Assessed Valuation Templates

Assessed Valuation: A Comprehensive Overview

Welcome to our webpage dedicated to providing you with valuable information on assessed valuation, also known as valuation assessment. We understand that navigating the world of property and personal valuations can be complex, which is why we've created this resource to simplify the process for you.

Assessed valuation is an essential component in determining the value of property, both real estate and personal, for taxation purposes. By accurately assessing the value of properties, government entities can ensure fair and equitable property tax assessments, which in turn supports vital public services such as schools, infrastructure, and emergency services.

Our collection of documents covers a broad range of topics related to assessed valuation, from the procedural aspects of valuation assessment to specific forms required by various states. Whether you are a property owner, a tax professional, or a government official, these resources will provide you with the information and tools you need to navigate the assessment process effectively.

Some of the documents you can expect to find in our collection include:

-

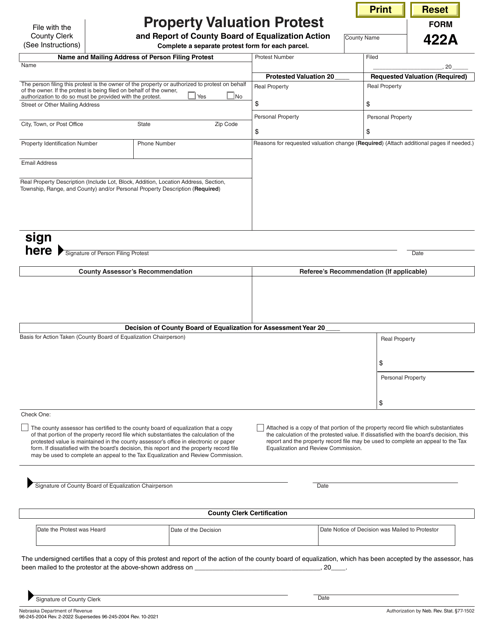

Form 422A Property Valuation Protest and Report of County Board of Equalization Action - Nebraska: This document outlines the procedures for lodging a protest against a property valuation and provides information on the actions taken by the County Board of Equalization.

