Involuntary Conversions Templates

Involuntary Conversions: Simplifying Complex Tax Procedures

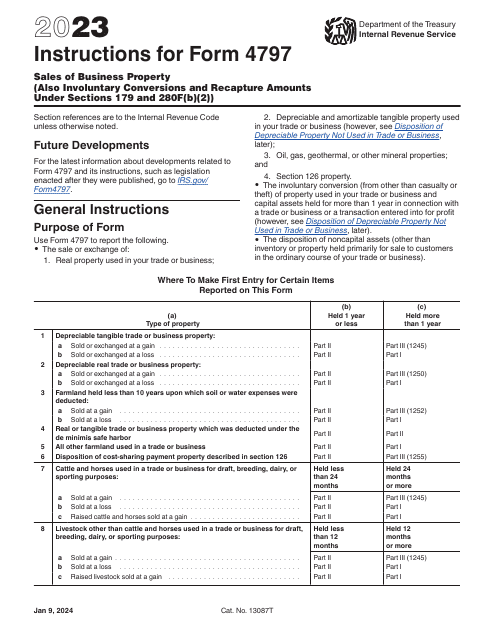

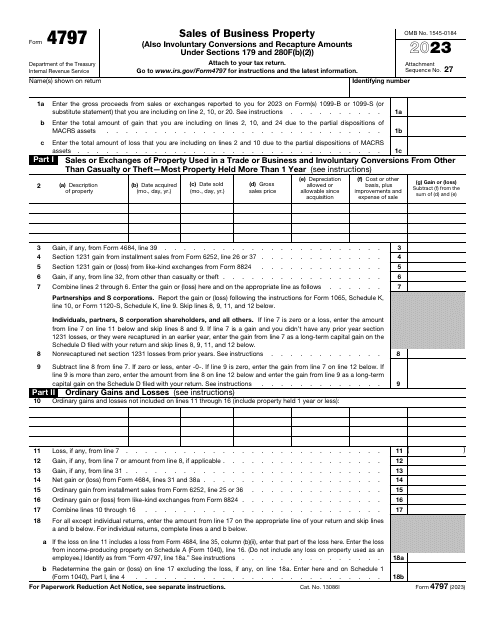

Navigating the realm of involuntary conversions can often be a daunting task. With various rules and regulations dictating the process, it's crucial to have access to the right resources to ensure compliance and avoid potential penalties. This collection of documents, also known as involuntary conversions, provides invaluable guidance and information to individuals and businesses alike.

Whether you're involved in a like-kind exchange or facing an involuntary conversion due to unforeseen circumstances, these documents offer step-by-step instructions, forms, and other resources to help you understand and successfully navigate this complex tax procedure.

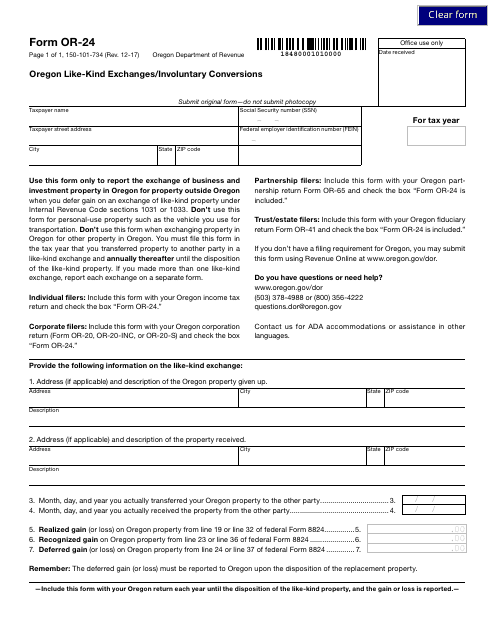

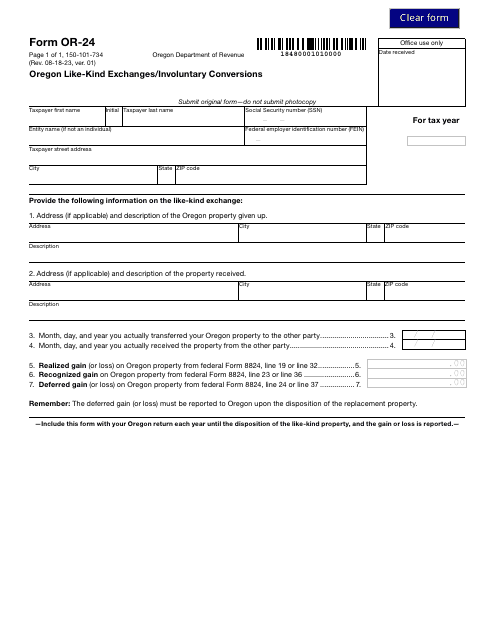

The alternate names for this document group, such as Form 150-101-734 (OR-24) Oregon Like-Kind Exchanges/Involuntary Conversions - Oregon or Instructions for Form OR-24, 150-101-734 Oregon Like-Kind Exchanges/Involuntary Conversions - Oregon, demonstrate the specificity and relevance of the documents within this collection.

With the help of these resources, you can ensure that you are well-equipped to handle any involuntary conversion situation, stay compliant with tax regulations, and make informed decisions based on your unique circumstances. Simplify the process with these comprehensive documents on involuntary conversions.

Documents:

10

This Form is used for reporting like-kind exchanges and involuntary conversions in the state of Oregon.