Fuel Tax Rate Templates

When it comes to fuel tax rates, staying informed is key. Keeping up with the latest updates and regulations regarding fuel taxes can help businesses and individuals avoid penalties and ensure compliance. Our extensive collection of resources on fuel tax rates, also known as fuel tax rate documents or fuel tax rate information, is designed to provide you with the knowledge and guidance you need.

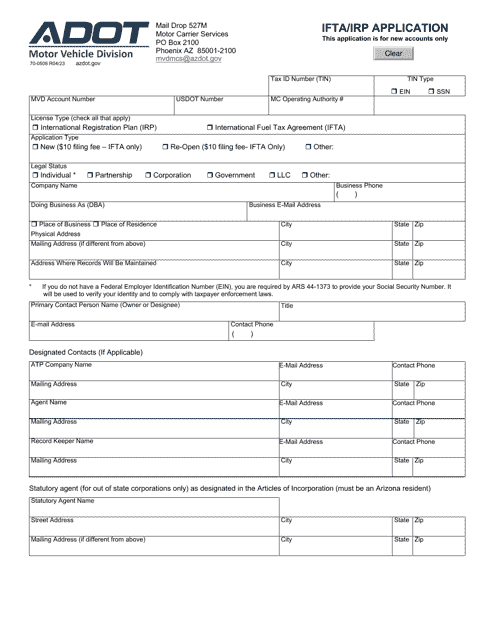

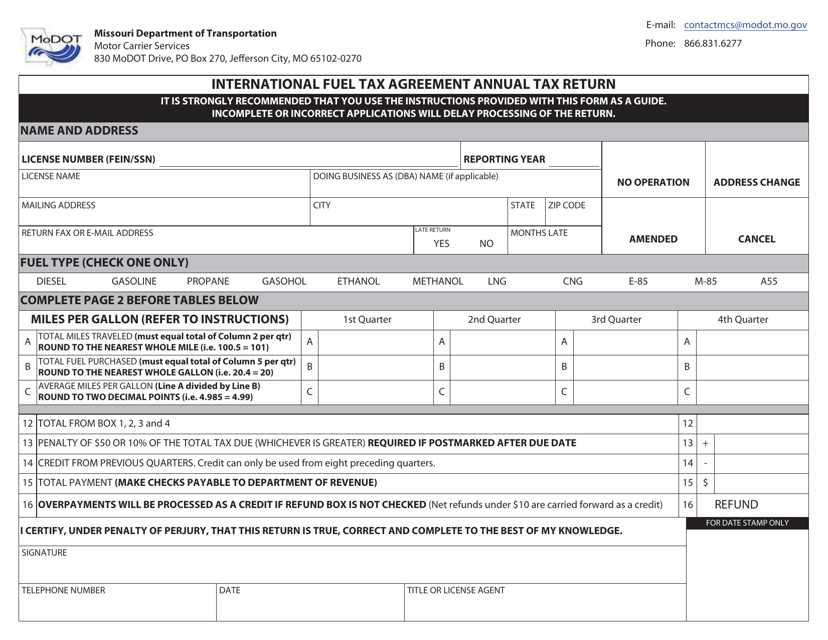

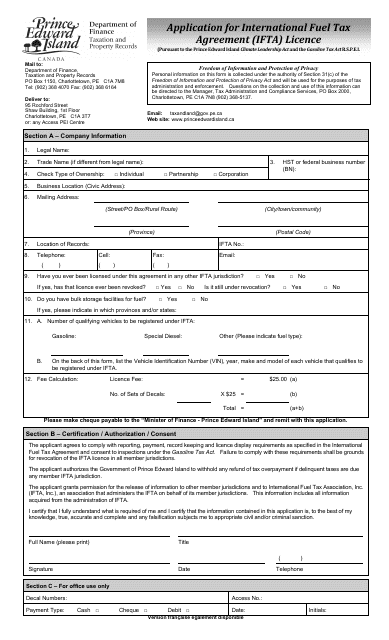

Whether you are a fleet manager, a tax professional, or someone who needs to stay informed about fuel tax rates, our documents cover a wide range of topics. From application forms for an International Fuel Tax Agreement (IFTA) license in different jurisdictions to quarterly and annual tax returns, we have you covered.

