Property Ownership Templates

Documents:

313

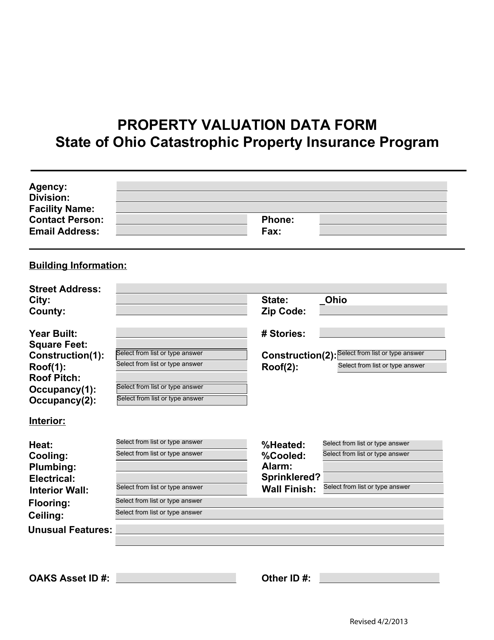

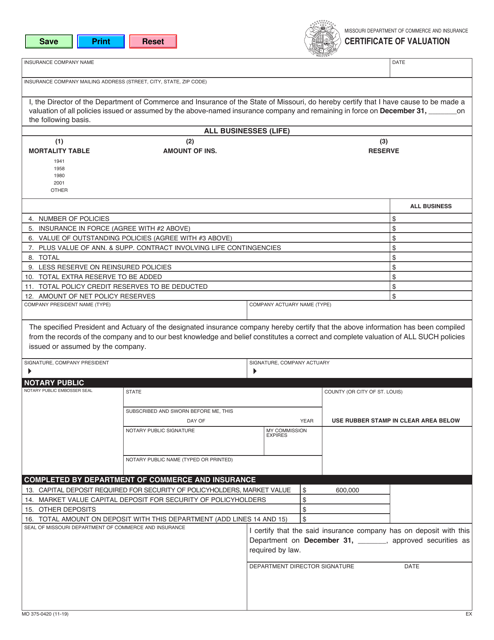

This Form is used for obtaining property valuation data in the state of Ohio.

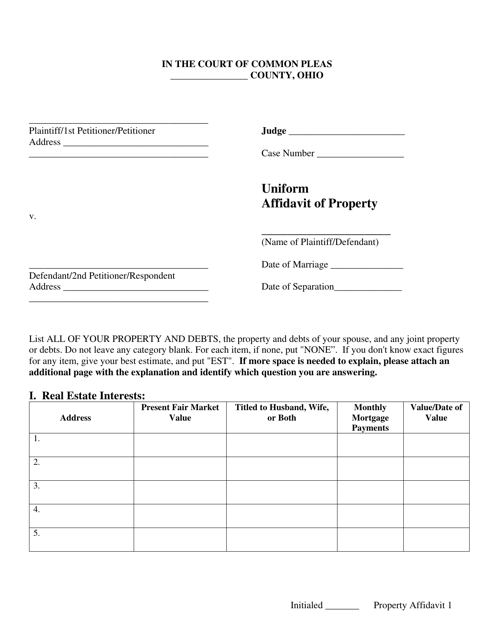

This document is used for declaring ownership and details of properties in Ohio. It serves as a legal affirmation of property.

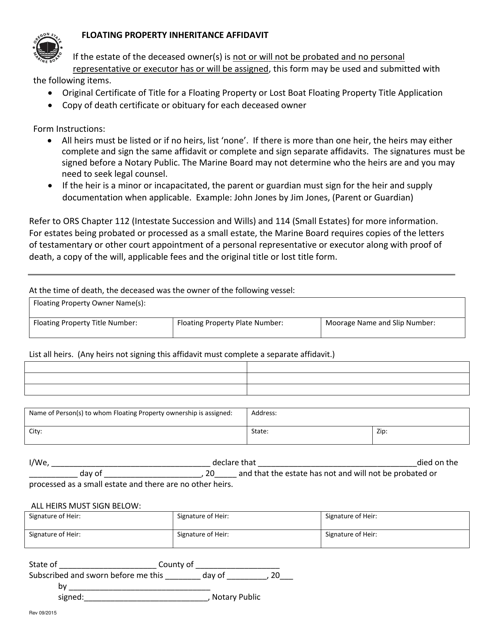

This document is used for declaring the inheritance of floating property in the state of Oregon.

