Ingreso Del Trabajo Templates

Are you looking for information about ingreso del trabajo, also known as ingresos del trabajo? This collection of documents provides important information and forms related to work income. These documents are necessary for various purposes, such as reporting self-employment income, claiming the Earned Income Tax Credit based on a qualified child, or applying for the California Earned Income Tax Credit.

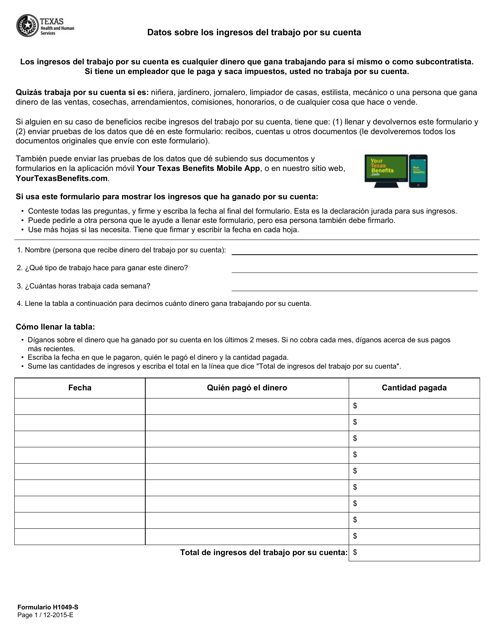

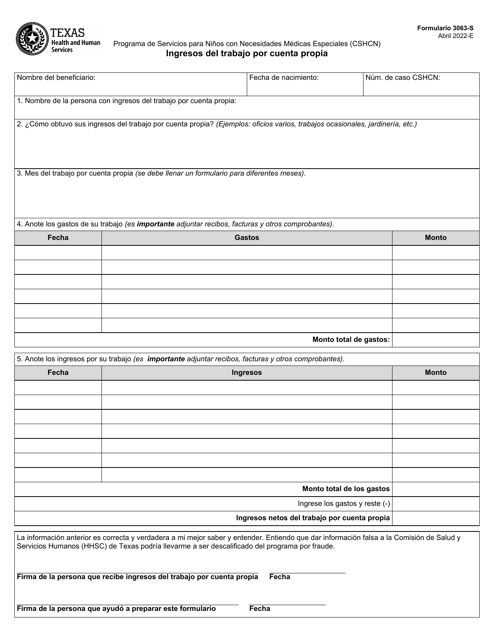

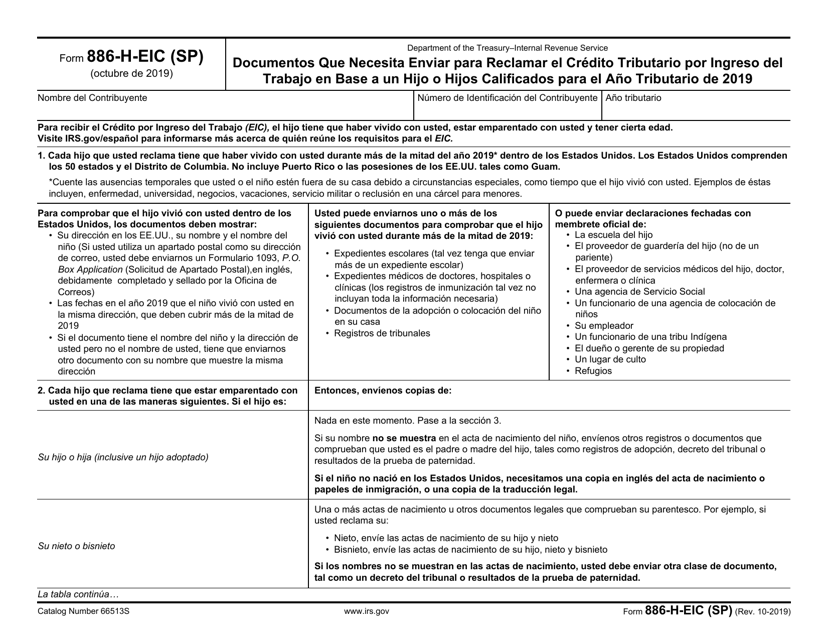

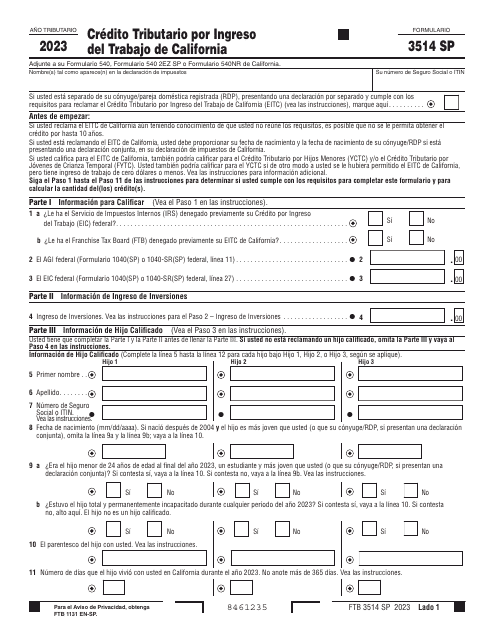

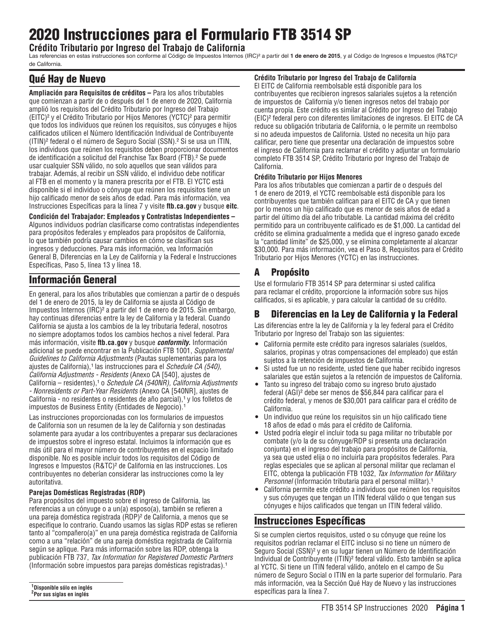

Included in this collection of documents are Formulario H1049-S Datos Sobre Los Ingresos Del Trabajo Por Su Cuenta - Texas (Spanish), Formulario 3063-S Ingresos Del Trabajo Por Cuenta Propia - Texas (Spanish), IRS Formulario 886-H-EIC (SP) Documentos Que Necesita Enviar Para Reclamar El Credito Tributario Por Ingreso Del Trabajo En Base a Un Hijo O Hijos Calificados (Spanish), Formulario FTB3514 SP Credito Tributario Por Ingreso Del Trabajo De California - California (Spanish), and Instrucciones para Formulario FTB3514 SP Credito Tributario Por Ingreso Del Trabajo De California - California (Spanish).

These documents provide clear instructions, necessary forms, and important information on how to accurately report and claim work income for various purposes. Understanding and complying with the requirements outlined in these documents is crucial for individuals and businesses to ensure compliance with tax regulations and claim any applicable tax credits.

For more information and to access these important documents, browse through our collection of ingreso del trabajo documents. Ensure you accurately report and claim your work income to fulfill your tax obligations and potentially benefit from available tax credits.

Documents:

7

This document is used for reporting self-employment income in Texas. It is in Spanish.

This document is for Spanish-speaking individuals who need to submit documents to claim the Earned Income Tax Credit based on a qualified child or children.