Employee Business Expenses Templates

Employee Business Expenses is a collection of documents that provide guidance and information on deducting business expenses incurred by employees. Whether you are filing your personal income tax return or seeking reimbursement from your employer, these documents provide the necessary resources and instructions to properly claim your business expenses.

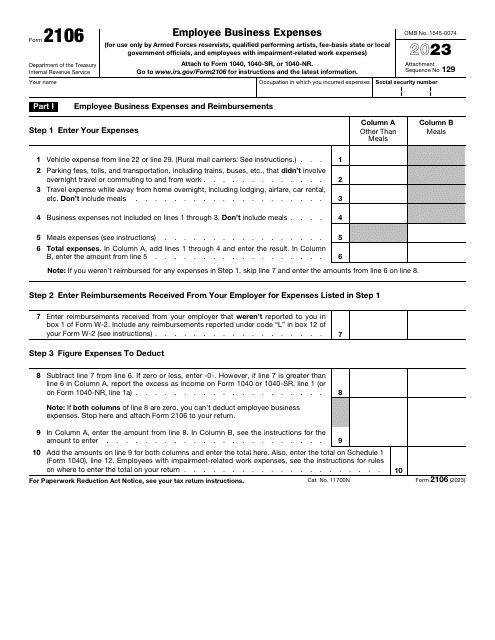

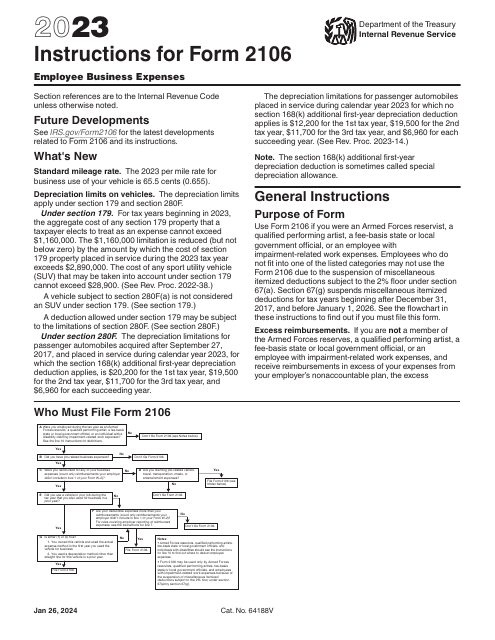

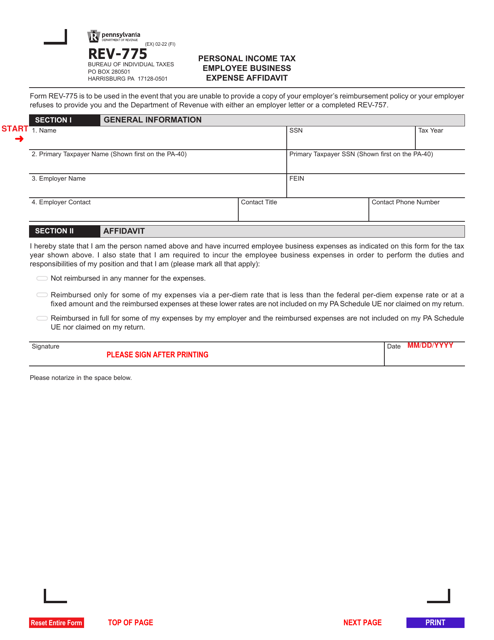

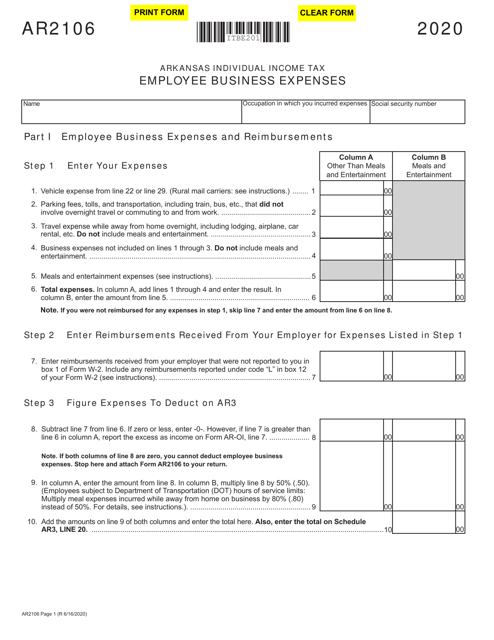

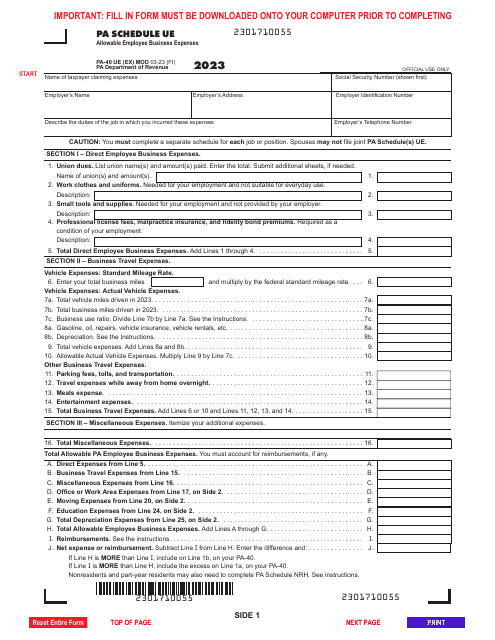

The documents within this group include forms, such as IRS Form 2106 Employee Business Expenses and Form REV-775 Personal Income Tax Employee Business Expense Affidavit - Pennsylvania, which help you report and substantiate your business expenses. Each form is specifically tailored to the requirements of a particular jurisdiction, such as Form AR2106 Employee Business Expenses - Arkansas, ensuring compliance with local regulations.

