Property Tax Reimbursement Templates

Are you a homeowner looking to receive a reimbursement for your property taxes? Look no further than our comprehensive collection of property tax reimbursement documents. These valuable resources will guide you through the process of applying for and receiving the reimbursement you deserve.

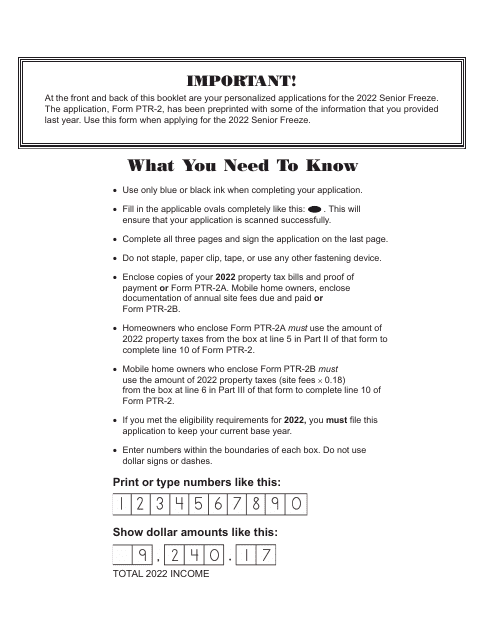

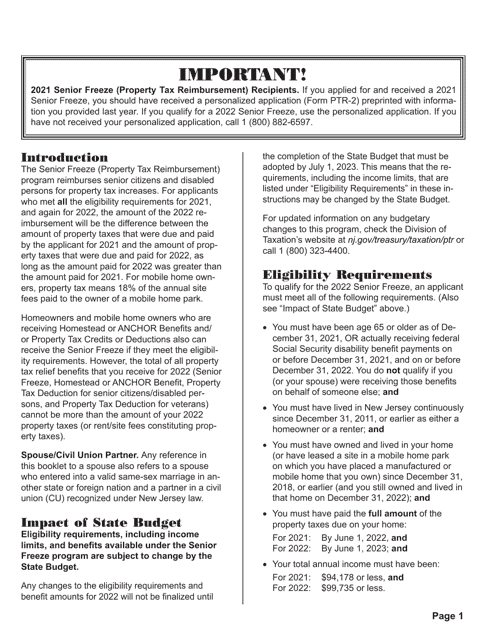

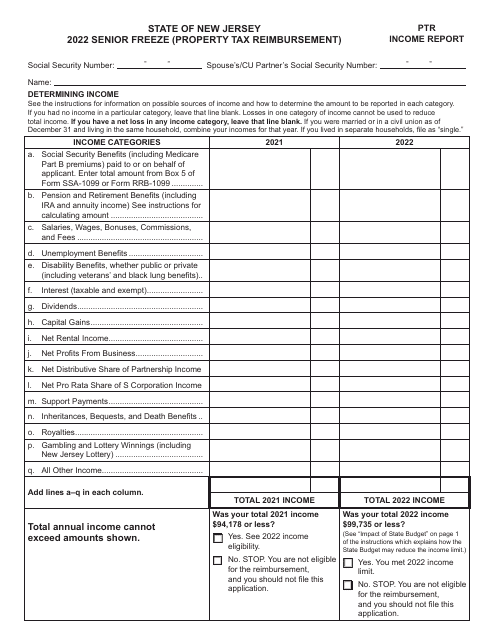

Our property tax reimbursement documents include forms and instructions specifically designed for homeowners seeking reimbursement in various states, such as New Jersey. For example, you can find Form PTR-1 Senior Freeze (Property Tax Reimbursement) Application as well as its corresponding instructions to help you fill out the application correctly. We also offer Form PTR and its instructions to provide a thorough overview of the reimbursement process.

Whether you are a senior citizen looking to freeze your property taxes, or a homeowner interested in receiving a reimbursement for other reasons, our property tax reimbursement documents have got you covered. Take advantage of these valuable resources and ensure that you are receiving the maximum amount of reimbursement for your property taxes.

Documents:

8

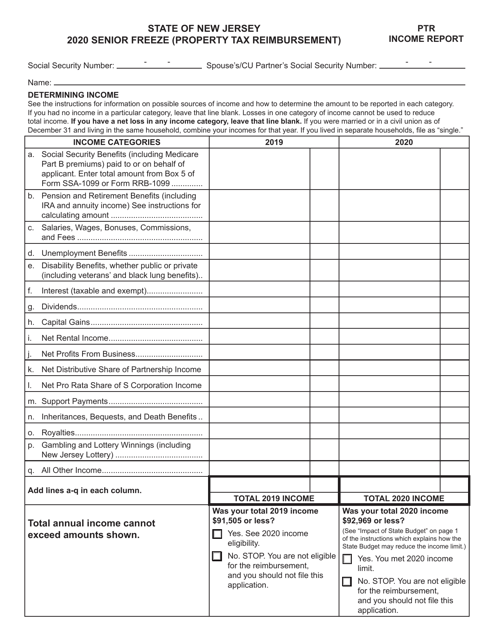

This Form is used for reporting property tax reimbursement income in New Jersey. It is used by taxpayers to report their income earned from property tax reimbursements and calculate any potential tax liability.

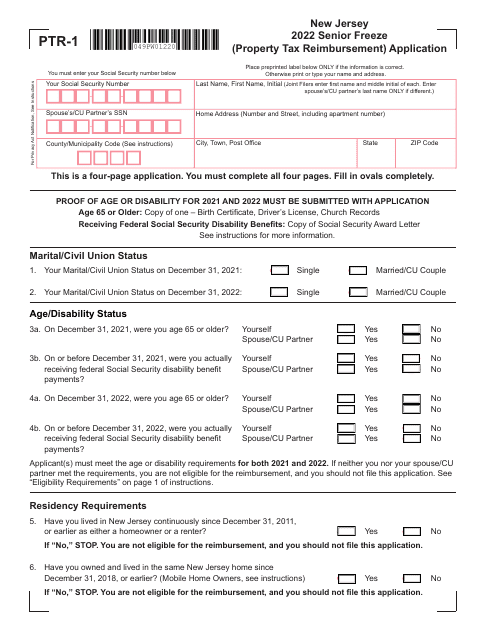

This Form is used for applying for the Property Tax Reimbursement program, also known as the Senior Freeze, in the state of New Jersey. It provides instructions on how to fill out the PTR-1 application.

This form is used for applying for the PTR Senior Freeze program in New Jersey, which provides property tax reimbursement for eligible senior citizens.