Eligible Rollover Distribution Templates

Are you looking for information on how to handle eligible rollover distributions? Look no further! In this section, we provide all the necessary resources and forms you need to understand and manage your eligible rollover distribution.

An eligible rollover distribution, also known as an eligible rollover distribution form or eligible rollover distributions, refers to the distribution of funds from a retirement plan that can be rolled over into another eligible retirement plan or IRA without incurring penalties or taxes.

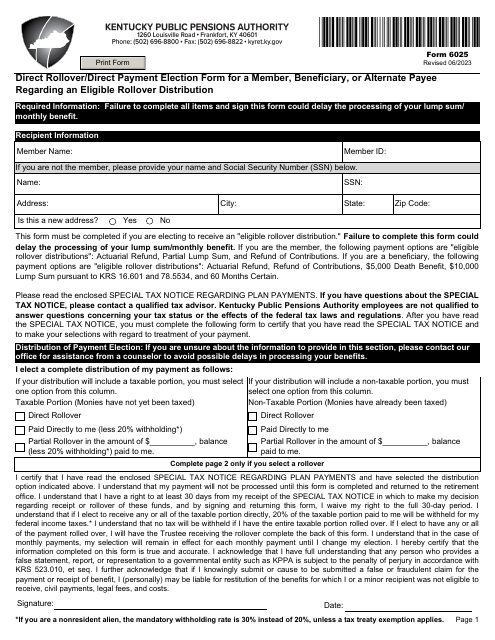

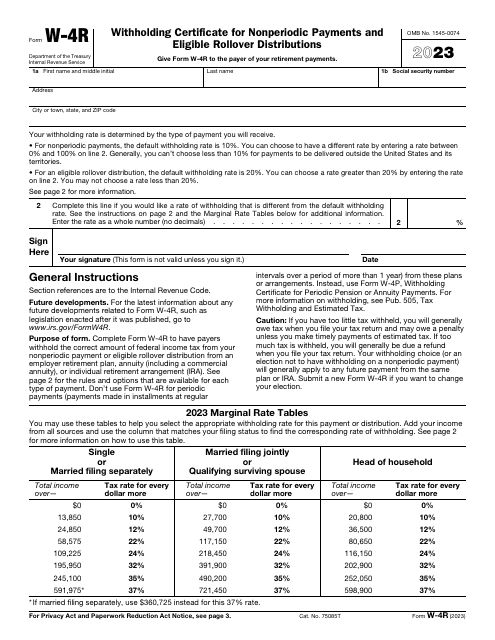

We have a comprehensive collection of documents related to eligible rollover distributions, including Form 6025 Direct Rollover/Direct Payment Election Form for a Member or a Beneficiary of an Eligible Rollover Distribution - Kentucky, IRS Form W-4R Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions, and more.

Our resources provide step-by-step instructions on how to complete the necessary forms and guidance on the rules and regulations surrounding eligible rollover distributions. Whether you're an individual managing your own rollover or a financial professional assisting clients, our documents will ensure a smooth and compliant process.

Make the most of your eligible rollover distribution by accessing our handy collection of documents. Take control of your retirement savings today!