-

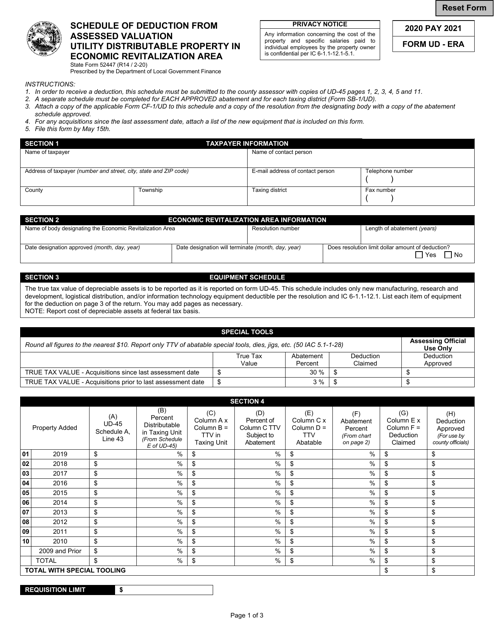

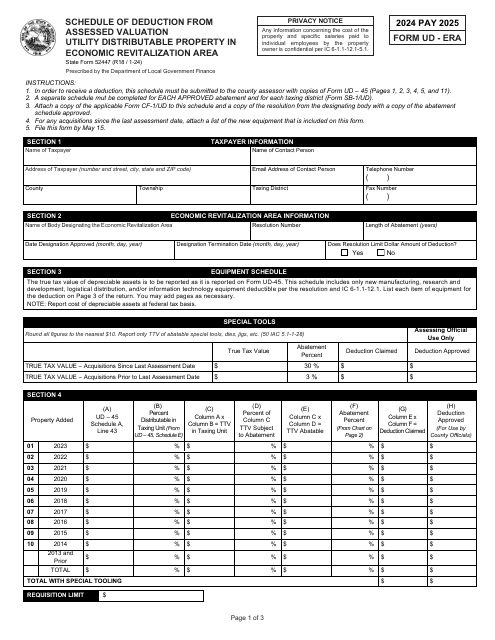

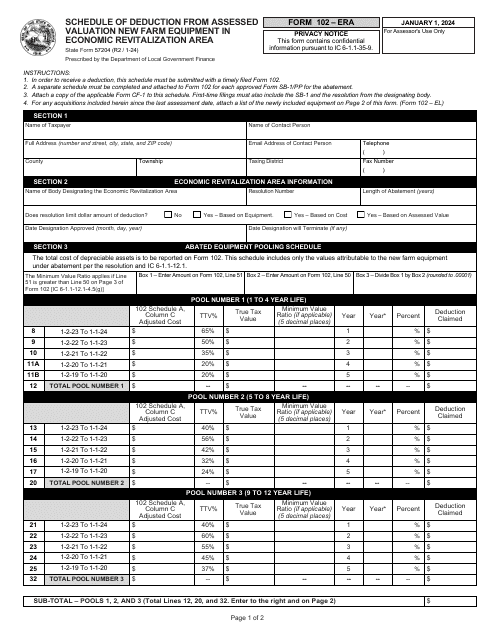

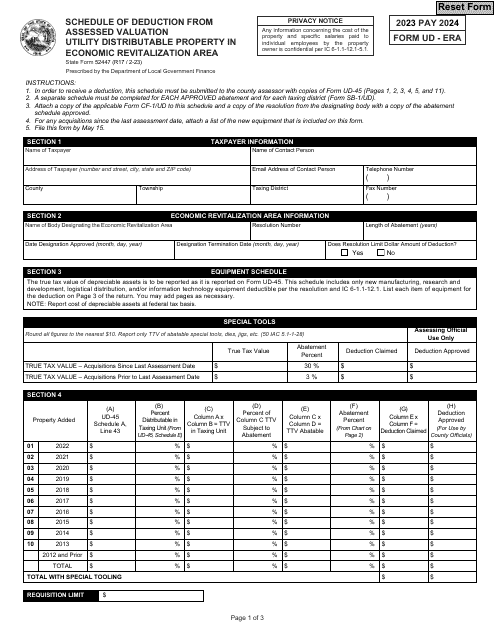

Form UD-ERA (State Form 52447) Schedule of Deduction From Assessed Valuation Utility Distributable Property in Economic Revitalization Area - Indiana: This form details the deductions applied to the assessed valuation of utility distributable properties located within an Economic Revitalization Area in Indiana.

-

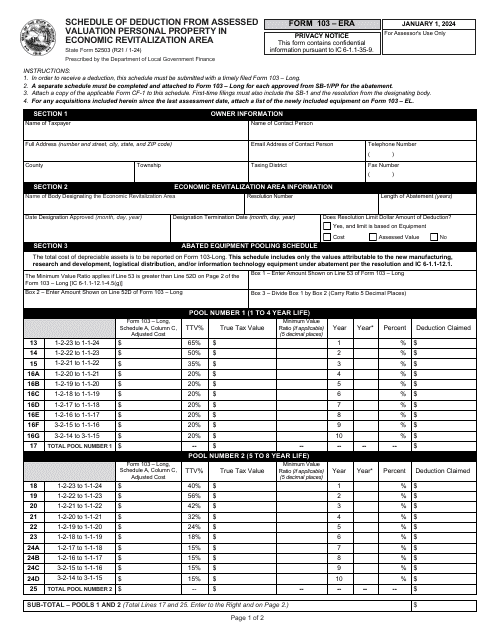

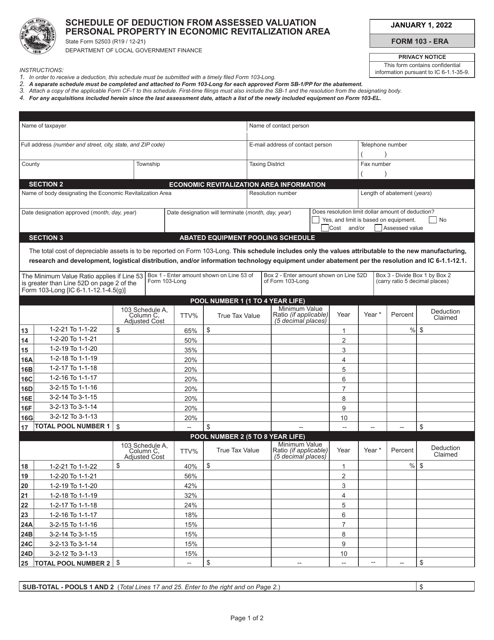

State Form 52503 (103-ERA) Schedule of Deduction From Assessed Valuation Personal Property in Economic Revitalization Area - Indiana: Similar to the previous form, this document focuses on deductions from the assessed valuation of personal property within an Economic Revitalization Area in Indiana.

