Apportionment Schedule Templates

Are you looking for an authoritative resource on apportionment schedules or alternate names like apportionment schedules? Look no further! Our comprehensive document collection on apportionment schedules will provide you with all the information you need.

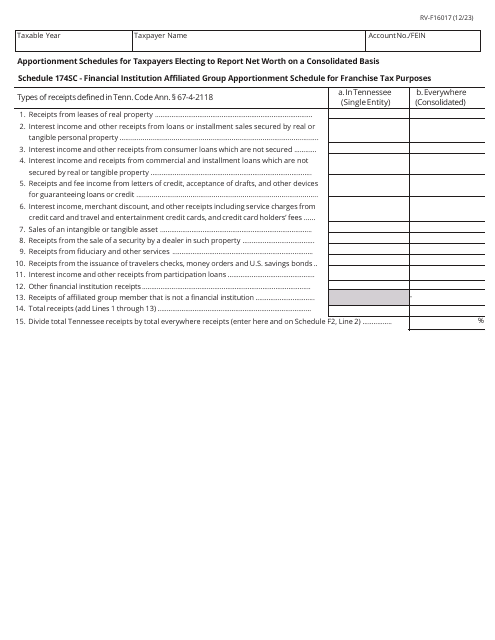

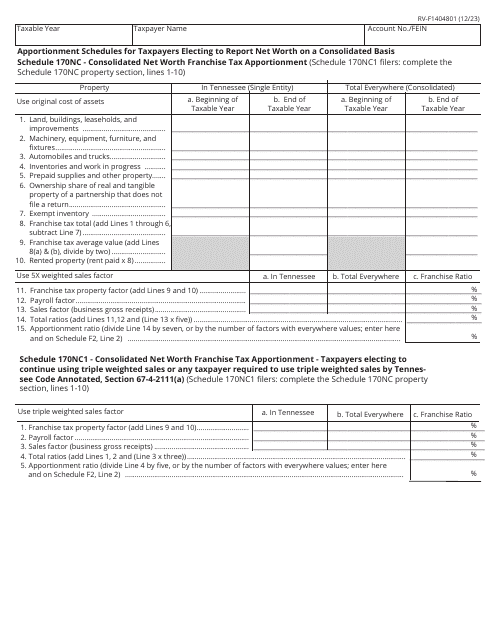

Apportionment schedules, also known as apportionment schedules or apportionment schedules, are essential documents utilized by taxpayers to report their net worth on a consolidated basis. These schedules play a crucial role in determining the appropriate amount of tax liability for individuals and businesses.

