Investment Advisor Templates

An Investment Advisor, also known as an Investment Advisory Firm or Investment Management Firm, is a financial institution or individual that provides guidance and recommendations to clients regarding their investment portfolios.

Through a range of specialized services, an Investment Advisor helps clients make informed decisions about their investments, taking into account their financial goals, risk tolerance, and market conditions. These professionals stay up to date with the latest market trends, investment strategies, and regulatory changes to provide clients with the best possible advice.

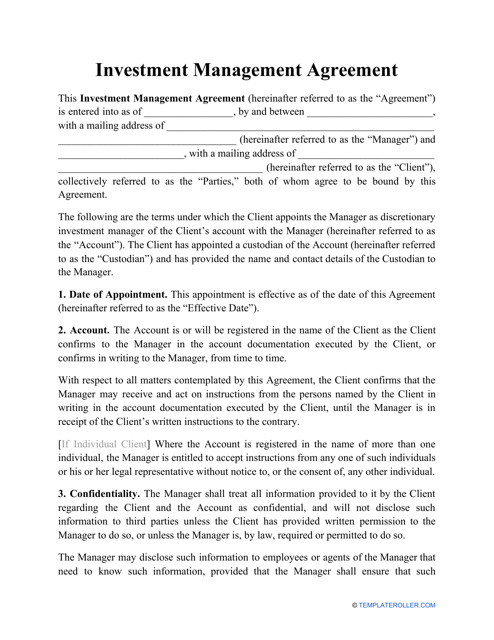

An Investment Management Agreement is a common document utilized by Investment Advisors to formalize their relationship with their clients. This agreement outlines the terms and conditions of the advisory services, including fees, investment objectives, and responsibilities of both parties. It ensures transparency and sets clear expectations for all parties involved.

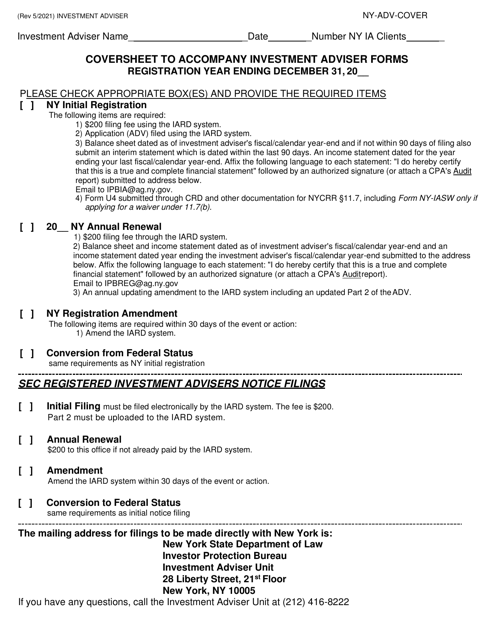

In addition to client-specific documents, investment advisors are required to comply with regulatory requirements. For example, the Coversheet to Accompany Investment Advisor Forms, specific to New York, provides essential information about the investment advisor and the nature of their business. Compliance with these forms and regulations is crucial for the protection of both clients and the advisors themselves.

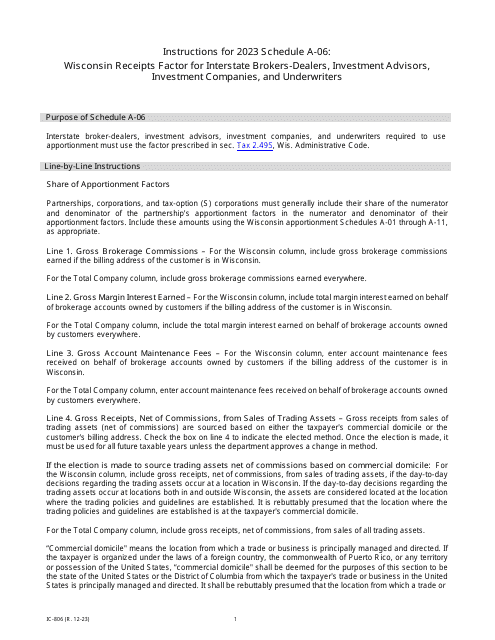

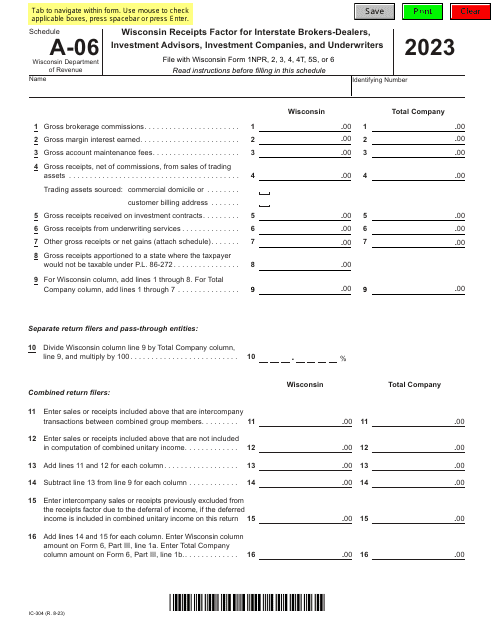

Furthermore, investment advisors may be subject to state-specific regulations and reporting requirements. For instance, instructions for Form IC-304 Schedule A-06 in Wisconsin are intended to assist investment advisors in calculating the Wisconsin Receipts Factor for Interstate Brokers-Dealers, Investment Advisors, Investment Companies, and Underwriters. These documents ensure compliance with local laws and enable investment advisors to accurately report their financial activities.

