Filing Status Templates

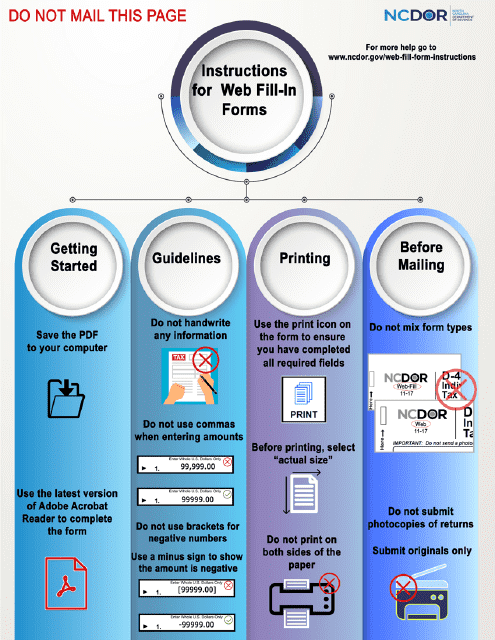

Are you unsure about your filing status? Do you need help determining which category you fall into? Look no further! Our comprehensive collection of documents related to filing status is here to assist you.

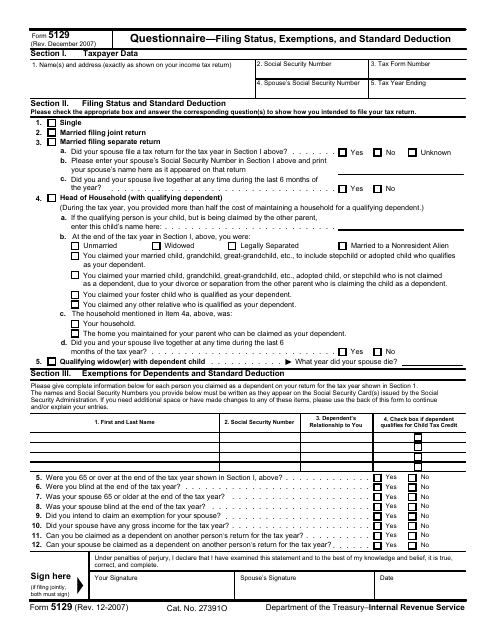

Whether you are filing your taxes with the Internal Revenue Service (IRS) in the United States or with the Canada Revenue Agency (CRA) in Canada, we have the resources you need. Our extensive range of documents includes questionnaires, such as the IRS Form 5129 and the Request for Return in Saskatchewan, Canada. These questionnaires will guide you through the process of determining your filing status, exemptions, and standard deduction.

