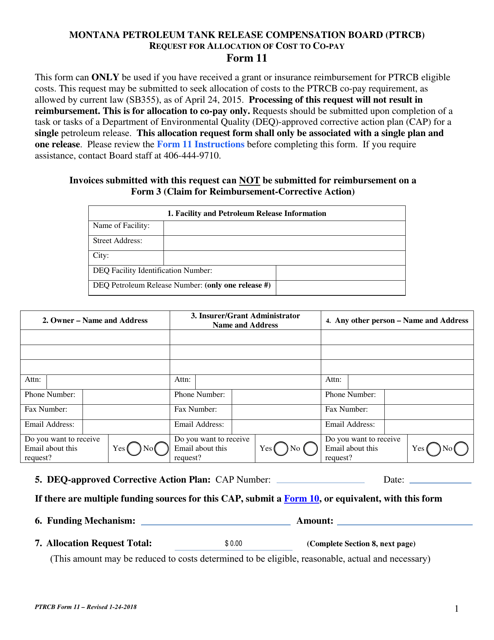

In addition, various instructions and forms exist for different states and regions. For example, the Instructions for Cost Center Request Funds Management Assignment in Arkansas provide guidelines for requesting funds and allocating costs within specific cost centers. Similarly, the PTRCB Form 11 Request for Allocation of Cost to Co-pay in Montana helps in determining the appropriate allocation of costs for co-payment services.

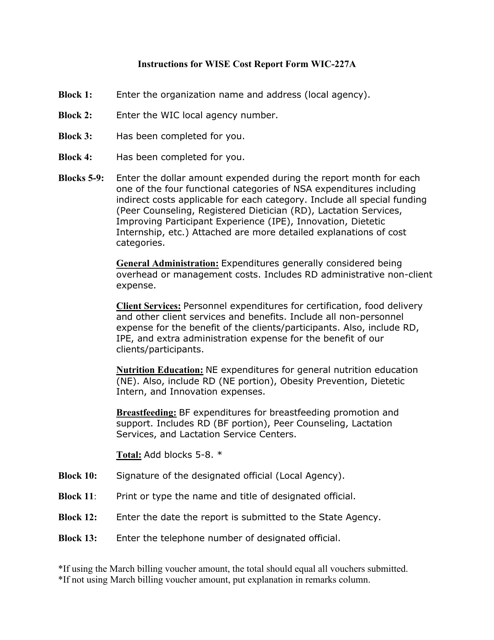

Furthermore, organizations in Texas can refer to the Instructions for Form WIC-227A Wise Cost Report, which provides detailed instructions on preparing cost reports and allocating costs efficiently within the WIC program.

Cost allocation might go by different names such as cost distribution or expense assignment. Regardless of the terminology, this process is essential for ensuring accurate financial reporting, optimizing resource utilization, and maintaining transparency throughout the organization.

If you are looking to streamline your cost allocation processes, our team is here to help. We provide innovative solutions and expertise to assist organizations in efficiently managing their expenses and optimizing their financial resources. Our cost allocation services are tailored to meet your specific needs, ensuring accuracy, efficiency, and compliance.

Contact us today to learn more about our cost allocation services and how we can help your organization achieve financial stability and success.

Documents:

9

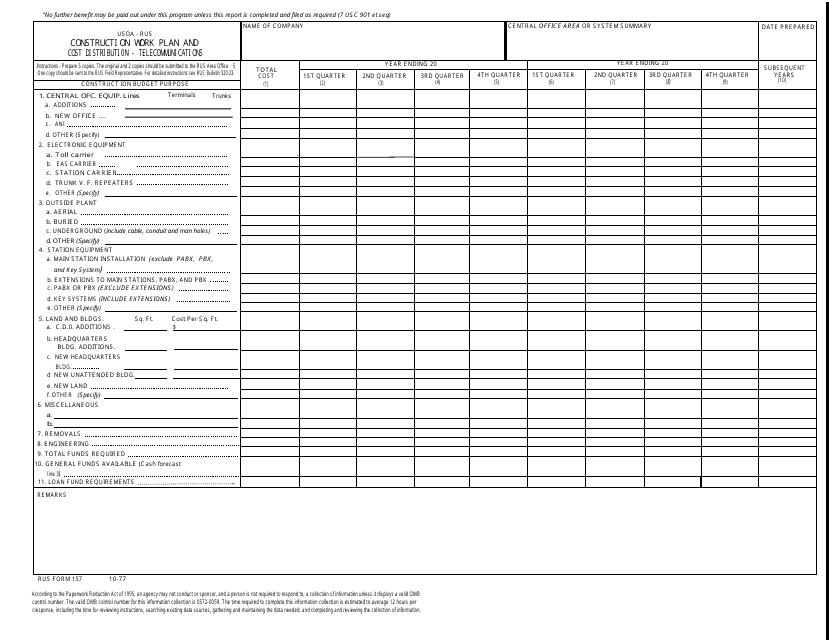

This Form is used for submitting a construction work plan and cost distribution for telecommunications projects.

This document is used to certify the indirect costs incurred by an organization. It provides information on the allocation and calculation of indirect costs for budgeting and financial reporting purposes.

This Form is used for authorizing and requesting the transfer of salary costs between funds in the GSA (General Services Administration).

This form is used for requesting the allocation of cost to co-pay in the state of Montana.

This form is used for reporting wise cost information under the Women, Infants, and Children (WIC) program in Texas.

This document is used to propose the indirect cost rate for organizations in Wyoming.

This form is used for tracking cost-sharing expenses in Canada. It is specifically known as Form F (GAC-AMC2273).