Conveyance Tax Templates

Are you looking to understand more about conveyance tax? Look no further. This webpage is dedicated to providing you with a comprehensive guide to conveyance tax, also known as transfer tax or deed tax. Whether you are a real estate company, a homeowner, or a town clerk, this information will be invaluable.

Conveyance tax is a tax levied on the transfer of real property from one party to another. It is collected at the state or local level and the rates vary depending on the jurisdiction. This tax is typically paid by the buyer or seller during the closing process.

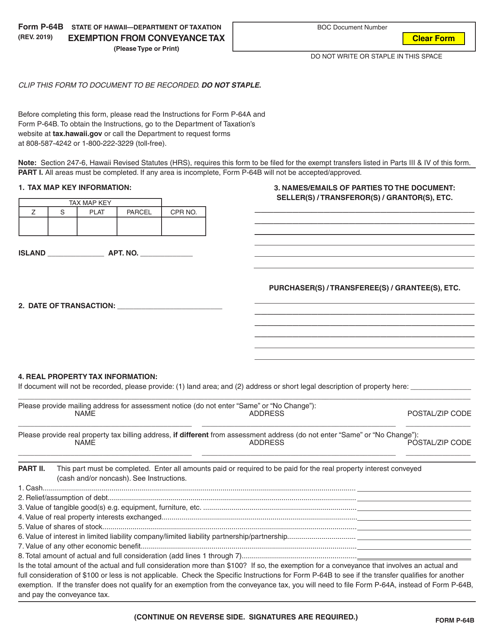

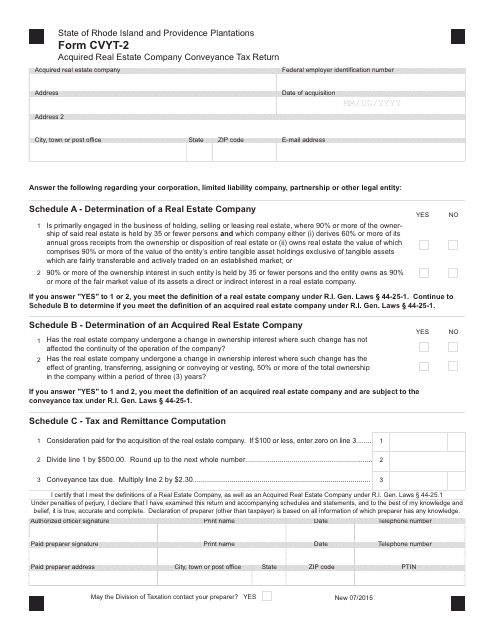

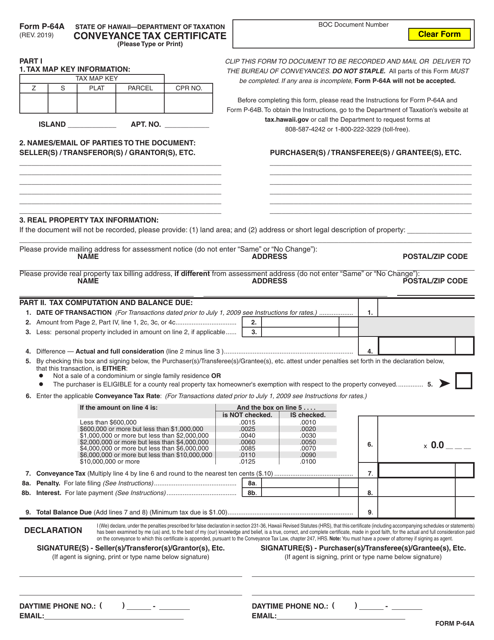

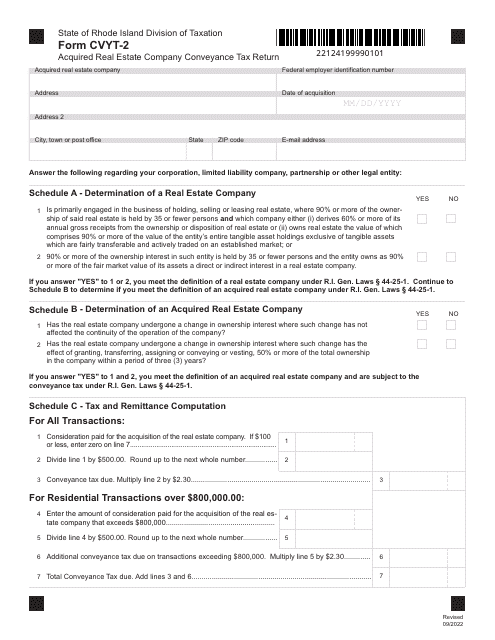

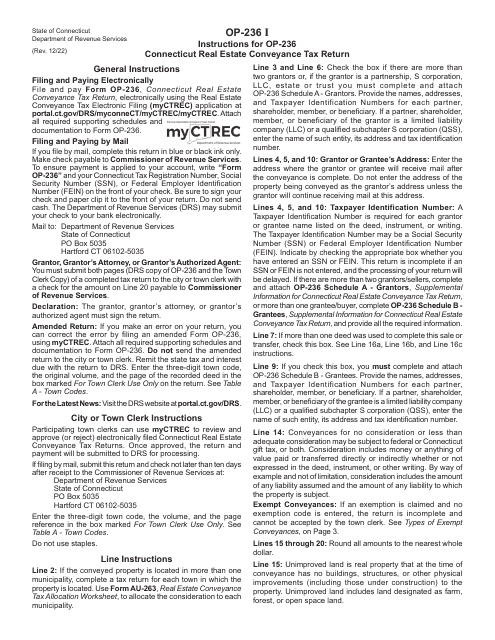