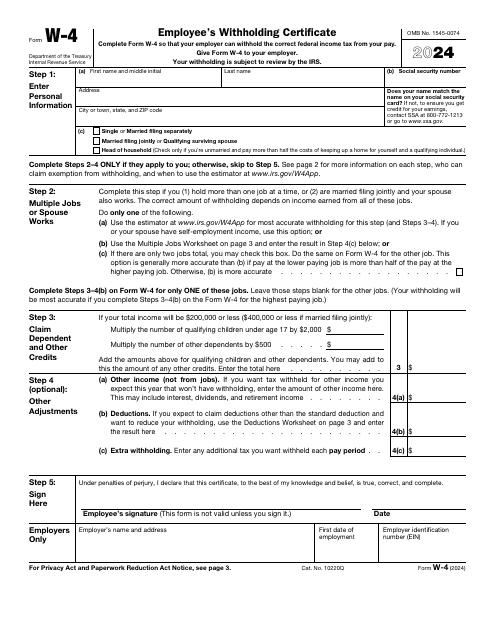

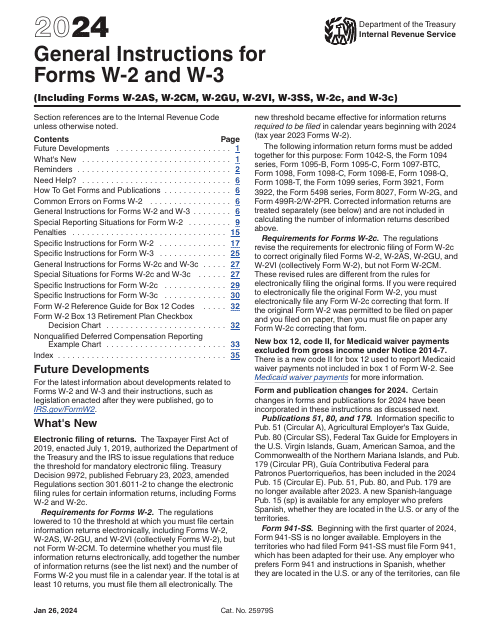

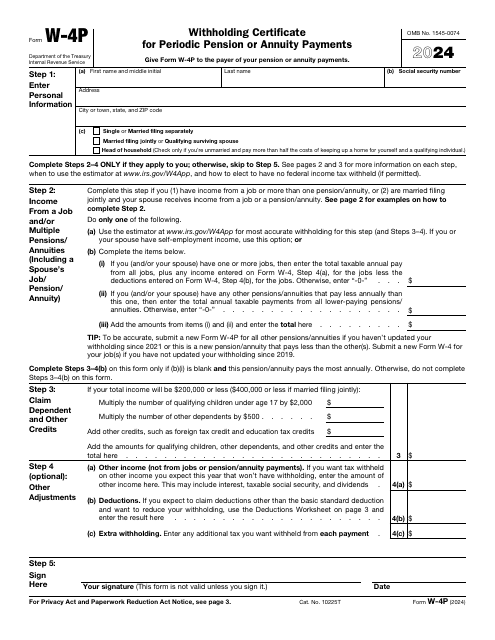

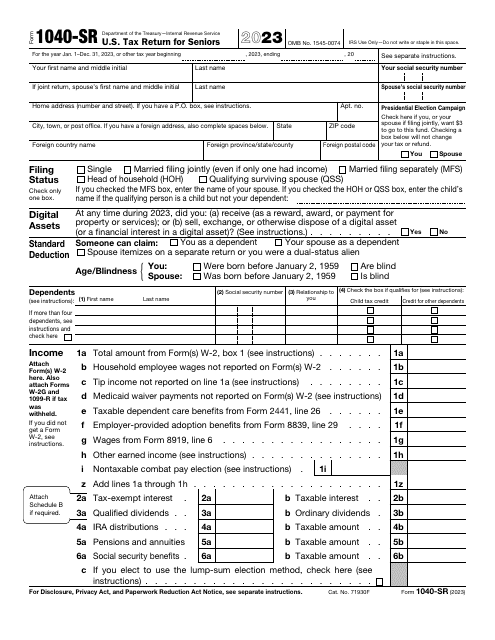

For individuals in the United States, we offer essential forms like the IRS Form W-4 Employee's Withholding Certificate and the IRS Form 1040-SR U.S. Tax Return for Seniors. These forms are designed to help you accurately declare your filing status and ensure that you are withholding the appropriate amount from your paycheck.

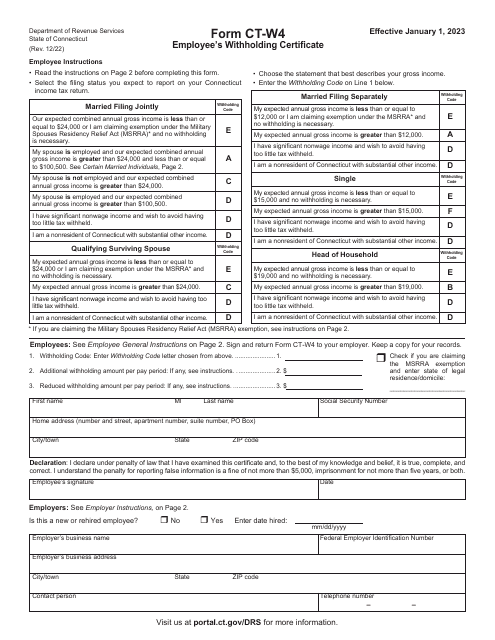

If you reside in Connecticut, we have you covered too. Our collection includes the Form CT-W4 Employee's Withholding Certificate, specifically tailored to meet the state's requirements.

Don't let uncertainty linger when it comes to your filing status. Our documents are here to provide clarity and guidance, no matter which country or state you reside in. Let us help you accurately determine your filing status and make the tax filing process seamless.

