Wholesale Tax Templates

Wholesale Tax

Welcome to our Wholesale Tax

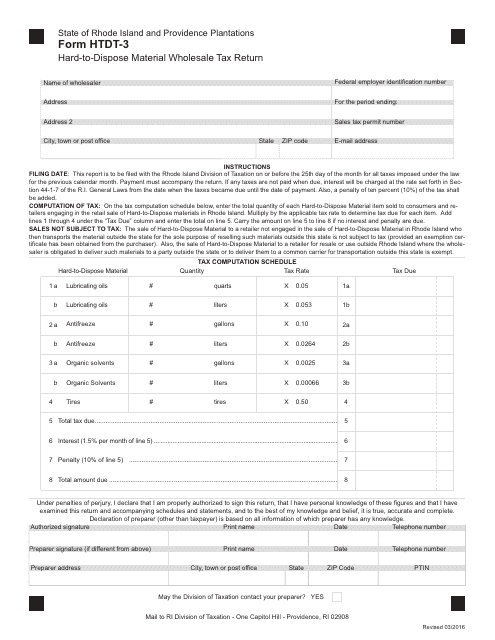

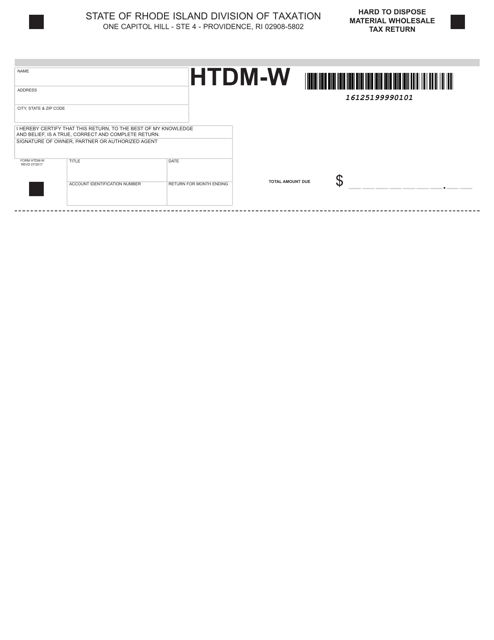

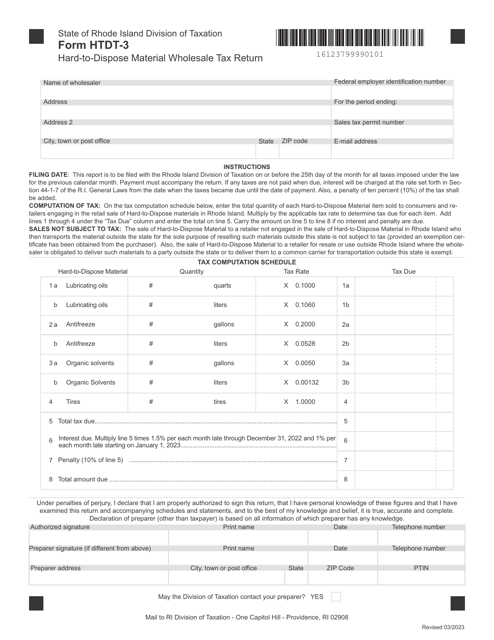

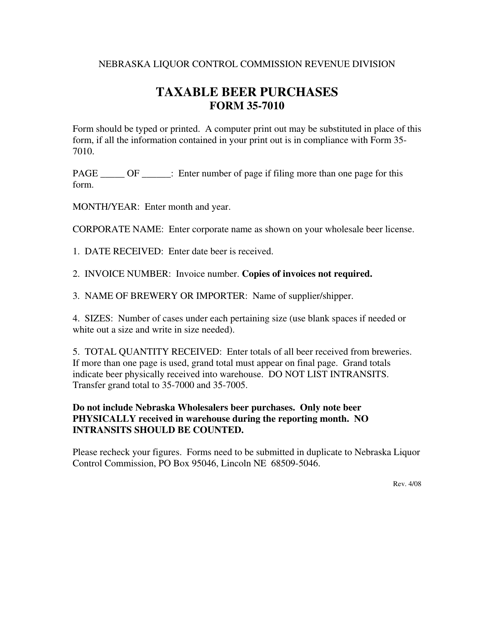

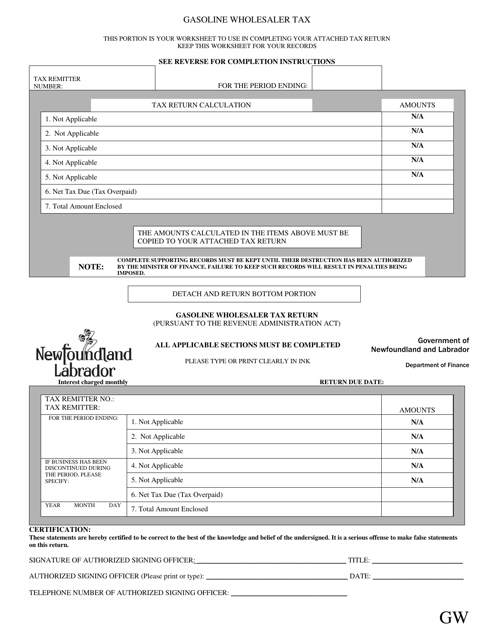

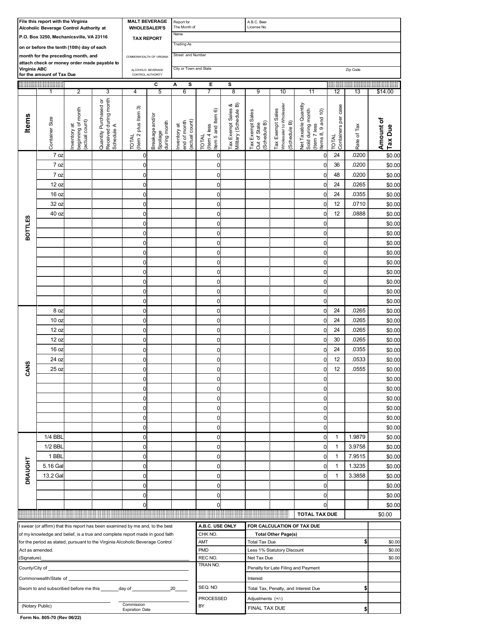

webpage, where you can find all the information you need about wholesale taxes. Wholesale taxes, also known as wholesaler tax or wholesale tax form, are specific taxes imposed on the sale of goods or services at the wholesale level.To comply with tax regulations, wholesalers are required to submit various forms and returns, depending on the jurisdiction. Examples of these documents include the Hard to Dispose Material Wholesale Tax

Return, Malt Beverage Wholesaler's Tax Report, and the Blank Return Gasoline and Carbon Wholesaler Tax.Whether you are a wholesaler looking for guidance on filing your taxes or a taxpayer wanting to understand more about wholesale taxes, our website provides comprehensive resources and helpful information. From state-specific forms to tax rates and exemptions, we have everything you need to stay compliant with wholesale tax requirements.

Don't let the complexities of wholesale tax laws overwhelm you. Let us be your trusted source of information and assistance in navigating the world of wholesale taxes. Browse through our website to find the answers to your questions, download necessary forms, and stay up to date with the latest wholesale tax news.

Choose us as your reliable partner in managing your wholesale tax obligations. We are here to help you simplify the process and ensure compliance with the wholesale tax regulations in your area.

Documents:

7

This Form is used for filing the Hard-To-Dispose Material Wholesale Tax Return in Rhode Island.

This form is used for filing the Hard to Dispose Material Wholesale Tax Return in the state of Rhode Island.

This Form is used for reporting taxable beer purchases in the state of Nebraska. It provides instructions on how to accurately fill out and submit the form to the appropriate tax authority.

This document is used for reporting the gasoline and carbon wholesaler tax in Newfoundland and Labrador, Canada.

This form is used for reporting and paying the wholesale tax on malt beverages by wholesalers in Virginia.