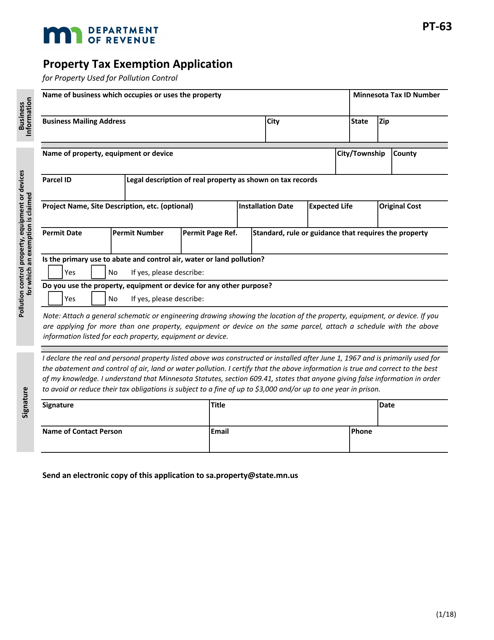

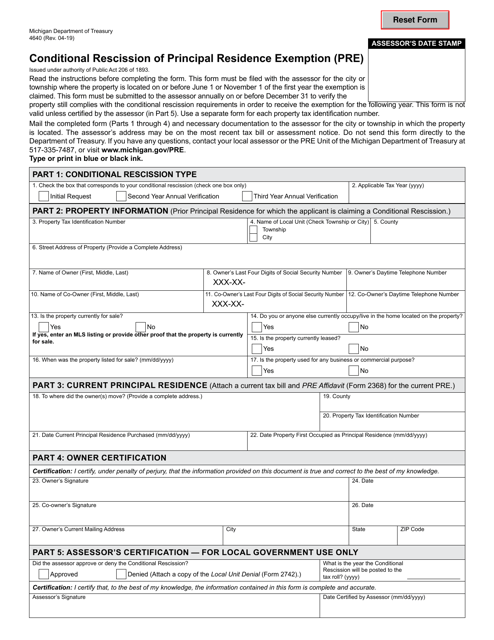

This document is used for applying for a property tax exemption in Minnesota.

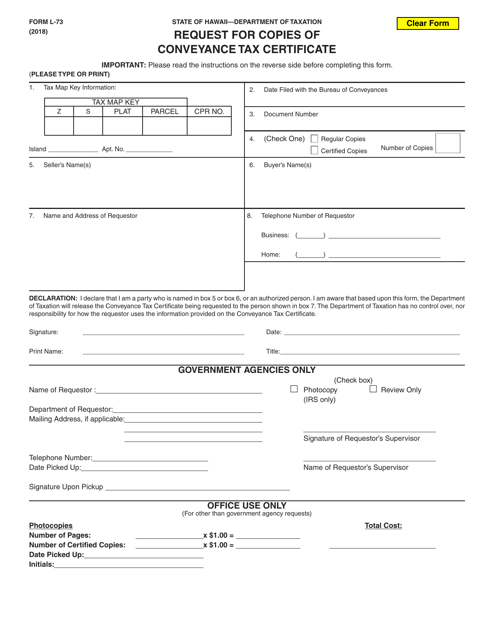

This form is used for requesting copies of conveyance tax certificates in Hawaii.

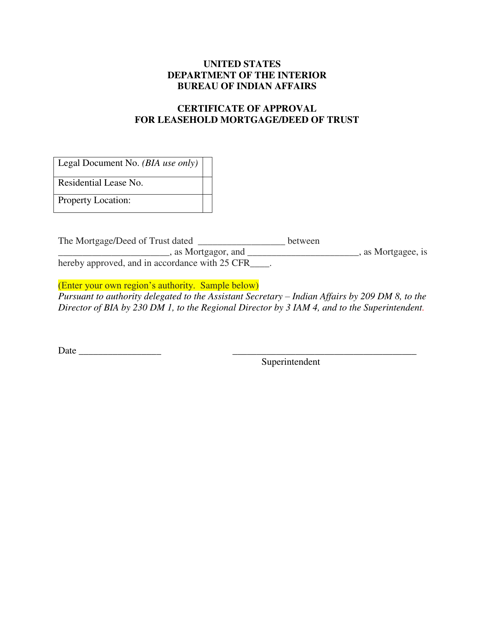

This document is used for obtaining approval for a leasehold mortgage or deed of trust. It provides a certificate of approval for the arrangement.

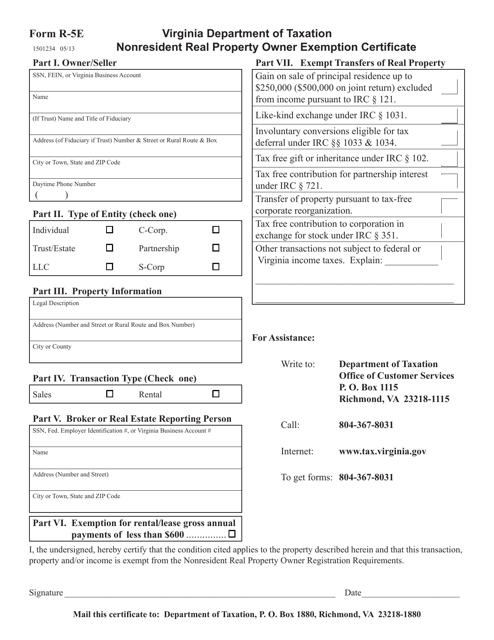

This form is used for nonresident property owners in Virginia to claim an exemption from real property taxes.