Documents:

25

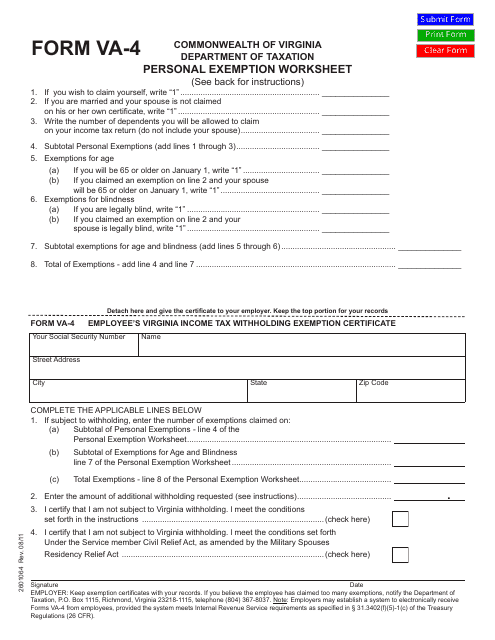

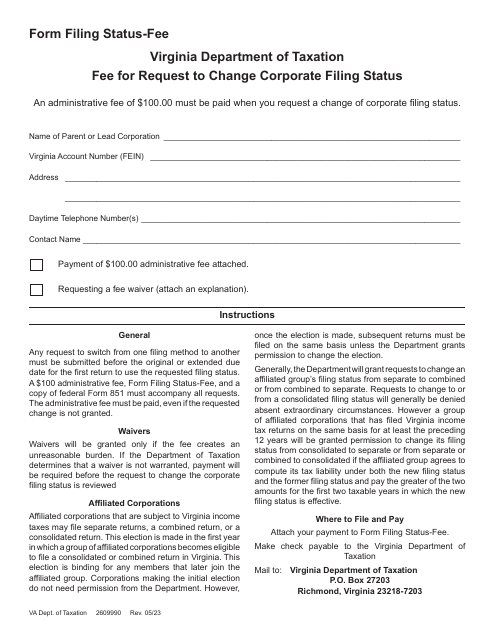

This form is used for calculating personal exemptions for tax purposes in the state of Virginia.

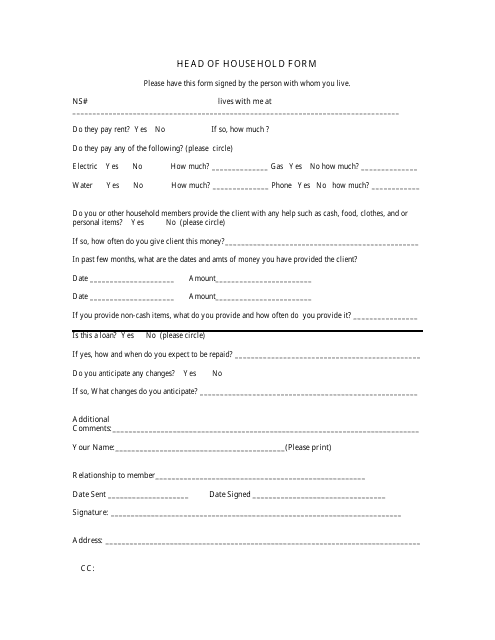

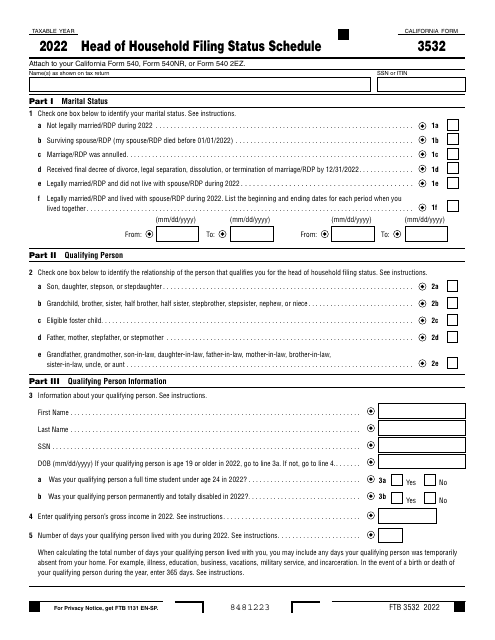

This form is used for individuals who qualify as a "head of household" for tax purposes. It helps determine your filing status and eligibility for certain tax credits and deductions.