Throughout this webpage, you will find a collection of documents that are commonly used when dealing with conveyance tax. These forms and instructions will help you navigate the often complex process of filing the necessary paperwork and calculating the proper amount of tax. From the Form CVYT-2 Acquired Real Estate Company Conveyance Tax Return in Rhode Island, to the Form P-64B Exemption From Conveyance Tax in Hawaii, we've got you covered.

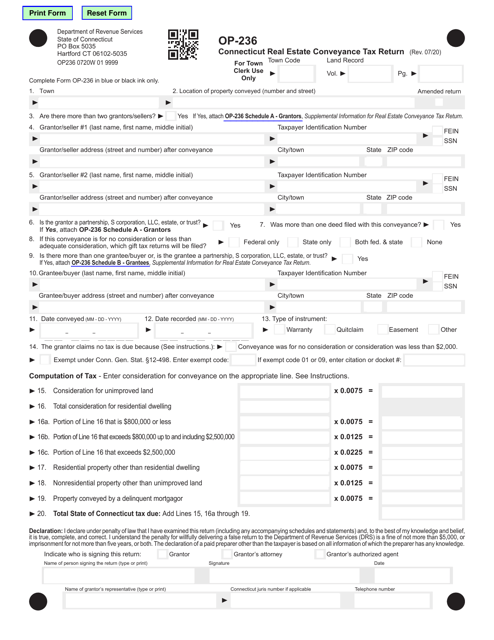

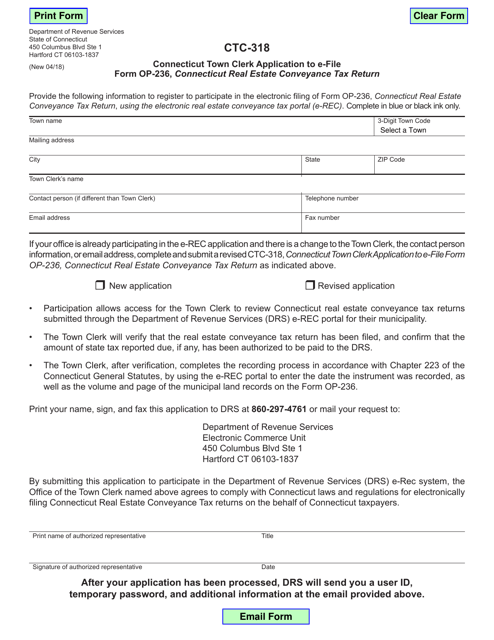

Our goal is to make the conveyance tax process as simple and straightforward as possible. Whether you are a first-time homebuyer or a seasoned real estate professional, you'll find the information and resources you need here. Need to file a Connecticut Real Estate Conveyance Tax Return? We have the Form CTC-318 Connecticut Town Clerk Application to E-File Form Op-236, as well as the Instructions for Form OP-236 Connecticut Real Estate Conveyance Tax Return.

