Franchise and Excise Tax Templates

Franchise and excise taxes are a vital part of the financial landscape for businesses operating in certain regions. These taxes are levied by state governments and can affect a variety of industries. If your business falls under this tax jurisdiction, it is important to understand your obligations and fulfill them accordingly.

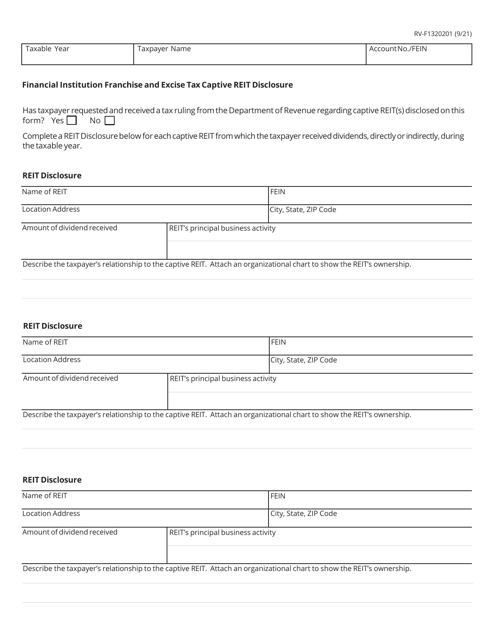

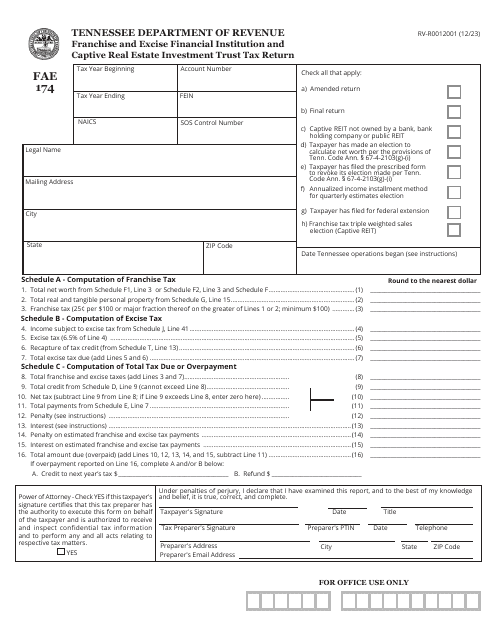

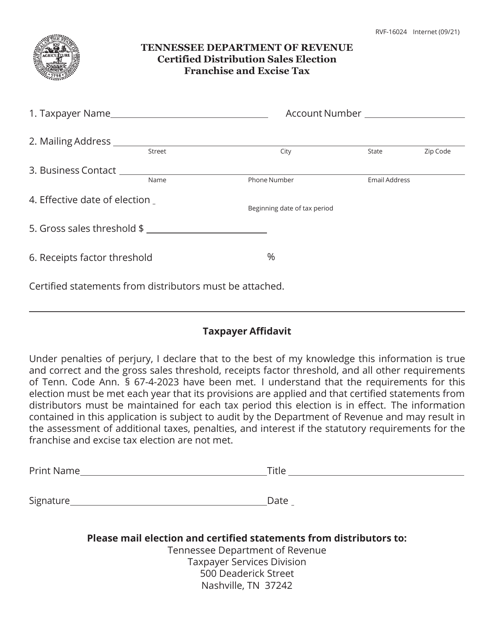

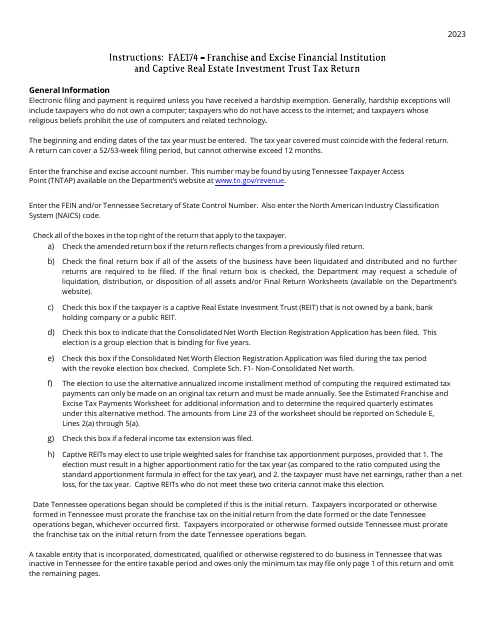

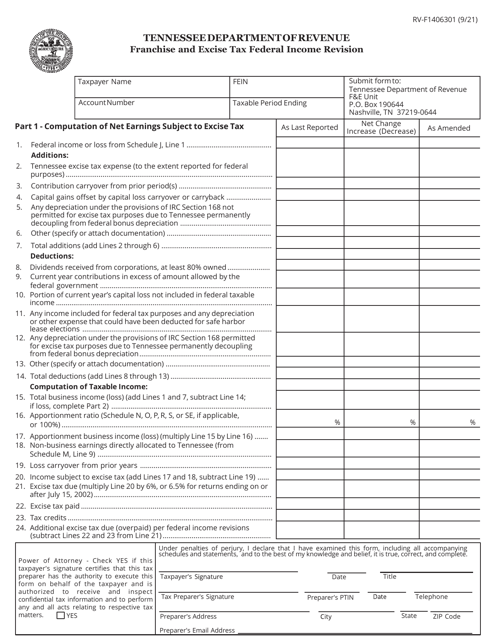

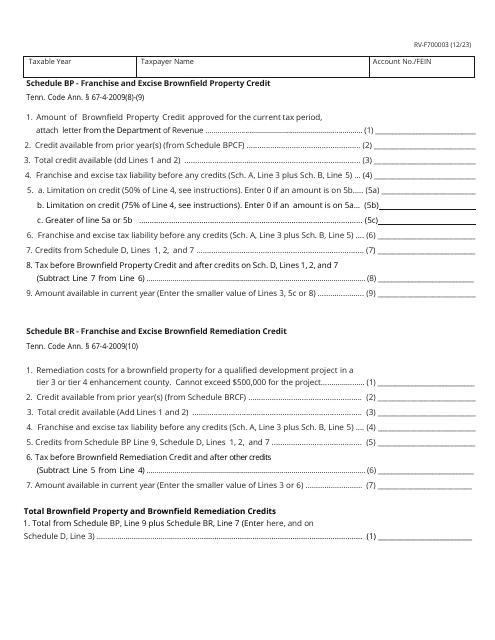

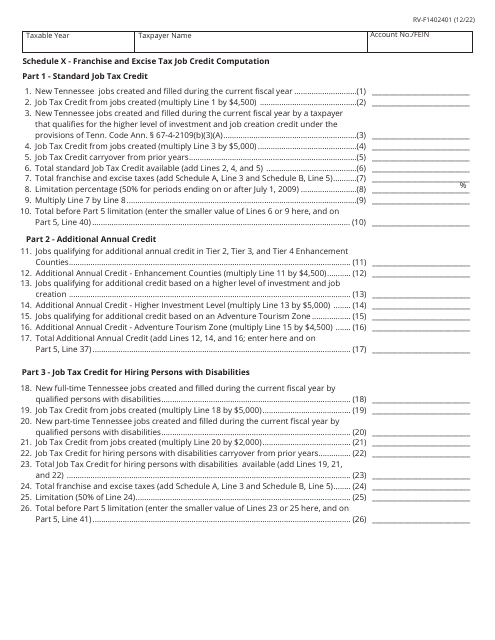

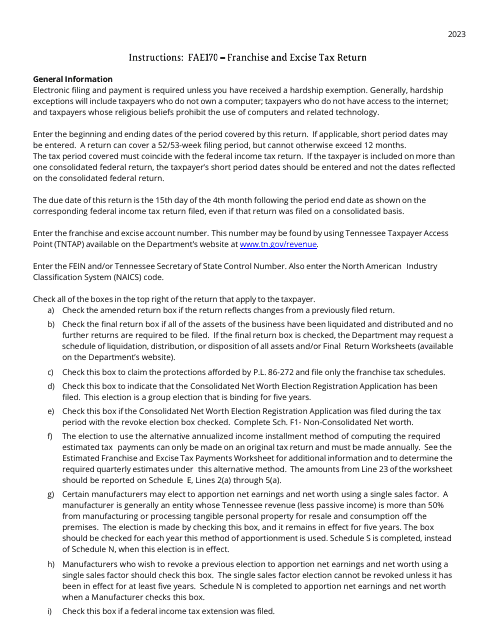

The franchise and excise tax documents collection includes a range of forms and instructions that businesses must use when reporting their tax liabilities. These documents enable businesses to accurately calculate and report their franchise and excise tax obligations in compliance with state regulations.

One form in this collection is the Form FAE174 (RV-R0012001) Franchise and Excise Financial Institution and Captive Real Estate Investment Trust Tax Return - Tennessee. This form is specifically designed for financial institutions and captive real estate investment trusts operating in Tennessee. It allows these entities to report their franchise and excise tax liabilities accurately.

Another form, the Form RVF-16024 Certified Distribution Sales Election Franchise and Excise Tax - Tennessee, is used by businesses to elect to pay franchise and excise tax on certified distribution sales in Tennessee. By completing this form, businesses ensure they meet their tax obligations in relation to these specific sales.

The collection also includes important instructions that guide businesses through the process of completing and submitting their tax forms. For example, the Instructions for Form FAE174, RV-R0012001 Franchise and Excise Financial Institution and Captive Real Estate InvestmentTrust Tax Return - Tennessee provide step-by-step guidance on how to accurately complete the Form FAE174.

Additionally, the Form RV-F1402401 Schedule X Franchise and Excise Tax Job Credit Computation - Tennessee is a key part of the collection. This form allows businesses to calculate the job credit they may be eligible for under the franchise and excise tax regulations in Tennessee.

In summary, the franchise and excise tax documents collection provides businesses with the necessary tools to accurately report and fulfill their franchise and excise tax obligations. By utilizing these forms and instructions, businesses can ensure compliance with state regulations and avoid unnecessary penalties or audits.

Documents:

10