This type of document, IRS Form 5129 Questionnaire, is used for determining your filing status, exemptions, and standard deduction when filing your taxes with the Internal Revenue Service (IRS).

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

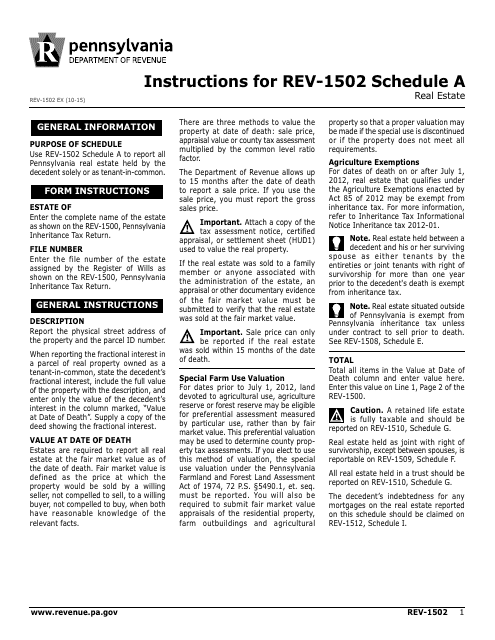

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

This document is used to request a return in the province of Saskatchewan, Canada.

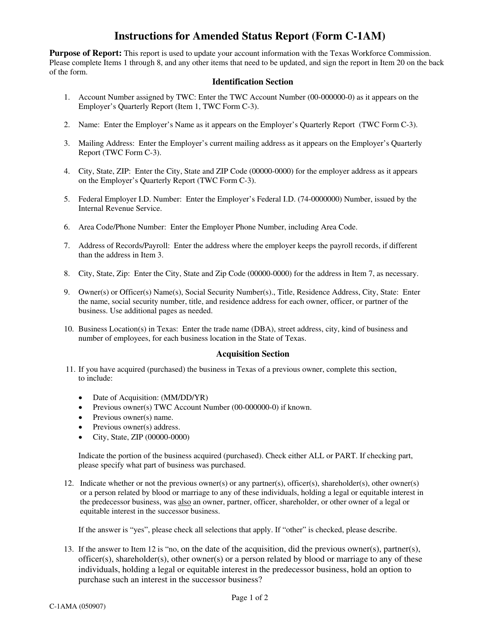

This Form is used for filing an amended status report in Texas. It provides instructions on how to update and correct information previously submitted.

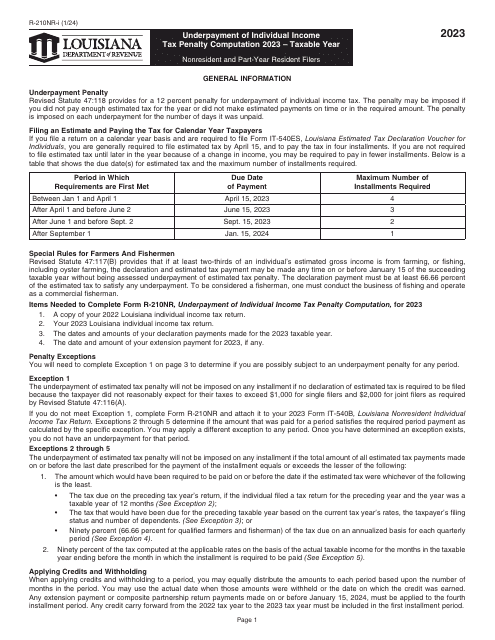

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

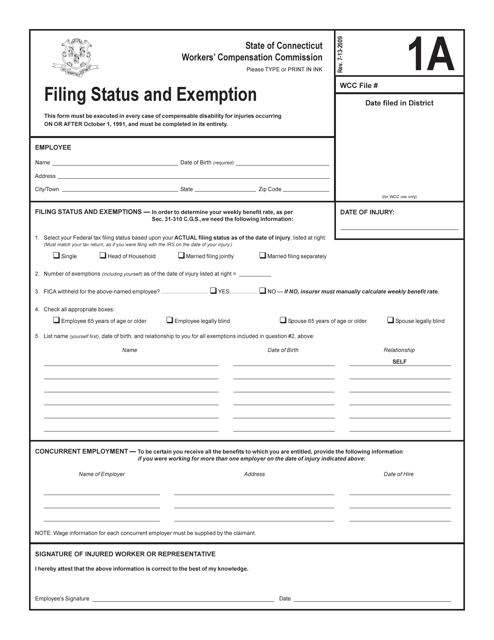

This form is used for filing status and claiming exemptions in the state of Connecticut.