Our collection includes documents from various states and provinces, such as New Brunswick in Canada, New Jersey, West Virginia, Arizona, and Missouri, among others. These documents will help you navigate the complexities of fuel tax rates and ensure that you are filing the correct returns in a timely manner.

By accessing our fuel tax rate documents, you can stay on top of changes in fuel tax rates, understand the requirements for IFTA licenses and renewals, and ensure that you are in compliance with the applicable regulations. Don't let the complexities of fuel tax rates overwhelm you – our resources are here to help. Explore our collection today and stay informed about fuel tax rates.

Documents:

6

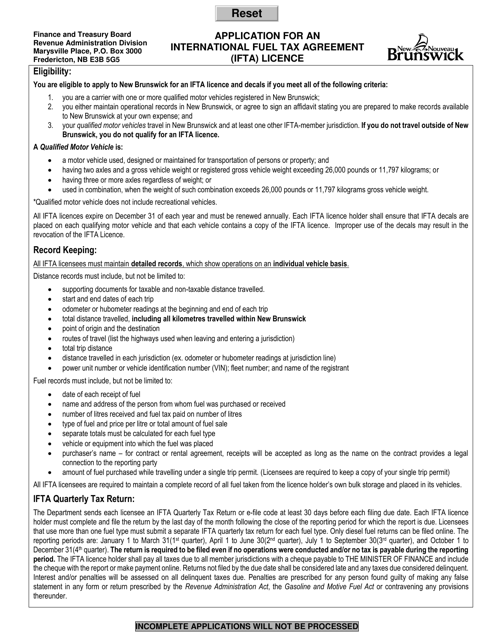

This form is used for applying for an International Fuel Tax Agreement (IFTA) license in New Brunswick, Canada. It allows individuals or businesses to report and pay taxes on fuel use for qualified motor vehicles operating in multiple jurisdictions.

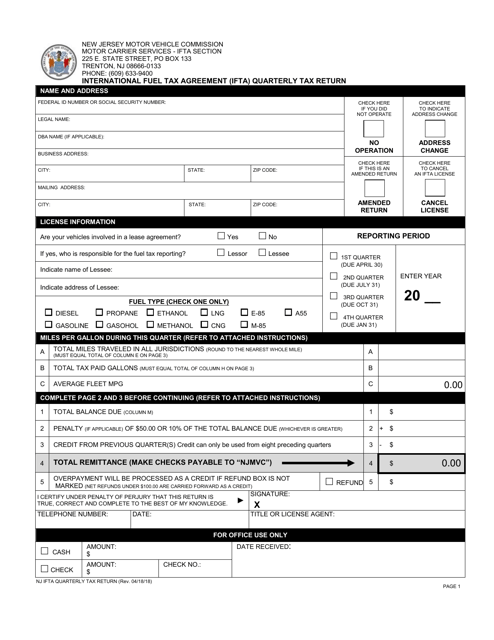

This document is used for submitting the quarterly tax return for the International Fuel Tax Agreement (IFTA) in the state of New Jersey.

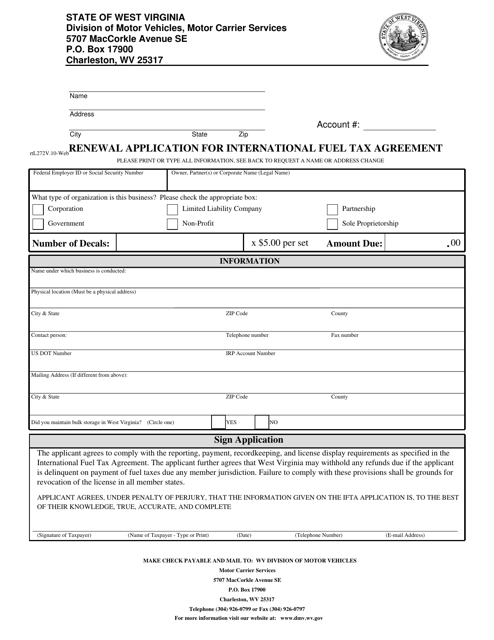

This form is used for renewing the International Fuel Tax Agreement in the state of West Virginia.

This document is used for filing the annual tax return related to the International Fuel Tax Agreement in the state of Missouri.