Family Trust Templates

A family trust, also known as a family trust or exempt trust, is a legally binding arrangement that allows families to manage and protect their assets for future generations. This type of trust offers a variety of benefits, including estate tax planning, asset protection, and privacy.

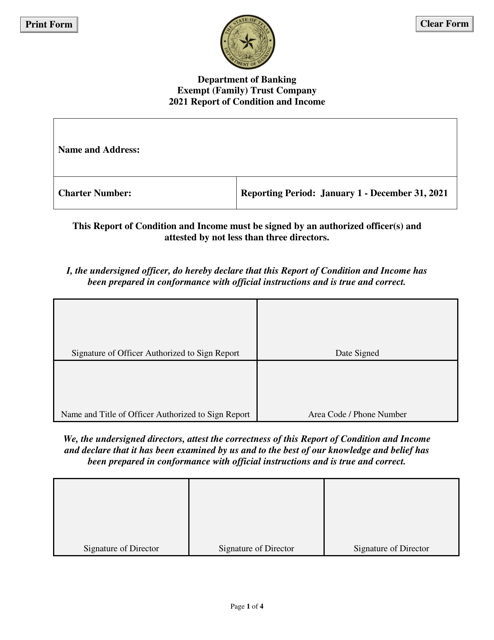

One of the main documents associated with a family trust is the Exempt (Family) Trust Company Report of Condition and Income. This report is required by the state of Texas and provides a detailed overview of the trust's financial condition and income. It ensures transparency and accountability in managing the trust's assets.

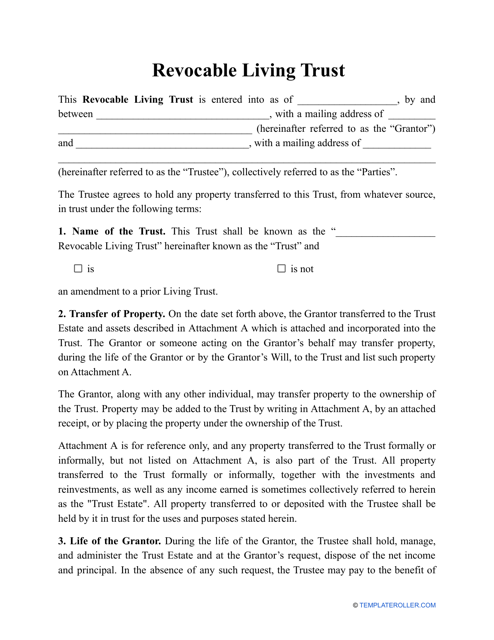

Another important document is the Revocable Living Trust Form. This form allows individuals to create a trust that can be modified or revoked during their lifetime. It is a flexible tool that helps families plan for their future and ensure their assets are distributed according to their wishes.

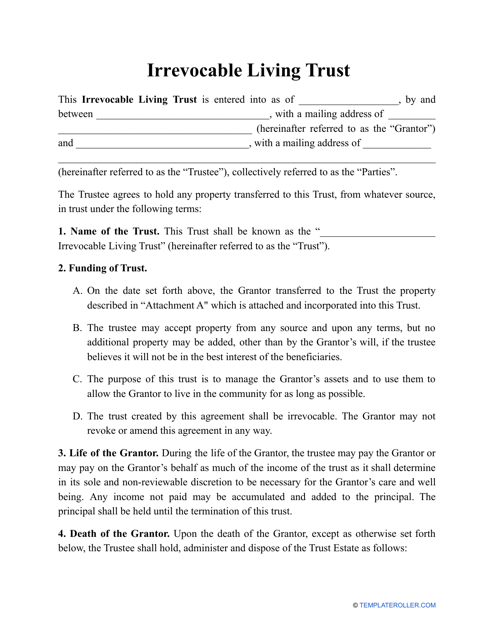

For those looking for a more permanent arrangement, the Irrevocable Living Trust Template is a valuable resource. This template provides a framework for creating a trust that cannot be altered once it's established. It offers enhanced protection for assets and can be used for estate planning and tax purposes.