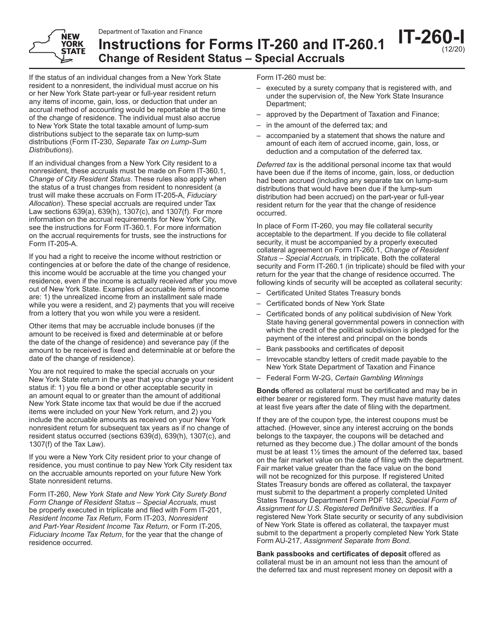

This Form is used for reporting a change in resident status and special accruals in the state of New York. It provides instructions on how to accurately complete the form.

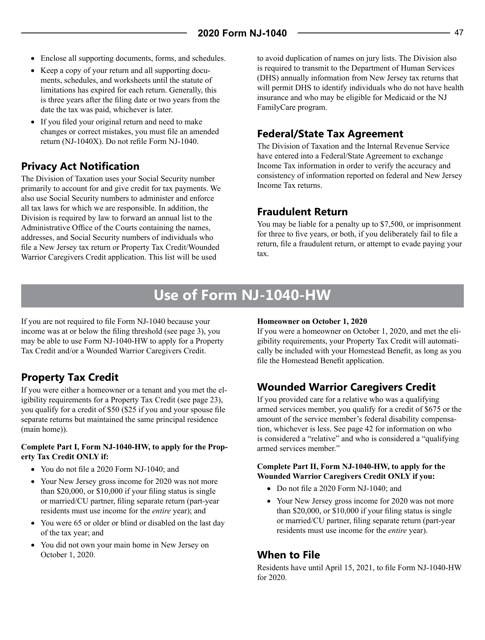

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

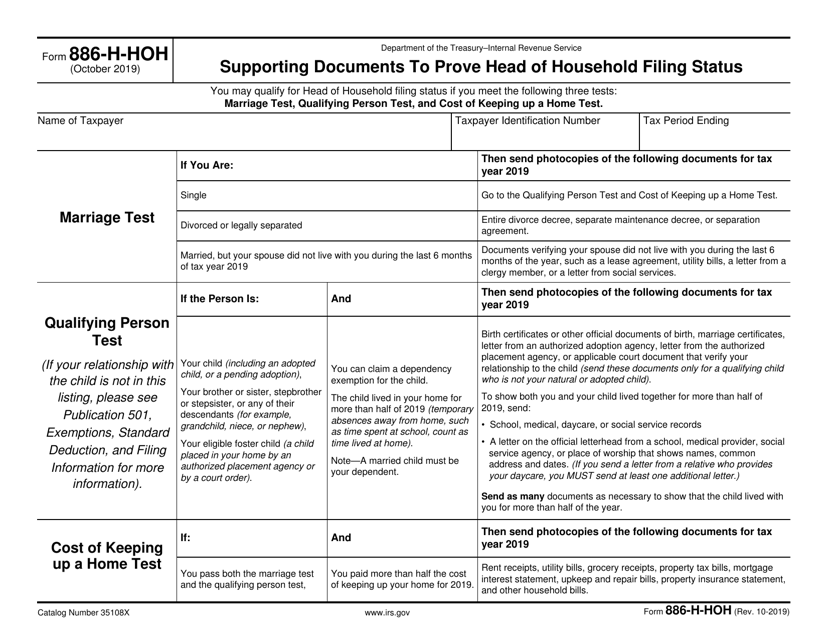

This document is used for providing supporting documents to prove your head of household filing status with the IRS. It is necessary to demonstrate your eligibility for certain tax benefits.

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.