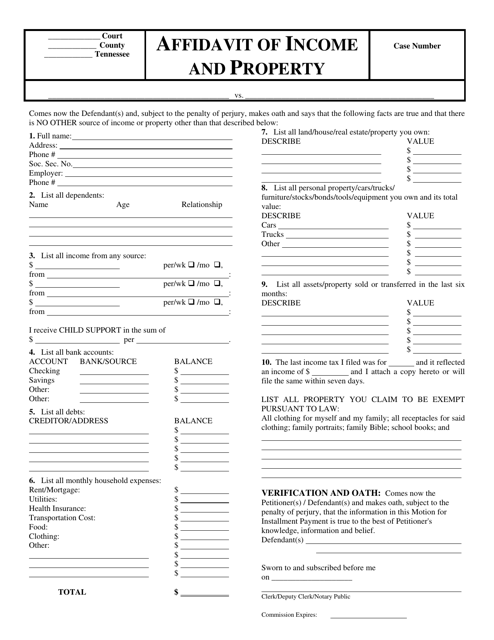

This form is used for declaring and providing evidence of income and property in the state of Tennessee. It is typically used in legal proceedings or when applying for certain benefits or programs.

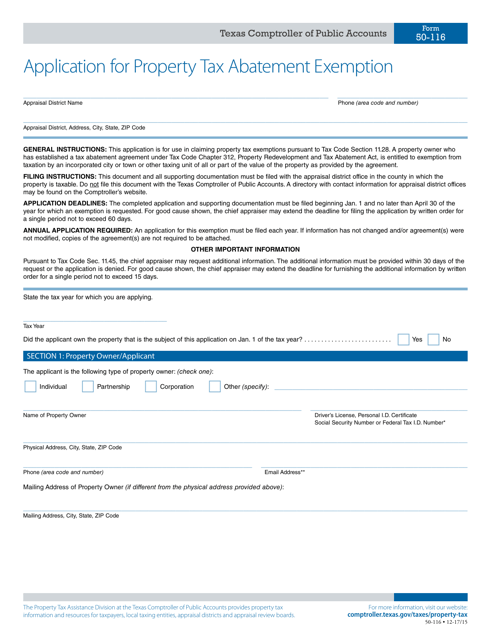

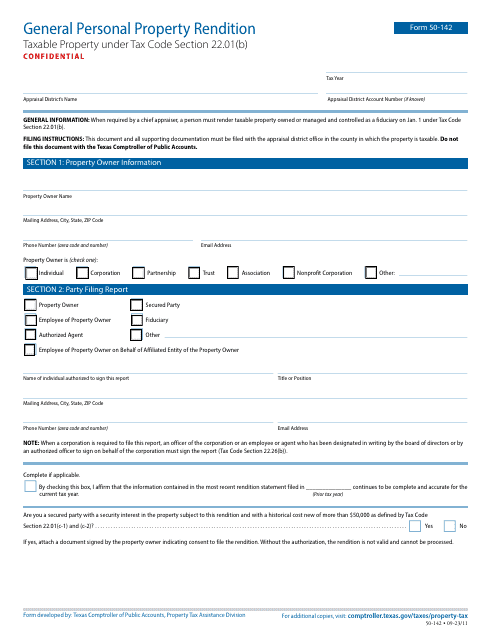

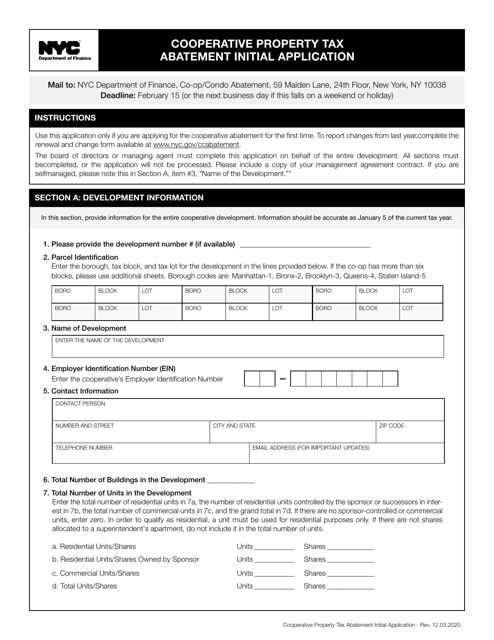

This form is used for applying for a property tax abatement exemption in Texas.