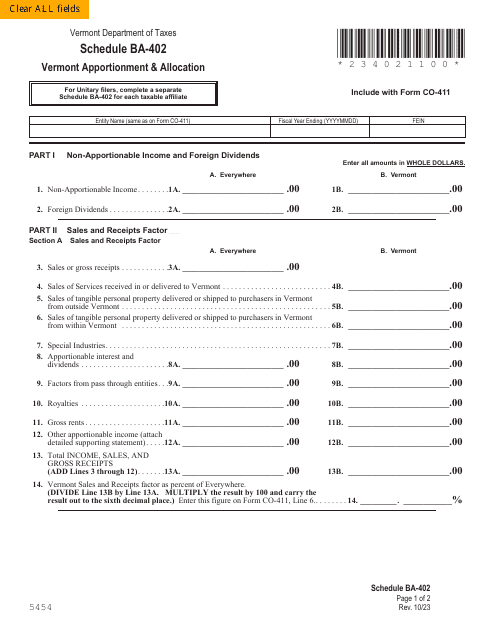

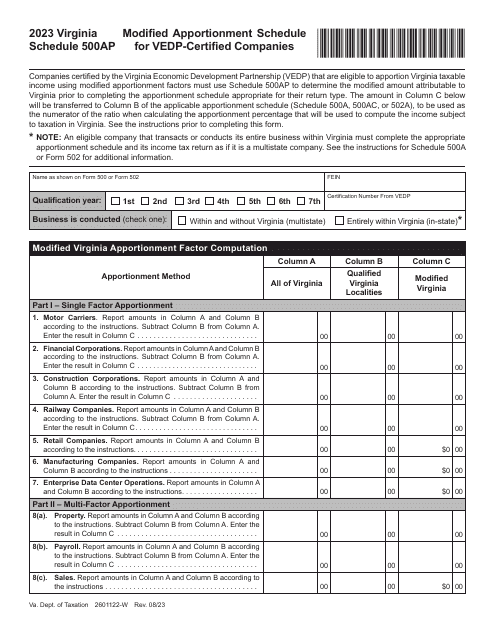

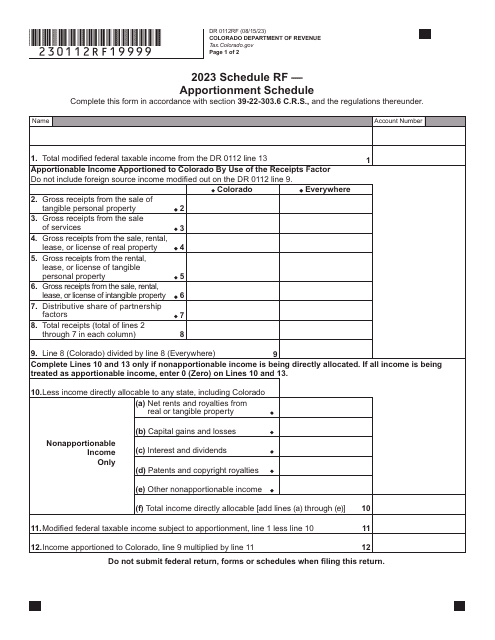

Our wide-ranging collection includes various forms and schedules from different states such as Tennessee, Virginia, Colorado, and more. For example, you can find Form RV-F16017 Schedule 174NC, 174SC Apportionment Schedules for Taxpayers Electing to Report Net Worth on a Consolidated Basis in Tennessee. Or, if you need information on modified apportionment schedules for Vedp-Certified Companies in Virginia, we have Schedule 500AP ready for you.

Whether you are a taxpayer, accountant, or legal professional, our apportionment schedule documents will provide you with the necessary insights and guidelines to navigate this complex topic. Stay informed and ensure compliance by accessing our comprehensive collection today.

Note: This is a generated text, and it is always recommended to have human input in creating website content for accuracy and quality purposes.

Documents:

12

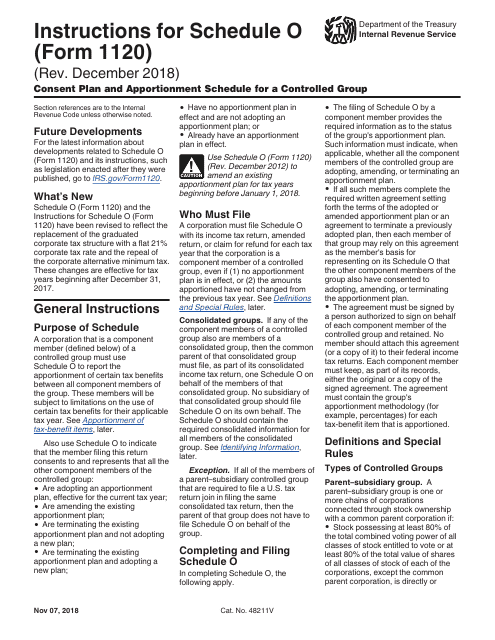

This Form is used for providing consent and creating a plan for allocation of income and deductions among companies in a controlled group. It helps with the apportionment of taxes for multiple companies.

This form is used for submitting a consent plan and apportionment schedule for a controlled group for tax purposes. It provides instructions on how to allocate and apportion income, deductions, and taxes among the members of the controlled group.