-

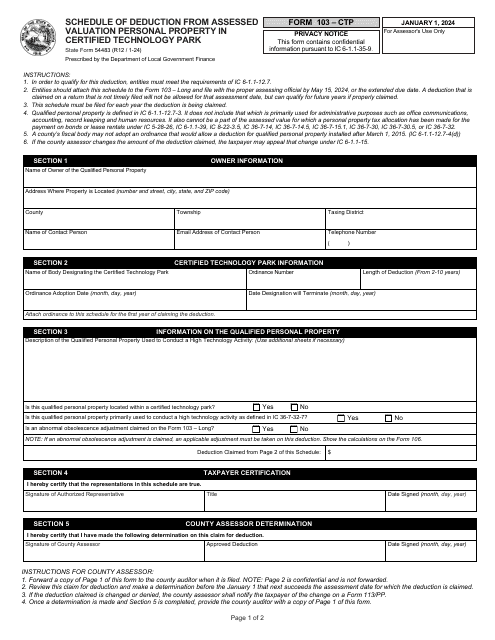

State Form 54483 (103-CTP) Schedule of Deduction From Assessed Valuation Personal Property in Certified Technology Park - Indiana: This form covers the deductions applied to the assessed valuation of personal property located within a Certified Technology Park in Indiana.

We strive to keep our document collection up to date and comprehensive, ensuring that you have access to the latest information regarding assessed valuation. With our easy-to-use search feature, you can quickly find the specific forms or resources you need, saving you valuable time and effort.

At [Organization Name], we are committed to empowering individuals and professionals alike with the knowledge and resources they need to navigate the intricacies of assessed valuation. Explore our collection today and discover a wealth of information that will help demystify the valuation assessment process.

Documents:

26

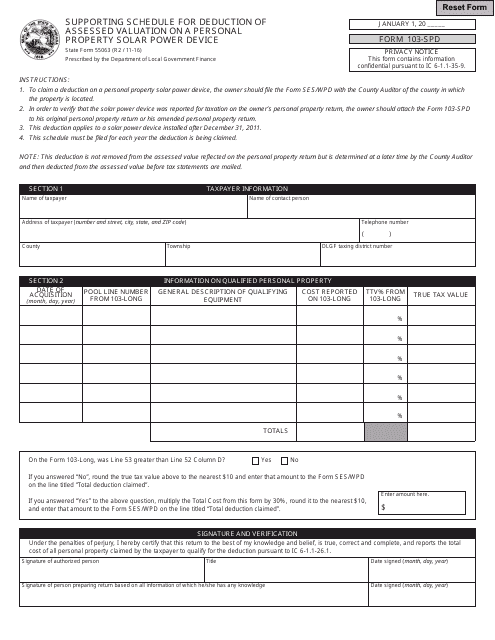

This form is used for supporting the deduction of assessed valuation on a personal property solar power device in Indiana.

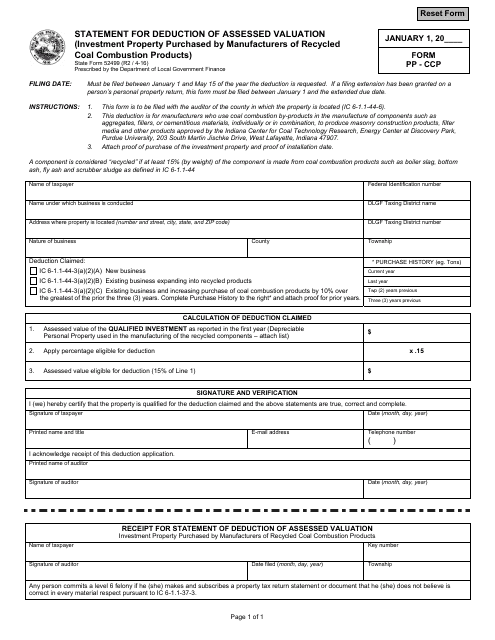

This document is used for reporting the deduction of assessed valuation for investment property purchased by manufacturers of recycled coal combustion products in the state of Indiana.