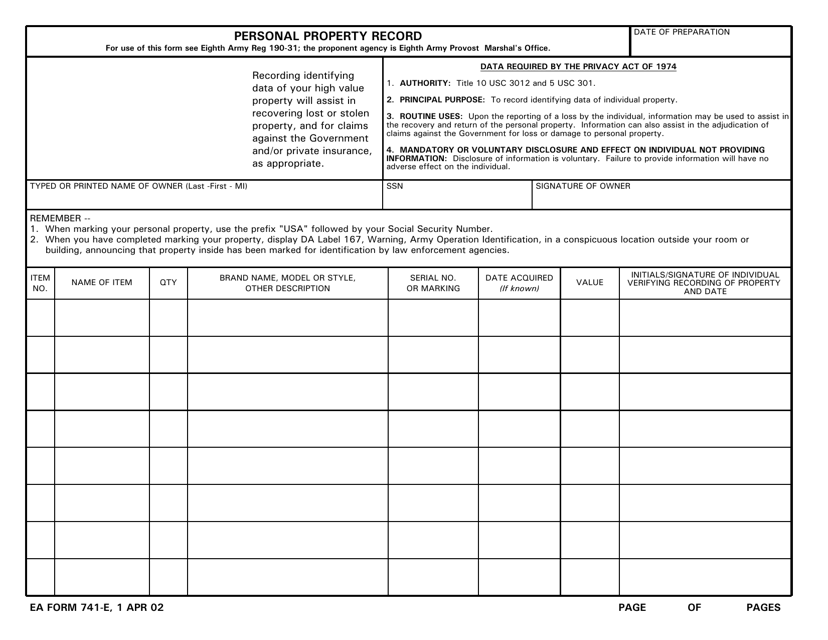

This document is used to keep track of personal belongings and assets. It is important for insurance purposes and for keeping an organized inventory of your possessions.

This document is an application for the Real Property Tax Deferral Program for senior citizens in Prince Edward Island, Canada. This program allows eligible seniors to defer payment of their property taxes.

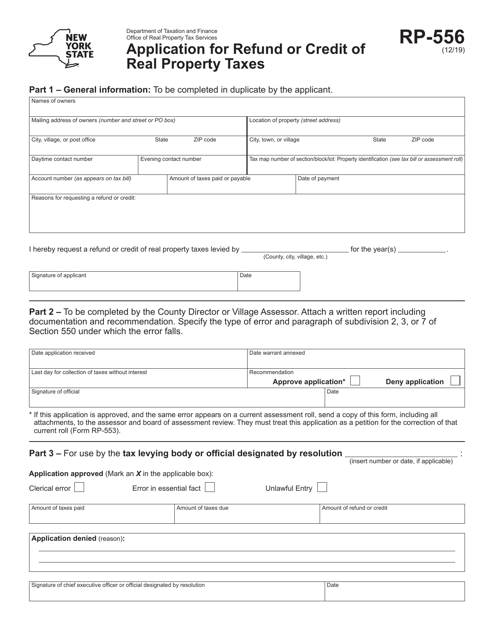

This form is used for applying for a refund or credit for the payment of real property taxes in the state of New York.

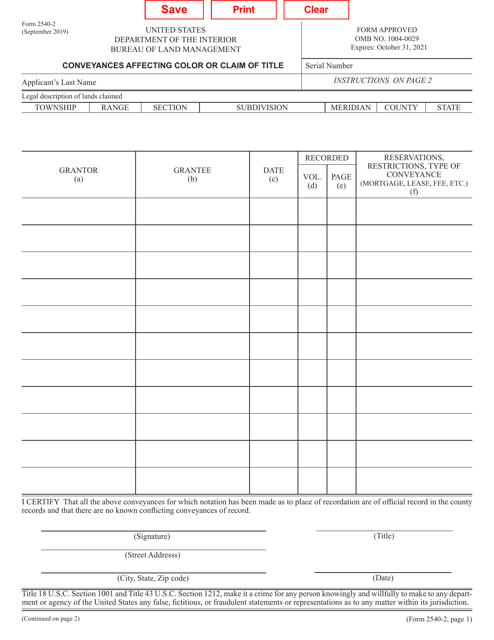

This document is used for recording conveyances that impact the ownership or title of a property, such as sales or transfers.

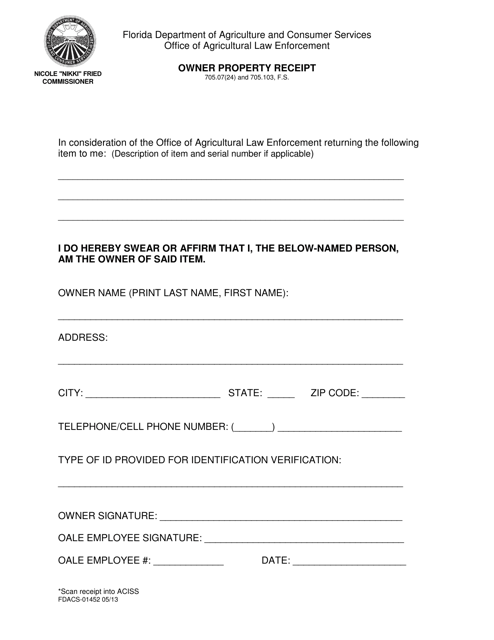

This form is used for property owners in Florida to receive a receipt for their property.

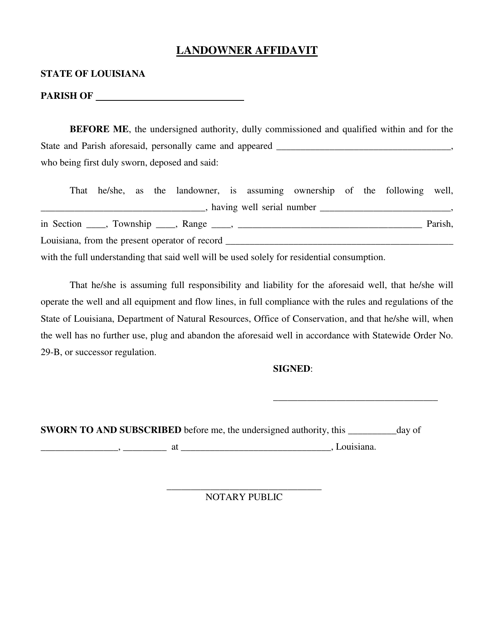

This document is used for landowners in Louisiana to provide a sworn statement or affirmation about their ownership of a property. It may be required for legal or administrative purposes.