In addition to the forms, you will find detailed instructions on how to complete IRS Form 2106 Employee Business Expenses, along with similar guidelines for other relevant forms. These instructions offer clarity on what expenses are eligible for deduction, how to calculate the deduction amount, and the supporting documentation required.

Employee Business Expenses documents can also be referred to as Employee Business Expense or Employee Business Expense documentation. By using any of these alternate names, you can easily recognize this collection of documents as a valuable resource for claiming deductions on your business expenses.

Take advantage of these documents to maximize your tax deductions or seek reimbursement from your employer for eligible business expenses. They provide the necessary guidance and information to ensure compliance with tax regulations and to accurately report your expenses. .

Documents:

15

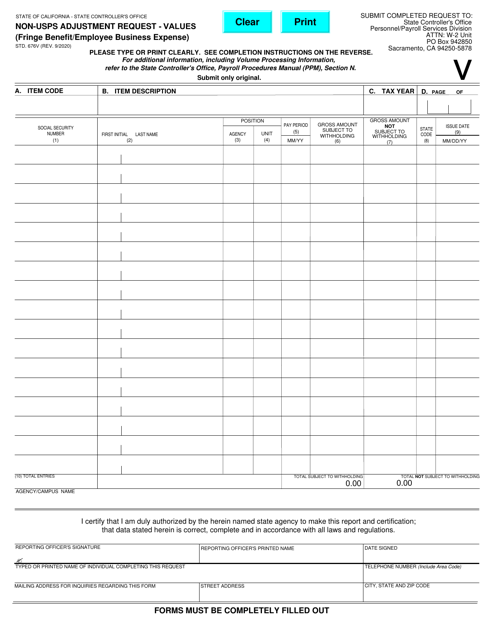

This form is used for making non-USPS adjustment requests regarding fringe benefits or employee business expenses in the state of California.

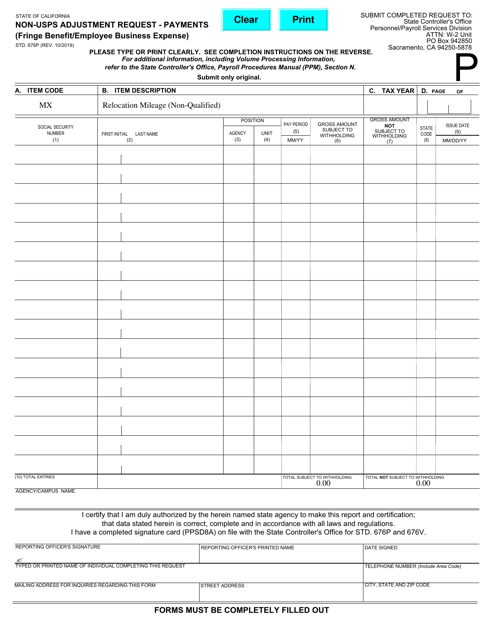

This form is used for requesting adjustments to payments related to fringe benefits or employee business expenses in California.