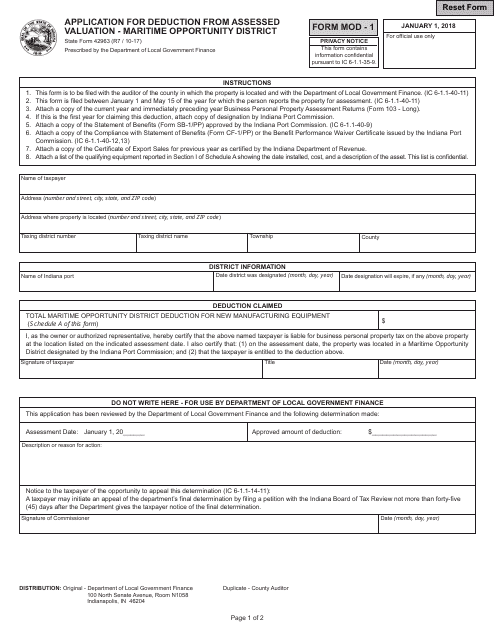

This Form is used for applying for a deduction from the assessed valuation in the Maritime Opportunity District of Indiana.

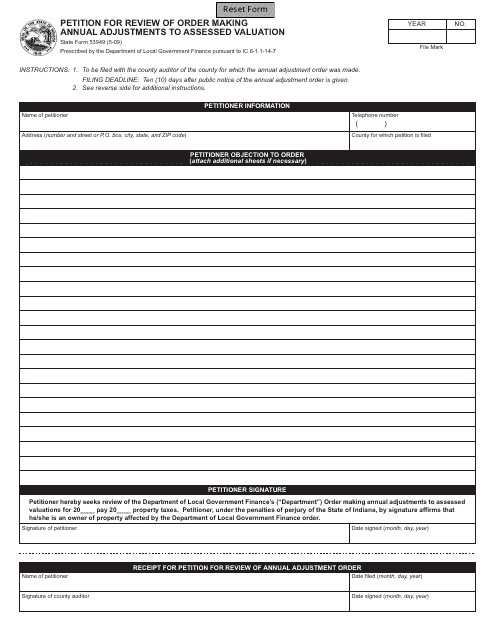

This form is used for filing a petition to review an order that makes annual adjustments to the assessed valuation of property in the state of Indiana.