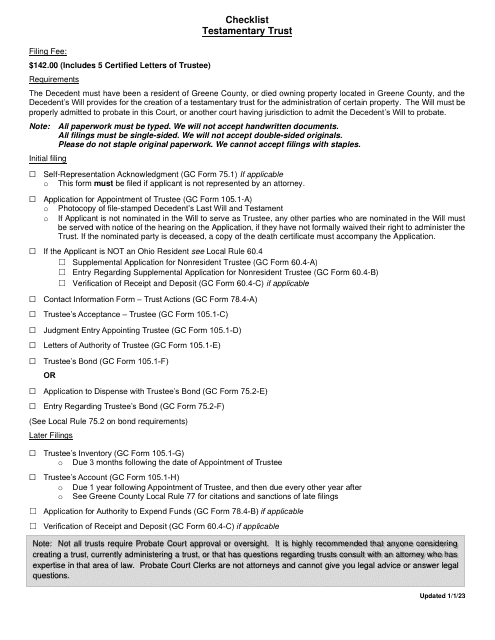

Additionally, individuals may find the Checklist - Testamentary Trust helpful, especially in locations like Greene County, Ohio. This checklist outlines the necessary steps and requirements for creating a testamentary trust, which is a trust established through a will. It ensures that all legal aspects of creating the trust are properly addressed.

In summary, a family trust, also referred to as a family trust or exempt trust, is a powerful tool for managing and preserving assets for future generations. Whether you need to report the trust's financial condition, create a revocable or irrevocable living trust, or establish a testamentary trust, having the right documents in place is crucial. These documents provide the legal framework and ensure that the trust operates smoothly and in accordance with your wishes.

Documents:

7

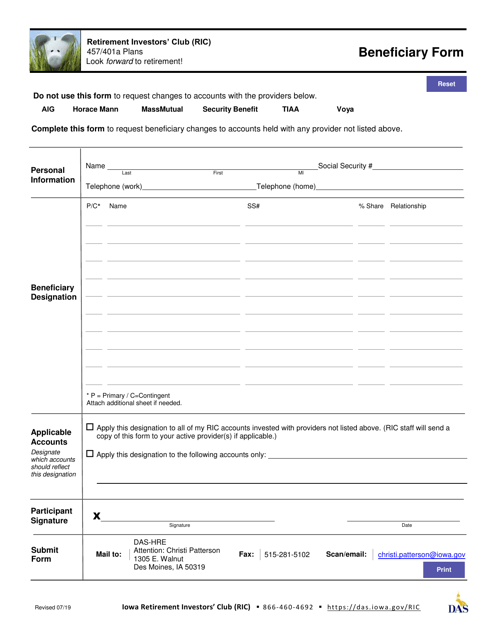

This Form is used for designating a beneficiary for certain assets or benefits in the state of Iowa.

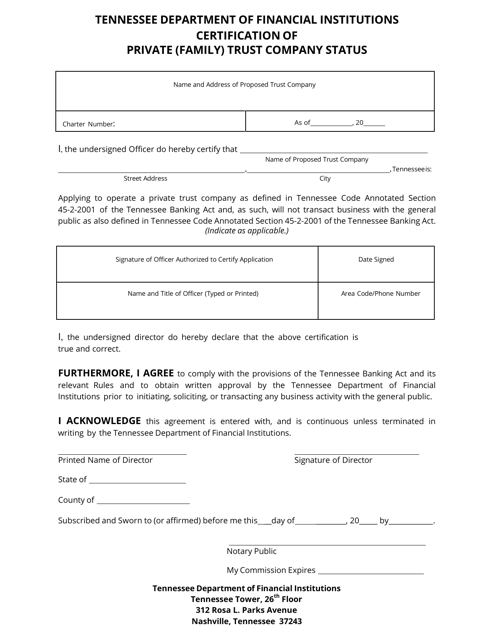

This form is used for certifying the status of a private (family) trust company in the state of Tennessee. It is meant to provide documentation of the company's legal status and compliance with state regulations.

This type of template acts as a formal document that establishes a revocable and modifiable trust.

This is a formal instrument used to place money, real estate, and valuable items into a trust which allows the beneficiaries named in writing to receive their inheritance upon the passing of the trustor.

This document is a checklist for creating a testamentary trust in Greene County, Ohio. It provides a step-by-step guide for organizing and establishing a trust that will come into effect upon the testator's death.