Film Tax Credits Templates

Are you a production company looking to save on film production costs? Look no further than film tax credits. These incentives offer substantial savings to productions in various regions, allowing you to maximize your budget while still creating top-quality content.

Film tax credits, sometimes referred to as film tax incentives, are government programs designed to attract film and television productions to specific locations. These programs provide financial incentives, such as tax breaks or grants, to qualifying productions that meet specific criteria. By taking advantage of film tax credits, you can significantly reduce your production costs and increase your return on investment.

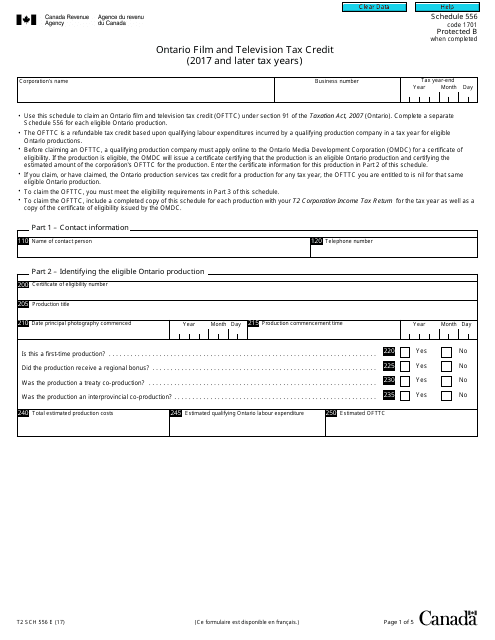

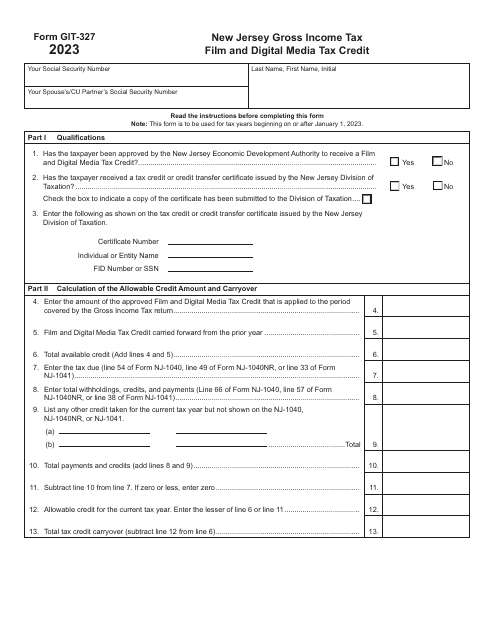

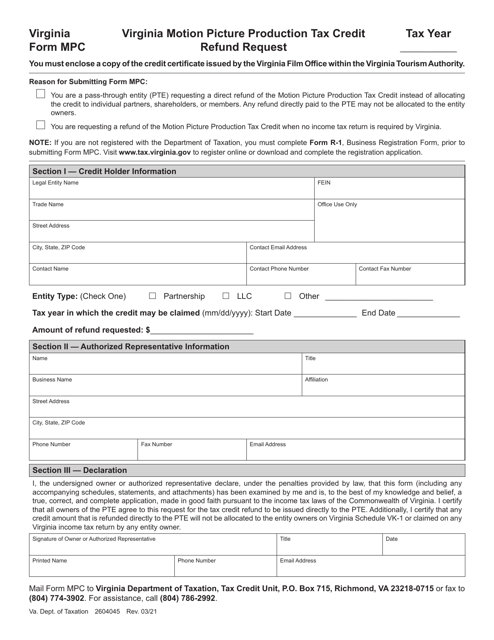

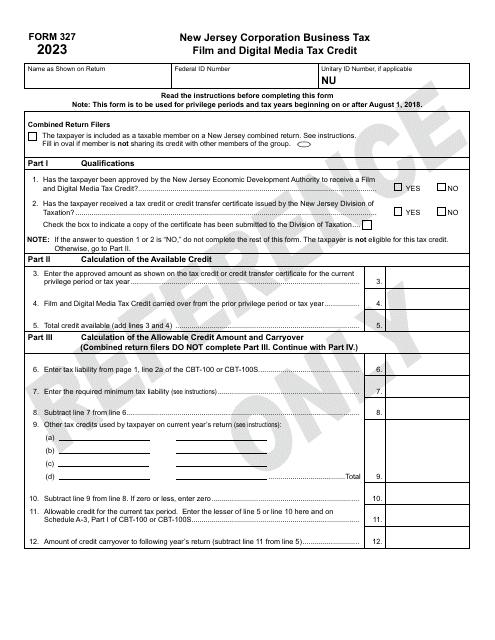

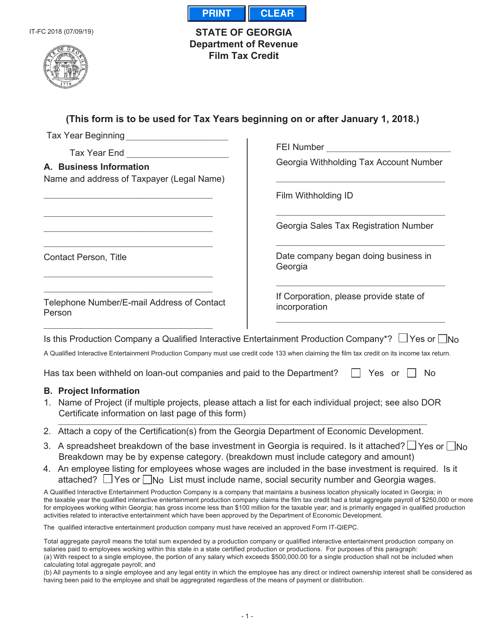

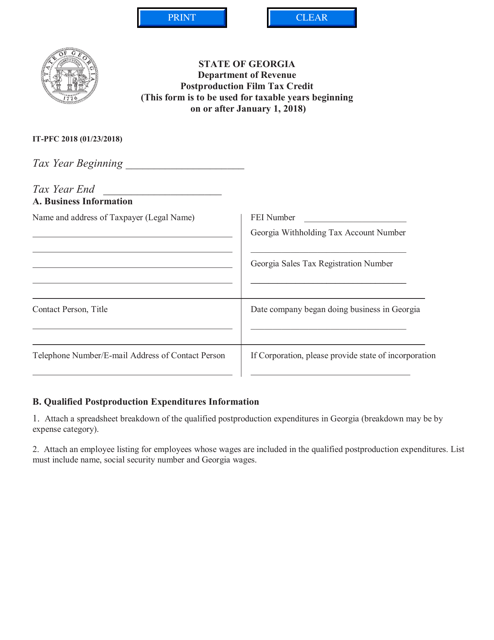