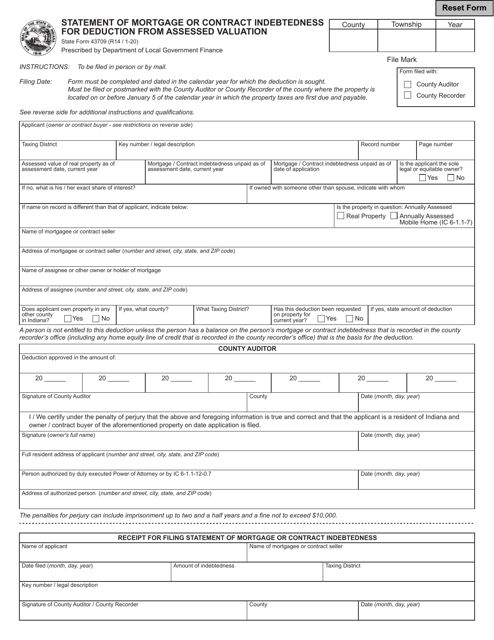

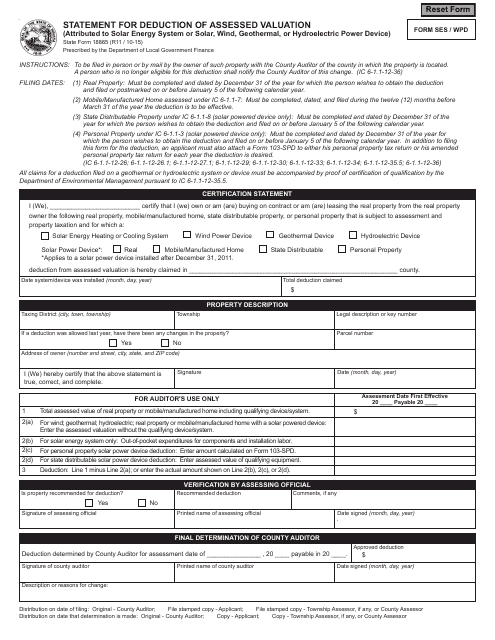

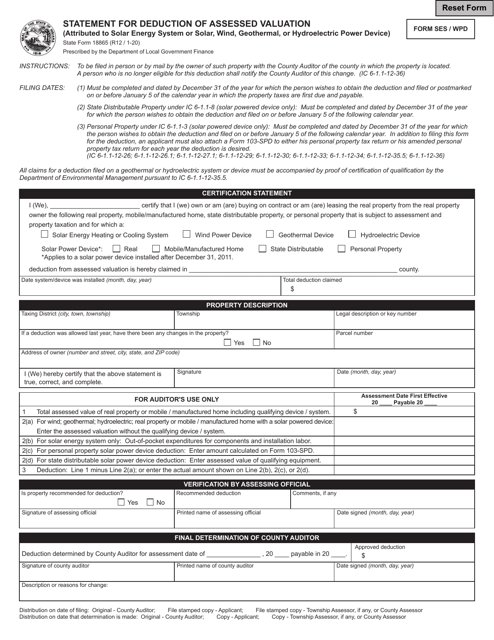

This form is used for submitting a statement to request a deduction in the assessed valuation of property due to the installation of a solar energy system or wind, geothermal, or hydroelectric power device in Indiana.

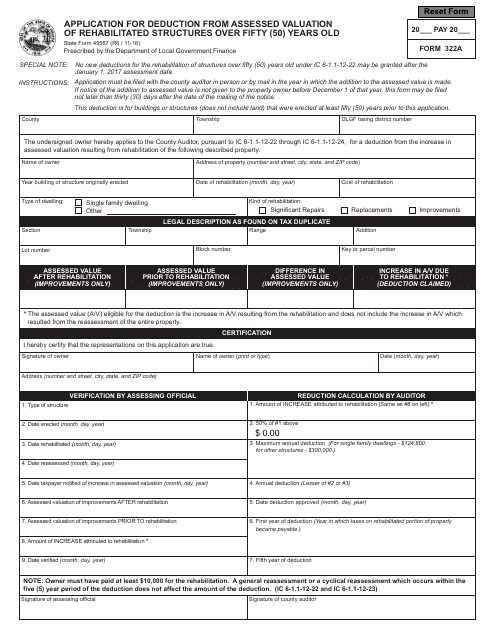

This Form is used for applying for a deduction from the assessed valuation of rehabilitated structures over 50 years old in the state of Indiana.

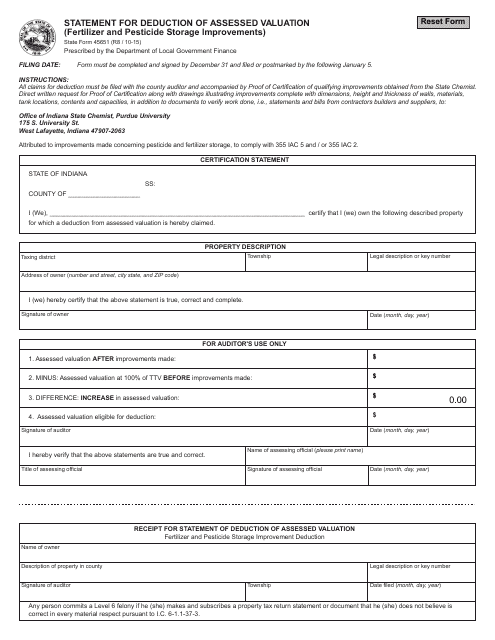

This form is used for claiming a deduction for the assessed valuation of fertilizer and pesticide storage improvements in the state of Indiana.

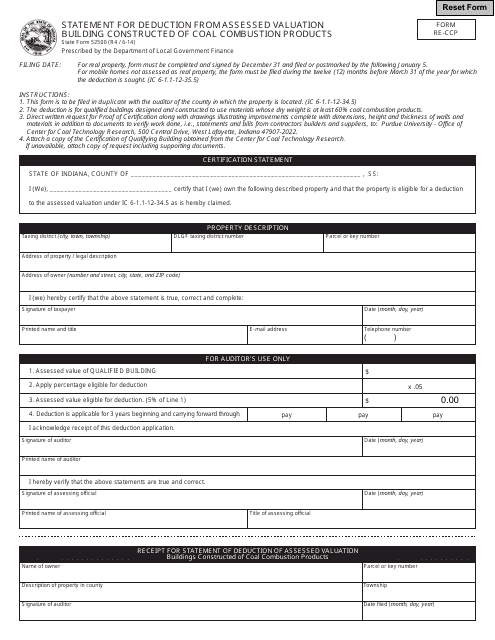

This form is used for reporting the deduction of assessed valuation for buildings constructed of coal combustion products in Indiana.