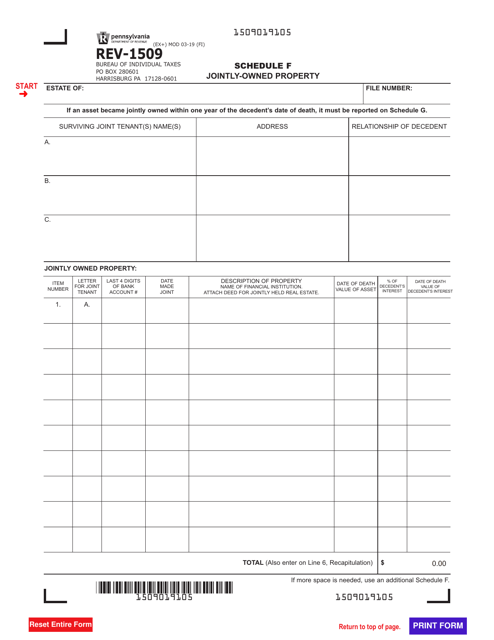

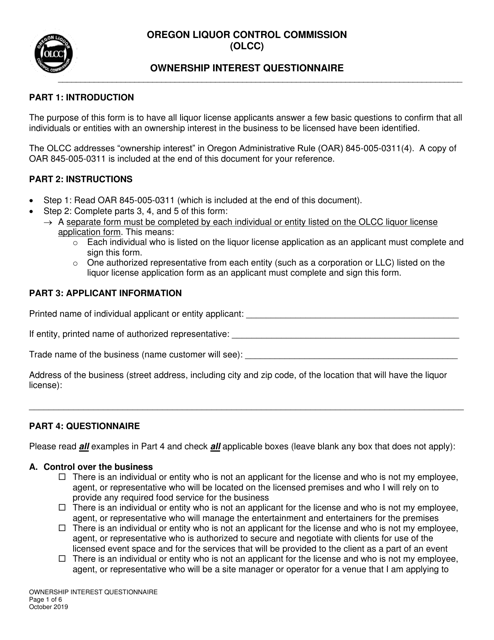

This document collects information about ownership interests in Oregon. It may be used for various purposes such as property ownership, business ownership, or estate planning.

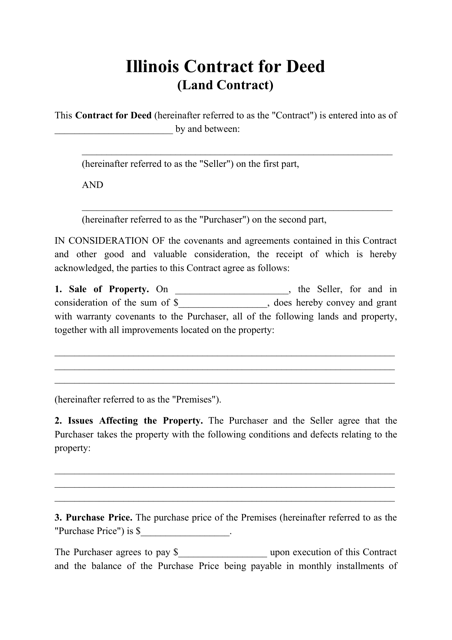

This document is used for a Contract for Deed, also known as a Land Contract, in the state of Illinois. It outlines the terms and conditions for the sale and purchase of property, where the buyer makes installment payments directly to the seller over an agreed-upon period of time.

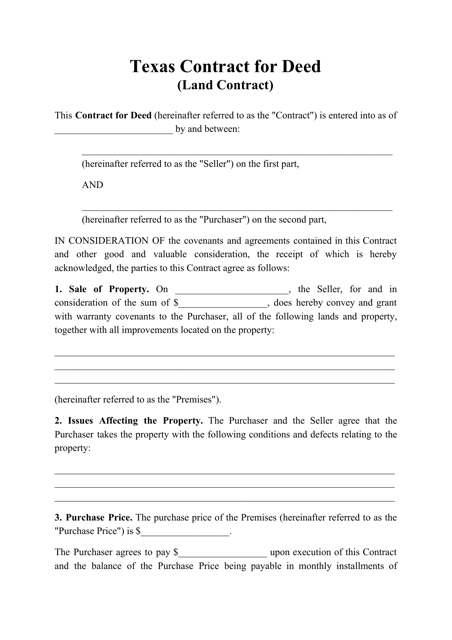

This document is used for a Contract for Deed (Land Contract) in the state of Texas. It is a legally binding agreement between a buyer and seller for the purchase of a property, where the buyer makes payments directly to the seller over a specified period of time before taking full ownership of the property.