Different regions offer their own film tax credit programs, each with its own set of requirements and benefits. For example, in Canada, you have the Ontario Film and Television Tax Credit, which provides a tax credit to eligible production companies based on a percentage of qualified expenditures. In the United States, states like New Jersey and Georgia offer their own film tax credits, such as the New Jersey Gross Income Tax Film and Digital Media Tax Credit and the Georgia Film Tax Credit, respectively.

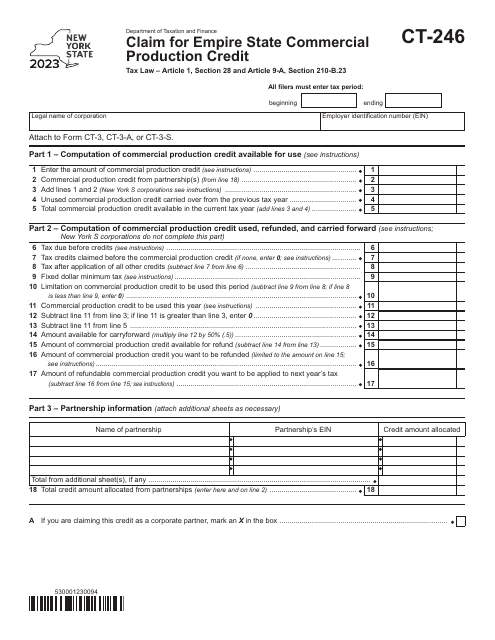

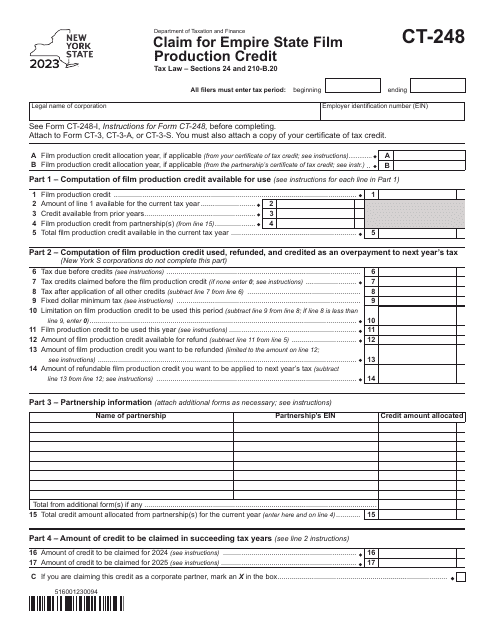

To take advantage of these film tax credits, you'll need to complete the necessary paperwork. For instance, in Canada, you'll need to fill out Form T2 Schedule 556, while in New Jersey, the required form is Form GIT-327. In Georgia, you may need to fill out Form IT-FC or Form IT-PFC, depending on the specific credit you're applying for. New York also offers a film tax credit, with Form CT-248 being the form to claim the Empire State FilmProduction Credit.

