Low Income Taxpayer Clinic Templates

A Low Income Taxpayer Clinic (LITC), also known as a Low Income Taxpayer Assistance Program, is a valuable resource for individuals who may not have the means to hire expensive tax professionals. These clinics provide free or low-cost assistance to low-income taxpayers, helping them navigate the complexities of the tax system and resolve any issues they may be facing.

At a Low Income Taxpayer Clinic, individuals can benefit from expert guidance and support in a variety of ways. These clinics offer assistance with tax return preparation, ensuring that taxpayers are taking advantage of all applicable deductions and credits. They also provide representation in tax disputes with the IRS, helping to negotiate affordable payment plans and reduce tax liabilities. Furthermore, Low Income Taxpayer Clinics offer educational programs and workshops, empowering taxpayers with the knowledge and skills to manage their taxes more effectively.

The aim of the Low Income Taxpayer Clinic network is to ensure that all individuals, regardless of their income level, have access to the resources they need to navigate the tax system successfully. By providing free or affordable assistance, these clinics play a vital role in promoting fairness and equity in our tax system. Whether you are struggling to understand your tax obligations, facing a tax dispute, or simply looking for guidance on how to manage your taxes better, a Low Income Taxpayer Clinic can provide the help you need.

Benefitting from the expertise of trained professionals and the support of a knowledgeable community, individuals can find relief and resolution at low income taxpayer clinics. If you are a low-income taxpayer or know someone who could benefit from these services, reach out to your local Low Income Taxpayer Clinic or Low Income Taxpayer Assistance Program for assistance.