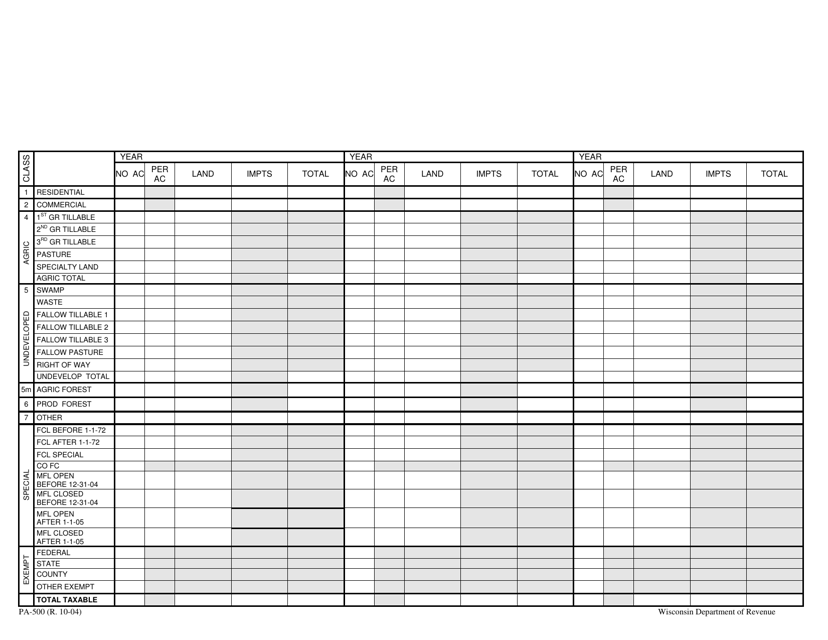

This form is used for recording residential property details in the state of Wisconsin. It allows property owners to provide information such as property address, size, and value to the relevant authorities.

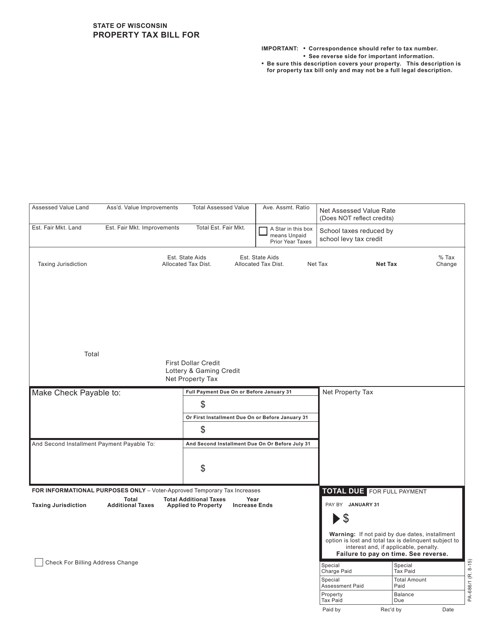

This form is used to send property tax bills to residents in Wisconsin.

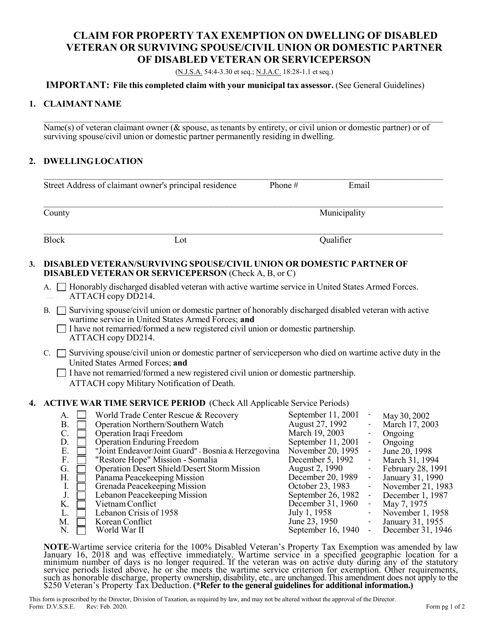

This form is used for claiming property tax exemption on the dwelling of a disabled veteran or surviving spouse or civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

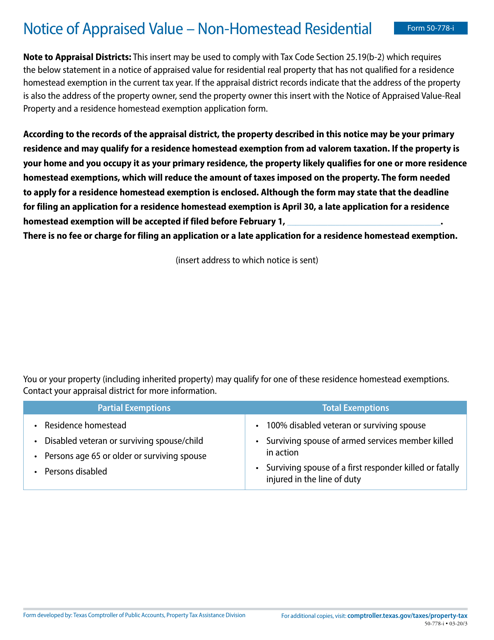

This Form is used for notifying property owners in Texas about the appraised value of their non-homestead residential property.

