Tax Rate Calculation Templates

Are you looking for accurate and efficient tax rate calculation? Look no further! Our tax rate calculation documents collection is designed to assist you in accurately calculating tax rates for various scenarios.

Our collection includes a wide variety of worksheets and forms, each specifically tailored to meet the requirements of different taxing authorities. Whether you need to calculate tax rates for additional levies, replacement levies, or even levies with increases or decreases, our collection has got you covered.

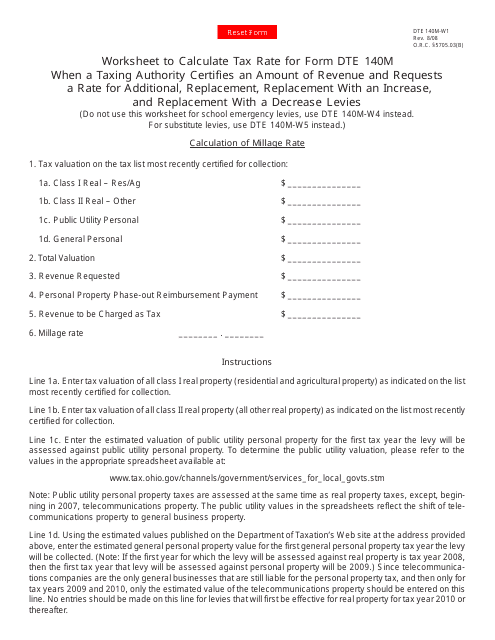

For example, our Form DTE140M-W1 Worksheet is specially designed for tax rate calculation in Ohio when a taxing authority certifies a specific amount of revenue and requests a rate for additional, replacement, replacement with an increase, or replacement with a decrease levies. This worksheet ensures accurate calculations, allowing you to determine the appropriate tax rate for your needs.