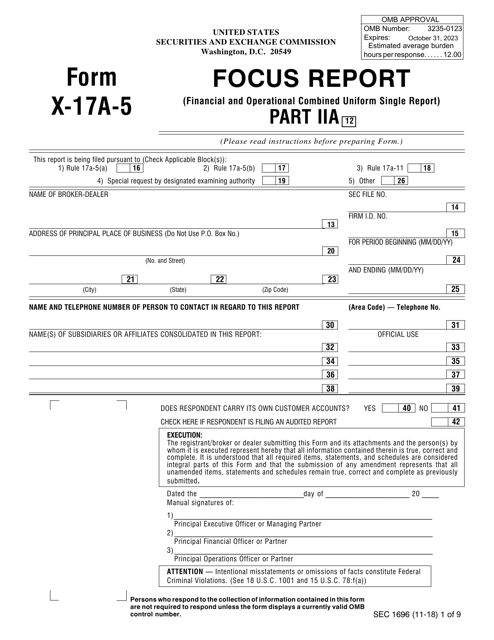

To enhance transparency in the financial industry, the Securities and Exchange Commission (SEC) introduced Form CRS (SEC Form 2942) - Customer Relationship Summary. This document provides essential information about an investment advisor's services, fees, potential conflicts of interest, and disciplinary history. It empowers investors to make informed decisions and understand the nature of their relationship with the investment advisor.

In summary, investment advisors play a vital role in helping individuals and organizations navigate the complex world of investing. Whether through specialized agreements with clients, adherence to regulatory requirements, or transparent reporting, investment advisors provide valuable services to clients seeking to achieve their financial objectives.

Documents:

12

This type of agreement can be used when a person or entity is interested in investing in any amount and would like to protect all of the involved parties from potential legal disputes.

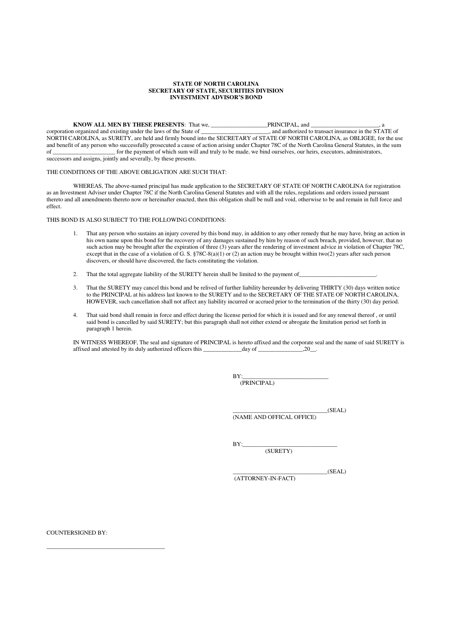

This document is a type of bond required for investment advisors in North Carolina. It serves as a form of financial protection for clients in case the advisor engages in any fraudulent or dishonest activities.

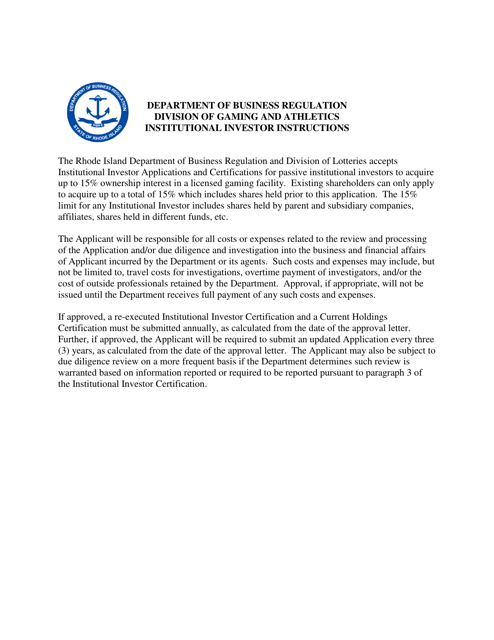

This form is used for applying as an institutional investor in Rhode Island.

This Form is used for providing customers with a summary of their relationship with a financial adviser or broker. It includes information about fees, services, and potential conflicts of interest.