Canadian Income Tax Templates

Are you a Canadian resident looking for information on the Canadian income tax? Look no further! Our website provides a comprehensive guide to help you navigate the complexities of the Canadian income tax system. Whether you need Canadian income tax forms, assistance with filing your tax return, or information on specific tax credits and deductions, we've got you covered.

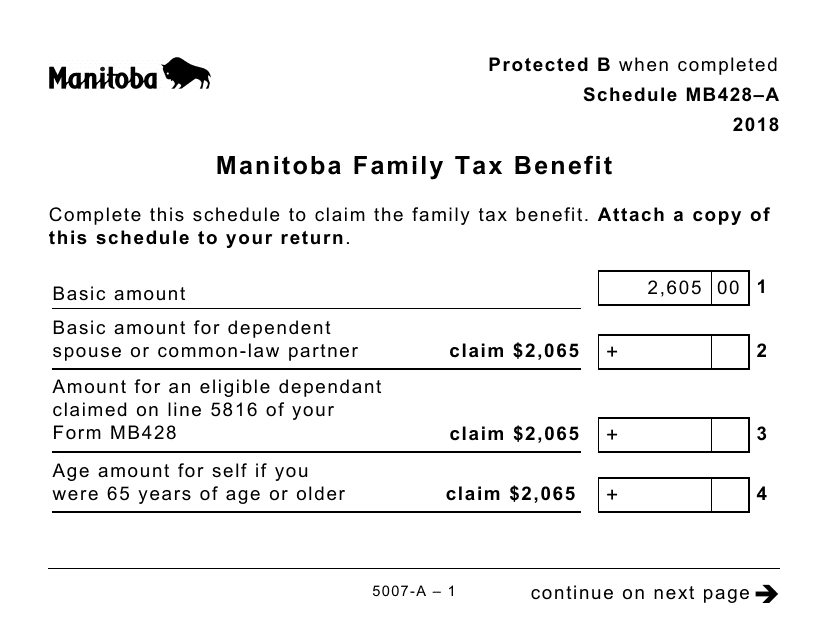

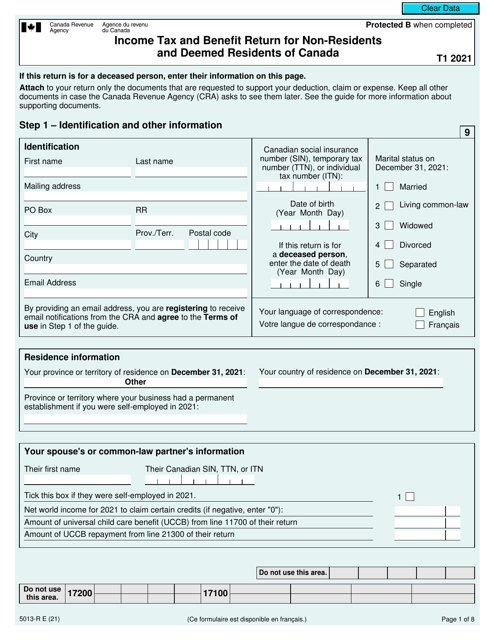

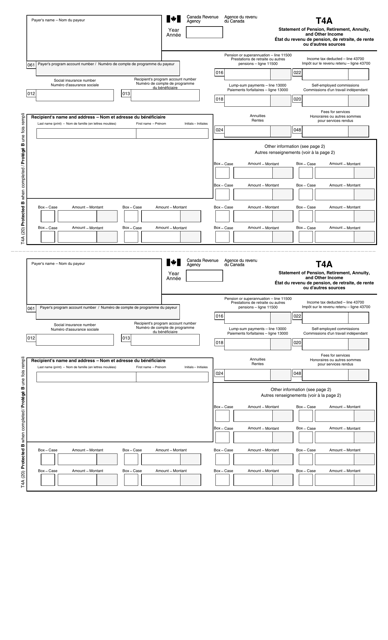

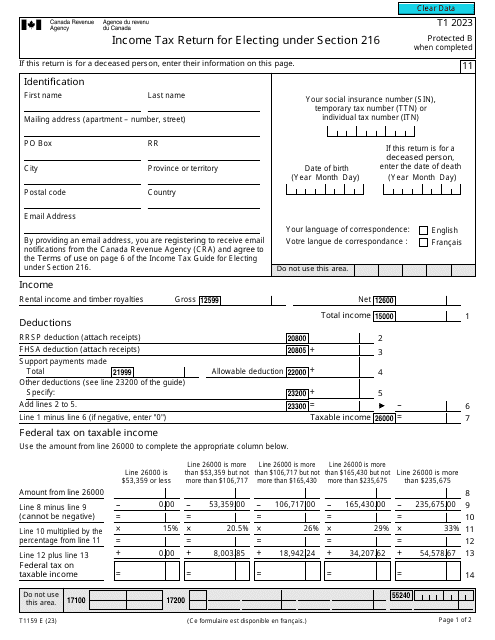

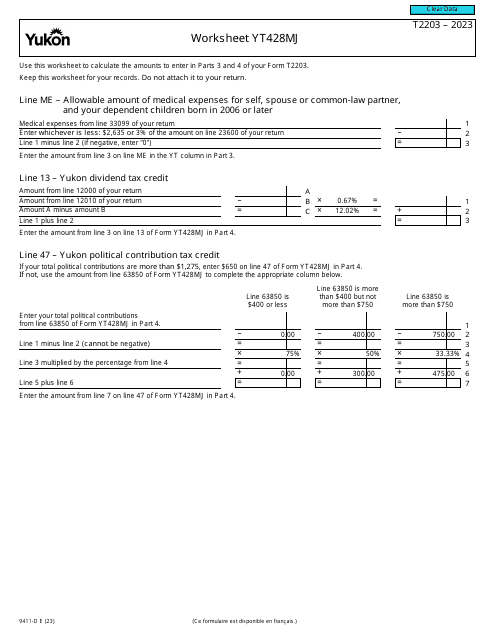

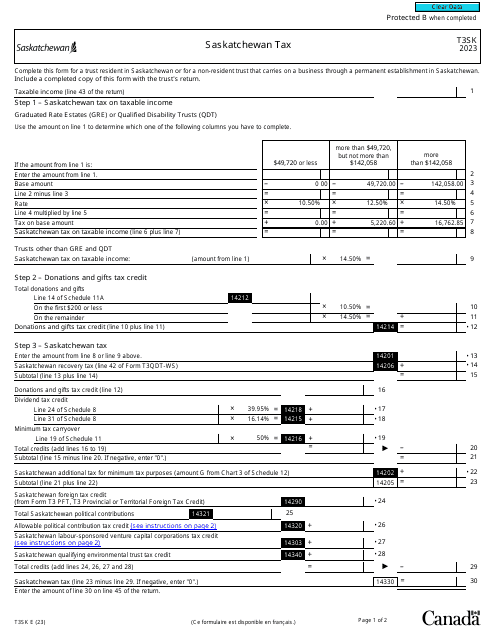

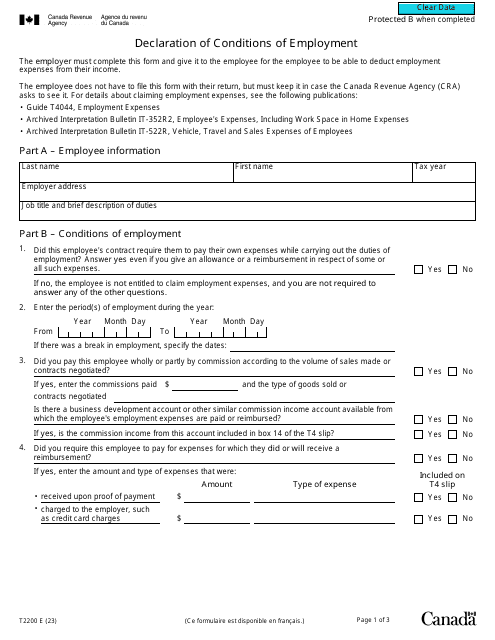

Our collection of Canadian income tax documents includes a wide range of forms, such as Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit (Large Print), Form T4A Statement of Pension, Retirement, Annuity, and Other Income (available in English and French), Form T1159 Income Tax Return for Electing Under Section 216, Form T2203 Worksheet YT428MJ Yukon, and