So, if you are looking for answers to your conveyance tax questions, look no further. Explore our collection of documents and alternate names for this tax, and take the first step towards understanding and complying with conveyance tax regulations.

Documents:

11

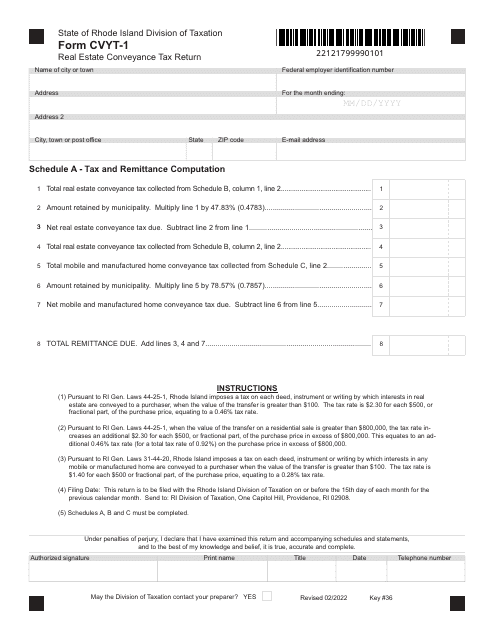

This Form is used for reporting and paying the conveyance tax on real estate transactions in Rhode Island by an acquired real estate company.

This form is used for obtaining a Conveyance Tax Certificate in Hawaii.

This form is used for reporting and paying the real estate conveyance tax in Connecticut.

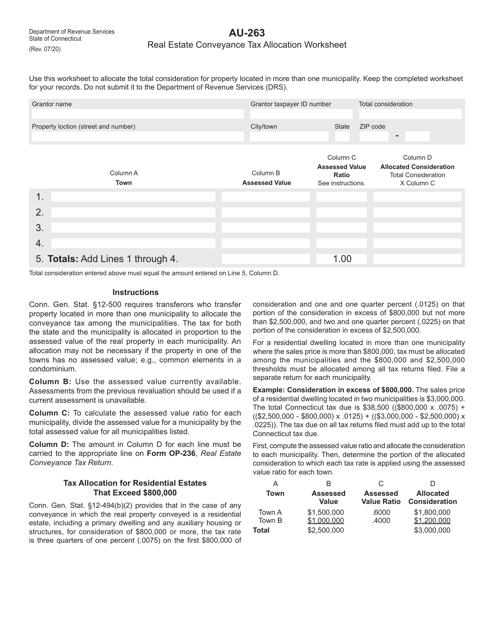

This document is used for calculating the allocation of real estate conveyance tax in Connecticut.

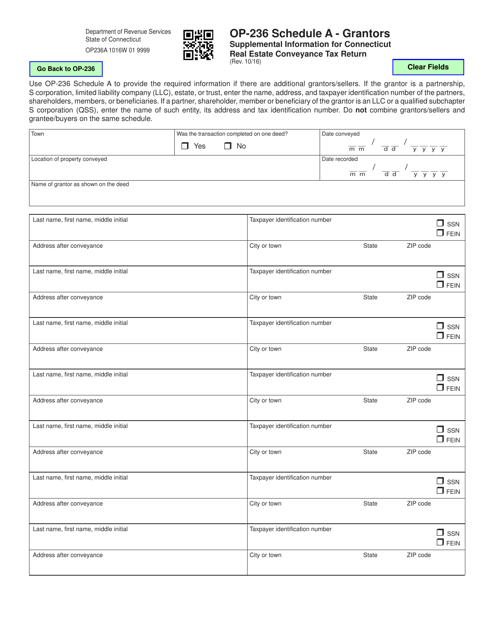

This Form is used for providing supplemental information for a Connecticut Real Estate Conveyance Tax Return for Grantors in Connecticut. It is used to disclose additional details related to the real estate transaction.

This form is used for Connecticut town clerks to apply for e-filing Form Op-236, which is a Connecticut Real Estate Conveyance Tax Return.