If you're looking for ways to make your film budget stretch further, film tax credits are an invaluable resource. Take advantage of these incentives and save big on your next production. Don't miss out on the opportunities provided by film tax credits – make sure you explore the available programs and complete the necessary paperwork to maximize your savings.

(Note: The example documents listed are for illustrative purposes only and may not apply to your specific situation. Please consult the official government websites or a qualified professional for the most up-to-date and accurate information.)

Documents:

14

This form is used for claiming the Ontario Film and Television Tax Credit in Canada for the tax years 2017 and onwards.

This Form is used for claiming film tax credits in Georgia, United States.

This form is used for claiming the Postproduction Film Tax Credit in the state of Georgia, United States.

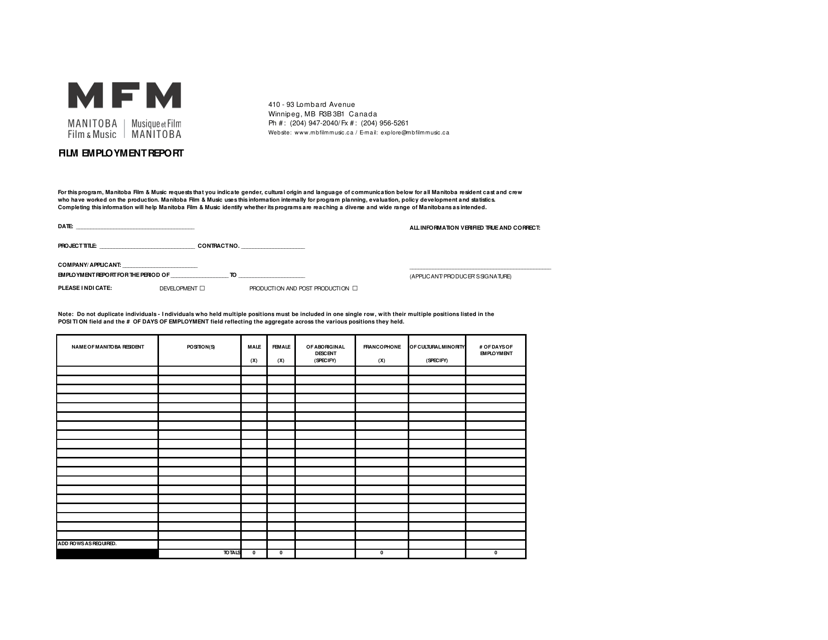

This document provides a report on employment in the film industry in Manitoba, Canada. It includes information on the number of jobs, salaries, and other relevant statistics.

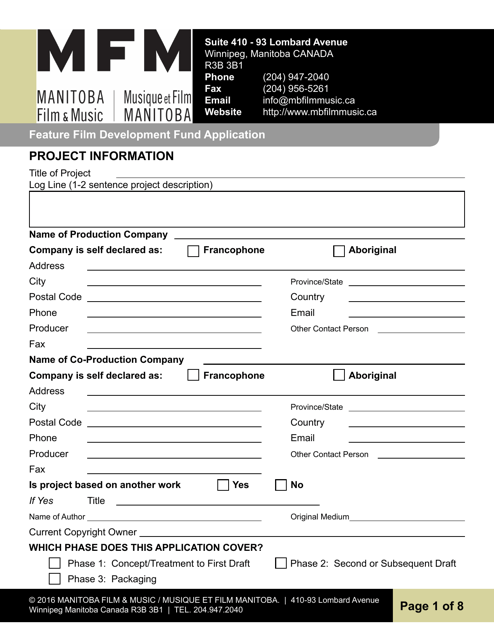

This document is for applying to the Feature Film Development Fund in Manitoba, Canada. It is used by filmmakers who are seeking financial support for the development of a feature film project.

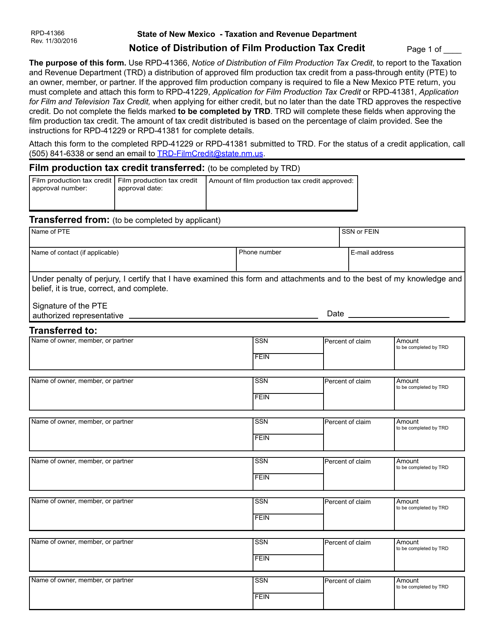

This Form is used for notifying the distribution of the Film Production Tax Credit in New Mexico. It is a document that ensures transparency and accountability in the tax credit distribution process for film production.