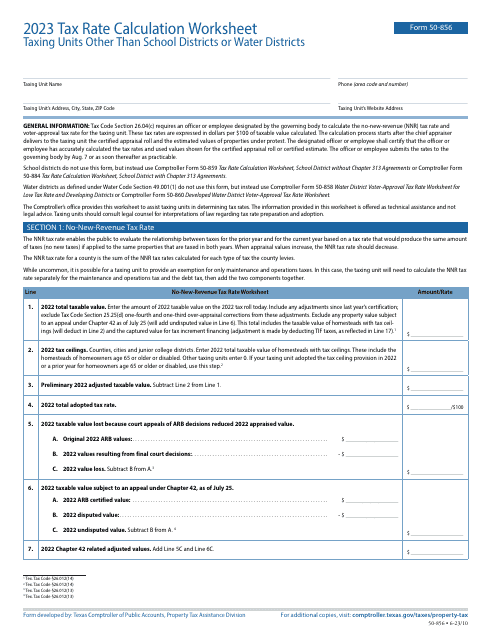

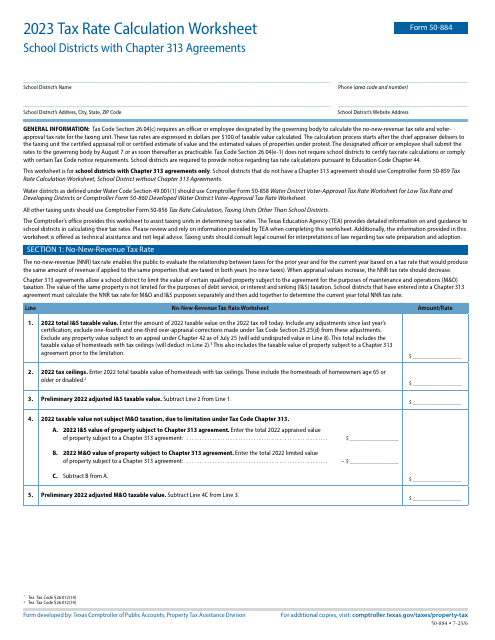

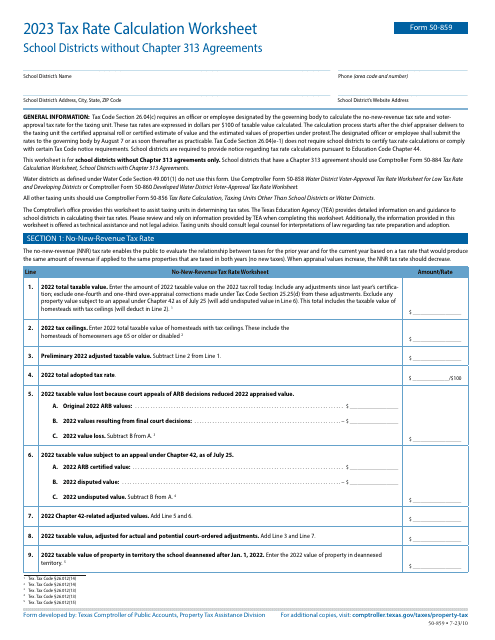

In addition, if you are operating outside of Ohio, we also have specialized worksheets for other states, such as Texas. Our Form 50-856 Tax Rate Calculation Worksheet is specifically designed for taxing units other thanschool districts or water districts in Texas. Similarly, we have Form 50-884 for school districts with Chapter 313 agreements and Form 50-859 for school districts without Chapter 313 agreements in Texas.

Our tax rate calculation documents collection provides a comprehensive solution for accurate and efficient tax rate calculations. Say goodbye to manual calculations and ensure compliance with the specific requirements of your taxing authority. Trust our collection to simplify the process and save you valuable time and resources.

Documents:

10

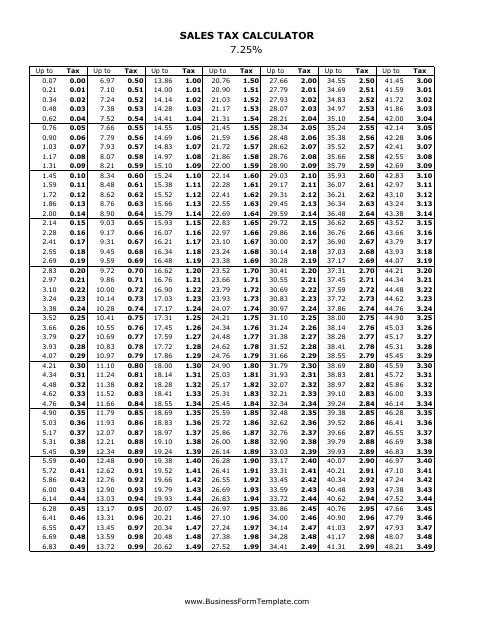

This document provides a calculator to determine the sales tax amount at a rate of 7.25%.

This form is used for calculating tax rates in Ohio when a taxing authority requests additional, replacement, or increased levies. It is used to determine the tax rate based on certified revenue amounts.

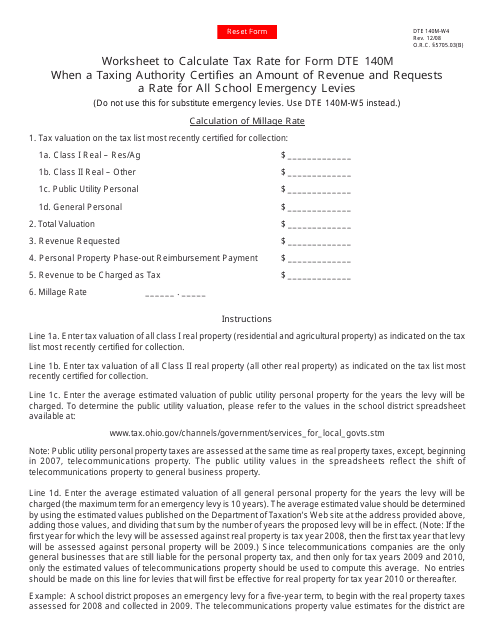

This form is used for calculating the tax rate for Form DTE 140M when a taxing authority requests a rate for all school emergency levies in Ohio.