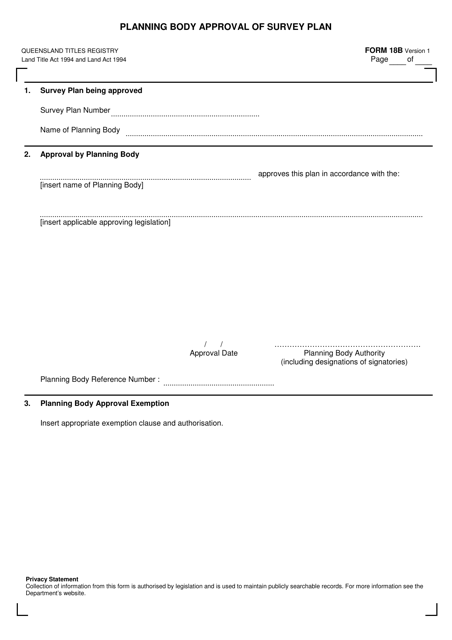

This form is used for obtaining approval from the planning body in Queensland, Australia for a survey plan.

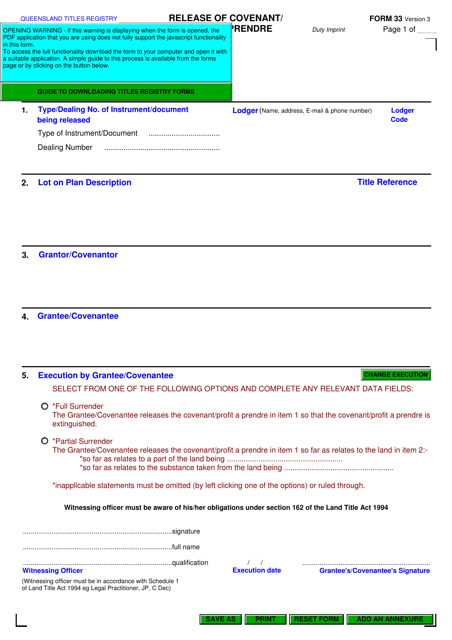

This document is used for the release of a covenant or profit a prendre in Queensland, Australia.

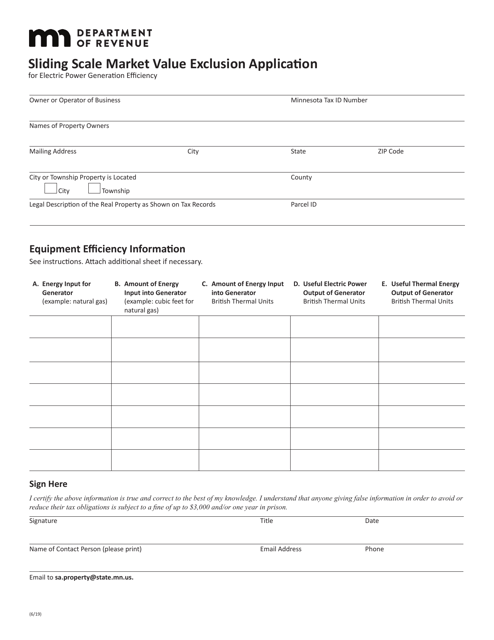

This form is used to apply for the sliding scale market value exclusion in Minnesota.

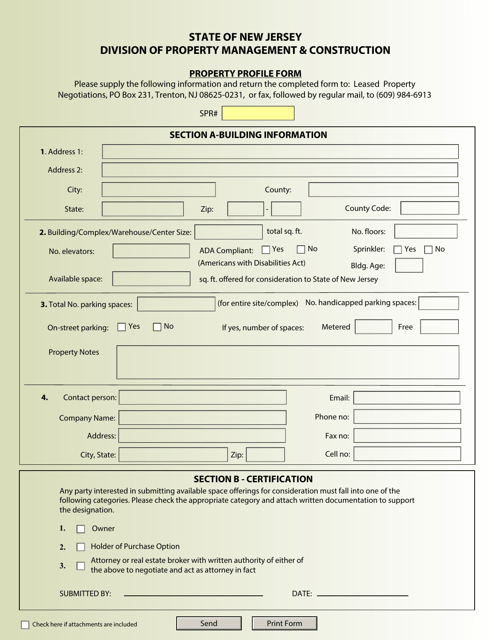

This form is used for obtaining detailed information about a property in New Jersey.

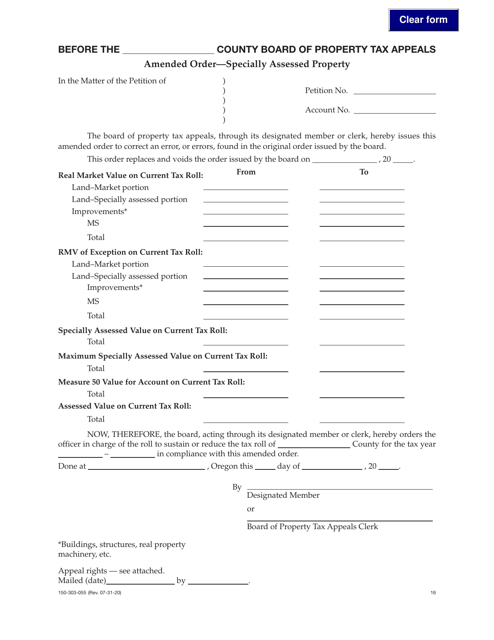

This Form is used for making an amended order for specially assessed property in Oregon.