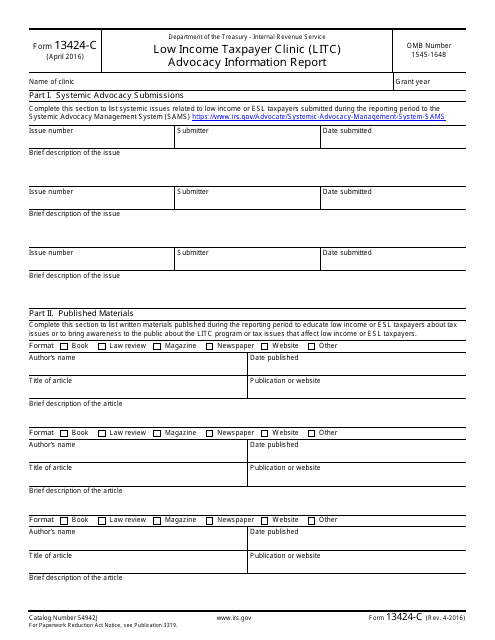

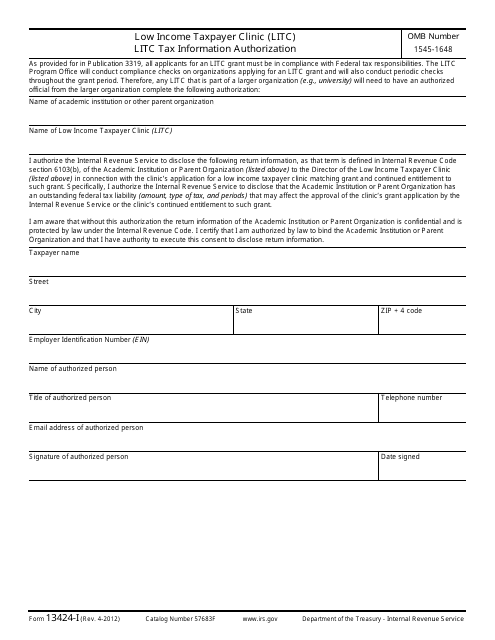

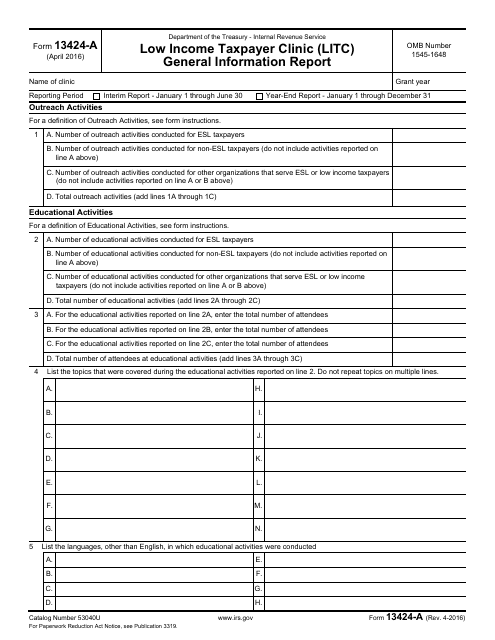

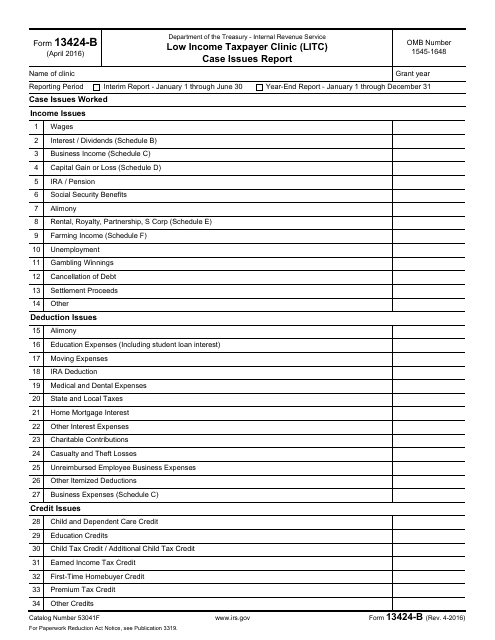

Documents:

7

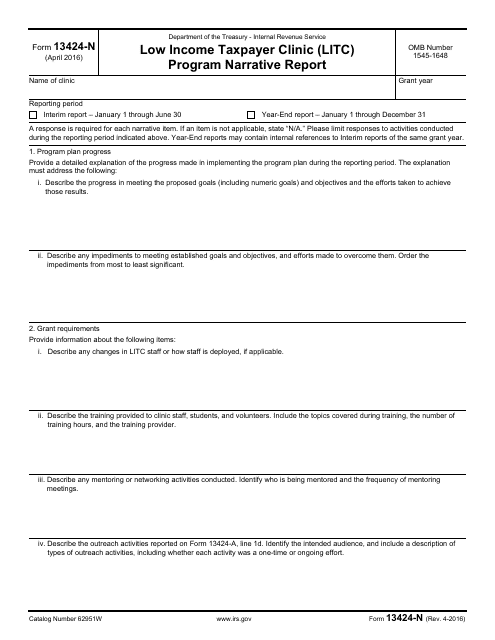

This document is for a Low Income Taxpayer Clinic (LITC) to authorize the tax information for LITC tax purposes.

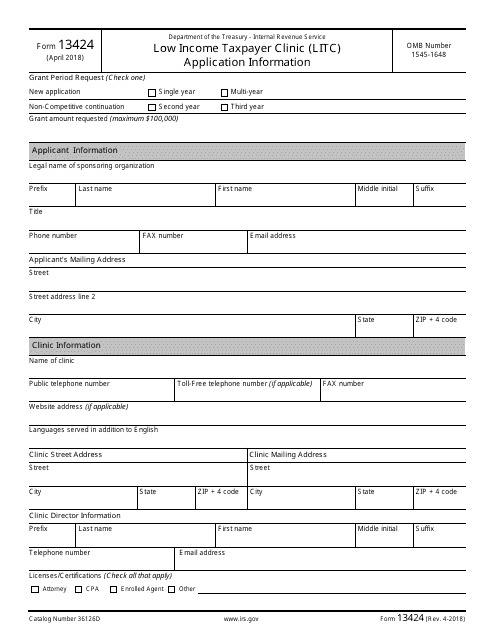

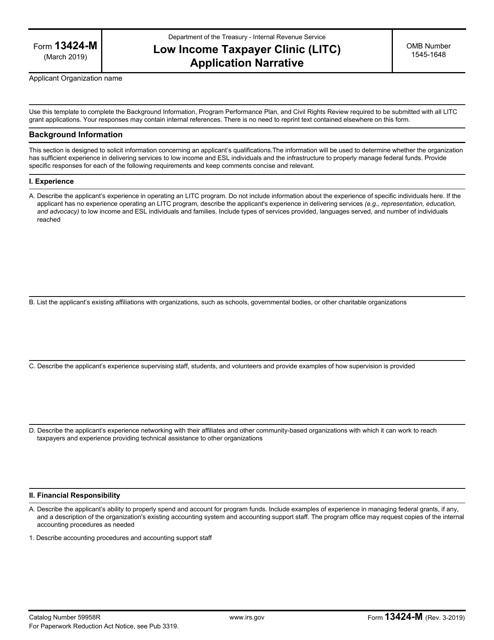

This form is used to apply for the Low Income Taxpayer Clinic (LITC) program offered by the IRS. The application requires a written narrative that provides information about the clinic's qualifications and experience in providing tax assistance to low-income taxpayers.