Home Buyers Plan Templates

Are you a first-time home buyer looking for financial assistance? The Home Buyers Plan, also known as the HBP, might just be the solution you need. This government initiative allows you to withdraw funds from your Registered Retirement Savings Plan (RRSP) to purchase your first home.

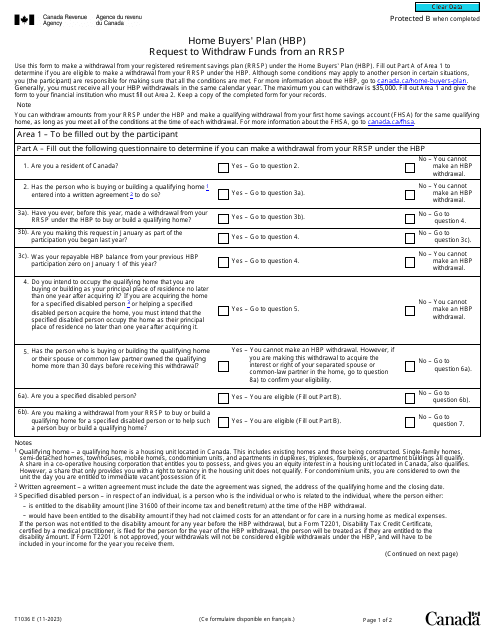

With the Home Buyers Plan, you can access up to $35,000 from your RRSP without paying income tax on the withdrawal. This money can be used towards the down payment or other expenses related to buying a home. It provides a valuable opportunity for individuals or couples to enter the housing market and fulfill their homeownership dreams.

To participate in the Home Buyers Plan, you need to meet certain criteria. You must be a Canadian resident and a first-time home buyer, meaning you haven't owned a home within the past four years. Additionally, the RRSP funds must have been in your account for at least 90 days before the withdrawal.

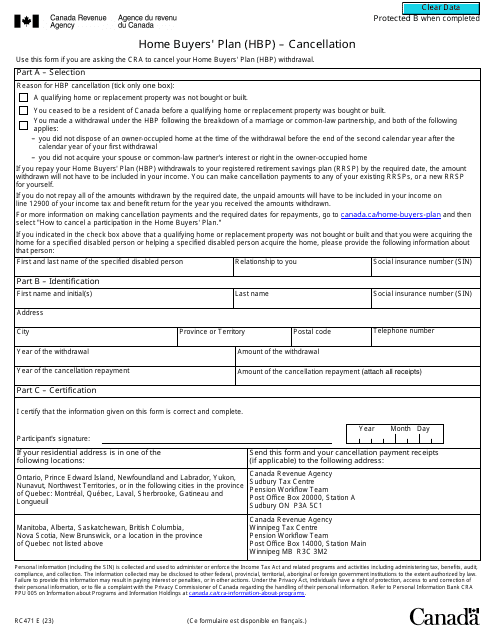

To get started, you'll need to fill out the necessary forms such as Form T1036 or Form RC471. These forms are designed to facilitate your request to withdraw funds from your RRSP for the Home Buyers Plan. They provide the government with the information needed to process your application and ensure that you are eligible for the program.

Remember that participating in the Home Buyers Plan is a serious financial decision. It's crucial to consult with a financial advisor or mortgage professional to fully understand the implications and plan accordingly. They can guide you through the process and help you make informed decisions about your RRSP and home purchase.

In summary, the Home Buyers Plan (HBP) is an excellent option for first-time home buyers. It allows you to tap into your RRSP savings without incurring tax penalties, helping you make that important leap towards homeownership. If you're ready to take the next step, explore the forms and resources available to you and get one step closer to turning your homeownership dreams into reality.

Documents:

8

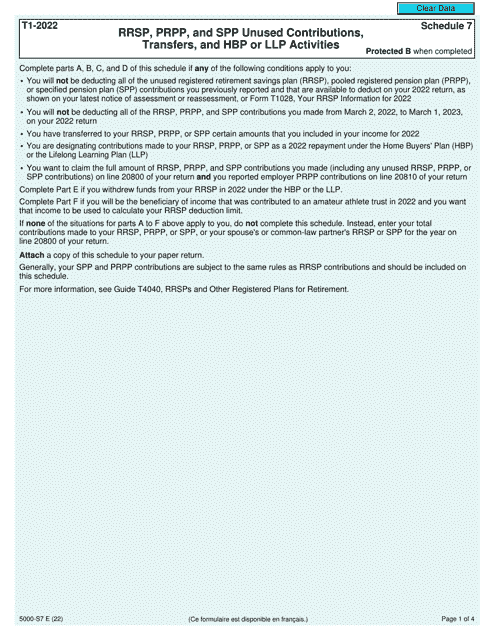

This form is used for reporting unused contributions, transfers, and activities related to RRSP, PRPP, and SPP in Canada.