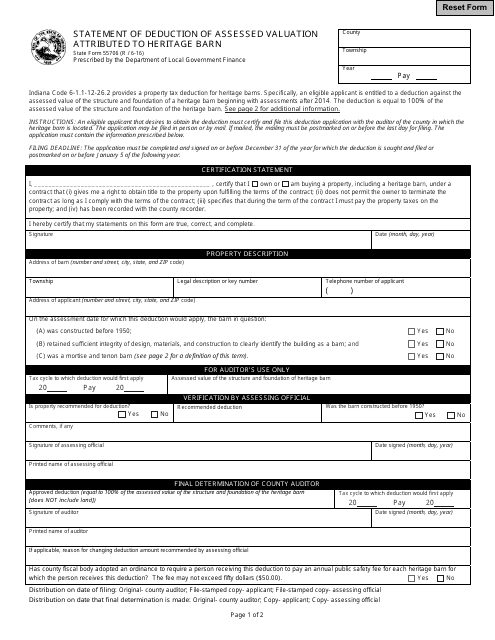

This document is used for recording the deduction of assessed valuation from a heritage barn in Indiana.

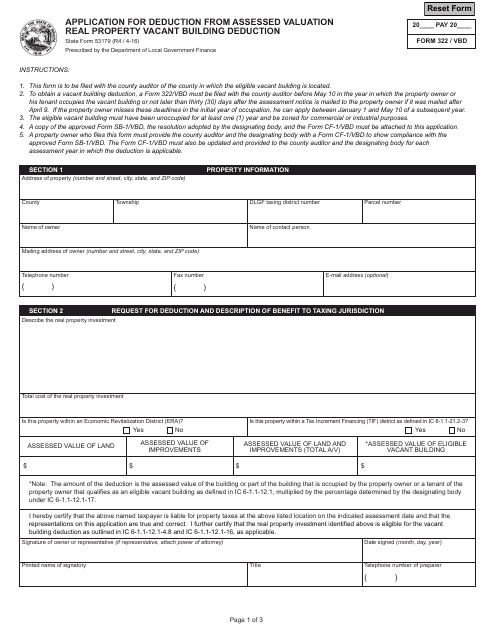

This Form is used for applying for the deduction from assessed valuation for vacant buildings in Indiana.

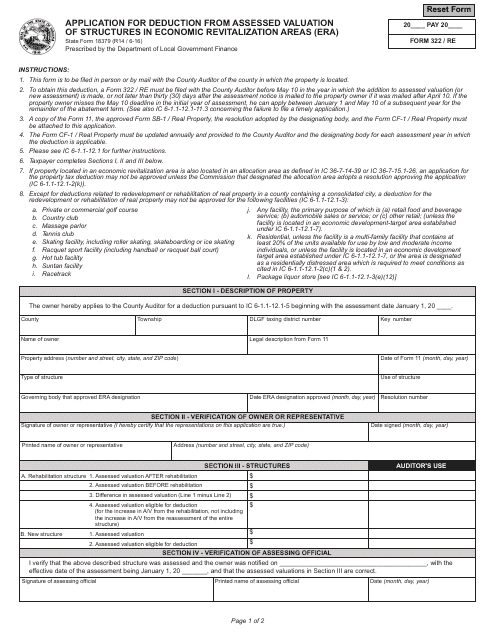

This form is used for applying for a deduction from the assessed valuation of structures in Economic Revitalization Areas (ERA) in Indiana.

This form is used for deducting the assessed valuation of a solar energy system or other renewable power devices in the state of Indiana.

This form is used for calculating the deduction from assessed valuation for utility distributable property in an economic revitalization area in Indiana.

This form is used for reporting the schedule of deductions from assessed valuation for personal property in an Economic Revitalization Area in Indiana.

This form is used for reporting and documenting deductions from assessed valuation for utility distributable property in an Economic Revitalization Area in Indiana.