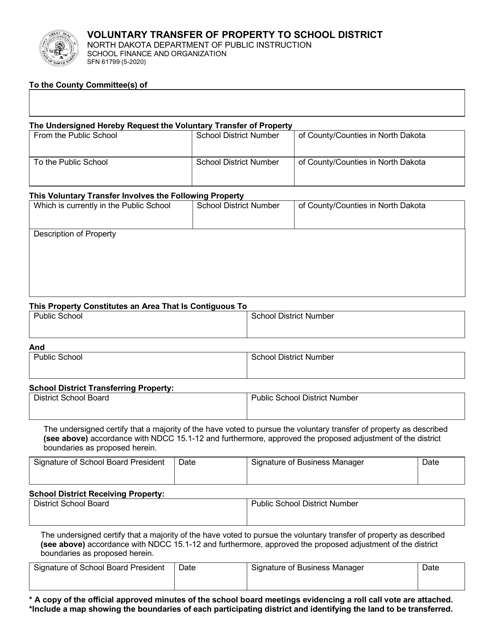

This Form is used for voluntarily transferring property to a school district in North Dakota.

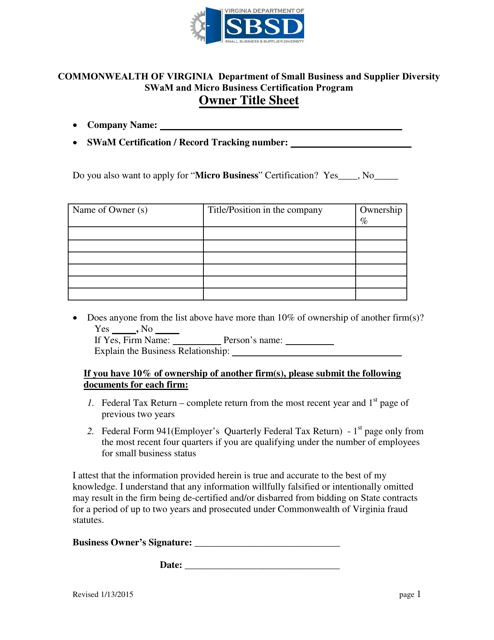

This document provides information and details about the ownership of a property in the state of Virginia. It includes the owner's name, contact information, and other relevant details.

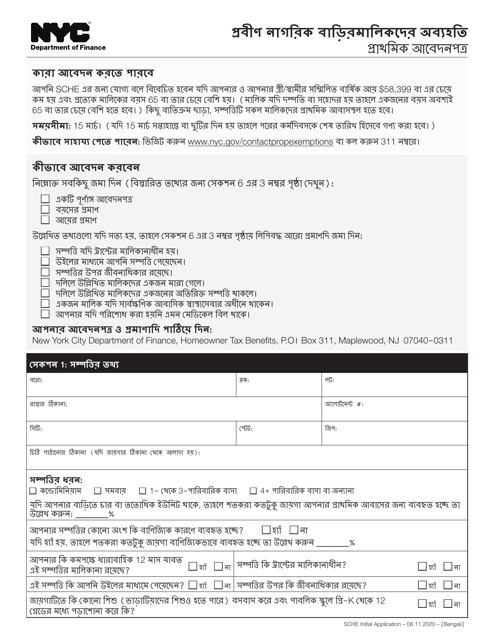

This document is for senior citizens in New York City who want to apply for a property tax exemption. It is available in the Bengali language.

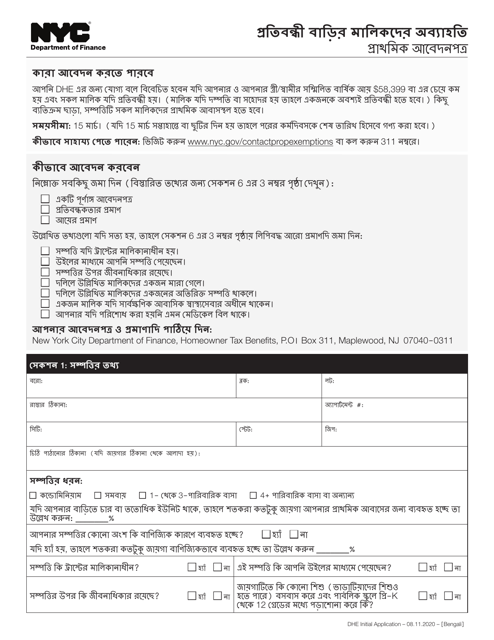

This document is for disabled homeowners in New York City who want to apply for an initial exemption. It is available in Bengali.