Form T2200 Declaration of Conditions of Employment. These documents cover various aspects of the Canadian income tax system, ensuring that you have the resources you need to fulfill your tax obligations.

As an alternate name for this collection of documents, you may also refer to it as the Canadian income tax forms or Canadian income tax form repository. Regardless of the name you use, our website is your one-stop destination for all your Canadian income tax needs.

Start exploring our extensive library of Canadian income tax documents today and simplify your tax preparation process. Access the information you need to file your taxes accurately and maximize your tax refunds. Don't let the complexities of the Canadian income tax system overwhelm you - let us be your guide.

Documents:

8

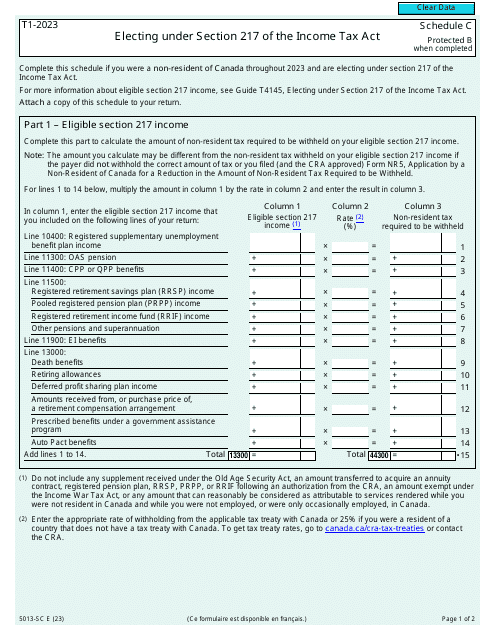

Canadian individuals may use this form when they are filing their taxes to report additional income that does not come from wages earned from completing work.

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.